UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_____________________

SCHEDULE 14A

_____________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant S

Filed by a Party other than the Registrant £

|

£ |

Preliminary Proxy Statement |

|

|

£ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

S |

Definitive Proxy Statement |

|

|

£ |

Definitive Additional Materials |

|

|

£ |

Soliciting Material Pursuant to §240.14a-12 |

THE LOVESAC COMPANY

(Name of Registrant as Specified in its Charter)

____________________________________________________________

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

S |

No fee required. |

|||||

|

£ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||||

|

(1) |

Title of each class of securities to which transaction applies: |

|||||

|

|

||||||

|

(2) |

Aggregate number of securities to which transaction applies: |

|||||

|

|

||||||

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||||

|

|

||||||

|

(4) |

Proposed maximum aggregate value of transaction: |

|||||

|

|

||||||

|

(5) |

Total fee paid: |

|||||

|

|

||||||

|

£ |

Fee paid previously with preliminary materials. |

|||||

|

£ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||||

|

(1) |

Amount Previously Paid: |

|||||

|

|

||||||

|

(2) |

Form, Schedule or Registration Statement No.: |

|||||

|

|

||||||

|

(3) |

Filing Party: |

|||||

|

|

||||||

|

(4) |

Date Filed: |

|||||

|

|

||||||

THE LOVESAC COMPANY

Two Landmark Square, Suite 300

Stamford, CT 06901

May 23, 2019

Dear Fellow Stockholders:

You are cordially invited to attend the 2019 Annual Meeting of Stockholders of The Lovesac Company (“we”, “us”, “Lovesac” or the “Company”) at 10:00 a.m. local time on June 5, 2019, at the Residence Inn located at 25 Atlantic Street, Stamford, CT 06901.

The annual meeting will be held for the following purposes:

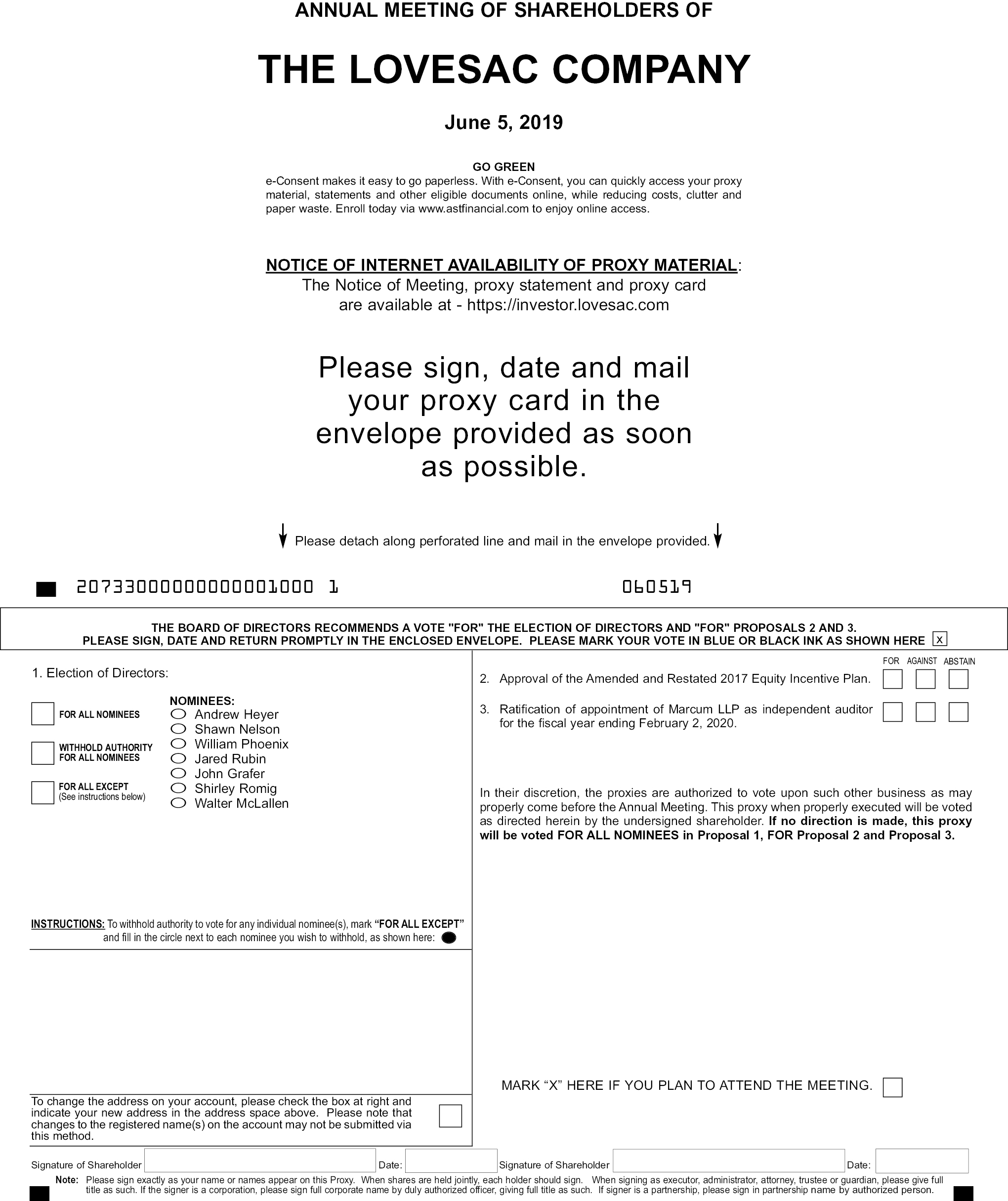

(1) to elect seven (7) directors to the board of directors to serve until the 2020 Annual Meeting of stockholders and until their successors are duly elected and qualified;

(2) to approve the Amended and Restated 2017 Equity Incentive Plan that, among other things, increases the number of shares reserved for issuance thereunder by 799,823 shares;

(3) to ratify the appointment of Marcum LLP as our independent auditor for the fiscal year ending February 2, 2020; and

(4) to transact any and all other business that may properly come before the annual meeting or any continuation, postponement, or adjournment thereof.

All stockholders of record of our common stock at the close of business on May 17, 2019, the record date, are entitled to notice of and to vote at this meeting and any continuation, postponement, or adjournment thereof. Whether or not you expect to attend the annual meeting of stockholders in person, we urge you to mark, sign, date and return the enclosed proxy card as promptly as possible in the provided postage-prepaid envelope to ensure your representation and the presence of a quorum at the annual meeting. If you send in your proxy card, you may still decide to attend the annual meeting of stockholders and vote your shares in person. Your proxy is revocable in accordance with the procedures set forth in the Proxy Statement.

On behalf of the board of directors and the officers and employees of Lovesac, I would like to take this opportunity to thank our stockholders for their continued support of Lovesac. We look forward to seeing you at the meeting.

|

Sincerely yours, |

||

|

|

THE LOVESAC COMPANY

Two Landmark Square, Suite 300

Stamford, CT 06901

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 5, 2019

You are cordially invited to attend the 2019 Annual Meeting of Stockholders (the “Annual Meeting”) of The Lovesac Company (“we”, “us”, “Lovesac” or the “Company”) at 10:00 a.m. local time on June 5, 2019, at the Residence Inn, located at 25 Atlantic Street, Stamford, CT 06901.

The annual meeting will be held for the following purposes:

(1) to elect seven (7) directors to the board of directors to serve until the 2020 Annual Meeting of stockholders and until their successors are duly elected and qualified;

(2) to approve the Amended and Restated 2017 Equity Incentive Plan that, among other things, increases the number of shares reserved for issuance thereunder by 799,823 shares;

(3) to ratify the appointment of Marcum LLP as our independent auditor for the fiscal year ending February 2, 2020; and

(4) to transact any and all other business that may properly come before the annual meeting or any continuation, postponement, or adjournment thereof.

These matters are more fully described in the Proxy Statement accompanying this Notice. You may vote at the Annual Meeting (or any adjournment or postponement of the Annual Meeting) if you were a stockholder of the Company at the close of business on May 17, 2019, the record date. Only stockholders of record at the close of business on the record date are entitled to notice of, and to vote at, the Annual Meeting. The Company’s stock transfer books will not be closed. A list of the stockholders entitled to vote at the Annual Meeting may be examined at the Company’s offices during the 10 day period preceding the Annual Meeting.

