UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

THE LOVESAC COMPANY

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| ☐ | Fee paid previously with preliminary materials. | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

THE

LOVESAC COMPANY

Two Landmark Square, Suite 300

Stamford, CT 06901

May 22, 2020

Dear Fellow Stockholders:

You are cordially invited to attend the 2020 Annual Meeting of Stockholders of The Lovesac Company (“we”, “us”, “Lovesac” or the “Company”) at 10:00 a.m. EDT on June 4, 2020, to be conducted virtually via live webcast at https://viewproxy.com/LovesacCompany/2020/.

The following notice of annual meeting of stockholders outlines the business to be conducted at the virtual annual meeting. All stockholders of record of our common stock at the close of business on May 15, 2020, the record date, are entitled to notice of and to vote at this meeting and any continuation, postponement, or adjournment thereof. In light of the public health and safety concerns related to the novel coronavirus (“COVID-19”), we determined that a virtual only meeting is advisable for the health and safety of our officers, directors and stockholders.

We encourage you to visit https://viewproxy.com/LovesacCompany/2020/ and log on with your control number to ask any questions you may have, which we will try to answer during the virtual annual meeting. Whether or not you expect to attend the annual meeting of stockholders online, we urge you to vote as promptly as possible. If you vote in advance you may still decide to attend the virtual annual meeting of stockholders and vote your shares during the meeting. Your proxy is revocable in accordance with the procedures set forth in the Proxy Statement.

On behalf of the board of directors, the officers and employees of Lovesac, I would like to take this opportunity to thank our stockholders for their continued support of Lovesac. We hope you can attend the virtual annual meeting.

| Sincerely yours, | |

| /s/ Shawn Nelson | |

| Shawn Nelson Chief Executive Officer |

THE

LOVESAC COMPANY

Two Landmark Square, Suite 300

Stamford, CT 06901

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 4, 2020

You are cordially invited to attend the 2020 Annual Meeting of Stockholders (the “Annual Meeting”) of The Lovesac Company (“we”, “us”, “Lovesac” or the “Company”) at 10:00 a.m. EDT on June 4, 2020, to be conducted virtually via live webcast at https://viewproxy.com/LovesacCompany/2020/.

The annual meeting will be held for the following purposes:

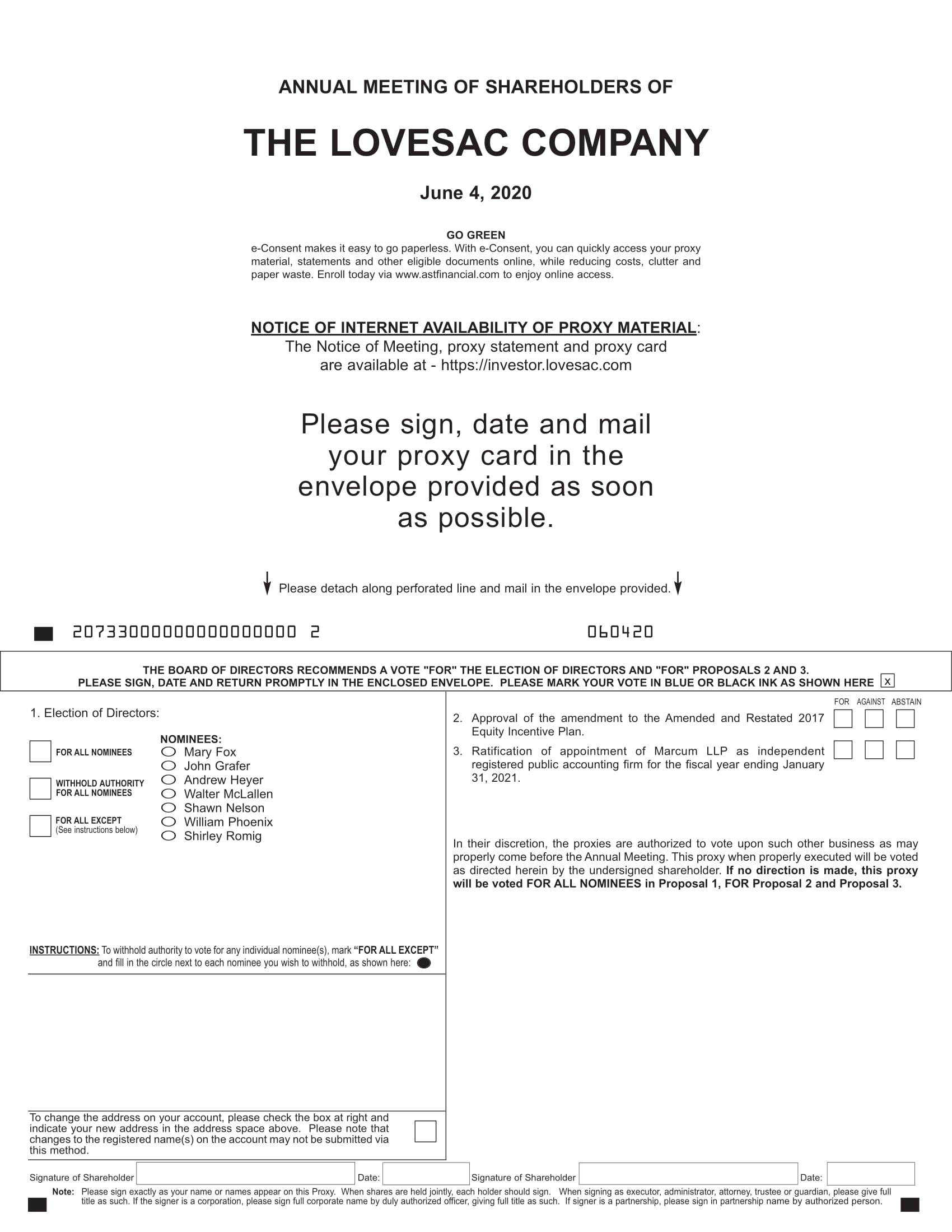

| (1) | to elect seven (7) directors to the board of directors to serve until the 2021 Annual Meeting of stockholders and until their successors are duly elected and qualified; |

| (2) | to approve the amendment to the Amended and Restated 2017 Equity Incentive Plan that increases the number of shares reserved for issuance thereunder by 690,000 shares; |

| (3) | to ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2021; and |

| (4) | to transact any and all other business that may properly come before the annual meeting or any continuation, postponement, or adjournment thereof. |

These matters are more fully described in the Proxy Statement accompanying this Notice. You may virtually attend and vote at the Annual Meeting (or any adjournment or postponement of the Annual Meeting) if you were a stockholder of the Company at the close of business on May 15, 2020, the record date.

The Company’s stock transfer books will not be closed. A list of the stockholders entitled to vote at the Annual Meeting may be examined at the Company’s offices during the 10 day period preceding the Annual Meeting. The list of stockholders will also be available for examination during the virtual Annual Meeting at https://viewproxy.com/LovesacCompany/2020/.

You may vote your shares at the Annual Meeting via the Internet, by telephone or by completing, dating, signing and promptly returning a proxy card to us in the envelope provided. Further information about how to register for and attend the virtual annual meeting online, vote your shares online during the meeting and submit questions online during the meeting is included in the accompanying Proxy Statement. For instructions on how to vote your shares, please refer to the attached Proxy Statement or proxy card.

You are cordially invited to attend the Annual Meeting virtually via live webcast online. Whether or not you expect to attend, the board of directors respectfully requests that you vote your shares in the manner described in the Proxy Statement. You may revoke your proxy in the manner described in the Proxy Statement at any time before it has been voted at the Annual Meeting.

| By Order of the Board of Directors | |

| /s/ Shawn Nelson | |

Shawn Nelson May 22, 2020 |

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING: Our Annual Report on Form 10-K, this Notice and the Proxy Statement and the proxy card are available electronically at https://investor.lovesac.com.

THE

LOVESAC COMPANY

Two Landmark Square, Suite 300

Stamford, CT 06901

PROXY

STATEMENT

For the 2020 Annual Meeting of Stockholders

to be held on June 4, 2020

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving these materials?

