CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS AGREEMENT HAS BEEN OMITTED BY MEANS OF REDACTING A PORTION OF THE TEXT AND REPLACING IT WITH [***], PURSUANT TO REGULATION S-K ITEM 601(B) OF THE SECURITIES ACT OF 1933, AS AMENDED. CERTAIN CONFIDENTIAL INFORMATION HAS BEEN EXCLUDED FROM THE EXHIBIT BECAUSE IT IS: (i) NOT MATERIAL AND (ii) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED. (***). Exhibit 10.29

.. ' 2.3 Addition of .New Section 5(g). There are two Sections S(f) in the Agreemenl The first Section 5(f) related to Volume Rebate is deleted in its enUrety and replaced with the followin.9 new Sect{on 5(g): "(gl Provided tllat no event has occ;urre(I Which would allow Bank to terminate tills Agreement under Section 15(b), Bank will pay to Retailer: 2.4 Agreement; Adi:Utlon of Section 5(h). The following new S�ction �(h) is hereby added to the "{h) [***] "Marketing Fund" means a recol1! maintained by Bank that is used to. fu,nd the mutually agreed· upon cqsts and expenses of implemenUn.9 the mutually agreed upon marketing plans fc;,r thl;l Program, Including agreed upon costs incurred by Bank and Retailer. Bank will reimburse Retailer for mutually .agr�ed u·p on, out of pocket, marketing e�penses witbin 30 days of receipt ofan invoice meeting Bank's reasonable requirements. Exceptfor the right to require Bank to rnake payments from such fund frc,m time to time in accordance with thls Agreemen� Reta lier shall have no right, title or interest in or to.the .Marketing F ufid or In ·or to any amounts which have been alocated �hereto. hly amounts previously allocated to the Ma•ketinQ. Fund but not _used ·as of [***]. 