You are cordially invited to attend the Annual Meeting. Whether or not you expect to attend, the board of directors respectfully requests that you vote your shares in the manner described in the Proxy Statement. You may revoke your proxy in the manner described in the Proxy Statement at any time before it has been voted at the Annual Meeting.

|

By Order of the Board of Directors |

||

|

May 23, 2019 |

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING: Our Annual Report on Form 10-K, this Notice and the Proxy Statement and the proxy card are available electronically at https://investor.lovesac.com.

THE LOVESAC COMPANY

Two Landmark Square, Suite 300

Stamford, CT 06901

PROXY STATEMENT

For the 2019 Annual Meeting of Stockholders

to be held on June 5, 2019

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving these materials?

The board of directors of The Lovesac Company (which we refer to in this proxy statement as “we”, “our”, “us” or “Lovesac”) is providing you these proxy materials in connection with the Board’s solicitation of proxies from our stockholders for our 2019 Annual Meeting of Stockholders (which we refer to as the “Annual Meeting”) and any adjournments and postponements of the Annual Meeting. The Annual Meeting will be held at the Residence Inn, located at 25 Atlantic Street, Stamford, CT 06901, on Wednesday, June 5, 2019, commencing at 10:00 a.m. local time. On or about May 23, 2019, we expect to begin mailing to our stockholders proxy materials. Whether or not you plan to attend the Annual Meeting, you may submit a proxy to vote your shares by the Internet or mail as more fully described below.

What is the purpose of the Annual Meeting?

At the Annual Meeting, you and our other stockholders entitled to vote at the Annual Meeting are requested to vote on proposals to (1) elect seven members of our board of directors to serve until our 2020 annual meeting of stockholders, (2) approve the Amended and Restated 2017 Equity Incentive Plan that, among other things increases the number of shares reserved for issuance thereunder by 799,823 shares, and (3) ratify the appointment of Marcum LLP as our independent auditor for fiscal year 2020.

Who is entitled to attend and vote at the Annual Meeting?

Only stockholders of record as of the close of business on May 17, 2019, the record date for the Annual Meeting, or the holders of their valid proxies may attend the Annual Meeting. A list of our stockholders will be available for review at our executive offices in Stamford, Connecticut, during ordinary business hours for a period of 10 days prior to the meeting. Each person attending the Annual Meeting may be asked to present a photo ID before being admitted to the meeting. In addition, stockholders who hold their shares through a broker or nominee (i.e., in street name) should provide proof of their beneficial ownership, such as a brokerage statement showing their ownership of shares as of May 17, 2019. Cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting, and attendees will be subject to security inspections.

Only holders of record of our common stock at the close of business on May 17, 2019 are entitled to notice of and to vote at the Annual Meeting. Each stockholder is entitled to one vote for each share of common stock held. Shares of our common stock represented in person or by a properly submitted proxy will be voted at the Annual Meeting. On the record date, 13,773,665 shares of our common stock were outstanding and entitled to vote.

What constitutes a quorum?

The presence at the Annual Meeting in person or by proxy of the holders of a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting is required to constitute a quorum for the transaction of business.

1

What vote is required to approve each item to be voted on at the Annual Meeting?

Election of Directors — a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors is required for the election of directors. This means that the seven director nominees receiving the highest number of affirmative votes of the shares present in person or represented by proxy at the annual meeting and entitled to vote on the election of directors will be elected to our board. Broker non-votes and votes marked “WITHHOLD AUTHORITY FOR ALL NOMINEES” will have no legal effect on the outcome of the election of directors. With respect to votes marked “FOR ALL EXCEPT,” votes for director nominees that are withheld will have no legal effect on the outcome of the election of directors, while votes for all other director nominees will count toward a plurality.

Approval of Amended and Restated 2017 Equity Incentive Plan — requires the affirmative vote of a majority of the shares present at the meeting and entitled to vote on this proposal. You may vote “FOR,” “AGAINST,” or “ABSTAIN” with respect to this proposal. If you indicate on your proxy card that you wish to “ABSTAIN” from voting on this proposal, your shares will not be voted on this proposal. Abstentions are not counted in determining the number of shares voted “FOR” or “AGAINST” this proposal, but will be counted as present and entitled to vote on this proposal. Accordingly, an abstention will have the effect of a vote against this proposal. Broker non-votes are not counted in determining the number of shares voted for or against this proposal and will not be counted as present and entitled to vote on this proposal.

Ratification of Appointment of Independent Registered Public Accounting Firm for the Year Ending February 2, 2020 — requires the affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote on the proposal at the annual meeting. You may vote “FOR,” “AGAINST,” or “ABSTAIN” with respect to this proposal. Abstentions are considered shares present and entitled to vote on this proposal, and thus, will have the same effect as a vote “AGAINST” this proposal. Broker non-votes will have no effect on the outcome of this proposal.

How does the Board of Directors recommend that I vote?

Our board of directors recommends that you vote:

• FOR each of the nominees for director named in this proxy statement;

• FOR the approval of the Amended and Restated 2017 Equity Incentive Plan; and

• FOR the ratification of the appointment of Marcum LLP as our independent auditor for fiscal year 2020.

How do I vote?

If your shares are held in your name, you may vote your shares or submit a proxy to have your shares voted by one of the methods described below. If you hold your shares through a bank, broker or other nominee, it will give you separate instructions for voting your shares.

