Filed

Pursuant to Rule 424(b)(4)

Registration

No. 333-224358

PROSPECTUS

3,500,000 Shares

The Lovesac Company

Common Stock

This is the initial public offering of shares of common stock of The Lovesac Company. We are offering 3,500,000 shares of our common stock.

The initial public offering price is $16.00 per share. Currently, no public market exists for our common stock. Our common stock has been approved for listing on the Nasdaq Global Market under the symbol “LOVE.”

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company disclosure standards. See “Prospectus Summary — Implications of Being an Emerging Growth Company.” We will also be a “controlled company” under the corporate governance standards for Nasdaq listed companies and would be exempt from certain corporate governance requirements of the rules. See “Risk Factors — Risks Relating to this Offering and Ownership of Our Common Stock.”

The offering is being underwritten on a firm commitment basis. We have granted the underwriters an option to buy up to an additional 525,000 shares of common stock from us to cover over-allotments. The underwriters may exercise this option at any time and from time to time during the 30-day period from the date of this prospectus.

|

|

|

|

|

Total |

|||||

|

|

|

Per Share |

|

No

Exercise of |

|

Full

Exercise of Over- |

|||

|

Public offering price |

|

$ |

16.00 |

|

$ |

56,000,000 |

|

$ |

64,400,000 |

|

Underwriting discounts |

|

$ |

1.12 |

|

$ |

3,920,000 |

|

$ |

4,508,000 |

|

Proceeds to us, before expenses |

|

$ |

14.88 |

|

$ |

52,080,000 |

|

$ |

59,892,000 |

We have also agreed to issue to Roth Capital Partners, LLC a warrant to purchase up to 281,750 shares of our common stock, which equates to 7% of the number of shares of our common stock to be issued and sold in this offering. In addition, we have agreed to reimburse the underwriters for certain expenses. See “Underwriting” on page 100 of this prospectus for additional information.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” starting on page 16 of this prospectus and elsewhere in this prospectus for information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Delivery of the shares is expected to be made to the purchasers on or about June 29, 2018.

Sole Book-Running Manager

Roth Capital Partners

Co-Manager

Craig-Hallum Capital Group

The date of this prospectus is June 26, 2018

TABLE OF CONTENTS

|

Prospectus Summary |

|

1 |

|

Risk Factors |

|

16 |

|

Cautionary Note Regarding Forward-Looking Statements |

|

35 |

|

Use of Proceeds |

|

36 |

|

Dividend Policy |

|

37 |

|

Capitalization |

|

38 |

|

Dilution |

|

40 |

|

Selected Consolidated Financial Information |

|

42 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

46 |

|

Business |

|

60 |

|

Management |

|

74 |

|

Executive Compensation |

|

80 |

|

Security Ownership of Certain Beneficial Owners and Management |

|

86 |

|

Certain Relationships and Related Party Transactions |

|

88 |

|

Description of Capital Stock |

|

91 |

|

Shares Eligible for Future Sale |

|

95 |

|

Material United States Federal Income Tax Consequences To Non-U.S. Holders of Our Common Stock |

|

97 |

|

Underwriting |

|

100 |

|

Legal Matters |

|

105 |

|

Experts |

|

105 |

|

Where You Can Find More Information |

|

105 |

|

Index to Financial Statements |

|

F-1 |

You should rely only on the information contained in this prospectus or in any free writing prospectus that we may specifically authorize to be delivered or made available to you. Neither we nor the underwriters have authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside the United States: We and the underwriters have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of securities and the distribution of this prospectus outside the United States.

As used in this prospectus, the terms “we”, “us”, “our”, “our Company”, “the Company” and “Lovesac” refer to The Lovesac Company, our wholly-owned subsidiary, Lovesac, LLC, and our predecessor entities, as applicable, unless the context clearly indicates otherwise.

We do not have a calendar year end fiscal year, instead we use a 52 or 53 week fiscal year ending on the Sunday closest to February 1st. Fiscal years are identified in this prospectus according to the calendar year in which they end. For example, references to “fiscal 2018” or “fiscal year 2018” or similar references refer to the fiscal year ended February 4, 2018, and “fiscal 2017” or “fiscal year 2017” or similar references refer to the fiscal year ended January 29, 2017. Alternatively, references to “2018” and “2017” refer to the calendar years ended December 31, 2018 and December 31, 2017, respectively.

In this prospectus, unless otherwise specified, all references to “common stock” refer to shares of our common stock.

i

Trademarks, Trade Names and Service Marks

We own various U.S. federal trademark registrations and applications, certain foreign trademark registrations and applications, and unregistered trademarks, including the following marks referred to in this prospectus: Lovesac®, Lovesoft®, Sactionals®, Durafoam®, SAC® and Designed For Life®. All other trademarks or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the symbols ® and ™, but such references are not intended to indicate that we or their respective owners will not assert, to the fullest extent possible under applicable law, our or their rights thereto.

Market, Industry and Other Data

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on reports from various third-party sources. We believe this information to be reasonable based on the information available to us as of the date of this prospectus. However, we have not independently verified market and industry data from third-party sources. Because this information involves a number of assumptions and limitations, you are cautioned not to give undue weight to such information. The content of the sources, except to the extent specifically set forth in this prospectus, does not constitute a portion of this prospectus and is not incorporated herein.

In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those discussed under the sections entitled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in this prospectus. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us.

ii

Prospectus Summary

This summary highlights certain information contained in other parts of this prospectus. Because it is a summary, it does not contain all of the information you should consider before investing in shares of our common stock. You should read the entire prospectus carefully, including “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the financial statements and related notes included in this prospectus before deciding to invest in our common stock. Except for the information contained in our audited consolidated financial statements, all share and per share information relating to our common stock in this prospectus has been adjusted to reflect a 1-for-2.5 reverse stock split immediately prior to the closing of this offering.

Our Business

We are a technology driven, omni-channel company that designs, manufactures and sells unique, high quality furniture comprised of modular couches called Sactionals and premium foam beanbag chairs called Sacs. We market and sell our products through modern and efficient showrooms and, increasingly, through online sales. We believe that our ecommerce centric approach, coupled with our ability to deliver our large upholstered products through nationwide express couriers, are unique to the furniture industry.

The name “Lovesac” was derived from our original innovative product, a premium foam beanbag chair, the Sac. The Sac was developed in 1995 and provided the foundation for the Company. Sales of this product have been increasing, representing $26.9 million for fiscal 2018, as compared to $20.1 million for fiscal 2017. We believe that the large size, comfortable foam filling and irreverent branding of our Sacs products have been instrumental in growing a loyal customer base and our positive, fun image.