2.5· folfowing: Amendment to Section 15(a). Section 15(a) Is hereby deleted an� replace� with the "(a) This Agreement shall co.mmence upon the execution of this Agreement and shall continue until ancHncludlng March 31, 2023 and shall a1,.1tomatically renew for additlonal one (1) year t�mls each ending on March 31 of the fQllowing Y!!ar {each such period, a "Temt), unless either party shal] give written notice lo the qther party of its Intention to terminate the Program at least one hundred and eighiy (180) days pflor to ttie end of the scheduled expiration of such Term." 2.6 Amendment to Section 18( g). Tt:ie following new Seption 1 S(g)(vii) I& hereby added to the Agreement: •(vii} Tax· Refunds ot Deductions. Retailer will cooperate with Bank's attempt to recover. sales taxes in accordance with Scnedule 1 S(g)." DWT 23750635v2 0050741-000568. [***]

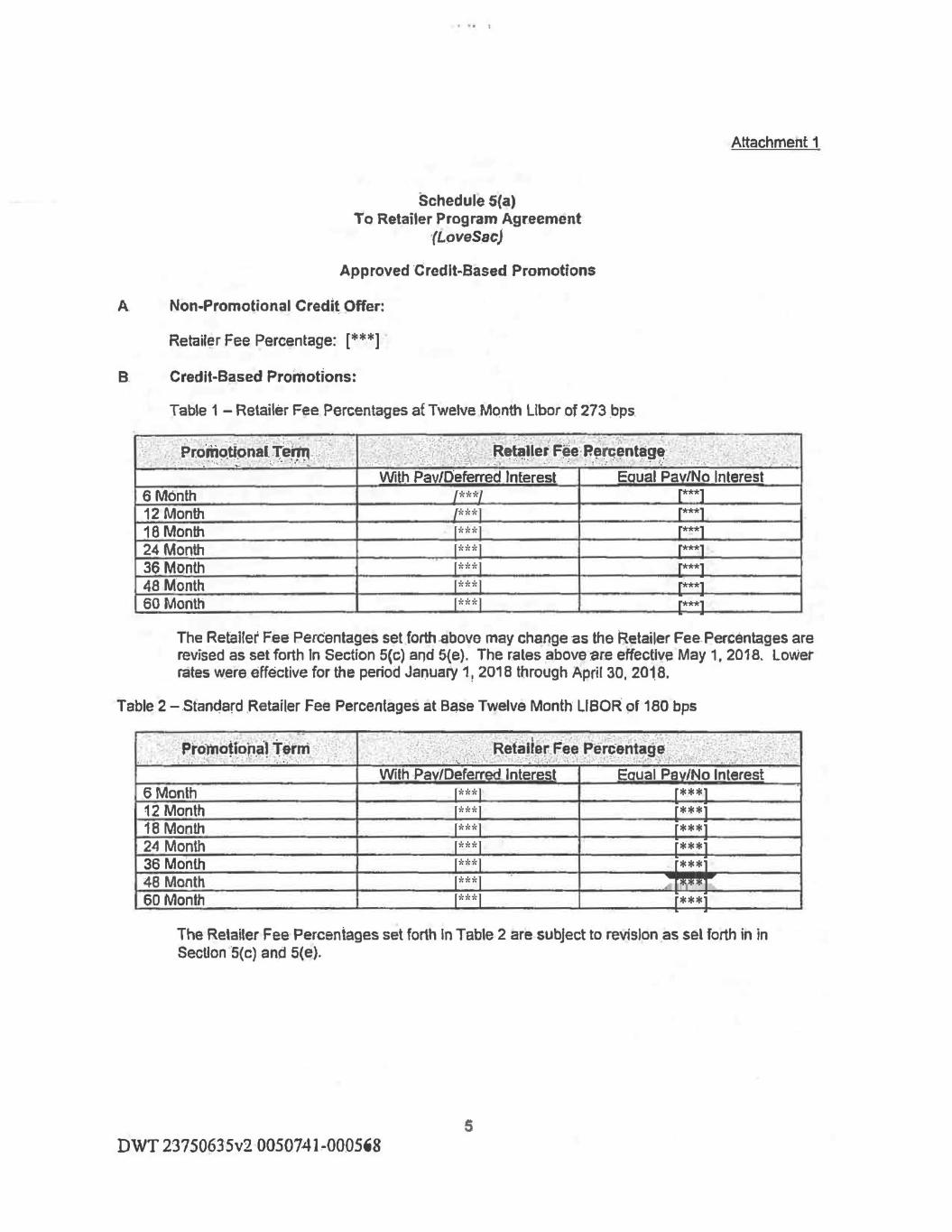

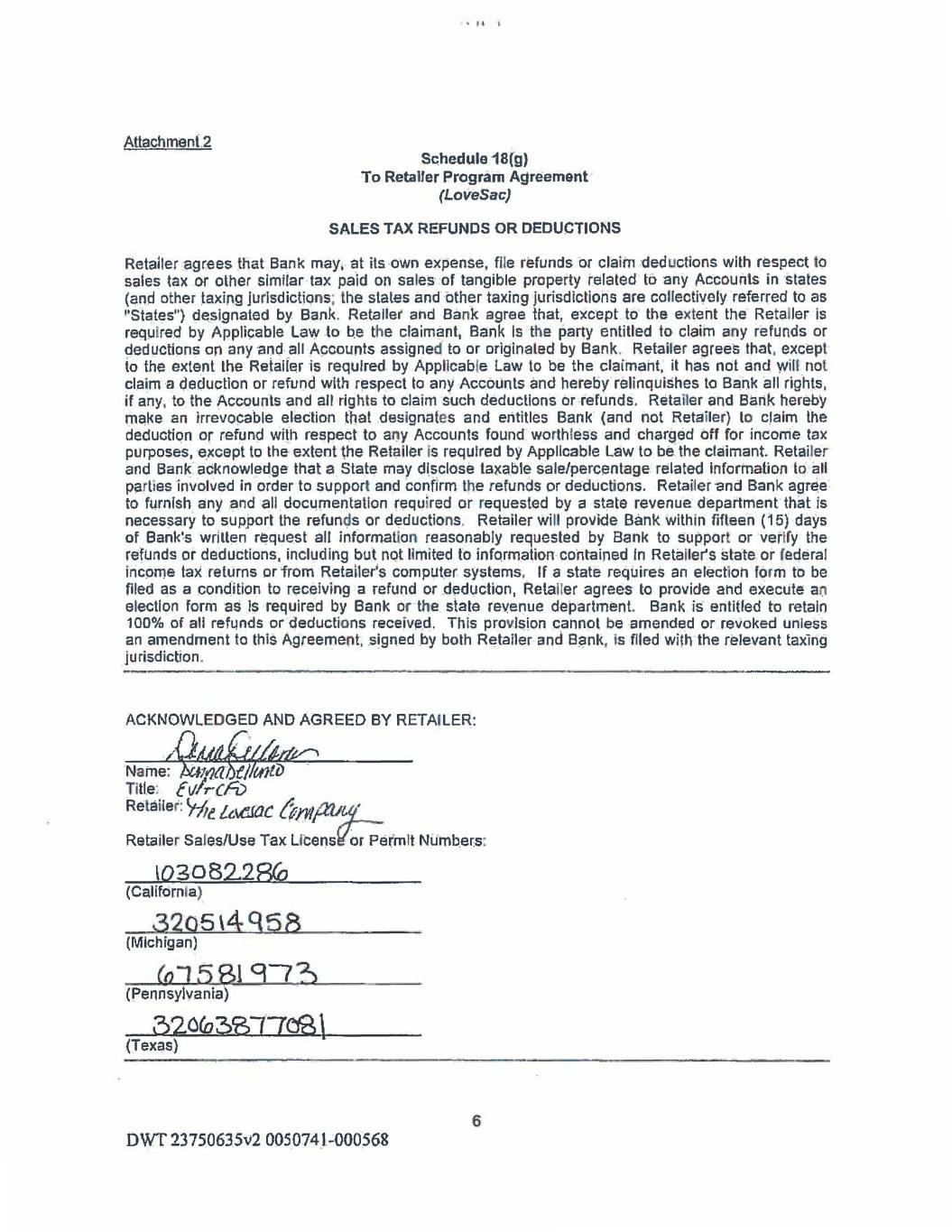

2.7 Amendment lo Schedule .5(a). Effective as of Janµary 1, 2018, Schedule S(a) to the Agreement is hereby deleted in Its ~ntirety and replaced with the revised Schei;lule 5(a) attached hereto as Attachment I. Within a reaso·nable period after execution ·of the Amendment.by each party, Bank wilf refund·the.differenc,e b~tween the Retailer fees paid by Retailer and the Retai.ler Fees que under Schedul~ 5(a) for the period January 1, 2018 through April 30, ·2~1 a .. 2,8 New Schedule 1 S(g). A new Schedule 1 B(g)·, attached hereto as Attachment II, is added to the Agreement.· JII, GENERAL 3.1 Authority for Am-endment Retailer and SAC represent and warrant to B.ank. that the execution, delivery and performance of this Amendment has been duly·authorized by all requisite . corporate actloi1 on the part of Retaller and SAC and upon execution by all parties, will constitute a legal, bindihg obligatioh of Retaiier and SAC. 2.2 Effect of Amendment, Except ~s specifically amended hereby; the Agreement, ~nd all terms _contained therein, remains in full force and effect. The Agreement, as •amended by this Amehdmen~ constitute~ the entire understanding ofthe parties with respect to the subject matter hereof. 