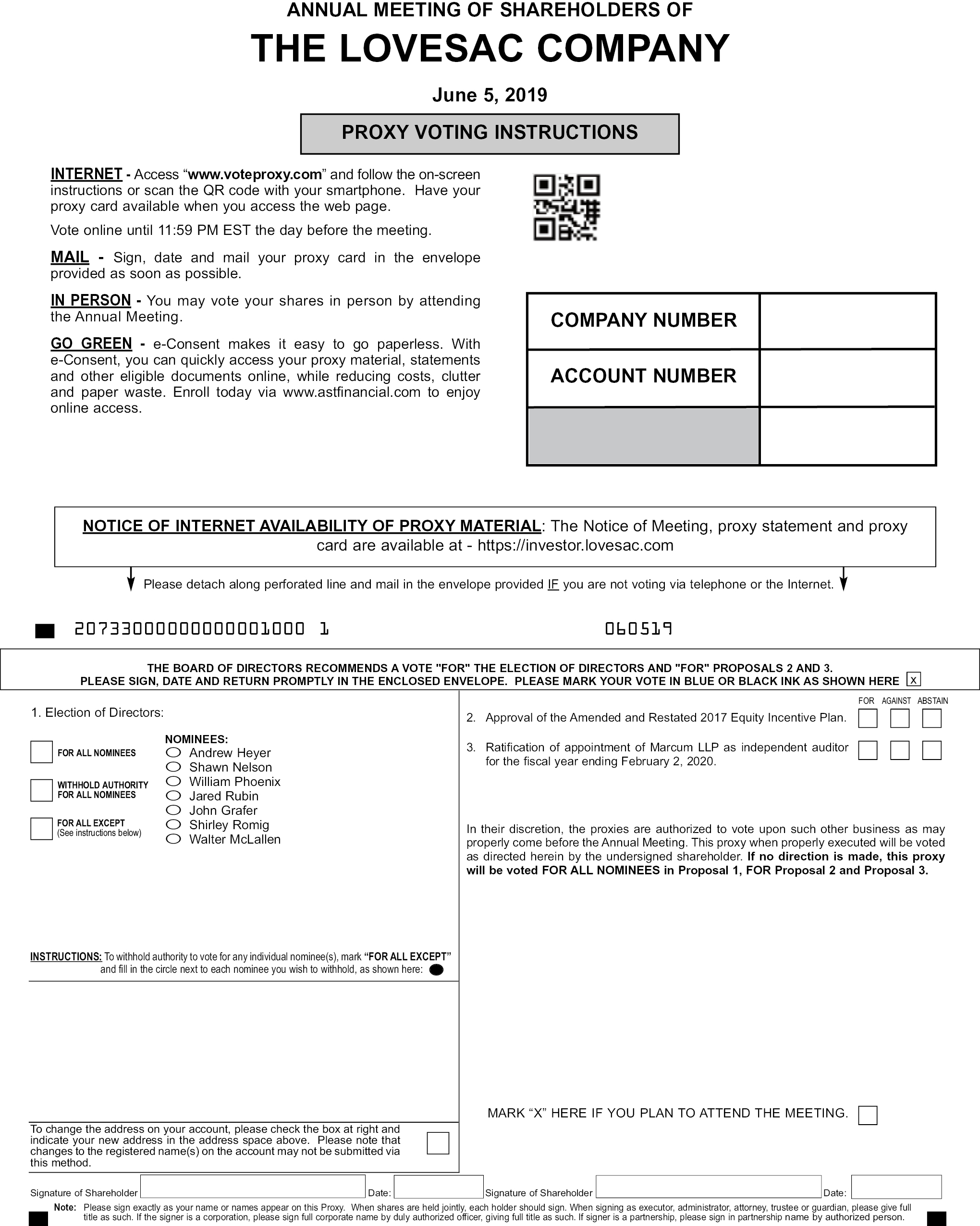

• By Internet. You may submit a proxy electronically via the Internet at www.voteproxy.com. Have your proxy card available when you long onto the website. Then follow the on-screen instructions or scan the QR code that is on your proxy card with your smartphone. Internet voting facilities will close and no longer be available as of 11:59 p.m. ET on June 4, 2019.

• By Mail. You may submit a proxy by signing, dating and returning your proxy card in the pre-addressed envelope provided.

• In Person. You may vote in person at the Annual Meeting by completing a ballot.

If you vote by granting a proxy, the proxy holders will vote the shares according to your instructions. If you submit a proxy without giving specific voting instructions, the proxy holders will vote those shares as recommended by our Board. If you plan to vote in person at the Annual Meeting and your shares are held in your name, please bring proof of identification.

2

How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?

Brokerage firms and other intermediaries holding shares of our common stock in street name for their customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker will have discretion to vote your shares on our sole “routine” matter: the proposal to ratify the appointment of Marcum LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2019. Your broker will not have discretion to vote on any other proposals, which are “non-routine” matters, absent direction from you (and failure to provide instructions on these matters will result in a “broker non-vote”).

Can I change my vote after I return my proxy card?

You may vote in person at the Annual Meeting or you may give us your proxy. We recommend that you vote by proxy even if you plan to attend the Annual Meeting. As described below, you can change your vote at the Annual Meeting. You can vote by proxy electronically by using the Internet or through the mail as described below. If you would like to vote by using the Internet, please refer to the specific instructions set forth on the proxy card. If you are a holder of record and received your proxy statement and Annual Report by mail, you can vote by signing, dating and completing the enclosed proxy card and returning it by mail in the enclosed postpaid envelope. No postage is necessary if the proxy card is mailed in the United States. If you hold your shares through a bank, broker or other nominee, it will give you separate instructions for voting your shares.

Your proxy may be revoked at any time before its exercise by sending written notice of revocation to The Lovesac Company, Two Landmark Square, Suite 300, Stamford, CT 06901, Attention: Secretary, or by submitting a valid proxy that is dated later, or, if you attend the Annual Meeting in person, by giving notice of revocation to the Inspector of Election referred to below at the Annual Meeting.

How will votes be recorded and where can I find the voting results of the Annual Meeting?

We have engaged American Stock Transfer & Trust Company, LLC (“AST”), our transfer agent, as our inspector of elections to receive and tabulate votes. AST will separately tabulate “for” and “against” votes, abstentions and broker non-votes. AST will also certify the results and determine the existence of a quorum and the validity of proxies and ballots.

We plan to announce preliminary voting results at the Annual Meeting and to publish the final results in a current report on Form 8-K following the Annual Meeting.

Who conducts the proxy solicitation and how much will it cost?

The Company is requesting your proxy for the Annual Meeting and will pay the costs of requesting stockholder proxies. Proxies may be solicited by directors, officers and other employees of the Company, personally or by telephone, Internet, or mail, none of whom will receive compensation for their solicitation efforts. We may also reimburse brokerage firms, dealers, banks, voting trustees or other record holders for their reasonable expenses for forwarding proxy materials to the beneficial owners of our common stock.

Questions and Additional Copies

If you have any additional questions with respect to the Company or the matters described herein, or questions about how to submit your proxy, or if you need additional copies of this proxy statement or the attached proxy card, you should contact our Secretary at The Lovesac Company, Two Landmark Square, Suite 300, Stamford, CT 06901, by telephone at (888) 636-1223, or by email at InvestorRelations@lovesac.com.

3

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

Nominees

Our board of directors currently consists of seven (7) members and is authorized to have no less than five (5) members nor more than seven (7) members. Each our directors serves until the next annual meeting of stockholders and until his successor is elected and duly qualified, or until his earlier death, resignation or removal.

We have no formal policy regarding board diversity. In selecting board candidates, we seek individuals who will further the interests of our stockholders through an established record of professional accomplishment, the ability to contribute positively to our collaborative culture, knowledge of our business and understanding of our prospective markets. We plan to recruit additional independent directors who can bring specific expertise and experience that is relevant to our business and future direction.

Shawn Nelson, Andrew Heyer, William Phoenix, Jared Rubin, John Grafer, Shirley Romig and Walter McLallen have been nominated for election as directors to serve until the 2020 Annual Meeting of Stockholders and until their successors are elected and have qualified. Christopher Bradley and David Yarnell are not standing for re-election. Each nominee has consented to being named in the proxy statement and has agreed to serve as a member of the board of directors, if elected. In the event that any of the nominees should be unable to serve as a director, it is intended that the proxy will be voted for the election of such substitute nominee, if any, as shall be designated by the board of directors. The board of directors has no reason to believe that any of the nominees named below will be unable to serve if elected.

The board of directors believes that each nominee and director has valuable individual skills and experiences that, taken together, provide us with the knowledge, judgment and strategic vision necessary to provide effective oversight. The biographies below reflect the particular experience, qualifications, attributes and skills that led the board of directors to conclude that each nominee and director should serve on the board.

The following table sets forth, as of May 22, 2019, the names of, and certain information concerning, the persons nominated by the board of directors for election as directors of the Company.

|

Name |

Age |

Title |

Date Appointed |

|||

|

Shawn Nelson |

41 |

Chief Executive Officer and Director |

February 27, 2017(1) |

|||

|

Andrew Heyer |

60 |

Chairman of the Board of Directors |

February 27, 2017(2) |

|||

|

William Phoenix |

60 |

Director |

January 3, 2017(3) |

|||

|

Jared Rubin |

39 |

Director |

January 3, 2017(4) |

|||

|

John Grafer |

48 |

Director |

June 27, 2017 |

|||

|

Shirley Romig |

41 |

Director Nominee |

— |

|||

|

Walter McLallen |

53 |

Director Nominee |

— |

|||

|

Christopher Bradley* |

41 |

Director |

January 3, 2017(5) |

|||

|

David Yarnell* |

63 |

Director |

January 3, 2017(6) |

____________

* Messrs. Bradley and Yarnell have decided not to stand for re-election at the Annual Meeting. Pursuant to Item 401(a) of Regulation S-K, their biographies have been omitted below.

(1) Mr. Nelson has been a Director of SAC Acquisition, LLC, the predecessor entity of the Company, since May 8, 2008.

(2) Mr. Heyer has been a Director of SAC Acquisition, LLC, the predecessor entity of the Company, since March 3, 2015.

(3) Mr. Phoenix has been a Director of SAC Acquisition, LLC, the predecessor entity of the Company, since May 24, 2010.

(4) Mr. Rubin has been a Director of SAC Acquisition, LLC, the predecessor entity of the Company, since June 30, 2014.

(5) Mr. Bradley has been a Director of SAC Acquisition LLC, the predecessor entity of the Company, since May 24, 2010.

(6) Mr. Yarnell has been a Director of SAC Acquisition LLC, the predecessor entity of the Company, since May 8, 2008.

Shawn Nelson founded Lovesac in 1998 and is currently serving as our Chief Executive Officer and as a member of the board of directors. Mr. Nelson is the lead designer of the Company’s patented products and directly oversees design, sourcing, public relations, investor relations and culture. In 2005, Mr. Nelson won Richard Branson’s “The Rebel Billionaire” on Fox and continues to participate in ongoing TV appearances. Mr. Nelson has a Master’s Degree in Strategic Design and Management and is a graduate-level instructor at Parsons, The New School for Design in New York City. Mr. Nelson is also fluent in Chinese with a BA in Mandarin from the University of Utah. We believe Mr. Nelson is qualified to serve on our board because of his leadership experience as our founder, his extensive knowledge of our Company and his service as our Chief Executive Officer.