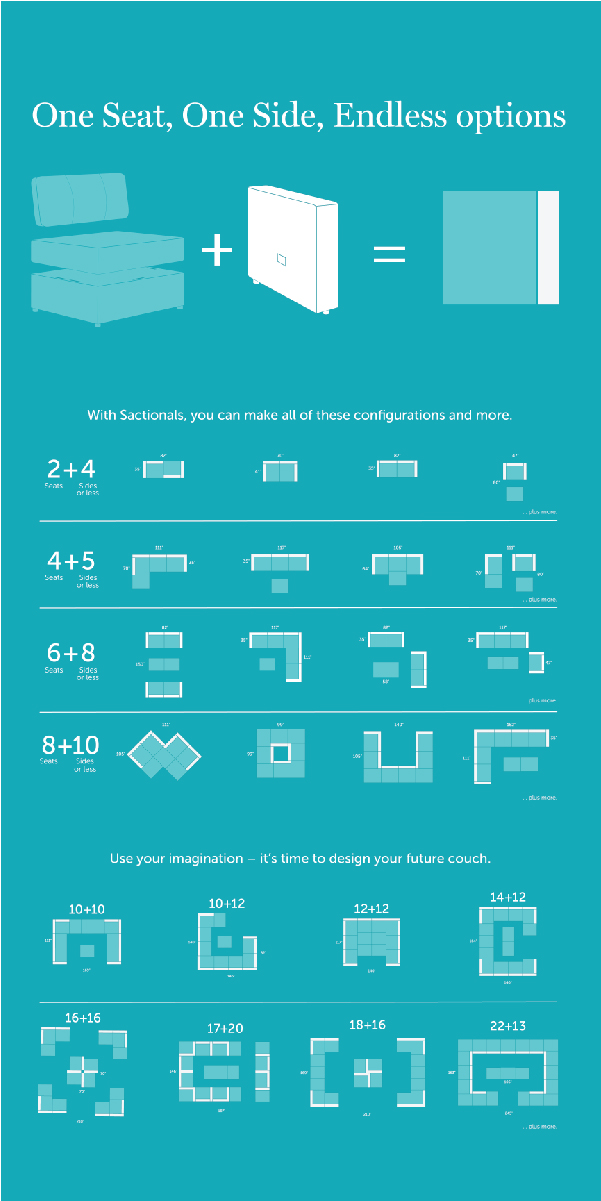

Our Sactionals product line currently represents a majority of our sales. Sactionals are a couch system that consists of two components, seats and sides, which can be arranged, rearranged and expanded into thousands of configurations easily and without tools. Our Sactional products include a number of patented features relating to its geometry and modularity, coupling mechanisms and other features. Our Sactionals represented 71.3% of our sales for fiscal 2018 (or $72.6 million) as compared to 70.9% of sales for fiscal 2017 (or $54.1 million). We believe that these high quality premium priced products enhance our brand image and customer loyalty and expect them to continue to garner a significant share of our sales.

Sacs and Sactionals come in a wide variety of colors and fabrics that allow consumers to customize their purchases in numerous configurations and styles. We provide lifetime warranties on our Sactionals frames and the proprietary foam used in both product lines, and 3-year warranties on our covers. Our Designed for Life trademark reflects our dynamic product line that is built to last and evolve throughout a customer’s life. Customers can continually update their Sacs and Sactionals with new covers, additions and configurations to accommodate the changes in their family and housing situations.

We believe that our products complement one another and have generated a loyal customer base, evidenced by our recent estimate that 39% of our transactions in fiscal 2018 were from repeat customers. We believe the strength of our brand is reflected in the number of customers who routinely share their purchases of Lovesac products with their friends through social media, often displaying our logos or company name in their posts. Our customers include celebrities and other influencers who support our brand through postings made on an uncompensated and unsolicited basis. As of May 6, 2018, we had approximately 588,131 followers on Facebook and 218,556 followers on Instagram, representing increases of 66% and 152%, respectively, from the same date in the prior year.

We currently market and sell our products through 68 showrooms at top tier malls and lifestyle centers in 29 states in the U.S. Our modern, efficient showrooms are designed to appeal to millennials and other purchasers looking for comfortable, enduring, premium furniture. They showcase the different sizes of our Sacs, the myriad forms into which our Sactionals can be configured, and the large variety of fabrics that can be used to cover our products. According to Furniture Today, our showrooms generated the highest reported sales per square foot in the industry in 2016, reflecting our efficient, small-footprint showroom model.

As part of our direct to consumer sales approach, we also sell our products through our fast growing ecommerce platform. We believe our products are uniquely suited to this channel. Our foam based Sacs can be reduced to one-eighth of their normal size and each of our Sactionals components weighs less than 40 pounds upon shipping. With furniture

1

especially suited to ecommerce applications, our sales completed through this channel accounted for 18.5% of our total sales in fiscal 2018, up from 16.1% for fiscal 2017. Our showrooms and other direct marketing efforts work in concert to drive customer conversion in ecommerce.

Despite the increase in sales of both our Sacs and Sactionals, net losses were $5.5 million for fiscal 2018 and $6.9 million for fiscal 2017, primarily due to increased spending on showrooms and marketing.

Product Overview

We challenge the notion that a piece of furniture is static by offering a dynamic product line built to last and evolve throughout a customer’s life. Our products serve as a set of building blocks that can be rearranged, restyled and re-upholstered with any new setting, mitigating constant changes in fashion and style.

• Sactionals. We believe our Sactionals platform is unlike competing products in its adaptability, yet is comparable aesthetically to similarly priced premium couches and sectionals. Our Sactional products include a number of patented features relating to its geometry and modularity, coupling mechanisms and other features. Utilizing only two, standardized pieces, “seats” and “sides,” and over 300 high quality, tight-fitting covers that are removable, washable, and changeable, customers can create numerous permutations of a sectional couch with minimal effort. Customization is further enhanced with our specialty-shaped modular offerings, such as our wedge seat and roll arm side. Our custom features and accessories can be added easily and quickly to a Sactional to meet endless design, style and utility preferences, reflecting our Designed for Life philosophy. Sactionals are built to meet the highest durability and structural standards applicable to fixed couches. Sactionals are comprised of standardized units and we guarantee their compatibility over time, a major pillar of their value proposition to the consumer.

• Sacs. We believe that our Sacs product line is a category leader in oversized beanbags. The Sac product line offers 6 different sizes ranging from 22 pounds to 95 pounds with capacity to seat 3+ people on the larger model Sacs. Filled with Durafoam, a proprietary blend of shredded foam, Sacs provide serene comfort and guaranteed durability. Their removable covers are machine washable, and may be easily replaced with a wide selection of cover offerings.

• Accessories. Our accessories complement our Sacs and Sactionals by increasing their adaptability to meet evolving consumer demands and preferences. Our current product line offers Sactional-specific drink holders, footsac blankets, decorative pillows, fitted seat tables and ottomans in varying styles and finishes, providing our customers with the flexibility to customize their furnishings with decorative and practical add-ons to meet evolving style preferences. We are in the process of developing additional accessories for the tech-savvy consumer.

Sales Channels

Lovesac offers its products through an inventory lean omni-channel platform that provides a seamless and meaningful experience to our customers in showrooms and online. In recent periods, we have increased our focus on providing a platform for the transaction of business online through digital and mobile applications. As consumers increasingly transact via various ecommerce channels, our robust and user-friendly technological platform is well positioned to benefit from this growth. Additionally, our products’ compact packaging facilitates production scheduling, lower shipping costs and the outsourcing of our shipping function to nationwide express couriers, allowing us to quickly and cost-effectively deliver online orders.

We leverage our showroom as both a traditional retail channel to purchase our products and an educational center for prospective online customers to learn about and interact with our products in real time. Compared to traditional retailers, our showrooms require significantly less square footage because we need to maintain only a few sample seats, sides and Sacs to demonstrate numerous configurations. Warehouse space is minimized by our ability to stack our inventory for immediate sale. In addition to providing a compelling customer experience, we believe that our showroom model provides a more efficient use of capital and logistical advantages over our competitors.