2~ Bin.ding Effect; Severabfllty, Each reference herein to ~ party hereto shall be deemed to Include its successors-and assigns,. all of whom shall be bound by this .Am~ndment and in whose favor the provisions of this Amendment shall inure. In case any one or more of the provisions contained in this Amendment shall be Invalid, ill~gal ot unenforceable In-any respet;:t. the validity, l_eg~llty and .enforceability of the remaining provisions contained herein shall ·not In any ·way be aft'.ected or Jmp~ired tnereby. • .2.4 Further Ass!,I ranc~. The parties hereto agtee to execu~e such other documents. ar:id Jnstniments.and to do such other and further things as may be necessary or desirable for the ei<ecution and·implem~ri~tion of this. Amen(:lment.and the consummation of the transactions contemplated. hereby and thereby. 2.5 Governing Law. This Amendment shall b~ governed by and construed in accordance with the laws of the Slate of Utahi without regarcno principles of conflicts of laws. 2.6 Counterparts. This Amendment may ~ executed in counterparts, ~ac;:h of which shall constit4te an original, but all of wl'ilch, when taKen together, shall constitute but one agreement. 3 DWT 23750635y2 0050741-000568·

J • p • I IN WITNESS WHEREOF, -the parties.h!;!r~to have caused th!s Amendment to be e)(ecuted by their duly authorized officers, all as of the day and year first above, Written. SYNOH~ONY BANK By:~ Nam~S.~ Its: Senior Vice President DWT 23750635V2 0050741-000568 THE LOVESAC COMPANY ACKNOWLEDGED AND AGREED BY: SAC ACQUISITION LLC 4

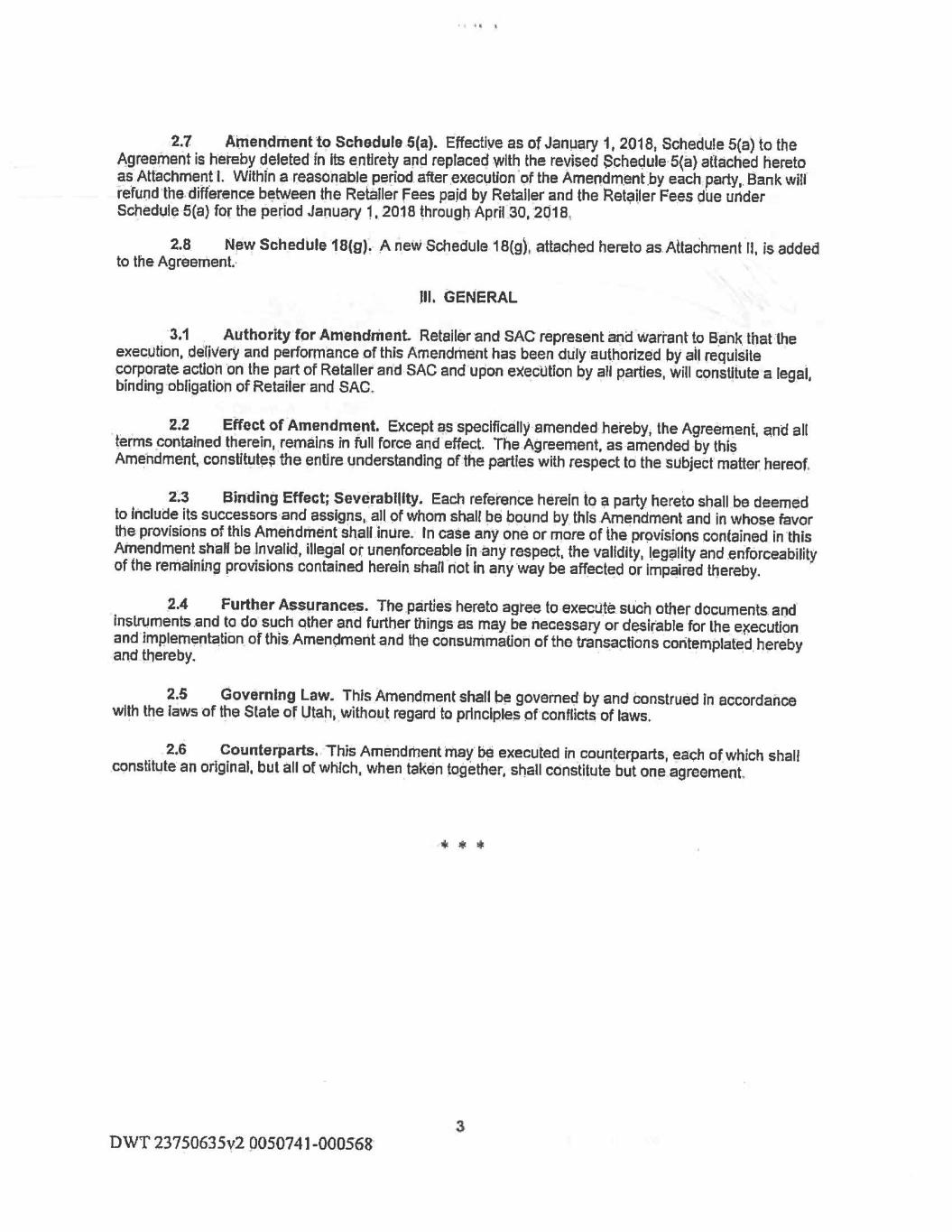

. .. . Attachment 1 Schedule S(a) To Retailer Program Agr.eement '(LoveS.ac) Approved ·credit-Based Promotions A. Non-Promotional Credit Offer: Retail�r Fee Percentage: [***] B. Credlt-B�sed Promotions: Ta�le 1 - Retailer Fee Percentages at Twelve Month Llbor of 273 _bps. ,, ', ,"::�- ---· •• _ •J!." . .... . :_�, • ... :.: '.