4

Andrew R. Heyer is the Chairman of our board of directors. Mr. Heyer is a finance professional with over 35 years of experience investing the consumer and consumer-related products and services industries. He has deployed in excess of $1 billion of capital over that time frame, and has guided several public and private companies as a member of their boards of directors. Mr. Heyer is the Chief Executive Officer and Founder of Mistral Equity Partners, a private equity fund manager founded in 2007 that invests in the consumer industry. Prior to founding Mistral, Mr. Heyer served as a Founding Managing Partner of Trimaran Capital Partners. Until 1995, Mr. Heyer was a vice chairman of CIBC World Markets Corp. and a co-head of the CIBC Argosy Merchant Banking Funds. Prior to joining CIBC World Markets Corp., Mr. Heyer was a founder and Managing Director of The Argosy Group L.P. Prior to joining Argosy, Mr. Heyer was a Managing Director at Drexel Burnham Lambert Incorporated and, prior to that, he worked at Shearson/American Express. From 1993 to 2009 and from 2012 to April 2019, he has served on the board of The Hain Celestial Group (Nasdaq: HAIN), a natural and organic food and products company. Since December 2016, Mr. Heyer has served as a director of XpresSpa Group, Inc. (Nasdaq: XSPA), a diversified holding company. From April 2017 to March 2019, Mr. Heyer served as a director and president of Haymaker Acquisition Corp., which was acquired by OneSpaWorld Holdings Limited (Nasdaq: OSW) on March 19, 2019. Since March 2019, Mr. Heyer has served on the board of directors of OneSpaWorld Holdings Limited. Mr. Heyer also serves on the boards of directors of several private companies, including Worldwise, a pet accessories business. Mr. Heyer received his B.Sc. and M.B.A. from the Wharton School of the University of Pennsylvania, graduating magna cum laude. We believe Mr. Heyer is qualified to serve on our board because of his extensive experience in private equity investing in the consumer goods industry and his experience on other private and public company boards.

Jared Rubin is a member of our board of directors. He is currently a director at Schottenstein Stores Corporation. Since 2013, Mr. Rubin has held executive and board of director positions within the Schottenstein family of companies with a focus in the retail sector, including strategy and financial based roles at American Signature, Inc. and Artisan de Luxe. From 2009 to 2013, Mr. Rubin was a Vice President at Tiger Infrastructure Partners, a private equity investment firm. Mr. Rubin previously served at Lehman Brothers as a member of its private equity investment team within the firm’s asset management division and as an investment banker, holding various capital markets, investment banking and proprietary investment roles within the firm. He holds a B.Sc. in Economics from the Wharton School of the University of Pennsylvania. We believe Mr. Rubin is qualified to serve on our board because of his extensive background in retail, his experience in private equity investment and investment banking and leadership experience as a senior executive and director of retail and consumer product companies.

William P. Phoenix is a member of our board of directors. Since 2007, Mr. Phoenix has been a Managing Director at Mistral Equity Partners. He has extensive experience as a provider of all forms of capital to non-investment grade companies. From 2002 to 2007, Mr. Phoenix was a Managing Director of Trimaran Capital Partners, L.L.C. Mr. Phoenix spent a good portion of his career in various capacities at the Canadian Imperial Bank of Commerce (CIBC), beginning in 1982. He was a Managing Director of CIBC Capital Partners, where he focused on mezzanine transactions and private equity opportunities. While at CIBC, he also had management responsibilities for Acquisition Finance, Mezzanine Finance, and the Loan Workout and Restructuring businesses. Mr. Phoenix has been a member of the board of directors of Lovesac since 2010 and Blueport Commerce. Mr. Phoenix received his B.A. in Economics from the University of Western Ontario and his M.B.A. from the University of Toronto. He is a graduate of the Leadership New York Program. We believe Mr. Phoenix is qualified to serve on our board because of his extensive background in finance and private equity investment and his experience on other private company boards.

Shirley Romig is a director nominee nominated to join our board of directors at the Annual Meeting. Ms. Romig is a retail executive with nearly two decades of experience in operational growth strategies and leading transformational initiatives in complex consumer-oriented organizations. Most recently, Ms. Romig is the Group Vice President of Ancillary Operations at Equinox and led six lines of businesses within its fitness clubs. Previously, Ms. Romig was the Head of Retail Strategy for SapientRazorfish, a global digital agency. From 2013 to 2015, Ms. Romig was the Senior Vice President of Corporate Strategy with HBC responsible for implementation of growth initiatives across Saks Fifth Avenue, Saks OFF 5th, Lord & Taylor and Hudson’s Bay and Home Outfitters in Canada. Ms. Romig also served as a Vice President for Saks Incorporated where she led the company’s omnichannel transformation work and launched Saksoff5th.com as well as numerous growth initiatives for Saks.com. Ms. Romig previously served at Pali Capital in equity research as well as Kurt Salmon Associates and Kaiser Associates in strategy consulting. Ms. Romig holds an MBA from the Darden School of Business and a Bachelor of Science from the McIntire School of Commerce, both at the University of Virginia. We believe Ms. Romig is qualified to serve on our board based on her expertise in e-commerce, digital innovation, corporate strategy and scaling complex retail operations.

5

Walter D. McLallen is a director nominee nominated to join our board of directors at the Annual Meeting. Mr. McLallen is a finance professional with over 25 years of leveraged finance, private equity and operations experience. Mr. McLallen has been the Managing Member of Meritage Capital Advisors, an advisory boutique firm focused on debt and private equity transaction origination, structuring and consulting since 2004. Mr. McLallen has extensive board and organizational experience and has served on numerous corporate and non-profit boards and committees, with a significant historical focus on consumer products-related companies. Mr. McLallen serves as a director of publicly traded Centric Brands Inc. (CTRC:NASDAQ), a lifestyle brands collective in the branded and licensed apparel and accessories sectors and OneSpaWorld Holdings (OSW:NASDAQ), a pre-eminent global provider of health and wellness services and products onboard cruise ships and in destination resorts around the world; as well as several consumer-focused private companies, including Timeless Wine Company, the producer of consumer luxury wine brands Silver Oak, Twomey and OVID; Worldwise, a consumer branded pet products company; adMarketplace, a search engine advertiser; and Classic Brands, an e-commerce marketer of mattresses and related products. Mr. McLallen is also a founder and Co-Chairman of Tomahawk Strategic Solutions, a law enforcement and corporate training and risk management company. From 2006 to 2015, Mr. McLallen was Vice Chairman of Remington Outdoor Company, an outdoor consumer platform he co-founded with a major investment firm. Mr. McLallen was formerly with CIBC World Markets from 1995 to 2004, during which time he was a Managing Director, head of Debt Capital Markets and head of High Yield Distribution. Mr. McLallen started his career in the Mergers & Acquisitions Department of Drexel Burnham Lambert and was a founding member of The Argosy Group L.P. Mr. McLallen received a B.A. with a double major in Economics and Finance from the University of Illinois at Urbana-Champaign. Mr. McLallen is qualified to serve as a director due to his extensive consumer products, operational and board experience, as well as his background in finance.

Vote Required

The affirmative vote of a plurality of the votes of the shares present in person or represented by proxy at the annual meeting and entitled to vote is required for the election of directors. A properly executed proxy marked “WITHHOLD AUTHORITY FOR ALL NOMINEES” or “FOR ALL EXCEPT” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether a quorum is present.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE OF “FOR” ALL SEVEN (7) NOMINEES TO SERVE UNTIL THE 2020 ANNUAL MEETING OF STOCKHOLDERS AND UNTIL THEIR RESPECTIVE SUCCESSORS SHALL BE ELECTED AND QUALIFIED.