The board of directors of The Lovesac Company (which we refer to in this proxy statement as “we”, “our”, “us” or “Lovesac”) is providing you these proxy materials in connection with the board of directors’ solicitation of proxies from our stockholders for our 2020 Annual Meeting of Stockholders (which we refer to as the “Annual Meeting”) and any adjournments and postponements of the Annual Meeting. The Annual Meeting will be held virtually at https://viewproxy.com/LovesacCompany/2020/ on Thursday, June 4, 2020, commencing at 10:00 a.m. EDT. On or about May 22, 2020, we expect to begin mailing to our stockholders the proxy materials and our annual report. Whether or not you plan to attend the Annual Meeting online, you may submit a proxy to vote your shares by the Internet, telephone or mail as more fully described below.

What is the purpose of the Annual Meeting?

At the Annual Meeting, you and our other stockholders entitled to vote at the Annual Meeting are requested to vote on proposals to (1) elect seven members of our board of directors to serve until our 2021 annual meeting of stockholders, (2) approve an amendment to the Amended and Restated 2017 Equity Incentive Plan that increases the number of shares reserved for issuance thereunder by 690,000 shares, and (3) ratify the appointment of Marcum LLP as our independent registered accounting firm for fiscal year 2021.

Who is entitled to attend and vote at the Annual Meeting?

Only stockholders of record as of the close of business on May 15, 2020, the record date for the Annual Meeting, or the holders of their valid proxies may attend and shall be entitled to vote the Annual Meeting and any adjournment or postponement of the Annual Meeting. As of the close of business on the record date, 14,508,255 shares of our common stock were outstanding and entitled to vote. Each share of common stock entitles the record holder to one vote on each matter to be voted upon at the Annual Meeting.

What do I need to do to attend the Annual Meeting virtually?

In order to attend our 2020 Annual Meeting live via the Internet, you must register at https://viewproxy.com/LovesacCompany/2020/ by 11:59 PM EDT on Wednesday, June 3, 2020, using your Virtual Control Number that was included in your proxy card. If you hold your shares beneficially through a bank or broker, you must provide a legal proxy from your bank or broker during registration and you will be assigned a Virtual Control Number in order to vote your shares during the Annual Meeting. If you are unable to obtain a legal proxy to vote your shares, you will still be able to attend the Annual Meeting (but will not be able to vote your shares) so long as you demonstrate proof of stock ownership. Further instructions on how to connect and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at https://viewproxy.com/LovesacCompany/2020/.

On the day of the Annual Meeting, if you have properly registered, you may enter the Annual Meeting at https://viewproxy.com/LovesacCompany/2020/ by logging in using the password you received via e-mail in your registration confirmation. You are entitled to attend our Annual Meeting only if you were a stockholder as of the Record Date.

Webcast replay of the Annual Meeting will be available at https://viewproxy.com/LovesacCompany/2020/ until the sooner of June 4, 2021 or the date of the next annual meeting of stockholders to be held in 2021.

1

Is a list of stockholders available?

A list of our stockholders will be available for review at our executive offices in Stamford, Connecticut, during ordinary business hours for a period of 10 days prior to the meeting. The list will also be available for examination by stockholders of record during the virtual Annual Meeting live webcast at https://viewproxy.com/LovesacCompany/2020/.

What constitutes a quorum?

The presence by attendance at the Annual Meeting virtually through the virtual webcast or by proxy of the holders of a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting is required to constitute a quorum for the transaction of business at the Annual Meeting.

What vote is required to approve each item to be voted on at the Annual Meeting?

Election of Directors — a plurality of the votes of the shares present by remote communication or represented by proxy at the meeting and entitled to vote on the election of directors is required for the election of directors. This means that the seven director nominees receiving the highest number of affirmative votes of the shares present by remote communication or represented by proxy at the annual meeting and entitled to vote on the election of directors will be elected to our board. Broker non-votes and votes marked “WITHHOLD AUTHORITY FOR ALL NOMINEES” will have no legal effect on the outcome of the election of directors. With respect to votes marked “FOR ALL EXCEPT,” votes for director nominees that are withheld will have no legal effect on the outcome of the election of directors, while votes for all other director nominees will count toward a plurality.

Approval of the amendment to the Amended and Restated 2017 Equity Incentive Plan — requires the affirmative vote of a majority of the shares present by remote communication or represented by proxy at the meeting and entitled to vote on this proposal. You may vote “FOR,” “AGAINST,” or “ABSTAIN” with respect to this proposal. If you indicate on your proxy card that you wish to “ABSTAIN” from voting on this proposal, your shares will not be voted on this proposal. Abstentions are not counted in determining the number of shares voted “FOR” or “AGAINST” this proposal but will be counted as present and entitled to vote on this proposal. Accordingly, an abstention will have the effect of a vote against this proposal. Broker non-votes are not counted in determining the number of shares voted for or against this proposal and will not be counted as present and entitled to vote on this proposal.

Ratification of Appointment of Independent Registered Public Accounting Firm for the Year Ending January 31, 2021 — requires the affirmative vote of the holders of a majority of the shares present by remote communication or represented by proxy and entitled to vote on the proposal at the annual meeting. You may vote “FOR,” “AGAINST,” or “ABSTAIN” with respect to this proposal. Abstentions are considered shares present and entitled to vote on this proposal, and thus, will have the same effect as a vote “AGAINST” this proposal. This proposal is considered a routine matter where brokers are permitted to vote your shares held by them in their discretion in the event that they do not receive voting instructions from you.

How does the Board of Directors recommend that I vote?

Our board of directors recommends that you vote:

| ● | FOR each of the nominees for director named in this proxy statement; |

| ● | FOR the approval of the amendment to the Amended and Restated 2017 Equity Incentive Plan; and |

| ● | FOR the ratification of the appointment of Marcum LLP as our independent registered accounting firm for fiscal year 2021. |

How do I vote my shares?

The answer depends on whether you own your shares of common stock of the Company as of the record date directly (that is, you hold shares that show your name as the registered stockholder) or if your shares are held in a brokerage account or by another nominee holder.

If you own shares of the Company directly (i.e., you are a “registered stockholder”): your proxy is being solicited directly by us, and you can vote by Internet, by telephone, by mail or you can vote at our virtual Annual Meeting online. You are encouraged to vote prior to the Annual Meeting to ensure that your shares will be represented.