We have an ongoing working relationship with Costco to operate “roadshows” in Costco’s stores, which we refer to as shop in shops, throughout fiscal 2019. Our shop in shops display select Sacs and Sactionals and are staffed similarly to

2

our more traditional showrooms with associates trained to demonstrate and sell the product. Between January 30, 2017 and February 4, 2018, we hosted 100+ roadshows that averaged sales of $3,800 per day. For fiscal 2018, the Costco shop in shop showrooms represented approximately 5% of sales. Our research found that nearly 2% of our in-store purchasers and 3% of our online visitors cited Costco as their source of awareness for Lovesac, reflecting the efficacy of our shop in shop concept in generating revenue and driving brand awareness.

Current and Target Customers

We believe there is significant overlap in the profiles of our current customers and our target customers. Our target customer earns a household income of at least $100,000, is between the ages of 24 and 45, is married and currently has or plans to form a household. While we seek to market our products to this target customer broadly, we especially target millennials (who we define as those persons born between 1983 and 2000) because we believe they desire the branding, transparent business practices, innovative solutions and convenience of the on-demand commerce we offer. Millennial heads of household have increasingly become a larger portion of our customer base as represented by a 19% share (based on internal sampling we conducted with one of our products). We believe our culture of innovation, superior product development capabilities and integrated omni-channel infrastructure enable us to offer our customers a value proposition superior to our competitors.

Our Market

Large and Growing Furniture Retailing Industry

We sell our products in the large and highly fragmented furniture retailing industry, which has been rebounding steadily since the global recession. According to Mintel, a market research firm, consumer furniture expenditures are expected to grow to $127.5 billion in 2021, representing an average annual growth rate of 3.4% between 2016 and 2021. Additionally, Mintel reported that the segment consisting of couches, chairs, and other seating products comprised nearly 30% of all U.S. consumer furniture expenditures in 2015, surpassing the next largest segment, mattresses and sleep equipment, which represented 17% of expenditures.

A Maturing Millennial Population with Favorable Furniture Purchasing Habits

Millennials, our target demographic, have surpassed Baby Boomers (persons generally born between 1946 and 1964) as the largest living generation in the U.S. The millennial population reached 83.1 million people in 2015, representing more than 25% of the U.S. population according to data from the U.S. Census Bureau. Moreover, tech savvy millennials are maturing to an age where their buying power coincides with larger discretionary purchases, including furniture products. Based on a survey conducted by Mintel, 73% of millennials (who Mintel defines as those persons born between 1977 and 1994) purchased furniture between April 2014 and April 2016. According to Mintel, of those purchasing furniture between April 2014 and April 2016, 47% of millennials reported that they had made the purchase online, compared to just 26% for Generation X and 17% for Baby Boomers.

Emergence of Online Sales in the Furniture Industry

According to eMarketer, a market research company that provides insights and trends related to digital marketing, media and commerce, retail ecommerce sales of furniture and home furnishings will grow from $36.0 billion in 2017 to $62.4 billion in 2021. In addition, over one-third of furniture consumers have purchased products online, and this number is expected to continue to expand, according to Mintel. Driving the market share growth of the online segment are retailers that offer fully supported shopping experiences across their web and mobile platforms. When purchasing their most recent home furnishing product, 30% of consumers made an online purchase using a computer and 9% of consumers made an online purchase using a mobile device, according to data from Mintel. While consumers are now more tech savvy and likely to browse for furniture products online, many consumers still prefer to see and feel products in-store before making their purchasing decision. Omni-channel retailers that offer a comprehensive shopping experience across all channels are well positioned to attract the growing portion of consumers who use multiple channels to browse, compare and purchase furniture products.

3

Our Competitive Strengths

We believe that the following strengths are central to the power of our brand and business model:

Innovative Business Model

• Merchandising Strategy. Nearly all home furnishings retailers, online or offline, rely on an assortment of new offerings each season to drive their business and to refashion their offerings. We have avoided this “merchandising” approach in favor of a product platform-based approach that reduces the need for seasonal introductions, designer collections, or broad in-stock assortments. We optimize our in-stock assortment of covers and accessories by limiting them to those that sell in large quantity and therefore reduce our inventory. We also provide a broad assortment of made-to-order items, that we manufacture after the consumer has purchased and paid for them. This business model yields little to no surplus inventory, less margin erosion due to overstock write-downs, higher than average annual inventory turns, increased focus at the showroom management level, and simplicity at merchandising display execution.

• Product Platform Approach. We have essentially two platforms upon which we develop, manufacture and sell our fundamental Sacs and Sactionals products. We market our product platforms as a long term investment that our customers can continually update with new arrangements, coverings and accessories. In turn, these changes and updates provide a recurring revenue source for our business. In addition, our Sactionals platform is an environmentally conscious alternative to fixed couches which tend to be discarded when they go out of style or wear out, a by-product of our Designed for Life approach and an important feature to some consumers.

• Ecommerce Focus. We build our business processes, systems, compensation structures, and logistical models with an ecommerce-first approach. We continually innovate to make shopping online easier for our customers, and we use social media to drive increased traffic to our web-based sales applications. From a product standpoint, the open-cell nature of the Durafoam filler in our Sacs allows them to be compressed for shipping to one-eighth of their normal size. To facilitate shipping, Sactionals seat cushions and back pillows are compressed to fit inside an otherwise hollow hardwood upholstered Seat frame.

• A Culture of Innovation. From inception, we have focused on developing unique, innovative and proprietary product platforms. We are continuously expanding and introducing new extensions to these platforms to broaden the appeal and grow the addressable market of our product offerings. We continually evaluate new products to complement our Sactionals and Sac lines and are currently developing accessories for the tech-savvy consumer. We have 10 issued U.S. utility patents, 21 issued international utility patents, 10 pending U.S. utility patent applications and 4 pending international utility patent applications. We expect to file U.S. and international patent applications for future innovations. We believe that our patent portfolio, combined with our innovative design approach may deter others from attempting to imitate or replicate our products.

• Customer Acquisition Cost. For fiscal 2018, our customer acquisition cost (“CAC”) was $283.22 per customer. We calculate CAC on an annual basis by dividing our expenses associated with acquiring new customers for a fiscal year by the number of new customers we acquire in that fiscal year. We include premium rent for locations above commercial rates, media costs to new customers, and a portion of showroom merchandising costs in our marketing expenses associated with acquiring new customers when calculating our CAC. We believe that fiscal 2018 is the first fiscal year that our CAC fully reflects the implementation of changes to our marketing. In fiscal 2018 we significantly increased our spending on marketing expenses and media costs. Our marketing expenses for fiscal 2018 were equal to 6.3% of revenue as compared to 1.3% of revenue for fiscal 2017.

Strong Brand Loyalty

We believe our brand, products, and Designed for Life philosophy encourage people to share their stories and develop a personal relationship with Lovesac and its community. We foster these interactions through active direct engagement using several social media platforms. We believe that our customers are active ambassadors, providing organic public relations, word of mouth advertising, and customer testimonials and endorsements. In addition, our customers have a high repeat purchasing rate and high expected lifetime engagement.