Director Independence

Our board of directors has undertaken a review of the independence of each director. Based on information provided by each director concerning his background, employment and affiliations, our board of directors has determined that our directors and director nominees (other than Andrew Heyer, Shawn Nelson and John Grafer) do not have relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of our directors and director nominees (other than Andrew Heyer, Shawn Nelson and John Grafer) is “independent” as that term is defined under the listing standards of Nasdaq. In making these determinations, our board of directors considered the current and prior relationships that each non-employee director and each director nominee has with our company and all other facts and circumstances our board of directors deemed relevant in determining their independence and eligibility to serve on the committees of our board of directors.

Board Meetings

During fiscal 2019, the board of directors held seven meetings. Each director then serving attended at least 75% of the aggregate of the total number of meetings of the board of directors held during the period such director served and the total number of meetings held by any of the committees of the board of directors on which such director served during such period.

6

Board Committees

Our board of directors has established an audit committee and a compensation committee. Audit committees generally must be comprised of at least three independent directors. Compensation committees generally must be comprised of at least two independent directors. As a result of our loss of “controlled company” status in connection with a secondary offering of our common stock on October 31, 2018, the Company is allowed to phase-in its compliance with the compensation committee composition requirements as follows: (1) one member must satisfy the requirement as of October 31, 2018; (2) a majority of members must satisfy the requirement by January 29, 2019; and (3) all members must satisfy the requirement within one year of the closing of the secondary offering. Our board of directors may establish other committees to facilitate the management of our business. The functions of the audit and compensation committees are described below. Directors serve on these committees until their resignation or until otherwise determined by our board of directors.

Audit Committee

Our audit committee, which met two times in fiscal 2019, consists of William Phoenix, as the chair, and Messrs. Rubin and Yarnell. Our board of directors has determined that Messrs. Phoenix, Rubin and Yarnell qualify as “audit committee financial experts” within the meaning of Item 407(d) of Regulation S-K promulgated under the Securities Act. Our audit committee assists our board of directors in its oversight of our accounting and financial reporting process and the audits of our financial statements. Our audit committee, which operates under a written charter that is posted on the Investor Relations section of our website at https://investor.lovesac.com, is, among other things, responsible for:

• appointing, approving the compensation of, and assessing the independence of our registered public accounting firm;

• overseeing the work of our registered public accounting firm, including through the receipt and consideration of reports from such firm;

• reviewing and discussing with management and the registered public accounting firm our annual and quarterly financial statements and related disclosures;

• monitoring our internal control over financial reporting, disclosure controls and procedures and code of business conduct and ethics;

• overseeing our internal accounting function;

• discussing our risk management policies;

• establishing policies regarding hiring employees from our registered public accounting firm and procedures for the receipt and retention of accounting-related complaints and concerns;

• meeting independently with our internal accounting staff, registered public accounting firm and management;

• reviewing and approving or ratifying related party transactions; and

• preparing the audit committee reports required by SEC rules.

Compensation Committee

Our compensation committee, which met six times in fiscal 2019, consists of Mr. Heyer, as the chair, and Mr. Grafer. Our compensation committee, which operates under a written charter that is posted on the Investor Relations section of our website at https://investor.lovesac.com, is, among other things, responsible for:

• reviewing and approving corporate goals and objectives with respect to Chief Executive Officer compensation;

• making recommendations to our board with respect to the compensation of our Chief Executive Officer and our other executive officers;

7

• overseeing evaluations of our senior executives;

• reviewing and assessing the independence of compensation advisers;

• overseeing and administering our equity incentive plans;

• reviewing and making recommendations to our board with respect to director compensation; and

• preparing the compensation committee reports required by SEC rules.

Compensation Committee Interlocks and Insider Participation

No member of our compensation committee will be or at any time during the past year have been one of our officers or employees. None of our executive officers currently serves or in the past year has served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board of directors or compensation committee.

Director Nominations

The board of directors as a whole will consider director candidates recommended for nomination by our stockholders during such times as they are seeking proposed nominees to stand for election at the next annual meeting of stockholders (or, if applicable, a special meeting of stockholders). Our stockholders that wish to nominate a director for election to our board of directors should follow the procedures set forth in our bylaws.

We have not formally established any specific, minimum qualifications that must be met or skills that are necessary for directors to possess. In general, in identifying and evaluating nominees for director, our board of directors considers educational background, diversity of professional experience, knowledge of our business, integrity, professional reputation, independence, wisdom, and the ability to represent the best interests of our stockholders.

Board Leadership Structure and Risk Oversight

The board of directors oversees our business and considers the risks associated with our business strategy and decisions.

The board of directors currently implements its risk oversight function as a whole. Each of the board committees will provide risk oversight in respect of its areas of concentration and reports material risks to the board of directors for further consideration.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics (the “Code of Ethics”), that applies to all directors, officers and employees of our Company and its subsidiaries. This Code of Ethics covers a wide range of business practices and procedures and promotes honest and ethical conduct, full, fair, accurate and timely disclosure in all reports and documents that our Company files under public communication, compliance with all applicable governmental laws, rules and regulations, protection of company assets, and fair dealing practices. The full text of our Code of Ethics is posted on the Investor Relations section of our website at https://investor.lovesac.com. We will disclose future amendments or waivers to our code of business conduct and ethics on our website within four business days following the date of the amendment or waiver.

8

Director Compensation

The following table provides information concerning the compensation paid to persons serving as non-employee directors of our Company for the fiscal year ended February 3, 2019 for whom information has not been disclosed above under the heading “Summary Compensation Table.”

|

Name |

Fees Earned or Paid in Cash |

Stock Awards ($) |

Option Awards ($) |

Non-equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings |

All Other Compensation ($) |

Total ($) |

|||||||

|

Andrew Heyer |

— |

— |

— |

— |

— |

— |

— |

|||||||

|

David Yarnell |

— |

— |

— |

— |

— |

— |

— |

|||||||

|

William Phoenix |

— |

— |

— |

— |

— |

— |

— |

|||||||

|

Jared Rubin |

— |

— |

— |

— |

— |

— |

— |

|||||||

|

Christopher Bradley |

— |

— |

— |

— |

— |

— |

— |

|||||||

|

John Grafer |

— |

— |

— |

— |

— |

— |

— |

We currently do not have a formal non-employee director compensation policy. During fiscal 2019, we did not pay cash compensation to any non-employee director for his or her service as a director. We reimburse our non-employee directors for reasonable travel and out-of-pocket expenses incurred in connection with attending board of director and committee meetings.

9

PROPOSAL NO. 2 — APPROVAL OF AMENDMENT TO THE LOVESAC COMPANY

2017 EQUITY INCENTIVE PLAN

Background

In 2017, our board of directors adopted and our stockholders approved our 2017 Equity Incentive Plan (the “2017 Plan”).

At this time, we estimate that the 2017 Plan has only enough shares reserved to provide for equity incentive grants through the 2019 fiscal year. Since our ability to grant equity incentive compensation to eligible individuals is an integral part of our compensation practices, we are requesting stockholder approval to add 799,823 shares to the 2017 Plan’s share reserve so that we may continue to grant awards after fiscal year 2019. At the same time, we are making several changes to the terms of the 2017 Plan that are favorable to stockholders.

Summary of the Proposal

We operate in a challenging marketplace in which our success depends to a great extent on our ability to attract and retain employees, directors and other service providers of the highest caliber. One of the tools our board of directors regards as essential in addressing these human resource challenges is a competitive equity incentive program. Our employee stock incentive program provides a range of incentive tools and sufficient flexibility to permit the Board’s Compensation Committee to implement them in ways that will make the most effective use of the shares our stockholders authorize for incentive purposes.

In May 2019, our board of directors adopted an amendment and restatement of the 2017 Plan (the “Amended Plan”), subject to approval by our stockholders at our 2019 annual meeting, that increases by 799,823 the aggregate maximum number of shares that may be issued under the Amended Plan, so that the new total share reserve for grants under the Amended Plan will be 1,414,889 shares. As of May 17, 2019, a total of 348,462 shares had been issued under the 2017 Plan, 89,182 shares remained subject to outstanding awards under the 2017 Plan, and 160,177 shares remained available for the future grant of awards under the 2017 Plan.

We believe that increasing the shares reserved for issuance under the 2017 Plan is necessary for us to continue to offer a competitive equity incentive program. We believe that the additional shares will provide us with enough shares to continue to offer competitive equity compensation through fiscal year 2022. This estimate is based on a number of assumptions, including that our grant practices under the Amended Plan will be consistent with our historical practices and usage, and is dependent on a number of other factors that are difficult to predict or beyond our control, including the price of our Common Stock underlying future grants, our hiring activity, forfeitures of outstanding awards and other circumstances that may require us to change our equity grant practices.