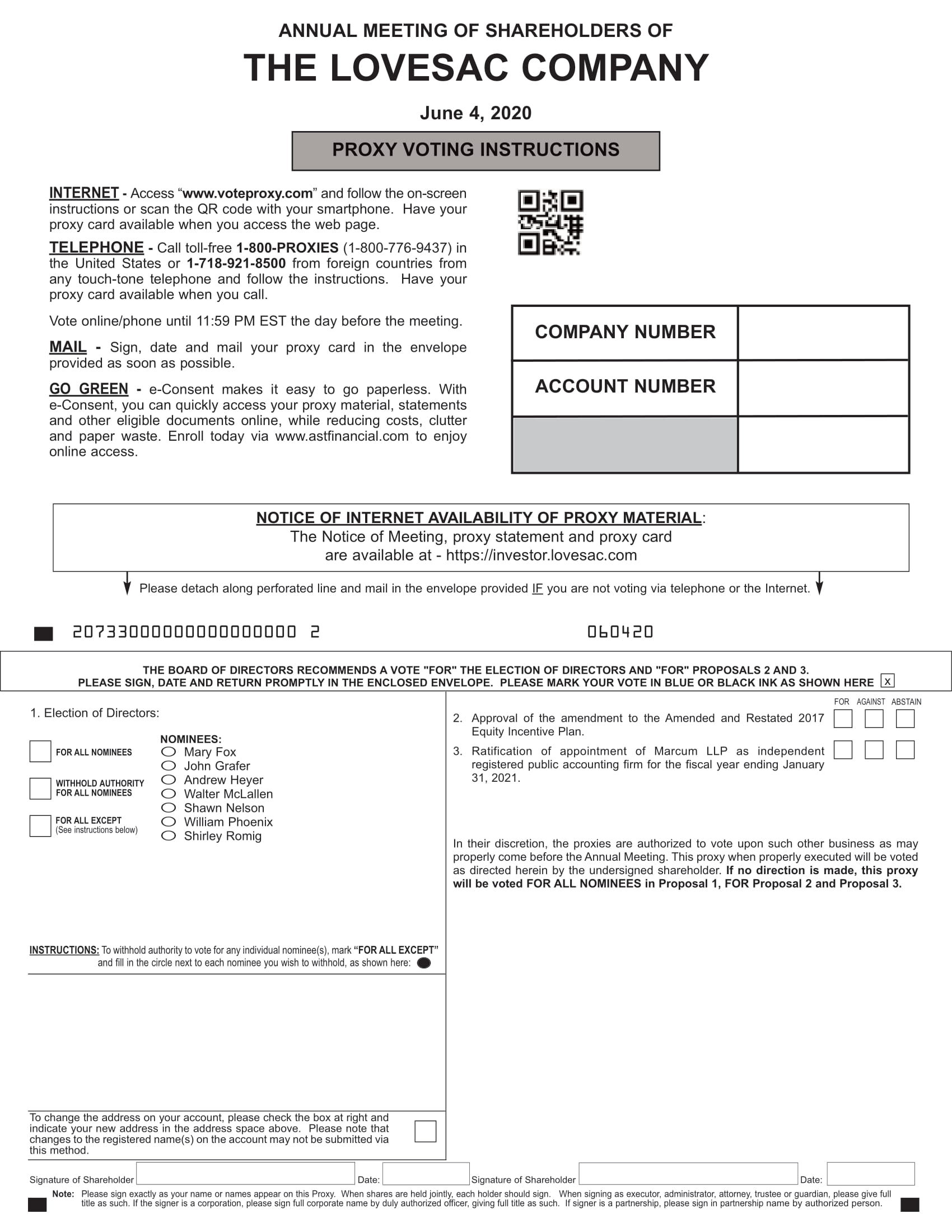

If you wish to vote by Internet, access www.voteproxy.com and follow the on-screen instructions or scan the QR code with your smartphone. Have your proxy card available when you access the web page. Internet voting will close and no longer be available as of 11:59 p.m. EDT on June 3, 2020.

If you wish to vote by telephone, call toll-free 1-800-PROXIES (1-800-776-9437) in the United States or 1-718-921-8500 from foreign countries from any touch-tone telephone and follow the instructions. Have your proxy card available when you call. Telephone voting will close and no longer be available as of 11:59 p.m. EDT on June 3, 2020.

If you wish to vote by mail, please sign, date and complete the enclosed proxy card and return it by mail in the enclosed postpaid envelope. No postage is necessary if the proxy card is mailed in the United States.

2

If you sign your proxy card but do not indicate how you wish to vote, the proxies will vote your shares “FOR” each of the seven director nominees, “FOR” the approval of the amendment to the Amended and Restated 2017 Equity Incentive Plan, “FOR” the ratification of Marcum LLP as our independent registered public accounting firm, and, in their discretion, on any other matter that properly comes before the Annual Meeting. We have not received notice of other matters that may properly be presented at the Annual Meeting. Unsigned proxy cards will not be counted.

If you wish to vote at the Annual Meeting, you will be able to vote your shares if you register to attend by Internet and attend the virtual Annual Meeting pursuant to the instructions below.

If you hold your shares of the Company through a broker, bank or other nominee: you are considered to be the beneficial owner of shares held in “street name” and these proxy materials are being made available to you by your broker, bank or nominee. You may not vote directly any shares held in “street name”; however, as the beneficial owner of the shares, you have the right to direct your broker, bank or nominee on how to vote your shares. A voting instruction card has been provided to you by your broker, bank or other nominee describing how to vote your shares. If you receive a voting instruction card, you can vote by completing and returning the voting instruction card. Please be sure to mark your voting choices on your voting instruction card before you return it. You may also be able to vote by telephone, via the Internet, or virtually at the Annual Meeting, depending upon your voting instructions. Please refer to the instructions provided with your voting instruction card and see “What do I need to do to attend the Annual Meeting virtually?” below for information about voting in these ways. See also “What is the effect if I fail to give voting instructions to my broker or other nominee?” below.

If you plan to vote by mail, telephone or Internet in advance of the Annual Meeting, your vote must be received by 11:59 p.m., EDT, on June 3, 2020 to be counted. Internet voting during the Annual Meeting is also permissible through the virtual webcast at https://viewproxy.com/LovesacCompany/2020/.

Will I have the same participation rights in this virtual-only stockholder meeting as I would have at an in-person stockholder meeting?

Yes. If you register to attend, and attend, the Annual Meeting pursuant to the instructions above, you will be able to vote online during the Annual Meeting, change a vote you may have submitted previously, or ask questions online that will be reviewed and answered by the speakers. If you wish to submit a question during the virtual Annual Meeting, you may log into, https://viewproxy.com/LovesacCompany/2020/ and ask a question on the virtual meeting platform. Our virtual meeting will be governed by our Rules of Conduct which will be available on the virtual meeting platform.

How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?

Brokerage firms and other intermediaries holding shares of our common stock in street name for their customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker will have discretion to vote your shares on our sole “routine” matter: the proposal to ratify the appointment of Marcum LLP as our independent registered public accounting firm for our fiscal year ending January 31, 2021. Your broker will not have discretion to vote on any other proposals, which are “non-routine” matters, absent direction from you (and failure to provide instructions on these matters will result in a “broker non-vote”).

Can I change my vote after I return my proxy card?

Stockholders of record may revoke their proxies by virtually attending the Annual Meeting and voting online during the virtual meeting, by filing an instrument in writing revoking the proxy prior to the meeting or by filing another duly executed proxy bearing a later date with our Secretary at the address below before the vote is counted or by voting again using the telephone and Internet before the cutoff time (11:59 p.m., EDT, on June 3, 2020). Your latest telephone or Internet proxy submitted prior to the Annual Meeting is the one that will be counted, unless you virtually attend the Annual Meeting and vote your shares online during the meeting. We recommend that you vote by proxy even if you plan to attend the Annual Meeting online. If you hold your shares through a bank, broker or other nominee, you may revoke any prior voting instructions by contacting the institution that holds your shares.

Written notice of revocation may be sent to The Lovesac Company, Two Landmark Square, Suite 300, Stamford, CT 06901, Attention: Secretary.

How will votes be recorded and where can I find the voting results of the Annual Meeting?

We have engaged American Stock Transfer & Trust Company, LLC (“AST”), our transfer agent, as our inspector of elections to receive and tabulate votes. AST will separately tabulate “for” and “against” votes, abstentions and broker non-votes. AST will also certify the results and determine the existence of a quorum and the validity of proxies and ballots.

3

We plan to announce preliminary voting results at the Annual Meeting and to publish the final results in a current report on Form 8-K following the Annual Meeting.

Who conducts the proxy solicitation and how much will it cost?

The Company is requesting your proxy for the Annual Meeting and will pay the costs of requesting stockholder proxies. Proxies may be solicited by directors, officers and other employees of the Company, personally or by telephone, Internet, or mail, none of whom will receive compensation for their solicitation efforts. We may also reimburse brokerage firms, dealers, banks, voting trustees or other record holders for their reasonable expenses for forwarding proxy materials to the beneficial owners of our common stock.

Implications of Being an “Emerging Growth Company”

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and may remain an emerging growth company for up to five years from the date of our initial public offering, or IPO. The JOBS Act contains provisions that, among other things, reduce certain reporting requirements for an “emerging growth company.” For so long as we remain an emerging growth company, we are permitted and plan to rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include reduced disclosure obligations regarding executive compensation. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We may take advantage of some or all these exemptions until we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.07 billion in annual revenue, we have more than $700 million in market value of our stock held by non-affiliates or we issue more than $1 billion of non-convertible debt over a three-year period. We have taken advantage of certain reduced reporting obligations in this proxy statement. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

Questions and Additional Copies

If you have any additional questions with respect to the Company or the matters described herein, or questions about how to submit your proxy, or if you need additional copies of this proxy statement or the attached proxy card, you should contact our Secretary at The Lovesac Company, Two Landmark Square, Suite 300, Stamford, CT 06901, by telephone at (888) 636-1223, or by email at InvestorRelations@lovesac.com.

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

Nominees

Our board of directors currently consists of seven (7) members and is authorized to have no less than five (5) members nor more than seven (7) members. Each of our directors serves until the next annual meeting of stockholders and until his or her successor is elected and duly qualified, or until his or her earlier death, resignation or removal.