· ;1- .. �r.��9-�!!)ri��J�rf.1:1 >·. J_ . - .·,. ·_�: r-: c :\�;; :,-' . •_ �t�: i; ,: ·t :.;.1. I - �•,- • ,j'- ·• ,. --��J:J!e�. F,:e.·· �(!-��-!�l�!f!'' ,. : .. •• - ., , I i :-:� 6 Month 12 Month 18 Month 24 Month 36 Month 48 Month 60 Montli With Pav/Deferred Interest [***] [***] [***] [***] [***] [***] [***] Eaual Pav/No Interest [***] [***] [***] [***] [***] [***] [***] ... The Retailer Fee Percentages set forth .above may change as the Retailer Fee. Percentages are revised as set forth In Section 5(c) a11d 5(e). The rates �hove :are effective May 1, 2018. Lower rates were effective for the period January 1, 201 B through April 30, 201 a. Table 2 - Stan"ard _Retailer Fee Percentages at Base Twelve Month LIBOR 9f 180 bps 6 Month 12 Month 18 Month 24 Month 36 Month 48 Month 60 Month With Pav/Deferrt>ti Interest [***] [***] [***] [***] [***] [***] [***] Eaual Pav/No Interest [***] [***] [***] [***] [***] [***] [***] The Retailer Fee Percentages set forth In Table 2 are subject to revision _as set forth iil in SecUon ··s(c) and 5(e). 5 DWT 2375063"5v2 0050741-000568

Attachmeni.2 Sc.hedule 18(g) To Retailer Program Agreement (Lovesac) SALES TAX REFUNDS OR DEDUCTIONS Retailer .l;lgrees that Bank may; at its •Own expense, file refunds or claim deductions with respect to sa,es tax or other simiiar tax pald on sales of tangible property related to any Actounts in states (and other taxing jurlsdictjons; the states and··oth~r taxing Jurisdictions are collectively referred to as ''States") d~signated by Bank. Retallet ahd Bank agree that, except to the e><tent the Retailer is required by Applicable· Law to be the claiml3nt, Bank Is the party entitled to claim any refunds or deductions on any ancl all Apcounts assigned to or originated by Bank. Retailer agree·s that, except io the extent the Re.iailer is required by Applicable Law to be the claimant. it has not and will not cl.aim a <;leouctlon