If the stockholders do not approve the proposed share increase, we believe we will not be able to continue to offer competitive equity packages to retain our current employees and recruit qualified new hires. This could significantly hamper our plans for growth and adversely affect our ability to operate our business. In addition, if we were unable to grant competitive equity awards, we may be required to offer additional cash-based incentives to replace equity as a means of competing for talent. This could have a significant effect upon our quarterly results of operations and balance sheet and not be competitive with other companies that offer equity.

The board of directors believes that the Amended Plan will serve a critical role in attracting and retaining the high caliber employees, consultants and directors essential to our success and in motivating these individuals to strive to meet our goals. Therefore, the Board urges you to vote to approve the adoption of the Amended Plan.

Stockholder-Favorable Amendments to the Plan

In connection with this proposal, we made several changes to the 2017 Plan, as reflected in the Amended Plan, that are favorable to our stockholders, as follows:

• The Amended Plan now prohibits repricing of stock options and stock appreciation rights without the approval of our stockholders.

• The Amended Plan now provides for gross share counting. The number of shares remaining for grant under the Amended Plan is reduced by the gross number of shares subject to options and stock appreciation rights settled on a net basis.

10

• We changed the share recycling provision so that shares withheld from options and stock appreciation rights for taxes are not added back to the pool for future awards.

• We confirmed that shares purchased in the open market with proceeds from the exercise of options will not be added back to the pool for future awards.

• We changed the provisions on dividend equivalents so that they cannot be paid currently on any unvested “full value” award and cannot be paid at all with respect to options or stock appreciation rights.

• We confirmed that an option or stock appreciation right can never be transferred to a third party financial institution for value.

• We made other minor, technical, and/or administrative changes as reflected in the Amended Plan.

Other Key Features of the Amended Plan

The following is a summary of other key features of the Amended Plan of particular interest to our stockholders that we believe reflect best practices:

• There is no “evergreen” annual share increase provision.

• No discount from fair market value is permitted in setting the exercise price of stock options and stock appreciation rights.

• The number of shares for which awards may be granted to any nonemployee member of our board of directors in a fiscal year is limited due to a total annual compensation limit in the Amended Plan.

• The Amended Plan does not contain a “liberal” change in control definition (e.g., mergers require actual consummation).

• The Amended Plan contains a clawback provision that applies to all equity grants made under the plan.

• The Amended Plan has a fixed term of ten years.

Total Potential Dilution and Run Rate Information

Common measures of a stock plan’s cost include burn rate, dilution and overhang. The burn rate, or run rate, refers to how fast a company uses the supply of shares authorized for issuance under its stock plan. Over the last two years, the Company has maintained an average equity run rate of only 3.7% of shares of Common Stock outstanding per year. Total Potential Dilution (under employee stock plans) measures the degree to which our stockholders’ ownership has been diluted by stock-based compensation awarded under the 2017 Plan and also includes shares that may be awarded under the Amended Plan in the future.

The following table shows how our key equity metrics have changed over the past two years, and also reflects the impact of the proposed new share request on such metrics:

|

Key Equity Metrics: |

As of 4/30/19 including the New Share Request(1) |

Fiscal Year End 2019 |

Fiscal Year End 2018 |

|||

|

Equity Run Rate(2) |

N/A |

3.1% |

4.3% |

|||

|

Outstanding Overhang(3) |

0.7% |

2.7% |

3.0% |

|||

|

Total Potential Dilution under Employee Stock Plans(4) |

7.2% |

3.0% |

5.5% |

____________

(1) Includes all information as of 4/30/19, including the impact of the 799,823 new shares that shareholders are being asked to approve in this proposal.

(2) Equity run rate is calculated by dividing the number of shares subject to equity awards granted during the year by the weighted-average number of basic shares outstanding during the year.

(3) Outstanding Overhang is calculated by dividing (a) the number of shares subject to equity awards outstanding at the end of the year, by (b) the sum of number of shares outstanding at the end of the year, the number of shares subject to equity awards outstanding at the end of the year, and the number of shares available for future grants at the end of the year.

11

(4) Total Potential Dilution under Employee Stock Plans is calculated by dividing (a) the sum of the number of shares subject to equity awards outstanding at the end of the year and the number of shares available for future grants at the end of the year, by (b) the sum of number of shares outstanding at the end of the year, the number of shares subject to equity awards outstanding at the end of the year, and the number of shares available for future grants at the end of the year.

Authorized Shares Requested

The maximum aggregate number of shares we are requesting our stockholders to authorize under the Amended Plan is 1,414,889. The total overhang resulting from this share request represents approximately 0.7% of the number of shares of our common stock outstanding on May 17, 2019, determined on a fully diluted basis.

Our Board considered several factors in determining the amount of shares requested as set forth above, including the intention to authorize sufficient shares to provide for the needs of a reasonable incentive program for the next three years.

Summary of the Amended Plan

The following summary of the Amended Plan is qualified in its entirety by the specific language of the Amended Plan, a copy of which is attached to this proxy statement as Appendix A.

General. The purpose of the Amended Plan is to advance the interests of the Company and its stockholders by providing an incentive program that will enable the Company to attract and retain employees, consultants and directors and to provide them with an equity interest in the growth and profitability of the Company. These incentives are provided through the grant of stock options, stock appreciation rights, restricted stock, restricted stock units, performance shares, performance units, other stock-based awards and cash-based awards.

Authorized Shares. The maximum aggregate number of shares authorized for issuance under the Amended Plan is 1,414,889 shares, assuming the stockholders approve the addition of 799,823 shares to the reserve. Given the 160,177 shares that remain available for grant as of April 30, 2019, if approved, we would have 960,000 shares for new grants following approval of the Amended Plan.

Share Counting. Each share subject to a stock option, stock appreciation right, or other award that requires the participant to purchase shares for their fair market value determined at the time of grant will reduce the number of shares remaining available for grant under the Amended Plan by one share.

If any award granted under the Amended Plan expires or otherwise terminates for any reason without having been exercised or settled in full, or if shares subject to forfeiture or repurchase are forfeited or repurchased by the Company for not more than the participant’s purchase price, any such shares reacquired or subject to a terminated award will again become available for issuance under the Amended Plan. Shares will not be treated as having been issued under the Amended Plan and will therefore not reduce the number of shares available for issuance to the extent an award is settled in cash. Shares purchased in the open market with proceeds from the exercise of options will not be added to the share reserve. Shares that are withheld or reacquired by the Company in satisfaction of a tax withholding obligation in connection with an option or a stock appreciation right or that are tendered in payment of the exercise price of an option will not be made available for new awards under the Amended Plan. Upon the exercise of a stock appreciation right or net-exercise of an option, the number of shares available under the Amended Plan will be reduced by the gross number of shares for which the award is exercised. Shares withheld or reacquired by the Company in satisfaction of tax withholding obligations pursuant to the vesting or settlement of “full value” awards will again become available for issuance under the Amended Plan.

Adjustments for Capital Structure Changes. Appropriate and proportionate adjustments will be made to the number of shares authorized under the Amended Plan, to the numerical limits on certain types of awards described below, and to outstanding awards in the event of any change in our common stock through merger, consolidation, reorganization, reincorporation, recapitalization, reclassification, stock dividend, stock split, reverse stock split, split-up, split-off, spin-off, combination of shares, exchange of shares or similar change in our capital structure, or if we make a distribution to our stockholders in a form other than common stock (excluding regular, periodic cash dividends) that has a material effect on the fair market value of our common stock. In such circumstances, the Compensation Committee also has the discretion under the Amended Plan to adjust other terms of outstanding awards as it deems appropriate.

12

Nonemployee Director Award Limits. The aggregate grant date fair value of all awards granted to any nonemployee director during any fiscal year of the Company combined with any cash compensation for that year for services as a nonemployee director will not exceed $300,000.