Shawn Nelson, Andrew Heyer, John Grafer, Mary Fox, Walter McLallen, William Phoenix and Shirley Romig have been nominated for election as directors to serve until the 2021 Annual Meeting of Stockholders and until their successors are elected and have qualified. Each nominee has consented to being named in the proxy statement and has agreed to serve as a member of the board of directors, if elected. In the event that any of the nominees should be unable to serve as a director, it is intended that the proxy will be voted for the election of such substitute nominee, if any, as shall be designated by the board of directors. The board of directors has no reason to believe that any of the nominees named below will be unable to serve if elected.

The board of directors believes that each nominee and director has valuable individual skills and experiences that, taken together, provide us with the knowledge, judgment and strategic vision necessary to provide effective oversight. The biographies below reflect the particular experience, qualifications, attributes and skills that led the board of directors to conclude that each nominee and director should serve on the board. There is no family relationship between and among any of our executive officers or directors. There are no arrangements or understandings between any of our executive officers or directors and any other person pursuant to which any of them are elected as an officer or director.

The following table sets forth the names of, and certain information concerning, the persons nominated by the board of directors for election as directors of the Company.

| Name | Age | Title | Director Since | |||

| Shawn Nelson | 42 | Chief Executive Officer and Director | 2017 | |||

| Andrew Heyer | 61 | Chairman of the Board of Directors | 2017 | |||

| John Grafer | 50 | Director | 2017 | |||

| Mary Fox | 47 | Director | 2020 | |||

| Walter McLallen | 54 | Director | 2019 | |||

| William Phoenix | 61 | Director | 2017 | |||

| Shirley Romig | 42 | Director | 2019 |

4

Shawn Nelson founded Lovesac in 1998 and is currently serving as our Chief Executive Officer and as a member of the board of directors. Mr. Nelson is the lead designer of the Company’s patented products and directly oversees design, sourcing, public relations, investor relations and culture. In 2005, Mr. Nelson won Richard Branson’s “The Rebel Billionaire” on Fox and continues to participate in ongoing TV appearances. Mr. Nelson has a Master’s Degree in Strategic Design and Management and is a graduate-level instructor at Parsons, The New School for Design in New York City. Mr. Nelson is also fluent in Chinese with a BA in Mandarin from the University of Utah. We believe Mr. Nelson is qualified to serve on our board because of his leadership experience as our founder, his extensive knowledge of our Company and his service as our Chief Executive Officer.

Andrew R. Heyer is the Chairman of our board of directors. Mr. Heyer is a finance professional with over 35 years of experience investing the consumer and consumer-related products and services industries. He has deployed in excess of $1 billion of capital over that time frame and has guided several public and private companies as a member of their boards of directors. Mr. Heyer is the Chief Executive Officer and Founder of Mistral Equity Partners, a private equity fund manager founded in 2007 that invests in the consumer industry. Prior to founding Mistral, Mr. Heyer served as a Founding Managing Partner of Trimaran Capital Partners. Until 1995, Mr. Heyer was a vice chairman of CIBC World Markets Corp. and a co-head of the CIBC Argosy Merchant Banking Funds. Prior to joining CIBC World Markets Corp., Mr. Heyer was a founder and Managing Director of The Argosy Group L.P. Prior to joining Argosy, Mr. Heyer was a Managing Director at Drexel Burnham Lambert Incorporated and, prior to that, he worked at Shearson/American Express. From 1993 to 2009 and from 2012 to April 2019, he has served on the board of The Hain Celestial Group (Nasdaq: HAIN), a natural and organic food and products company. From December 2016 to March 2020, Mr. Heyer served as a director of XpresSpa Group, Inc. (Nasdaq: XSPA), a diversified holding company. From April 2017 to March 2019, Mr. Heyer served as a director and president of Haymaker Acquisition Corp., which was acquired by OneSpaWorld Holdings Limited (Nasdaq: OSW) on March 19, 2019. Since March 2019, Mr. Heyer has served on the board of directors of OneSpaWorld Holdings Limited. Mr. Heyer also serves on the boards of directors of several private companies, including Worldwise, a pet accessories business. Since June 2019, Mr. Heyer has served as a director and president of Haymaker Acquisition Corp. II (Nasdaq: HYAC). Mr. Heyer received his B.Sc. and M.B.A. from the Wharton School of the University of Pennsylvania, graduating magna cum laude. We believe Mr. Heyer is qualified to serve on our board because of his extensive experience in private equity investing in the consumer goods industry and his experience on other private and public company boards.

Mary Fox is a member of our board of directors. Since 2018, Ms. Fox has served as General Manager for North America Consumer Products at BIC (OTCMKTS: BICEF). Prior to joining BIC, she spent six years at L’Oréal (OTCMKTS: LRLCF) in various roles within Ecommerce, New Business Development, and Business Transformation in the United States. Before L’Oréal, Ms. Fox held several senior leadership positions at Walmart (NYSE: WMT) in both the United States and International divisions. During her time as SVP Global Sourcing at Walmart, Ms. Fox co-founded the Sustainable Apparel Coalition (SAC) in 2009 with Patagonia, which is now the leading apparel, footwear, and textile coalition focused on sustainable production with over 10,000 members. Ms. Fox graduated from Coventry University in the United Kingdom and holds a degree in manufacturing engineering and business studies. We believe Ms. Fox is qualified to serve on our board because of her substantial experience in consumer products, ecommerce and sustainability.

John Grafer is a member of our board of directors. Since 2009, Mr. Grafer has been a principal at Satori Capital, LLC, a multi-strategy alternative investment firm founded on the principles of conscious capitalism. Mr. Grafer is a member of Satori’s investment committee, a board member of Longhorn Health Solutions, SunTree Snack Foods and Zorch International, a board observer for Aspen Heights, and a former board member of California Products Corporation and FWT. Prior to joining Satori in 2009, Mr. Grafer was senior vice president at Giuliani Partners, a principal investment and consulting firm founded by former New York City Mayor Rudolph W. Giuliani. Prior to joining Giuliani Partners in 2003, Mr. Grafer was a member of the mergers and acquisitions group at Credit Suisse First Boston, a member of the proprietary trading group at J.P. Morgan Chase, and a team member at Ernst & Young, where he earned his C.P.A. Mr. Grafer has also assisted a family office with early stage investments in sustainably managed companies, including Honest Tea. Mr. Grafer is an elected member of the board of directors and executive committee of Americans For Fair Taxation® (FairTax®) and has been a first-round judge for the McCloskey Business Plan competition at the University of Notre Dame. Mr. Grafer received a B.B.A. from the University of Notre Dame and an M.B.A. in finance from the University of Chicago Booth School of Business. We believe Mr. Grafer is qualified to serve on our board because of his substantial experience in private equity investing and investment banking, his accounting expertise and his experience on other company boards.

5

Walter D. McLallen is a member of our board of directors. Mr. McLallen is a finance professional with over 25 years of leveraged finance, private equity and operations experience. Mr. McLallen has been the Managing Member of Meritage Capital Advisors, an advisory boutique firm focused on debt and private equity transaction origination, structuring and consulting since 2004. Mr. McLallen has extensive board and organizational experience and has served on numerous corporate and non-profit boards and committees, with a significant historical focus on consumer products-related companies. Mr. McLallen serves as a director of publicly traded Centric Brands Inc. (CTRC:NASDAQ), a lifestyle brands collective in the branded and licensed apparel and accessories sectors and OneSpaWorld Holdings (OSW:NASDAQ), a pre-eminent global provider of health and wellness services and products onboard cruise ships and in destination resorts around the world; as well as several consumer-focused private companies, including Timeless Wine Company, the producer of consumer luxury wine brands Silver Oak, Twomey and OVID; Worldwise, a consumer branded pet products company; adMarketplace, a search engine advertiser; and Classic Brands, an e-commerce marketer of mattresses and related products. Mr. McLallen is also a founder and Co-Chairman of Tomahawk Strategic Solutions, a law enforcement and corporate training and risk management company. Since June 2019, Mr. McLallen has served as a director of Haymaker Acquisition Corp. II (Nasdaq: HYAC). From 2006 to 2015, Mr. McLallen was Vice Chairman of Remington Outdoor Company, an outdoor consumer platform he co-founded with a major investment firm. Mr. McLallen was formerly with CIBC World Markets from 1995 to 2004, during which time he was a Managing Director, head of Debt Capital Markets and head of High Yield Distribution. Mr. McLallen started his career in the Mergers & Acquisitions Department of Drexel Burnham Lambert and was a founding member of The Argosy Group L.P. Mr. McLallen received a B.A. with a double major in Economics and Finance from the University of Illinois at Urbana-Champaign. Mr. McLallen is qualified to serve as a director due to his extensive consumer products, operational and board experience, as well as his background in finance.