4

• Robust customer lifetime value. Once customers invest in our products, they tend to stay with them, grow with them, and add to them. We believe our customers’ loyalty is an important driver of our customer lifetime value (“CLV”). We estimate our three-year benchmark CLV to be $1,236 per customer. Our three-year benchmark CLV is a fixed estimate of the average gross profit we expect to receive from a customer during his or her purchasing lifetime. We based our three-year benchmark CLV on our internal data relating to customers who first purchased from us in fiscal 2015, which we refer to as our 2015 cohort. We chose fiscal 2015 as our base year because we began to make changes to our business and our target customers in fiscal 2015 and believe that the customers in fiscal 2015 more accurately reflect our current and target customer than in years prior to fiscal 2015. We calculated our three-year benchmark CLV by dividing the aggregate gross profits through fiscal 2018 attributable to the 2015 cohort (approximately $35,706,282) by the total number of customers in the 2015 cohort (28,882 customers).

• High repeat purchasing rates. We believe our focus on customer interaction and data driven analysis of their behavior and projected needs drives our high repeat customer rates. In fiscal 2018, our repeat customers accounted for 39% of all transactions. Additionally as of end of fiscal 2018, 7% of our customers purchased both Sacs and Sactionals in the fiscal 2017 cohort. As we attract more customers to the Sactionals product platform, we believe sustained repeat purchasing rates will create opportunities for accelerated growth and will allow us to capitalize on the high lifetime value of our customers.

Omni-Channel Approach

Our distribution strategy allows us to reach customers through three distinct, brand-enhancing channels, which we refer to as our omni-channel approach.

• Ecommerce. Through our mobile and ecommerce channel, we believe that we are able to significantly enhance the consumer shopping experience, driving deeper brand engagement and loyalty, while also realizing higher margins that are more favorable than our retail showroom locations. We believe our robust technological capabilities position us well to benefit from the growing consumer preference to transact at home and via mobile devices.

• Showrooms. We carefully select the best small-footprint retail locations in high-end malls and lifestyle centers for our showrooms. The architecture and layout of these showrooms is designed to communicate our brand personality and key product features. Our goal is to educate first-time customers, creating an environment where people can touch, feel, read, and understand the technology behind our products. We are updating and remodeling many of our showrooms to reflect our new showroom concept, which emphasizes our unique product platform, and will be the standard for future showrooms. Our new showroom concept, introduced in 2016, utilizes technology in more experiential ways to increase traffic and sales.

• Shop in shops. We are expanding the use of lower cost shop in shops to increase the number of locations where customers can experience and purchase our products. We have an ongoing working relationship with Costco to operate shop in shop programs, or “roadshows,” that usually run for 10 days at a time. These shop in shops are staffed similarly to our showrooms with associates trained to demonstrate and sell our products and promote our brand. We also believe our shop in shops provide a low cost alternative to drive brand awareness, in store sales, and ecommerce sales.

Strong Millennial Appeal

We have targeted the millennial generation because we believe they desire branded products, coupled with transparent business practices, innovative solutions and the convenience of on-demand commerce. Additionally, members of the millennial generation, currently the most populous age group in the U.S., are completing their educations, getting married, and starting or expanding their households. The peak ages for home furnishings purchases are 35-54. We believe that home furnishings will thrive as millennials and their children need larger residences and the necessary furnishings for household and family formation. The modularity of our Sactionals and ease of cleaning and replacing covers on Sactionals and Sacs provide our customers who are moving and expanding their households with the ability to evolve their purchases to accommodate the changes in their family and housing situations, offering us a competitive advantage.

5

Unique Distribution Capability

Due to the unique modularity of our Sactionals products and the shrinkability of our Sacs, we are able to distribute our products through nationwide express carriers and utilize warehouse space and international shipping routes. We believe our Sactionals are the only product in its category that enjoys these logistical advantages.

Seasoned Management Team

Our management team is led by our CEO and founder, Shawn Nelson, who continues to focus on developing new products and intellectual property to drive future growth. Our President and Chief Operating Officer, Jack Krause, has significant experience in and a deep understanding of the complexities in managing high-growth brands. Since joining Lovesac, he has been instrumental in guiding the company from a retail-led business model to an omni-channel direct-marketing driven business model. Our Executive Vice President and Chief Financial Officer, Donna Dellomo, is a Certified Public Accountant and possesses significant experience and knowledge regarding public company accounting and reporting. Prior to joining our Company, for 19 years, Ms. Dellomo served as Vice President and Chief Financial Officer of a publicly traded fragrance retailer with over 290 retail locations and a wholesale distribution network. In addition, we recently hired David Jensen as our Chief Technology/Chief Information Officer to lead our technology team as we evolve into a more marketing-driven digital-first retailer. Prior to joining our Company, Mr. Jensen served as the Senior Director of Information Services at the retailer J. Jill.

Our Growth Strategies

Key drivers of our growth strategy include:

Continue to Build on Our Brand

Despite our loyal following, we believe there is a significant opportunity to increase our brand awareness. Based on our own internal benchmarking study that was concluded in April 2017, we estimate that our brand awareness is less than 1% among all consumers nationally. Before 2017, we invested minimally in advertising. Since then, we have aggressively invested in brand building and direct marketing efforts, including direct mail, 30-second television commercials in select markets and social media. Our focus on building our brand has led to an increase in our new customer base, which grew by 27.2% in fiscal 2018. We plan to accelerate our ecommerce sales by building awareness via increased digital and social media, including digital videos and direct response television.

Update Showrooms and Add Other Locations

We intend to continue to renovate our current showroom locations, open new showrooms across the country in lifestyle centers, top tier shopping malls, and high street and urban locations, and expand product touch-feel points through the increased use of lower cost shop in shop locations.

• Showrooms. We are evolving our model for new showrooms and renovating our existing showrooms to reflect the standards of this new model. Our new showroom concept utilizes technology in more experiential ways to increase traffic and sales, and communicate our brand personality and key product features. The architecture and layout of these showrooms is designed to educate first-time customers, creating a nearly self-service environment where people can touch, feel and understand the technology behind our products. To attract customer traffic, our new model features two giant LED screens embedded in the walls that play videos demonstrating the Sactionals differentiating technology in motion. In addition, in connection with these renovations, we have experienced increased sales and negotiated more favorable lease terms.

In addition, we recently refined our real estate selection strategy for showrooms in shopping centers to include alignment with the demographics of customers located near the prospective center and to seek locations within the center near other furniture retailers to take advantage of furniture-related customer traffic and to provide a comparison shopping experience that we believe favors our products.

• Shop in shops. We have an ongoing working relationship with Costco to operate shop in shop showrooms and have been expanding the use of these shop in shop showrooms. At these locations, customers can experience and purchase our products at a lower cost to us than our permanent showrooms.

6

Increase Sales and Operating Margins

We will seek to improve operating margins by maintaining our premium pricing and increasing sales through our omni-channel distribution approach.

• Premium Pricing. Reflecting their durability, functionality and configurability, Lovesac’s products are positioned in the premium segment of the market. In fiscal 2018, the average purchase price of first time Sactionals was $3,789 and our average transaction was $1,058. Although Sactionals are premium priced, the cost of adding to or changing them over time is lower than purchasing another couch, which we believe motivates our customers to make higher margin initial investments in our products. Further, we believe that as we grow sales, we will be able to spread them over relatively fixed overhead and increase our margins.