Administration. The Amended Plan generally will be administered by the Compensation Committee of the board of directors, although the board of directors retains the right to appoint another of its committees to administer the Amended Plan or to administer the Amended Plan directly. (For purposes of this summary, the term “Committee” will refer to either such duly appointed committee or the board of directors.) Subject to the provisions of the Amended Plan, the Committee determines in its discretion the persons to whom and the times at which awards are granted, the types and sizes of awards, and all of their terms and conditions. The Committee may, subject to certain limitations on the exercise of its discretion provided by the Amended Plan, amend, cancel or renew any award, waive any restrictions or conditions applicable to any award, and accelerate, continue, extend or defer the vesting of any award.

The Amended Plan provides, subject to certain limitations, for indemnification by the Company of any director, officer or employee against all reasonable expenses, including attorneys’ fees, incurred in connection with any legal action arising from such person’s action or failure to act in administering the Amended Plan. All awards granted under the Amended Plan will be evidenced by a written or digitally signed agreement between the Company and the participant specifying the terms and conditions of the award, consistent with the requirements of the Amended Plan. The Committee will interpret the Amended Plan and awards granted thereunder, and all determinations of the Committee generally will be final and binding on all persons having an interest in the Amended Plan or any award.

Prohibition of Option and SAR Repricing. The Amended Plan expressly provides that, without the approval of a majority of the votes cast in person or by proxy at a meeting of our stockholders, the Committee may not provide for any of the following with respect to underwater options or stock appreciation rights: lower the exercise price per share of an option or the base price of a stock appreciation right after it is granted, cancel an option or stock appreciation right when the price per share exceeds the fair market value of one share of stock in exchange for cash or another award (other than in connection with a change in control), or take any other action with respect to an option or stock appreciation right that would be treated as a repricing under the rules and regulations of the principal U.S. national securities exchange on which the shares of stock are listed.

Eligibility. Awards may be granted to employees, directors and consultants of the Company or any present or future parent or subsidiary corporation or other affiliated entity of the Company. Incentive stock options may be granted only to employees who, as of the time of grant, are employees of the Company or any parent or subsidiary corporation of the Company. As of May 17, 2019, we employed a total of 257 full time and 314 part time employees, and we contracted with 6 independent contractors, including 3 executive officers, and 6 non-employee directors who would be eligible under the Amended Plan.

Stock Options. The Committee may grant nonstatutory stock options, incentive stock options within the meaning of Section 422 of the Code, or any combination of these. The exercise price of each option may not be less than the fair market value of a share of our common stock on the date of grant. However, any incentive stock option granted to a person who at the time of grant owns stock possessing more than 10% of the total combined voting power of all classes of stock of the Company or any parent or subsidiary corporation of the Company (a “10% Stockholder”) must have an exercise price equal to at least 110% of the fair market value of a share of common stock on the date of grant. On May 22, 2019, the closing price of our common stock as reported on Nasdaq was $36.16 per share.

The Amended Plan provides that the option exercise price may be paid in cash, by check, or cash equivalent; by means of a broker-assisted cashless exercise; by means of a net-exercise procedure; to the extent legally permitted, by tender to the Company of shares of common stock owned by the participant having a fair market value not less than the exercise price; by such other lawful consideration as approved by the Committee; or by any combination of these. Nevertheless, the Committee may restrict the forms of payment permitted in connection with any option grant. No option may be exercised unless the participant has made adequate provision for federal, state, local and foreign taxes, if any, relating to the exercise of the option, including, if permitted or required by the Company, through the participant’s surrender of a portion of the option shares to the Company.

Options will become vested and exercisable at such times or upon such events and subject to such terms, conditions, performance criteria or restrictions as specified by the Committee. The maximum term of any option granted under the Amended Plan is ten years, provided that an incentive stock option granted to a 10% Stockholder must have a term not exceeding five years. Unless otherwise permitted by the Committee, an option generally will remain

13

exercisable for three months following the participant’s termination of service, provided that if service terminates as a result of the participant’s death or disability, the option generally will remain exercisable for 12 months, but in any event the option must be exercised no later than its expiration date, and provided further that an option will terminate immediately upon a participant’s termination for cause (as defined by the Amended Plan).

Options are nontransferable by the participant other than by will or by the laws of descent and distribution, and are exercisable during the participant’s lifetime only by the participant. However, an option may be assigned or transferred to certain family members or trusts for their benefit to the extent permitted by the Committee and, in the case of an incentive stock option, only to the extent that the transfer will not terminate its tax qualification. No option (and no SAR) may be transferred to a third party financial institution for value.

The Company has not yet granted any options.

Stock Appreciation Rights. The Committee may grant stock appreciation rights either in tandem with a related option (a “Tandem SAR”) or independently of any option (a “Freestanding SAR”). A Tandem SAR requires the option holder to elect between the exercise of the underlying option for shares of common stock or the surrender of the option and the exercise of the related stock appreciation right. A Tandem SAR is exercisable only at the time and only to the extent that the related stock option is exercisable, while a Freestanding SAR is exercisable at such times or upon such events and subject to such terms, conditions, performance criteria or restrictions as specified by the Committee. The exercise price of each stock appreciation right may not be less than the fair market value of a share of our common stock on the date of grant.

Upon the exercise of any stock appreciation right, the participant is entitled to receive an amount equal to the excess of the fair market value of the underlying shares of common stock as to which the right is exercised over the aggregate exercise price for such shares. Payment of this amount upon the exercise of a Tandem SAR may be made only in shares of common stock whose fair market value on the exercise date equals the payment amount. At the Committee’s discretion, payment of this amount upon the exercise of a Freestanding SAR may be made in cash or shares of common stock. The maximum term of any stock appreciation right granted under the Amended Plan is ten years.

Stock appreciation rights are generally nontransferable by the participant other than by will or by the laws of descent and distribution, and are generally exercisable during the participant’s lifetime only by the participant. If permitted by the Committee, a Tandem SAR related to a nonstatutory stock option and a Freestanding SAR may be assigned or transferred to certain family members or trusts for their benefit to the extent permitted by the Committee. Other terms of stock appreciation rights are generally similar to the terms of comparable stock options.

Restricted Stock Awards. The Committee may grant restricted stock awards under the Amended Plan either in the form of a restricted stock purchase right, giving a participant an immediate right to purchase common stock, or in the form of a restricted stock bonus, in which stock is issued in consideration for services to the Company rendered by the participant. The Committee determines the purchase price payable under restricted stock purchase awards, which may be less than the then current fair market value of our common stock. Restricted stock awards may be subject to vesting conditions based on such service or performance criteria as the Committee specifies, including the attainment of one or more performance goals similar to those described below in connection with performance awards. Shares acquired pursuant to a restricted stock award may not be transferred by the participant until vested. Unless otherwise provided by the Committee, a participant will forfeit any shares of restricted stock as to which the vesting restrictions have not lapsed prior to the participant’s termination of service. Participants holding restricted stock will have the right to vote the shares and to receive any dividends paid, except that dividends or other distributions will be subject to the same vesting terms and restrictions as the original award.

Restricted Stock Units. The Committee may grant restricted stock units under the Amended Plan, which represent rights to receive shares of our common stock at a future date determined in accordance with the participant’s award agreement. No monetary payment is required for receipt of restricted stock units or the shares issued in settlement of the award, the consideration for which is furnished in the form of the participant’s services to the Company. The Committee may grant restricted stock unit awards subject to the attainment of one or more performance goals similar to those described below in connection with performance awards, or may make the awards subject to vesting conditions similar to those applicable to restricted stock awards. Unless otherwise provided by the Committee, a participant will forfeit any restricted stock units which have not vested prior to the participant’s termination of service. Participants have no voting rights or rights to receive cash dividends with respect to restricted stock unit awards until shares of

14

common stock are issued in settlement of such awards. However, the Committee may grant restricted stock units that entitle their holders to dividend equivalent rights, which are rights to receive cash or additional restricted stock units whose value is equal to any cash dividends the Company pays. The dividend equivalent rights would be subject to the same vesting conditions and settlement terms as the original award.

Performance Awards. The Committee may grant performance awards subject to such conditions and the attainment of such performance goals over such periods as the Committee determines in writing and sets forth in a written agreement between the Company and the participant. These awards may be designated as performance shares or performance units, which consist of unfunded bookkeeping entries generally having initial values equal to the fair market value determined on the grant date of a share of common stock in the case of performance shares and a monetary value established by the Committee at the time of grant in the case of performance units. Performance awards will specify a predetermined amount of performance shares or performance units that may be earned by the participant to the extent that one or more performance goals are attained within a predetermined performance period. To the extent earned, performance awards may be settled in cash, shares of common stock (including shares of restricted stock that are subject to additional vesting) or any combination of these.