William P. Phoenix is a member of our board of directors. Since 2007, Mr. Phoenix has been a Managing Director at Mistral Equity Partners. He has extensive experience as a provider of all forms of capital to non-investment grade companies. From 2002 to 2007, Mr. Phoenix was a Managing Director of Trimaran Capital Partners, L.L.C. Mr. Phoenix spent a good portion of his career in various capacities at the Canadian Imperial Bank of Commerce (CIBC), beginning in 1982. He was a Managing Director of CIBC Capital Partners, where he focused on mezzanine transactions and private equity opportunities. While at CIBC, he also had management responsibilities for Acquisition Finance, Mezzanine Finance, and the Loan Workout and Restructuring businesses. Mr. Phoenix has been a member of the board of directors of Lovesac since 2010 and Blueport Commerce. Mr. Phoenix received his B.A. in Economics from the University of Western Ontario and his M.B.A. from the University of Toronto. He is a graduate of the Leadership New York Program. We believe Mr. Phoenix is qualified to serve on our board because of his extensive background in finance and private equity investment and his experience on other private company boards.

Shirley Romig is a member of our board of directors. Ms. Romig has two decades of experience in operationalizing growth strategies and leading transformational initiatives in complex consumer-oriented and technology organizations. Currently, Ms. Romig is a Vice President with Lyft, leading Global Operations, East. From 2017 to 2019, Ms. Romig was the Group Vice President of Ancillary Operations at Equinox and led six lines of businesses within its fitness clubs. From 2016 to 2017, Ms. Romig was the Head of Retail Strategy for SapientRazorfish, a global digital agency. From 2013 to 2015, Ms. Romig was the Senior Vice President of Corporate Strategy with HBC responsible for implementation of growth initiatives across Saks Fifth Avenue, Saks OFF 5th, Lord & Taylor and Hudson’s Bay in Canada. Ms. Romig also served as a Vice President for Saks Incorporated where she led the company’s omnichannel transformation work and launched Saksoff5th.com as well as numerous growth initiatives for Saks.com. Earlier in her career, Ms. Romig worked in equity research and digital and strategy consulting. Ms. Romig holds an MBA from the Darden School of Business and a Bachelor of Science from the McIntire School of Commerce, both at the University of Virginia. We believe Ms. Romig is qualified to serve on our board based on her expertise in e-commerce, digital innovation, corporate strategy and scaling complex retail operations.

Vote Required

The affirmative vote of a plurality of the votes of the shares present or represented by proxy at the annual meeting and entitled to vote is required for the election of directors.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE OF “FOR” ALL SEVEN (7) NOMINEES TO SERVE UNTIL THE 2021 ANNUAL MEETING OF STOCKHOLDERS AND UNTIL THEIR RESPECTIVE SUCCESSORS SHALL BE ELECTED AND QUALIFIED.

Board Leadership Structure and Risk Oversight

The board of directors oversees our business and considers the risks associated with our business strategy and decisions.

The board of directors currently implements its risk oversight function as a whole. Each of the board committees will provide risk oversight in respect of its areas of concentration and reports material risks to the board of directors for further consideration.

Director Independence

Our board of directors has undertaken a review of the independence of each director. Based on information provided by each director concerning his background, employment and affiliations, our board of directors has determined that our directors and director nominees (other than Andrew Heyer and Shawn Nelson) do not have relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of our directors and director nominees (other than Andrew Heyer and Shawn Nelson) is “independent” as that term is defined under the listing standards of Nasdaq. Former director Jared Rubin, who resigned in February 2020, was also “independent” as that term is defined under the listing standards of Nasdaq. In making these determinations, our board of directors considered the current and prior relationships that each non-employee director and each director nominee has with our company and all other facts and circumstances our board of directors deemed relevant in determining their independence and eligibility to serve on the committees of our board of directors.

6

Board Meetings

During fiscal 2020, the board of directors held seven meetings. Each director then serving attended at least 75% of the aggregate of the total number of meetings of the board of directors held during the period such director served and the total number of meetings held by any of the committees of the board of directors on which such director served during such period. We encourage each member of the board of directors to attend our annual meetings of stockholders. All the members of our board of directors at the time of our 2019 annual meeting of stockholders attended the 2019 annual meeting of stockholders.

Board Committees

Our board of directors has established an audit committee, a compensation committee and a nominating and governance committee. Our board of directors may establish other committees to facilitate the management of our business. The functions of the audit and compensation committees are described below. All of our committees are comprised of only independent directors. All committees are chaired by independent directors who report to the full board of directors whenever necessary. We believe this leadership structure helps facilitate efficient decision-making and communication among our directors and fosters efficient board of directors functioning at meetings. Directors serve on these committees until their resignation or until otherwise determined by our board of directors.

Audit Committee

Our audit committee, which met four times in fiscal 2020, consists of Walter McLallen, as the chair, William Phoenix and Shirley Romig. Our board of directors has determined that Walter McLallen and William Phoenix qualify as “audit committee financial experts” within the meaning of Item 407(d) of Regulation S-K promulgated under the Securities Act. Our audit committee assists our board of directors in its oversight of our accounting and financial reporting process and the audits of our financial statements. Our audit committee, which operates under a written charter that is posted on the Investor Relations section of our website at https://investor.lovesac.com, is, among other things, responsible for:

| ● | appointing, approving the compensation of, and assessing the independence of our registered public accounting firm; |

| ● | overseeing the work of our registered public accounting firm, including through the receipt and consideration of reports from such firm; |

| ● | reviewing and discussing with management and the registered public accounting firm our annual and quarterly financial statements and related disclosures; |

| ● | monitoring our internal control over financial reporting, disclosure controls and procedures and code of business conduct and ethics; |

| ● | overseeing our internal accounting function; |

| ● | discussing our risk management policies; |

| ● | establishing policies regarding hiring employees from our registered public accounting firm and procedures for the receipt and retention of accounting-related complaints and concerns; |

| ● | meeting independently with our internal accounting staff, registered public accounting firm and management; |

| ● | reviewing and approving or ratifying related party transactions; and |

| ● | preparing the audit committee reports required by SEC rules. |

Compensation Committee

Our compensation committee, which met nine times in fiscal 2020, consists of Mary Fox as the chair, John Grafer, William Phoenix and Shirley Romig. Our compensation committee, which operates under a written charter that is posted on the Investor Relations section of our website at https://investor.lovesac.com, is, among other things, responsible for:

| ● | reviewing and approving corporate goals and objectives with respect to Chief Executive Officer compensation; |

| ● | making recommendations to our board with respect to the compensation of our Chief Executive Officer and our other executive officers; |

| ● | overseeing evaluations of our senior executives; |

7

| ● | reviewing and assessing the independence of compensation advisers; |

| ● | overseeing and administering our equity incentive plans; |

| ● | reviewing and making recommendations to our board with respect to director compensation; and |

| ● | preparing the compensation committee reports required by SEC rules. |

Nominating and Governance Committee

Our nominating and governance committee, which met one time in fiscal 2020, consists of Shirley Romig, as the chair, Mary Fox and Walter McLallen. The primary purpose of our nominating and governance committee, which operates under a written charter that is posted on the Investor Relations section of our website at https://investor.lovesac.com, is to assist our board in promoting our best interests and our stockholders through the implementation of sound corporate governance principles and practices. The functions of our nominating and governance committee include, among other things:

| ● | developing, overseeing and making recommendations to the board regarding our corporate governance principles; |

| ● | developing, recommending to the board of directors, implementing and monitoring compliance with the Code of Ethics; |

| ● | reviewing and advising the board of directors on composition and minimum director qualifications for the board of directors and each board of directors committee; |

| ● | identifying nominees for election to the board of directors, consistent with the qualifications and criteria approved by the board of directors and recommending to the board of directors the director nominees for the next annual meeting of stockholders |

| ● | developing a self-evaluation process of the board of directors’ effectiveness and overseeing the evaluation of the board of directors and each board of directors committee; and |

| ● | reviewing and evaluating, at least annually, the nominating and governance committee’s charter. |

While the nominating and governance committee does not have a formal diversity policy, the nominating and governance committee recommends candidates based upon many factors, including the diversity of their business or professional experience, the diversity of their background and their array of talents and perspectives. We believe that the nominating and governance committee’s existing nominations process is designed to identify the best possible nominees for the board, regardless of the nominee’s gender, racial background, religion or ethnicity. The nominating and governance committee identifies candidates through a variety of means, including recommendations from members of the board of directors and suggestions from our management including our Chief Executive Officer.