• Omni-Channel Platform. By leveraging our omni-channel platform, we cost-effectively drive traffic to our ecommerce channel, resulting in increased web-based sales and improved operating margins. We continually seek to improve our ecommerce capabilities to drive sales and take advantage of the lower cost of this channel. Our showrooms and other direct marketing efforts work in concert to drive customer conversion in ecommerce. In addition, our shop in shops provide a low cost alternative to drive brand awareness and both in-store and ecommerce sales.

Summary Risk Factors

Investing in our common stock involves substantial risk, and our business is subject to numerous risks and uncertainties, including those listed in the section entitled “Risk Factors” and elsewhere in this prospectus. These risks include, among other things:

• our ability to sustain recent growth rates, increase sales and achieve profitability;

• our ability to improve our products and develop new products;

• our ability to maintain and grow our brand image and reputation;

• our ability to maintain existing customers and acquire new customers in a cost-effective manner;

• our ability to manage the growth of our operations over time, including the growth of our omni-channel operations;

• our ability to successfully optimize our omni-channel operations and provide a seamless, relevant and reliable omni-channel experience;

• our ability to successfully open and operate new showrooms on a profitable basis;

• our ability to compete and succeed in a highly competitive and evolving industry;

• our ability to adapt to changes in consumer spending and general economic conditions;

• our dependence on a small number of suppliers and international suppliers in developing countries;

• our ability to manage supply chain-related expenses and disruptions in our supply chain;

• our ability to maintain adequate protection of our intellectual property and to avoid violation of the intellectual property rights of others;

• our ability to manage our information technology systems to support our growing business;

• our ability to secure the personal information of our customers and employees and comply with applicable security standards; and

• our failure to maintain adequate internal controls over our financial and management systems.

7

Recent Reorganization, Securities Issuances and Events

The Company was formed in the State of Delaware on January 3, 2017, in connection with a corporate reorganization with SAC Acquisition LLC, a Delaware limited liability company, the predecessor entity to the Company and current majority shareholder of the Company. Pursuant to the terms of the reorganization, on March 22, 2017, SAC Acquisition LLC assigned and the Company assumed all right, title and interest in and to all assets, including intellectual property, and liabilities of SAC Acquisition LLC in exchange for 6,000,000 shares of common stock.

We raised $25.5 million through the sale of preferred stock and warrants in multiple offerings in fiscal 2018. In March 2017, we issued an aggregate of 1,000,000 shares of our Series A-1 Preferred Stock at a purchase price of $10.00 per share for an aggregate purchase price of $10.0 million and warrants, as amended, to purchase 350,000 shares of our common stock at a price per share equal to the offering price to affiliates of Satori Capital, LLC (“Satori”). The Preferred A-1 Shares accrued dividends at a rate of 8% per annum, and, immediately prior to the closing of this offering, will accrue an additional amount of dividends equal to the amount of dividends that would have accrued and accumulated through and including the one year anniversary of the completion of this offering. Immediately prior to the closing of this offering, the Series A-1 Preferred Stock, along with the aggregate accrued or accumulated and unpaid dividends thereon, will convert into approximately 1,301,612 shares of our common stock.

Beginning in March 2017 and ending in October 2017, we completed an offering of our Series A Preferred Stock and issued an aggregate of 923,000 shares of our Series A Preferred Stock at a purchase price of $10.00 per share for an aggregate purchase price of $9.2 million and warrants, as amended, to purchase 230,750 shares of our common stock at a price per share equal to the offering price to various entities and accredited investors, including investment vehicles affiliated with Mistral Capital Management, LLC (“Mistral”). The Preferred A Shares accrued dividends at a rate of 8% per annum, and, immediately prior to the closing of this offering, will accrue an additional amount of dividends equal to the amount of dividends that would have accrued and accumulated through and including the one year anniversary of the completion of this offering. Immediately prior to the closing of this offering, the Series A Preferred Stock, along with the aggregate accrued or accumulated and unpaid dividends thereon, will convert into approximately 1,207,767 shares of our common stock.

Lastly, between October 2017 and December 2017: (i) we issued 400,000 shares of our Series A-2 Preferred Stock at a purchase price of $10.00 per share for an aggregate purchase price of $4.0 million and warrants, as amended, to purchase 140,000 shares of our common stock at a price per share equal to the offering price to entities affiliated with Satori; (ii) we issued an aggregate of 11,500 shares of our Series A-2 Preferred Stock at a purchase price of $10 per share for an aggregate purchase price of $115,000 and warrants, as amended, to purchase 4,025 shares of our common stock at a price per share equal to the offering price to Shawn Nelson, our founder and Chief Executive Officer, Jack Krause, our President and Chief Operating Officer, and Donna Dellomo, our Executive Vice President and Chief Financial Officer; and (iii) we issued 212,000 shares of our Series A-2 Preferred Stock at a purchase price of $10.00 per share for an aggregate purchase price of $2.12 million and warrants, as amended, to purchase 74,200 shares of our common stock at a price per share equal to the offering price to an investment vehicle associated with Mistral. The Preferred A-2 Shares accrued dividends at a rate of 8% per annum, and, immediately prior to the closing of this offering, will accrue an additional amount of dividends equal to the amount of dividends that would have accrued and accumulated through and including the one year anniversary of the completion of this offering. Immediately prior to the closing of this offering, the Series A-2 Preferred Stock, along with the aggregate accrued or accumulated and unpaid dividends thereon, will convert into approximately 778,062 shares of our common stock.

On June 20, 2018, the Company granted to certain non-executive employees of the Company an aggregate of 68,378 restricted stock units, of which 14,625 restricted stock units immediately vested.

On June 22, 2018, the board of directors of the Company approved a 1-for-2.5 reverse stock split of our common stock to occur immediately prior to the closing of this offering.

Immediately prior to the closing of this offering, we intend to (i) convert all of our outstanding shares of preferred stock, along with the aggregate accrued or accumulated and unpaid dividends thereon, into approximately 3,287,441 shares of common stock, (ii) effect a 1-for-2.5 reverse stock split of our common stock, (iii) file an amended and restated certificate of incorporation, and (iv) adopt amended and restated bylaws. A description of the conversion features of our preferred stock can be found under the heading “Description of Capital Stock — Preferred Stock” and in Notes 7 and 12 to our consolidated financial statements for the fiscal year ended February 4, 2018.

Wells Fargo Credit Facility

On February 6, 2018, we terminated our line of credit with Siena Funding, LLC and replaced it with a four-year, secured revolving credit facility with Wells Fargo Bank, National Association (“Wells Fargo”). The credit facility

8

with Wells Fargo permits borrowings of up to $25.0 million, subject to borrowing base and availability restrictions. For additional information regarding our line of credit with Wells Fargo, see Note 12, to our consolidated financial statements for the fiscal year ended February 4, 2018.

Corporate Information

The Company’s principal executive office is Two Landmark Square, Suite 300, Stamford, CT 06901. Our telephone number is 888-636-1223. Our Internet address is www.lovesac.com. We do not incorporate the information on or accessible through our website into this prospectus, and you should not consider any information on, or that can be accessed through, our website a part of this prospectus.