The Committee will establish one or more performance goals applicable to the award. Performance goals will be based on the attainment of specified target levels with respect to one or more measures of business or financial performance of the Company and each subsidiary corporation consolidated with the Company for financial reporting purposes, or such division or business unit of the Company as may be selected by the Committee. The Committee, in its discretion, may base performance goals on one or more of the metrics as set forth in the Amended Plan, or on any other such metric it chooses.

The target levels with respect to these performance measures may be expressed on an absolute basis or relative to an index, budget or other standard specified by the Committee. The degree of attainment of performance measures will be calculated in accordance with the Company’s financial statements, generally accepted accounting principles, if applicable, or other methodology established by the Committee, but prior to the accrual or payment of any performance award for the same performance period, and, according to criteria established by the Committee, excluding the effect (whether positive or negative) of events as determined by the Committee, which may include changes in accounting standards or any unusual or infrequently occurring event or transaction occurring after the establishment of the performance goals applicable to a performance award.

Following completion of the applicable performance period, the Committee will certify in writing the extent to which the applicable performance goals have been attained and the resulting value to be paid to the participant. The Committee retains the discretion to increase, eliminate, or reduce the amount that would otherwise be payable on the basis of the performance goals attained to a participant. In its discretion, the Committee may provide for a participant awarded performance shares to receive dividend equivalent rights with respect to cash dividends paid on the Company’s common stock to the extent that the performance shares become vested (with any such dividend equivalents to be subject to the same vesting terms and restrictions as the underlying award). The Committee may provide for performance award payments in lump sums or installments.

Unless otherwise provided by the Committee, if a participant’s service terminates due to the participant’s death or disability prior to completion of the applicable performance period, the final award value will be determined at the end of the performance period on the basis of the performance goals attained during the entire performance period but will be prorated for the number of months of the participant’s service during the performance period. If a participant’s service terminates prior to completion of the applicable performance period for any other reason, the Amended Plan provides that, unless otherwise determined by the Committee, the performance award will be forfeited. No performance award may be sold or transferred other than by will or the laws of descent and distribution prior to the end of the applicable performance period.

Cash-Based Awards and Other Stock-Based Awards. The Committee may grant cash-based awards or other stock-based awards in such amounts and subject to such terms and conditions as the Committee determines. Cash-based awards will specify a monetary payment or range of payments, while other stock-based awards will specify a number of shares or units based on shares or other equity-related awards. Such awards may be subject to vesting conditions based on continued performance of service or subject to the attainment of one or more performance goals similar to those described above in connection with performance awards. Settlement of awards may be in cash or shares of common stock, as determined by the Committee. A participant will have no voting rights with respect to any such award unless and until shares are issued pursuant to the award. The committee may grant dividend equivalent

15

rights with respect to other stock-based awards, which will be subject to the same vesting terms and restrictions as the underlying award. The effect on such awards of the participant’s termination of service will be determined by the Committee and set forth in the participant’s award agreement.

Change in Control. Unless otherwise defined in a participant’s award or other agreement with the Company, the Amended Plan provides that a “Change in Control” occurs upon (a) a person or entity (with certain exceptions described in the Amended Plan) becoming the direct or indirect beneficial owner of more than 50% of the Company’s voting stock; (b) stockholder approval of a liquidation or dissolution of the Company; or (c) the occurrence of any of the following events upon which the stockholders of the Company immediately before the event do not retain immediately after the event direct or indirect beneficial ownership of more than 50% of the voting securities of the Company, its successor or the entity to which the assets of the company were transferred: (i) a sale or exchange by the stockholders in a single transaction or series of related transactions of more than 50% of the Company’s voting stock; (ii) a merger or consolidation in which the Company is a party; or (iii) the sale, exchange or transfer of all or substantially all of the assets of the Company (other than a sale, exchange or transfer to one or more subsidiaries of the Company).

If a Change in Control occurs, the surviving, continuing, successor or purchasing entity or its parent may, without the consent of any participant, either assume or continue outstanding awards or substitute substantially equivalent awards for its stock. If so determined by the Committee, stock-based awards will be deemed assumed if, for each share subject to the award prior to the Change in Control, its holder is given the right to receive the same amount of consideration that a stockholder would receive as a result of the Change in Control. Any awards which are not assumed or continued in connection with a Change in Control or exercised or settled prior to the Change in Control will terminate effective as of the time of consummation of the Change in Control.

Our Compensation Committee has discretion to accelerate vesting of awards in connection with a Change in Control. The vesting of all awards held by non-employee directors will be accelerated in full upon a Change in Control.

The Amended Plan also authorizes the Committee, in its discretion and without the consent of any participant, to cancel each or any award denominated in shares of stock upon a Change in Control in exchange for a payment to the participant with respect each vested share (and each unvested share if so determined by the Committee) subject to the cancelled award of an amount equal to the excess of the consideration to be paid per share of common stock in the Change in Control transaction over the exercise price per share, if any, under the award. An award having an exercise or purchase price per share equal to or greater than the fair market value of the consideration to be paid per share of common stock in the Change in Control may be canceled without payment of consideration to the holder.

Clawback Policy. The Amended Plan states that if the Company is required to prepare an accounting restatement due to the material noncompliance of the Company, as a result of misconduct, with any financial reporting requirement under the securities laws, any participant who knowingly or through gross negligence engaged in the misconduct, or who knowingly or through gross negligence failed to prevent the misconduct, or any participant who is one of the individuals subject to automatic forfeiture under Section 304 of the Sarbanes-Oxley Act of 2002, will reimburse the Company for (i) the amount of any payment in settlement of an award received by such participant during the twelve- month period following the first public issuance or filing with the United States Securities and Exchange Commission (whichever first occurred) of the financial document embodying such financial reporting requirement, and (ii) any profits realized by such participant from the sale of securities of the Company during such twelve-month period.

In addition, the Committee may specify in an award agreement that a participant’s rights with respect to an award will be subject to reduction, cancellation, forfeiture, or recoupment upon the occurrence of other specified events, in addition to any otherwise applicable vesting or performance conditions of an award.

Withholding of Shares. The Company has the right, but not the obligation, to deduct from the shares of stock issuable to a participant upon the exercise or settlement of an award, or to accept from the participant the tender of, a number of whole shares of common stock having a fair market value, as determined by the Company, equal to all or any part of the tax withholding obligations of the Company. The fair market value of any shares withheld or tendered to satisfy any such tax withholding obligations will not exceed an amount that would trigger adverse accounting consequences or costs, as determined by the Committee and in accordance with Company policies; provided, however, that any shares withheld in excess of the minimum statutory rate will not be added back to the Amended Plan’s share reserve and will not be available for new grants under the Amended Plan.

16

Awards Subject to Section 409A of the Code. Certain awards granted under the Amended Plan may be deemed to constitute “deferred compensation” within the meaning of Section 409A of the Code, providing rules regarding the taxation of nonqualified deferred compensation plans, and the regulations and other administrative guidance issued pursuant to Section 409A. Any such awards will be required to comply with the requirements of Section 409A. Notwithstanding any provision of the Amended Plan to the contrary, the Committee is authorized, in its sole discretion and without the consent of any participant, to amend the Amended Plan or any award agreement as it deems necessary or advisable to comply with Section 409A.

Amendment, Suspension or Termination. The Amended Plan will continue in effect until its termination by the Committee, provided that no awards may be granted under the Amended Plan following the tenth anniversary of the Amended Plan’s effective date, which was the date on which it is approved by the stockholders in 2017. The Committee may amend, suspend or terminate the Amended Plan at any time, provided that no amendment may be made without stockholder approval that would increase the maximum aggregate number of shares of stock authorized for issuance under the Amended Plan, change the class of persons eligible to receive incentive stock options or require stockholder approval under any applicable law or the rules of any stock exchange on which the Company’s shares are then listed. No amendment, suspension or termination of the Amended Plan may affect any outstanding award unless expressly provided by the Committee, and, in any event, may not have a materially adverse effect an outstanding award without the consent of the participant unless necessary to comply with any applicable law, regulation or rule, including, but not limited to, Section 409A of the Code.

Summary of U.S. Federal Income Tax Consequences