In addition, the nominating and governance committee considers candidates recommended by third parties, including stockholders. The nominating and governance committee gives the same consideration to candidates recommended by stockholders as those candidates recommended by members of our board. Stockholders wishing to recommend director candidates for consideration by the nominating and governance committee may do so by writing to our Secretary and giving the recommended candidate’s name, biographical data and qualifications. Nominees should have a reputation for integrity, honesty and adherence to high ethical standards, should have demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to the current and long-term objectives of the Company, should be willing and able to contribute positively to the decision-making process of the Company, should have a commitment to understand the Company and its industry and to regularly attend and participate in meetings of the board of directors and its committees, should have the interest and ability to understand the sometimes conflicting interests of the various constituencies of the Company, which include stockholders, employees, customers, governmental units, creditors and the general public, and to act in the interests of all stockholders, should not have, nor appear to have, a conflict of interest that would impair the nominee’s ability to represent the interests of all the Company’s stockholders and to fulfill the responsibilities of a director. Nominees shall not be discriminated against on the basis of race, religion, national origin, sex, sexual orientation, disability or any other basis proscribed by law. The value of diversity on the board should be considered.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics (the “Code of Ethics”), that applies to all directors, officers and employees of our Company and its subsidiaries. This Code of Ethics covers a wide range of business practices and procedures and promotes honest and ethical conduct, full, fair, accurate and timely disclosure in all reports and documents that our Company files under public communication, compliance with all applicable governmental laws, rules and regulations, protection of company assets, and fair dealing practices. The full text of our Code of Ethics is posted on the Investor Relations section of our website at https://investor.lovesac.com. We will disclose future amendments or waivers to our code of business conduct and ethics on our website within four business days following the date of the amendment or waiver.

8

Director Compensation

The following table provides information concerning the compensation paid to persons serving as non-employee directors of our Company for the fiscal year ended February 2, 2020 for whom information has not been disclosed below under the heading “Summary Compensation Table.”

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) | Non-equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||

| Andrew Heyer | — | 120,000 | — | — | — | — | 120,000 | |||||||||||||||||||||

| John Grafer | — | 120,000 | — | — | — | — | 120,000 | |||||||||||||||||||||

| William Phoenix | — | 120,000 | — | — | — | — | 120,000 | |||||||||||||||||||||

| Walter McLallen | 50,000 | 120,000 | — | — | — | — | 170,000 | |||||||||||||||||||||

| Jared Rubin | — | 120,000 | — | — | — | — | 120,000 | |||||||||||||||||||||

| Shirley Romig | 40,000 | 120,000 | — | — | — | — | 160,000 | |||||||||||||||||||||

On October 2, 2019, at the recommendation of the compensation committee, the board of directors approved the granting of 6,490 restricted stock units (“RSUs”) to each of the non-employee directors in accordance with a Restricted Stock Units Agreement (“Grant Agreement”) pursuant to the Company’s Amended and Restated 2017 Equity Incentive (the “2017 Plan”).

Unless the RSUs are forfeited pursuant to the 2017 Plan or the Grant Agreement, (i) 3,245 shall vest on the first anniversary of the grant date, and (ii) 3,245 which shall vest 50% on the first anniversary of the date of the grant and 50% on the second anniversary of the date of the grant. Each RSU represents the right to receive one share of our common stock upon vesting of the RSU.

Additionally, on October 2, 2019, at the recommendation of the compensation committee, the board of directors approved providing cash compensation of $40,000 per year to non-employee directors Ms. Romig and Mr. McLallen. Mr. McLallen will also receive $10,000 per year as chair of the audit committee.

We reimburse our non-employee directors for reasonable travel and out-of-pocket expenses incurred in connection with attending board of director and committee meetings.

PROPOSAL

NO. 2 — APPROVAL OF AMENDMENT TO THE LOVESAC COMPANY

2017 EQUITY INCENTIVE PLAN

Background

Our Amended and Restated 2017 Equity Incentive Plan (the “2017 Plan”), was approved by our board of directors and our stockholders on August 26, 2017. In 2018, the 2017 Plan was amended to increase the shares of our common stock authorized and reserved for issuance under the 2017 Plan to 615,066 shares. In 2019 the 2017 Plan was amended and restated to, among other things, increase the shares of our common stock authorized and reserved for issuance under the 2017 Plan to 1,414,889 shares.

At this time, we estimate that the 2017 Plan has only enough shares reserved to provide for equity incentive grants through the 2021 fiscal year. Since our ability to grant equity incentive compensation to eligible individuals is an integral part of our compensation practices, we are requesting stockholder approval to add 690,000 shares to the 2017 Plan’s share reserve so that we may continue to grant awards after fiscal year 2021.

Summary of the Proposal

We operate in a challenging marketplace in which our success depends to a great extent on our ability to attract and retain employees, directors and other service providers of the highest caliber. One of the tools our board of directors regards as essential in addressing these human resource challenges is a competitive equity incentive program. Our employee stock incentive program provides a range of incentive tools and sufficient flexibility to permit the board of directors’ compensation committee to implement them in ways that will make the most effective use of the shares our stockholders authorize for incentive purposes.

In May 2020, our board of directors adopted an amendment to the 2017 Plan, subject to approval by our stockholders at our 2020 annual meeting, that increases by 690,000 the aggregate maximum number of shares that may be issued under the 2017 Plan, so that the new total share reserve for grants under the Amended Plan will be 2,104,889 shares. As of May 15, 2020, a total of 406,213 shares had been issued under the 2017 Plan, 721,125 shares remained subject to outstanding awards under the 2017 Plan, and 184,480 shares remained available for the future grant of awards under the 2017 Plan. The 2017 Plan would be amended as set forth in the First Amendment to 2017 Equity Incentive Plan attached as Appendix A to this proxy statement.

9

We believe that increasing the shares reserved for issuance under the 2017 Plan is necessary for us to continue to offer a competitive equity incentive program. We believe that the additional shares will provide us with enough shares to continue to offer competitive equity compensation through fiscal year 2022. This estimate is based on a number of assumptions, including that our grant practices under the 2017 Plan will be consistent with our historical practices and usage, and is dependent on a number of other factors that are difficult to predict or beyond our control, including the price of our Common Stock underlying future grants, our hiring activity, forfeitures of outstanding awards and other circumstances that may require us to change our equity grant practices.

If the stockholders do not approve the proposed share increase, we believe we will not be able to continue to offer competitive equity packages to retain our current employees and recruit qualified new hires. This could significantly hamper our plans for growth and adversely affect our ability to operate our business. In addition, if we were unable to grant competitive equity awards, we may be required to offer additional cash-based incentives to replace equity as a means of competing for talent. This could have a significant effect upon our quarterly results of operations and balance sheet and not be competitive with other companies that offer equity.

The board of directors believes that the 2017 Plan will serve a critical role in attracting and retaining the high caliber employees, consultants and directors essential to our success and in motivating these individuals to strive to meet our goals. Therefore, the board of directors urges you to vote to approve the amendment to the 2017 Plan.

Total Potential Dilution and Run Rate Information

Common measures of a stock plan’s cost include burn rate, dilution and overhang. The burn rate, or run rate, refers to how fast a company uses the supply of shares authorized for issuance under its stock plan. Over the last two years, the Company has maintained an average equity run rate of only 4.1% of shares of Common Stock outstanding per year. Total Potential Dilution (under employee stock plans) measures the degree to which our stockholders’ ownership has been diluted by stock-based compensation awarded under the 2017 Plan and also includes shares that may be awarded under the 2017 Plan in the future.