Our Equity Sponsor

We have a valuable relationship with our equity sponsor, Mistral, who, through funds and investment vehicles advised by Mistral, has made significant equity investments in us, including a controlling interest in our majority shareholder, SAC Acquisition LLC. We believe that we will continue to benefit from Mistral’s investment experience in the consumer products sector, its expertise in effecting transactions and its support for our near-term and long term strategic initiatives.

Upon completion of this offering, assuming an offering size as set forth in “Summary of the Offering” and an initial public offering price of $16.00, Mistral, through its controlling interest of SAC Acquisition LLC and the common stock held by investment vehicles affiliated with Mistral, will control approximately 60% of our common stock and will therefore be able to control all matters that require approval by our stockholders, including the election and removal of directors, changes to our organizational documents and approval of acquisition offers and other significant corporate transactions. Because Mistral will control more than 50% of the voting power of our outstanding common stock, we will be a “controlled company” under the corporate governance rules for Nasdaq listed companies. We will therefore be permitted to, and we intend to, elect not to comply with certain corporate governance requirements. See “Management-Controlled Company.”

Control by Mistral may give rise to actual or perceived conflicts of interest with holders of our common stock. Mistral’s significant ownership in us and its resulting ability to effectively control us may discourage a third party from making a significant equity investment in us or a transaction involving a change of control, including transactions in which holders of shares of our common stock might otherwise receive a premium for such holders’ shares over the then-current market price. See “Risk Factors- Risks Related to this Offering and Ownership of Our Common Stock” for a summary of the potential conflicts of interest that may arise as a result of our control by Mistral.

Implications of Being an Emerging Growth Company

The Jumpstart Our Business Startups Act (the “JOBS Act”), was enacted in April 2012 with the intention of encouraging capital formation in the United States and reducing the regulatory burden on newly public companies that qualify as “emerging growth companies.” We are an emerging growth company within the meaning of the JOBS Act. As an emerging growth company, we may take advantage of exemptions from various public reporting requirements, including the requirement that our internal control over financial reporting be audited by our independent registered public accounting firm pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX”), requirements related to compliance with new or revised accounting standards, requirements related to the disclosure of executive compensation in this prospectus and in our periodic reports and proxy statements, and the requirement that we hold a nonbinding advisory vote on executive compensation and any golden parachute payments. We may take advantage of these exemptions until we are no longer an emerging growth company.

In addition, Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, for complying with new or revised accounting standards. As a result, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected to take advantage of this extended transition period.

We will remain an emerging growth company until the earliest to occur of (i) the last day of the fiscal year in which we have $1.07 billion or more in annual revenue; (ii) the date we qualify as a “large accelerated filer” with at least $700 million of equity securities held by non-affiliates; (iii) the date on which we have issued, in any three-year period, more than $1.0 billion in non-convertible debt securities; or (iv) the last day of the fiscal year ending after the fifth anniversary of our initial public offering.

9

Summary of the Offering

Common stock offered by us |

|

3,500,000 shares |

|

|

|

|

|

Offering price |

|

$16.00 per share |

|

|

|

|

|

Common stock outstanding before this offering |

|

|

|

|

|

|

Common stock to be outstanding after this offering |

|

|

|

|

|

|

|

Over-allotment option |

|

We have granted a 30-day option to the underwriters to purchase up to 525,000 additional shares of common stock solely to cover over-allotments, if any. |

|

|

|

|

|

Use of proceeds |

|

We intend to use the net proceeds of this offering for: (i) increased sales and marketing expenses; (ii) product development; (iii) repayment of amounts drawn from our credit facility with Wells Fargo; and (iv) working capital and other general corporate purposes. See “Use of Proceeds” beginning on page 36 of this prospectus. |

|

|

|

|

|

Risk factors |

|

Investing in our shares of common stock involves a high degree of risk. See “Risk Factors” beginning on page 16 of this prospectus for a discussion of factors you should consider before making a decision to invest in our common stock. |

|

|

|

|

|

Controlled Company |

|

After the completion of this offering, Mistral and its affiliates will continue to control a majority of our common stock. We will avail ourselves of the controlled company exemption under the corporate governance standards of Nasdaq. |

|

|

|

|

|

Proposed listing |

|

In connection with this offering, we are applying to list our common stock on the Nasdaq Global Market (“Nasdaq”) under the symbol “LOVE.” |

Immediately prior to the closing of this offering, we intend to (i) convert all of our outstanding shares of preferred stock, along with the aggregate accrued or accumulated and unpaid dividends thereon, into approximately 3,287,441 shares of common stock, (ii) effect a 1-for-2.5 reverse stock split of our common stock, (iii) file an amended and restated certificate of incorporation, and (iv) adopt amended and restated bylaws.

The number of shares of our common stock to be outstanding immediately after the closing of this offering is based on 6,077,626 shares of common stock outstanding as of May 6, 2018, and, except as otherwise indicated, all information in this prospectus, reflects and assumes the following:

• initial public offering price of $16.00 per share of common stock;

• conversion of the 923,000 outstanding shares of Series A Convertible Preferred Stock, along with the aggregate accrued or accumulated and unpaid dividends thereon, convertible to approximately 1,207,767 shares of our common stock;*

• conversion of the 1,000,000 outstanding shares of Series A-1 Convertible Preferred Stock, along with the aggregate accrued or accumulated and unpaid dividends thereon, convertible to approximately 1,301,612 shares of our common stock;*

• conversion of the 623,500 outstanding shares of Series A-2 Convertible Preferred Stock, along with the aggregate accrued or accumulated and unpaid dividends thereon, convertible to will approximately 778,062 shares of our common stock;*

• does not reflect the exercise of the outstanding warrants to purchase 798,975 shares of our common stock at an exercise price per share equal to the offering price;*

10

• does not reflect 475,548 unvested restricted stock units and 47,267 shares of common stock reserved for issuance under the Equity Plan; and

• does not reflect the exercise of the Representative’s Warrant to purchase up to 265,650 additional shares of our common stock in this offering.

____________

* A description of the conversion features of our preferred stock and of the exercise prices of our warrants can be found under the heading “Description of Capital Stock — Preferred Stock” and in Notes 7 and 12 to our consolidated financial statements for the fiscal year ended February 4, 2018.

Summary Consolidated Financial and Operating Data

The following tables present our summary consolidated financial and other data as of and for the periods indicated. The summary consolidated statements of operations data and the consolidated statement of cash flow data for the fiscal years ended February 4, 2018 and January 29, 2017, and the summary consolidated balance sheet data as of February 4, 2018 and January 29, 2017, are derived from our audited consolidated financial statements included elsewhere in this prospectus. The consolidated statement of operations data and the consolidated statement of cash flow data for the thirteen weeks ended May 6, 2018 and April 30, 2017 and the summary consolidated balance sheet data as of May 6, 2018, are derived from our unaudited consolidated financial statements included elsewhere in this prospectus and have been prepared on the same basis as the audited consolidated financial statements. Our historical audited results are not necessarily indicative of the results that should be expected in any future period.

The summarized financial information presented below is derived from and should be read in conjunction with our audited consolidated financial statements including the notes to those financial statements and our unaudited consolidated financial statements including the notes to those financial statements both of which are included elsewhere in this prospectus along with the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results are not necessarily indicative of our future results.