or refund with respect to any Accounts and hereby relinquishes to B~nk all rights, if any, to the Accounts and all rights to claim such deductions or .refunds. Retaner and Bank hereby mc!ke. an irrevocable election that desigm:ifes and entitles Bank (and not Retailer} lo cJaim the deductiqn or refunp wi,h respec,t to al')y Accounts found· worthless and charged off for income tax purposes, e.xcept to the extent 1he Ret~iler is required by Applicable Law to be.the claimant. Retailer and Bank· acknowledge that a State may d!sclose taxable sale/percentage related information to all p~rtles 1nvolved in ·order to support and confirm the refunds or deductions. Retailer c9nd Bank agree to furnish any and all doc1.1rnentatlon requfred or requested by a stale revenue department that is neces~ary to support the refunds or deductions. Retailer will provide Bank within fiftee·n n 5) days of Bank's wrltten r~quest all information reasonably requested by Bank to support or verify the refunds or deductions, including but nQt limited t'o information contained In Retailer's state or federal incpme tax returns or from Retaller;s comput.er systems, If a state requires an election fo,m to be filed as a conqition to receiving a refund or _deduction, Retailer agrees to provide ahd execute an election form as 1$ required by Bank or the slate revenue department. Bank is entitled to retain 100% of all refl!nds or qeductions receivf:!_d. This provision cannot be amended or revoked unless an amendment to this Agreeme{lt, .signed by both R~tailer and 8;3nk, is filed· with the relevant taxing jurisdiction. ACKNOWLEDGED AND AGREED BY RETAILER: ,~or Name: ~ 11Jfl(/.uiD • Titl.e: E vl,cR> Retailer: Y1!e. l..t\L'JOC 4n1ftu':f__ Retailer Sale.s/Use Tax Ucensv'or Pennlt Ntimber:s: l0308228(o (Cal!for,nla) 3205\4958 (Michigan) CoJ .5 8197~ (Pennsylvania) • 32C(a~B:{7eto \ (Texas} 6 owr 23750635v2 oos.014_1..:ooos68