The following table shows how our key equity metrics have changed over the past two years, and also reflects the impact of the proposed new share request on such metrics:

| Key Equity Metrics: | As of May 15, 2020 including the New Share Request (1) | Fiscal Year 2020 | Fiscal Year 2019 | |||||||||

| Equity Run Rate(2) | NA | 5.1 | % | 3.1 | % | |||||||

| Outstanding Overhang(3) | 4.5 | % | 4.4 | % | 2.7 | % | ||||||

| Total Potential Dilution under Employee Stock Plans(4) | 9.9 | % | 6.1 | % | 3.0 | % | ||||||

| (1) | Includes all information as of May 15, 2020, including the impact of the 690,000 new shares that shareholders are being asked to approve in this proposal. |

| (2) | Equity run rate is calculated by dividing the number of shares subject to equity awards granted during the year by the weighted-average number of basic shares outstanding during the year. |

| (3) | Outstanding Overhang is calculated by dividing (a) the number of shares subject to equity awards outstanding at the end of the year, by (b) the sum of number of shares outstanding at the end of the year, the number of shares subject to equity awards outstanding at the end of the year, and the number of shares available for future grants at the end of the year. |

| (4) | Total Potential Dilution under Employee Stock Plans is calculated by dividing (a) the sum of the number of shares subject to equity awards outstanding at the end of the year and the number of shares available for future grants at the end of the year, by (b) the sum of number of shares outstanding at the end of the year, the number of shares subject to equity awards outstanding at the end of the year, and the number of shares available for future grants at the end of the year. |

Authorized Shares Requested

The maximum aggregate number of shares we are requesting our stockholders to authorize under the 2017 Plan is 2,104,889. The total overhang resulting from this share request represents approximately 4.5% of the number of shares of our common stock outstanding on May 15, 2020, determined on a fully diluted basis.

Our board of directors considered several factors in determining the amount of shares requested as set forth above, including the intention to authorize sufficient shares to provide for the needs of a reasonable incentive program for the next two years.

Summary of the 2017 Plan

The following summary of the 2017 Plan is qualified in its entirety by the specific language of the 2017 Plan.

General. The purpose of the 2017 Plan is to advance the interests of the Company and its stockholders by providing an incentive program that will enable the Company to attract and retain employees, consultants and directors and to provide them with an equity interest in the growth and profitability of the Company. These incentives are provided through the grant of stock options, stock appreciation rights, restricted stock, restricted stock units, performance shares, performance units, other stock-based awards and cash-based awards.

10

Authorized Shares. The maximum aggregate number of shares authorized for issuance under the 2017 Plan is 2,104,889 shares, assuming the stockholders approve the addition of 690,000 shares to the reserve. Given the 184,480 shares that remain available for grant as of May 15, 2020, if approved, we would have 874,480 shares for new grants following approval of the 2017 Plan.

Share Counting. Each share subject to a stock option, stock appreciation right, or other award that requires the participant to purchase shares for their fair market value determined at the time of grant will reduce the number of shares remaining available for grant under the 2017 Plan by one share.

If any award granted under the 2017 Plan expires or otherwise terminates for any reason without having been exercised or settled in full, or if shares subject to forfeiture or repurchase are forfeited or repurchased by the Company for not more than the participant’s purchase price, any such shares reacquired or subject to a terminated award will again become available for issuance under the 2017 Plan. Shares will not be treated as having been issued under the 2017 Plan and will therefore not reduce the number of shares available for issuance to the extent an award is settled in cash. Shares purchased in the open market with proceeds from the exercise of options will not be added to the share reserve. Shares that are withheld or reacquired by the Company in satisfaction of a tax withholding obligation in connection with an option or a stock appreciation right or that are tendered in payment of the exercise price of an option will not be made available for new awards under the 2017 Plan. Upon the exercise of a stock appreciation right or net-exercise of an option, the number of shares available under the 2017 Plan will be reduced by the gross number of shares for which the award is exercised. Shares withheld or reacquired by the Company in satisfaction of tax withholding obligations pursuant to the vesting or settlement of “full value” awards will again become available for issuance under the 2017 Plan.

Adjustments for Capital Structure Changes. Appropriate and proportionate adjustments will be made to the number of shares authorized under the 2017 Plan, to the numerical limits on certain types of awards described below, and to outstanding awards in the event of any change in our common stock through merger, consolidation, reorganization, reincorporation, recapitalization, reclassification, stock dividend, stock split, reverse stock split, split-up, split-off, spin-off, combination of shares, exchange of shares or similar change in our capital structure, or if we make a distribution to our stockholders in a form other than common stock (excluding regular, periodic cash dividends) that has a material effect on the fair market value of our common stock. In such circumstances, the compensation committee also has the discretion under the 2017 Plan to adjust other terms of outstanding awards as it deems appropriate.

Nonemployee Director Award Limits. The aggregate grant date fair value of all awards granted to any nonemployee director during any fiscal year of the Company combined with any cash compensation for that year for services as a nonemployee director will not exceed $300,000.

Administration. The 2017 Plan generally will be administered by the compensation committee of the board of directors, although the board of directors retains the right to appoint another of its committees to administer the 2017 Plan or to administer the 2017 Plan directly. (For purposes of this summary, the term “Committee” will refer to either such duly appointed committee or the board of directors.) Subject to the provisions of the 2017 Plan, the Committee determines in its discretion the persons to whom and the times at which awards are granted, the types and sizes of awards, and all of their terms and conditions. The Committee may, subject to certain limitations on the exercise of its discretion provided by the 2017 Plan, amend, cancel or renew any award, waive any restrictions or conditions applicable to any award, and accelerate, continue, extend or defer the vesting of any award.

The 2017 Plan provides, subject to certain limitations, for indemnification by the Company of any director, officer or employee against all reasonable expenses, including attorneys’ fees, incurred in connection with any legal action arising from such person’s action or failure to act in administering the 2017 Plan. All awards granted under the 2017 Plan will be evidenced by a written or digitally signed agreement between the Company and the participant specifying the terms and conditions of the award, consistent with the requirements of the 2017 Plan. The Committee will interpret the 2017 Plan and awards granted thereunder, and all determinations of the Committee generally will be final and binding on all persons having an interest in the 2017 Plan or any award.

Prohibition of Option and SAR Repricing. The 2017 Plan expressly provides that, without the approval of a majority of the votes cast in person or by proxy at a meeting of our stockholders, the Committee may not provide for any of the following with respect to underwater options or stock appreciation rights: lower the exercise price per share of an option or the base price of a stock appreciation right after it is granted, cancel an option or stock appreciation right when the price per share exceeds the fair market value of one share of stock in exchange for cash or another award (other than in connection with a change in control), or take any other action with respect to an option or stock appreciation right that would be treated as a repricing under the rules and regulations of the principal U.S. national securities exchange on which the shares of stock are listed.

Eligibility. Awards may be granted to employees, directors and consultants of the Company or any present or future parent or subsidiary corporation or other affiliated entity of the Company. Incentive stock options may be granted only to employees who, as of the time of grant, are employees of the Company or any parent or subsidiary corporation of the Company.

Stock Options. The Committee may grant nonstatutory stock options, incentive stock options within the meaning of Section 422 of the Code, or any combination of these. The exercise price of each option may not be less than the fair market value of a share of our common stock on the date of grant. However, any incentive stock option granted to a person who at the time of grant owns stock possessing more than 10% of the total combined voting power of all classes of stock of the Company or any parent or subsidiary corporation of the Company (a “10% Stockholder”) must have an exercise price equal to at least 110% of the fair market value of a share of common stock on the date of grant.

11

The 2017 Plan provides that the option exercise price may be paid in cash, by check, or cash equivalent; by means of a broker-assisted cashless exercise; by means of a net-exercise procedure; to the extent legally permitted, by tender to the Company of shares of common stock owned by the participant having a fair market value not less than the exercise price; by such other lawful consideration as approved by the Committee; or by any combination of these. Nevertheless, the Committee may restrict the forms of payment permitted in connection with any option grant. No option may be exercised unless the participant has made adequate provision for federal, state, local and foreign taxes, if any, relating to the exercise of the option, including, if permitted or required by the Company, through the participant’s surrender of a portion of the option shares to the Company.