11

|

|

Fiscal Year Ended |

|

Thirteen Weeks Ended |

||||||||||||

|

|

February 4, 2018 |

|

January 29, 2017 |

|

May

6, |

|

April

30, |

||||||||

(dollars in thousands, except per share data) |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Operations Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

77,837 |

|

|

$ |

62,277 |

|

|

$ |

18,549 |

|

|

$ |

13,993 |

|

|

|

|

18,859 |

|

|

|

12,270 |

|

|

|

4,566 |

|

|

|

3,051 |

|

|

|

|

5,114 |

|

|

|

1,796 |

|

|

|

3,653 |

|

|

|

588 |

|

|

|

|

101,810 |

|

|

|

76,343 |

|

|

|

26,769 |

|

|

|

17,632 |

|

|

Costs of merchandise sold |

|

|

44,593 |

|

|

|

34,646 |

|

|

|

12,122 |

|

|

|

8,544 |

|

Gross profit |

|

|

57,217 |

|

|

|

41,697 |

|

|

|

14,647 |

|

|

|

9,088 |

|

|

|

|

|

|

|

|

|

|

||||||||

Selling, general and administrative expenses |

|

|

62,255 |

|

|

|

47,868 |

|

|

|

20,272 |

|

|

|

12,275 |

|

Operating loss |

|

|

(5,038 |

) |

|

|

(6,171 |

) |

|

|

(5,625 |

) |

|

|

(3,187 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(438 |

) |

|

|

(565 |

) |

|

|

(58 |

) |

|

|

(150 |

) |

|

|

|

(26 |

) |

|

|

(138 |

) |

|

|

— |

|

|

|

— |

|

|

Net Loss |

|

$ |

(5,502 |

) |

|

$ |

(6,874 |

) |

|

$ |

(5,683 |

) |

|

$ |

(3,337 |

) |

Net

Loss Attributable to Common |

|

$ |

(6,710 |

) |

|

$ |

(6,874 |

) |

|

$ |

(7,584 |

) |

|

$ |

(3,337 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss per Common Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share (basic and diluted)(1) |

|

$ |

(1.11 |

) |

|

$ |

(1.20 |

) |

|

$ |

(1.25 |

) |

|

$ |

(0.56 |

) |

Weighted-average shares used in computing net loss per common share(1) |

|

|

6,001,699 |

|

|

|

5,747,286 |

|

|

|

6,065,238 |

|

|

|

6,000,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma Net Loss per Common Share (unaudited): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma net loss per common share (basic and diluted)(2) |

|

$ |

(0.52 |

) |

|

$ |

(0.55 |

) |

|

$ |

(2.73 |

) |

|

$ |

(0.26 |

) |

Pro

forma weighted-average shares used in computing pro forma net loss per |

|

|

12,864,120 |

|

|

|

12,609,707 |

|

|

|

12,914,533 |

|

|

|

12,862,421 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Financial and Operating Data (unaudited): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19.5 |

% |

|

|

4 |

% |

|

|

28.2 |

% |

|

|

14.9 |

% |

|

|

|

66 |

|

|

|

60 |

|

|

|

68 |

|

|

|

59 |

|

|

|

|

88 |

|

|

|

80 |

|

|

|

90 |

|

|

|

80 |

|

|

|

|

62 |

|

|

|

57 |

|

|

|

63 |

|

|

|

56 |

|

|

|

$ |

1,262 |

|

|

$ |

1,101 |

|

|

$ |

294 |

|

|

$ |

250 |

|

|

Capital expenditures(7) |

|

$ |

6,636 |

|

|

$ |

3,681 |

|

|

$ |

2,774 |

|

|

$ |

827 |

|

|

$ |

(2,679 |

) |

|

$ |

(3,991 |

) |

|

$ |

(4,955 |

) |

|

$ |

(2,840 |

) |

|

Adjusted EBITDA(8)(9) |

|

$ |

1,271 |

|

|

$ |

(2,861 |

) |

|

$ |

(4,189 |

) |

|

$ |

(2,599 |

) |

Adjusted EBITDA Margin(8)(10) |

|

|

1 |

% |

|

|

(4 |

)% |

|

|

(16 |

)% |

|

|

(15 |

)% |

|

|

1,235,031 |

|

|

|

1,072,623 |

|

|

|

277,528 |

|

|

|

232,893 |

|

|

12

|

|

|

As

of |

|

As of February 4, 2018 |

|

As of January 29, 2017 |

|||

|

(dollars in thousands) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet data: |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,942 |

|

$ |

9,176 |

|

$ |

879 |

Working capital(12) |

|

|

6,779 |

|

|

12,946 |

|

|

3,350 |

|

Total assets |

|

|

39,090 |

|

|

41,441 |

|

|

20,720 |

|

Total liabilities |

|

|

20,840 |

|

|

17,802 |

|

|

13,670 |

|

Total stockholders’ equity |

|

|

18,250 |

|

|

23,638 |

|

|

7,050 |

|

|

|

Fiscal Year Ended |

|

Thirteen Weeks Ended |

||||||||||||

|

|

|

February 4, 2018 |

|

January 29, 2017 |

|

May 6, |

|

April 30, |

||||||||

|

(dollars in thousands) |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statement of Cash flow Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in operating activities |

|

$ |

(2,740 |

) |

|

$ |

(6,477 |

) |

|

$ |

(5,588 |

) |

|

$ |

(4,210 |

) |

|

Net cash used in investing activities |

|

|

(6,809 |

) |

|

|

(3,985 |

) |

|

|

(2,853 |

) |

|

|

(835 |

) |

|

Net cash provided by financing activities |

|

|

17,847 |

|

|

|

11,132 |

|

|

|

1,208 |

|

|

|

5,344 |

|

|

Net change in cash and cash equivalents |

|

|

8,297 |

|

|

|

670 |

|

|

|

(7,234 |

) |

|

|

299 |

|

|

Cash and cash equivalents at end of period |

|

|

9,176 |

|

|

|

879 |

|

|

|

1,942 |

|

|

|

1,178 |

|

____________

(1) For the calculation of basic and diluted net loss per share, see Note 1 and Note 7 to our audited consolidated financial statements. The weighted average number of common shares used in computing the net loss per common share gives effect to the 1-for-2.5 reverse stock split of our common stock that will occur immediately prior to the closing of this offering. The pro forma weighted average number of common shares used in computing pro forma net loss per common share gives effect to (i) the conversion of our outstanding preferred stock, along with the aggregate accrued or accumulated and unpaid dividends thereon, into approximately 3,287,441 shares of our common stock, and (ii) the 1-for-2.5 reverse stock split of our common stock that will occur immediately prior to the closing of this offering.

(2) For the quarter ended May 6, 2018, our pro forma net loss per common share increased as a result of the inducement offer made to preferred stockholders. This effect was calculated as follows:

(in thousands, except share and per share data) |

|

Thirteen weeks ended May 6, 2018 |

|

|

|

|

|

Net Loss Attributable to Common Stockholders |

$ |

(7,584 |

) |

Deemed dividend |

|

(27,630 |

) |

Pro forma Net loss Attributable to Common Stockholders |

$ |

(35,214 |

) |

|

|

|

|

Weighted-average shares used in computing net loss per common share |

|

6,065,238 |

|

Preferred conversion to common |

|

3,287,441 |

|

Vested restricted stock units |

|

61,854 |

|

Offering shares |

|

3,500,000 |

|

|

|

12,914,533 |

|

|

|

|

|

Pro forma net loss per common share (basic and diluted) |

$ |

(2.73 |

) |

(3) Retail data represents our showrooms exclusive of shop in shop showrooms.