Options will become vested and exercisable at such times or upon such events and subject to such terms, conditions, performance criteria or restrictions as specified by the Committee. The maximum term of any option granted under the 2017 Plan is ten years, provided that an incentive stock option granted to a 10% Stockholder must have a term not exceeding five years. Unless otherwise permitted by the Committee, an option generally will remain exercisable for three months following the participant’s termination of service, provided that if service terminates as a result of the participant’s death or disability, the option generally will remain exercisable for 12 months, but in any event the option must be exercised no later than its expiration date, and provided further that an option will terminate immediately upon a participant’s termination for cause (as defined by the 2017 Plan).

Options are nontransferable by the participant other than by will or by the laws of descent and distribution and are exercisable during the participant’s lifetime only by the participant. However, an option may be assigned or transferred to certain family members or trusts for their benefit to the extent permitted by the Committee and, in the case of an incentive stock option, only to the extent that the transfer will not terminate its tax qualification. No option (and no SAR) may be transferred to a third party financial institution for value.

Stock Appreciation Rights. The Committee may grant stock appreciation rights either in tandem with a related option (a “Tandem SAR”) or independently of any option (a “Freestanding SAR”). A Tandem SAR requires the option holder to elect between the exercise of the underlying option for shares of common stock or the surrender of the option and the exercise of the related stock appreciation right. A Tandem SAR is exercisable only at the time and only to the extent that the related stock option is exercisable, while a Freestanding SAR is exercisable at such times or upon such events and subject to such terms, conditions, performance criteria or restrictions as specified by the Committee. The exercise price of each stock appreciation right may not be less than the fair market value of a share of our common stock on the date of grant.

Upon the exercise of any stock appreciation right, the participant is entitled to receive an amount equal to the excess of the fair market value of the underlying shares of common stock as to which the right is exercised over the aggregate exercise price for such shares. Payment of this amount upon the exercise of a Tandem SAR may be made only in shares of common stock whose fair market value on the exercise date equals the payment amount. At the Committee’s discretion, payment of this amount upon the exercise of a Freestanding SAR may be made in cash or shares of common stock. The maximum term of any stock appreciation right granted under the 2017 Plan is ten years.

Stock appreciation rights are generally nontransferable by the participant other than by will or by the laws of descent and distribution and are generally exercisable during the participant’s lifetime only by the participant. If permitted by the Committee, a Tandem SAR related to a nonstatutory stock option and a Freestanding SAR may be assigned or transferred to certain family members or trusts for their benefit to the extent permitted by the Committee. Other terms of stock appreciation rights are generally similar to the terms of comparable stock options.

Restricted Stock Awards. The Committee may grant restricted stock awards under the 2017 Plan either in the form of a restricted stock purchase right, giving a participant an immediate right to purchase common stock, or in the form of a restricted stock bonus, in which stock is issued in consideration for services to the Company rendered by the participant. The Committee determines the purchase price payable under restricted stock purchase awards, which may be less than the then current fair market value of our common stock. Restricted stock awards may be subject to vesting conditions based on such service or performance criteria as the Committee specifies, including the attainment of one or more performance goals similar to those described below in connection with performance awards. Shares acquired pursuant to a restricted stock award may not be transferred by the participant until vested. Unless otherwise provided by the Committee, a participant will forfeit any shares of restricted stock as to which the vesting restrictions have not lapsed prior to the participant’s termination of service. Participants holding restricted stock will have the right to vote the shares and to receive any dividends paid, except that dividends or other distributions will be subject to the same vesting terms and restrictions as the original award.

12

Restricted Stock Units. The Committee may grant restricted stock units under the 2017 Plan, which represent rights to receive shares of our common stock at a future date determined in accordance with the participant’s award agreement. No monetary payment is required for receipt of restricted stock units or the shares issued in settlement of the award, the consideration for which is furnished in the form of the participant’s services to the Company. The Committee may grant restricted stock unit awards subject to the attainment of one or more performance goals similar to those described below in connection with performance awards or may make the awards subject to vesting conditions similar to those applicable to restricted stock awards. Unless otherwise provided by the Committee, a participant will forfeit any restricted stock units which have not vested prior to the participant’s termination of service. Participants have no voting rights or rights to receive cash dividends with respect to restricted stock unit awards until shares of common stock are issued in settlement of such awards. However, the Committee may grant restricted stock units that entitle their holders to dividend equivalent rights, which are rights to receive cash or additional restricted stock units whose value is equal to any cash dividends the Company pays. The dividend equivalent rights would be subject to the same vesting conditions and settlement terms as the original award.

Performance Awards. The Committee may grant performance awards subject to such conditions and the attainment of such performance goals over such periods as the Committee determines in writing and sets forth in a written agreement between the Company and the participant. These awards may be designated as performance shares or performance units, which consist of unfunded bookkeeping entries generally having initial values equal to the fair market value determined on the grant date of a share of common stock in the case of performance shares and a monetary value established by the Committee at the time of grant in the case of performance units. Performance awards will specify a predetermined amount of performance shares or performance units that may be earned by the participant to the extent that one or more performance goals are attained within a predetermined performance period. To the extent earned, performance awards may be settled in cash, shares of common stock (including shares of restricted stock that are subject to additional vesting) or any combination of these.

The Committee will establish one or more performance goals applicable to the award. Performance goals will be based on the attainment of specified target levels with respect to one or more measures of business or financial performance of the Company and each subsidiary corporation consolidated with the Company for financial reporting purposes, or such division or business unit of the Company as may be selected by the Committee. The Committee, in its discretion, may base performance goals on one or more of the metrics as set forth in the 2017 Plan, or on any other such metric it chooses.

The target levels with respect to these performance measures may be expressed on an absolute basis or relative to an index, budget or other standard specified by the Committee. The degree of attainment of performance measures will be calculated in accordance with the Company’s financial statements, generally accepted accounting principles, if applicable, or other methodology established by the Committee, but prior to the accrual or payment of any performance award for the same performance period, and, according to criteria established by the Committee, excluding the effect (whether positive or negative) of events as determined by the Committee, which may include changes in accounting standards or any unusual or infrequently occurring event or transaction occurring after the establishment of the performance goals applicable to a performance award.

Following completion of the applicable performance period, the Committee will certify in writing the extent to which the applicable performance goals have been attained and the resulting value to be paid to the participant. The Committee retains the discretion to increase, eliminate, or reduce the amount that would otherwise be payable on the basis of the performance goals attained to a participant. In its discretion, the Committee may provide for a participant awarded performance shares to receive dividend equivalent rights with respect to cash dividends paid on the Company’s common stock to the extent that the performance shares become vested (with any such dividend equivalents to be subject to the same vesting terms and restrictions as the underlying award). The Committee may provide for performance award payments in lump sums or installments.

Unless otherwise provided by the Committee, if a participant’s service terminates due to the participant’s death or disability prior to completion of the applicable performance period, the final award value will be determined at the end of the performance period on the basis of the performance goals attained during the entire performance period but will be prorated for the number of months of the participant’s service during the performance period. If a participant’s service terminates prior to completion of the applicable performance period for any other reason, the 2017 Plan provides that, unless otherwise determined by the Committee, the performance award will be forfeited. No performance award may be sold or transferred other than by will or the laws of descent and distribution prior to the end of the applicable performance period.

Cash-Based Awards and Other Stock-Based Awards. The Committee may grant cash-based awards or other stock-based awards in such amounts and subject to such terms and conditions as the Committee determines. Cash-based awards will specify a monetary payment or range of payments, while other stock-based awards will specify a number of shares or units based on shares or other equity-related awards. Such awards may be subject to vesting conditions based on continued performance of service or subject to the attainment of one or more performance goals similar to those described above in connection with performance awards. Settlement of awards may be in cash or shares of common stock, as determined by the Committee. A participant will have no voting rights with respect to any such award unless and until shares are issued pursuant to the award. The committee may grant dividend equivalent rights with respect to other stock-based awards, which will be subject to the same vesting terms and restrictions as the underlying award. The effect on such awards of the participant’s termination of service will be determined by the Committee and set forth in the participant’s award agreement.