(4) Comparable showroom sales are calculated based on showrooms that were open at least fifty-two weeks as of the end of the reporting period. A showroom is not considered a part of the comparable showroom sales base if the square footage of the showroom changed or if the showroom was relocated. If a showroom was closed for any period of time during the measurement period, that showroom is excluded from comparable showroom sales. The change in comparable showroom sales is calculated by comparing the period’s comparable showroom sales to the same period in the preceding fiscal year.

(5) Selling square footage is retail space at our showrooms used to sell our products. Selling square footage excludes backrooms at showrooms used for storage, office space or similar matters.

(6) Retail sales per selling square foot is calculated by dividing total net sales for all showrooms, comparable and non-comparable, by the average selling square footage for the period.

(7) Capital expenditures consist primarily of investments in new showrooms and remodeled showrooms.

13

(8) EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, and Average Unit Volume (collectively, our “Non-GAAP Measures”) are supplemental measures of financial performance that are not required by, or presented in accordance with, GAAP. We believe that EBITDA and Adjusted EBITDA are useful measures of operating performance, as they eliminate expenses that are not reflective of the underlying business performance, facilitate a comparison of our operating performance on a consistent basis from period-to-period and provide for a more complete understanding of factors and trends affecting our business. Additionally, EBITDA is frequently used by analysts, investors and other interested parties to evaluate companies in our industry. We use EBITDA and Adjusted EBITDA, alongside other GAAP measures such as gross profit, operating income (loss) and net income (loss), to measure evaluate our operating performance and we believe these measures are useful to investors in evaluating our operating performance.

Our Non-GAAP Measures are not GAAP measures of our financial performance or liquidity and should not be considered as alternatives to net income (loss) or net income (loss) per share as a measure of financial performance, cash flows from operating activities as a measure of liquidity, or any other performance measure derived in accordance with GAAP. They should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Additionally, our Non-GAAP Measures are not intended to be measures of free cash flow for management’s discretionary use, as they do not consider certain cash requirements such as tax payments and debt service requirements and certain other cash costs that may recur in the future. Our Non-GAAP Measures contain certain other limitations, including the failure to reflect our cash expenditures, cash requirements for working capital needs and cash costs to replace assets being depreciated and amortized. In addition, our Non-GAAP Measures exclude certain non-recurring and other charges.

You should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in Our Non-GAAP Measures. Our presentation of Our Non-GAAP Measures should not be construed to imply that our future results will be unaffected by any such adjustments. Management compensates for these limitations by relying primarily on our GAAP results and by using Our Non-GAAP Measures as supplemental information. Our Non-GAAP Measures are not necessarily comparable to other similarly titled captions of other companies due to different methods of calculation.

(9) We define EBITDA as net income before interest, taxes, depreciation and amortization. We define Adjusted EBITDA as EBITDA adjusted for the impact of certain non-cash and other items that we do not consider in our evaluation of ongoing operating performance. These items include sponsor fees, equity-based compensation expense, write-offs of property and equipment, deferred rent, financing expenses and certain other charges and gains that we do not believe reflect our underlying business performance. The following provides a reconciliation of net loss to EBITDA and Adjusted EBITDA for the periods presented:

|

|

|

Fiscal Year Ended |

|

Thirteen Weeks Ended |

||||||||||||

|

|

|

February 4, 2018 |

|

January 29, 2017 |

|

May 6, |

|

April 30, |

||||||||

|

(dollars in thousands) |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

Net loss |

|

$ |

(5,502 |

) |

|

$ |

(6,874 |

) |

|

$ |

(5,683 |

) |

|

$ |

(3,337 |

) |

|

|

|

438 |

|

|

|

565 |

|

|

|

58 |

|

|

|

150 |

|

|

|

|

|

26 |

|

|

|

138 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

2,359 |

|

|

|

2,180 |

|

|

|

670 |

|

|

|

347 |

|

|

|

EBITDA |

|

|

(2,679 |

) |

|

|

(3,991 |

) |

|

|

(4,955 |

) |

|

|

(2,840 |

) |

|

|

|

484 |

|

|

|

400 |

|

|

|

125 |

|

|

|

108 |

|

|

|

|

|

951 |

|

|

|

26 |

|

|

|

295 |

|

|

|

— |

|

|

|

|

|

197 |

|

|

|

77 |

|

|

|

6 |

|

|

|

— |

|

|

|

|

|

360 |

|

|

|

217 |

|

|

|

124 |

|

|

|

67 |

|

|

|

|

|

1,959 |

|

|

|

410 |

|

|

|

216 |

|

|

|

249 |

|

|

|

Adjusted EBITDA |

|

$ |

1,271 |

|

|

$ |

(2,861 |

) |

|

$ |

(4,189 |

) |

|

$ |

(2,416 |

) |

____________

(a) Represents management fees charged by our equity sponsors.

(b) Represents expenses associated with stock options and restricted stock units granted to our management.

(c) Represents the net loss on the disposal of fixed assets.

(d) Represents the difference between rent expense recorded and the amount paid by the Company. In accordance with generally accepted accounting principles, the Company records monthly rent expense equal to the total of the payments due over the lease term, divided by the number of months of the lease terms.

(e) Other expenses in fiscal 2018 are made up of: (1) $1,072 in fees and costs associated with our fundraising and reorganizing activities including the legal and professional services incurred in connection with such activities; (2) $182 in travel and logistical costs associated with the offering; (3) $484 in costs related to the offering and finance fees; and (4) $221 in accounting fees related to the offering. Other expenses in fiscal 2017 are made up of: (1) $242 in fees and costs associated with our fundraising and reorganizing activities including the legal and professional services

14

incurred in connection with such activities; (2) $29 in travel and logistical costs associated with the offering; and (3) $139 in accounting fees related to the offering.

(f) Other expenses in the thirteen weeks ended May 6, 2018 are made up of: (1) $94 in fees and costs associated with our fundraising and reorganizing activities including the legal and professional services incurred in connection with such activities; (2) $6 in travel and logistical costs associated with the offering; (3) $32 in costs related to the offering and finance fees; and (4) $82 in accounting fees related to the offering. Other expenses in the thirteen weeks ended April 30, 2017 are made up of: (1) $224 in fees and costs associated with our fundraising and reorganizing activities including the legal and professional services incurred in connection with such activities; and (2) $25 in travel and logistical costs associated with the offering.

(10) Adjusted EBITDA margin means, for any period, the Adjusted EBITDA for that period divided by the net sales for that period.

(11) Average Unit Volume is calculated by dividing total showroom sales by the average number of showrooms open during the period. For showrooms that are not open for the entire period, fractional adjustments are made to the number of showrooms used in the denominator such that it corresponds to the period of associated sales

(12) Working capital is defined as current assets, less current liabilities.

15

Risk Factors