I N V ES T OR DA Y 2 0 2 4 Investor Day December 17, 2024 H ®

I N V ES T OR DA Y 2 0 2 4 Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other legal authority. Forward-looking statements can be identified by words such as “may,” “continue(s),” “believe,” “anticipate,” “could,” “should,” “intend,” “plan,” “will,” “aim(s),” “can,” “would,” “expect(s),” “expectation(s),” “estimate(s),” “project(s),” “forecast(s)”, “positioned,” “approximately,” “potential,” “goal,” “pro forma,” “strategy,” “outlook” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. All statements, other than statements of historical facts, included in this press release under the heading “Outlook” and all statements regarding strategy, future operations, the pace and success of new products, future financial position or projections, future revenue, projected expenses, sustainability goals, prospects, plans and objectives of management are forward-looking statements. These statements are based on management’s current expectations, beliefs and assumptions concerning the future of our business, anticipated events and trends, the economy and other future conditions. We may not actually achieve the plans, carry out the intentions or meet the expectations disclosed in the forward-looking statements and you should not rely on these forward-looking statements. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors. Among the key factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements include: business disruptions or other consequences of economic instability, political instability, civil unrest, armed hostilities, natural and man-made disasters, pandemics or other public health crises, or other catastrophic events; the impact of changes or declines in consumer spending and increases in interest rates and inflation on our business, sales, results of operations and financial condition; our ability to manage and sustain our growth and profitability effectively, including in our ecommerce business, forecast our operating results, and manage inventory levels; our ability to improve our products and develop new products; our ability to successfully open and operate new showrooms; our ability to advance, implement or achieve the goals set forth in our ESG Report; our ability to realize the expected benefits of investments in our supply chain and infrastructure; disruption in our supply chain and dependence on foreign manufacturing and imports for our products; our ability to acquire new customers and engage existing customers; reputational risk associated with increased use of social media; our ability to attract, develop and retain highly skilled associates and employees; system interruption or failures in our technology infrastructure needed to service our customers, process transactions and fulfill orders; any inability to implement and maintain effective internal control over financial reporting or inability to remediate any internal controls deemed ineffective; the impact of the restatement of our previously issued audited financial statements as of and for the year ended January 29, 2023 and our unaudited condensed financial statements for the quarterly periods ended April 30, 2023, October 30, 2022, July 31, 2022 and May 1, 2022; unauthorized disclosure of sensitive or confidential information through breach of our computer system; unauthorized disclosure of sensitive or confidential information through breach of our computer system; the ability of third-party providers to continue uninterrupted service; the impact of tariffs, and the countermeasures and tariff mitigation initiatives; the regulatory environment in which we operate, our ability to maintain, grow and enforce our brand and intellectual property rights and avoid infringement or violation of the intellectual property rights of others; and our ability to compete and succeed in a highly competitive and evolving industry, as well as those risks and uncertainties disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Amendment No. 2 to Form 10-K/A, Amendment No. 2 to Form 10-Q/A, and in our Form 10-Qs filed with the Securities and Exchange Commission, and similar disclosures in subsequent reports filed with the SEC, which are available on our investor relations website at investor.lovesac.com and on the SEC website at www.sec.gov. Any forward-looking statement made by us in this press release speaks only as of the date on which we make it. We disclaim any intent or obligation to update these forward-looking statements to reflect events or circumstances that exist after the date on which they were made. Certain data in this presentation was obtained from various external sources. Neither the Company nor its affiliates, advisers or representatives have verified such data with independent sources. Accordingly, neither the Company nor any of its affiliates, advisers or representatives make any representations as to the accuracy or completeness of that data or to update such data after the date of this presentation. Such data involves risks and uncertainties and is subject to change based on various factors. Use of Non-GAAP Information This presentation includes certain non-GAAP financial measures that are supplemental measures of financial performance not required by, or presented in accordance with, GAAP, including Adjusted EBITDA. We define “Adjusted EBITDA” as earnings before interest, taxes, depreciation and amortization, adjusted for the impact of certain non-cash and other items that we do not consider in our evaluation of ongoing operating performance. These items include management fees, equity-based compensation expense, write- offs of property and equipment, deferred rent, financing expenses and certain other charges and gains that we do not believe reflect our underlying business performance. We have reconciled this non-GAAP financial measure with the most directly comparable GAAP financials which can be found on page 160. We have also presented herein certain forward-looking statements about the Company’s future financial performance that include non-GAAP (or “as-adjusted”) financial measures, including Adjusted EBITDA. This non–GAAP financial measure is derived by excluding certain amounts, expenses or income, from the corresponding financial measures determined in accordance with GAAP. The determination of the amounts that are excluded from this non-GAAP financial measure is a matter of management judgment and depends upon, among other factors, the nature of the underlying expense or income amounts recognized in a given period. We are unable to present a quantitative reconciliation of the aforementioned forward-looking non- GAAP financial measure to its most directly comparable forward-looking GAAP financial measures because management cannot reliably predict all of the necessary components of such GAAP measures, which could be significant in amount. We believe that these non-GAAP financial measures not only provide its management with comparable financial data for internal financial analysis but also provide meaningful supplemental information to investors. However, other companies in our industry may calculate these items differently than we do. These non-GAAP measures should not be considered as a substitute for the most directly comparable financial measures prepared in accordance with GAAP, such as net income (loss) or net income (loss) per share as a measure of financial performance, cash flows from operating activities as a measure of liquidity, or any other performance measure derived in accordance with GAAP.

I N V ES T OR DA Y 2 0 2 4 Key CEO Takeaways through today Lovesac has a track record of profitable growth regardless of macro or category conditions 2 superpowers driving huge market share gains: Designed For Life Products + Customer Acquisition Engines Massive TAM and household penetration opportunity ahead despite our 7 year 31% CAGR of late Digital platform, showrooms & partners provide a long runway of growth as we expand into new DFL platforms

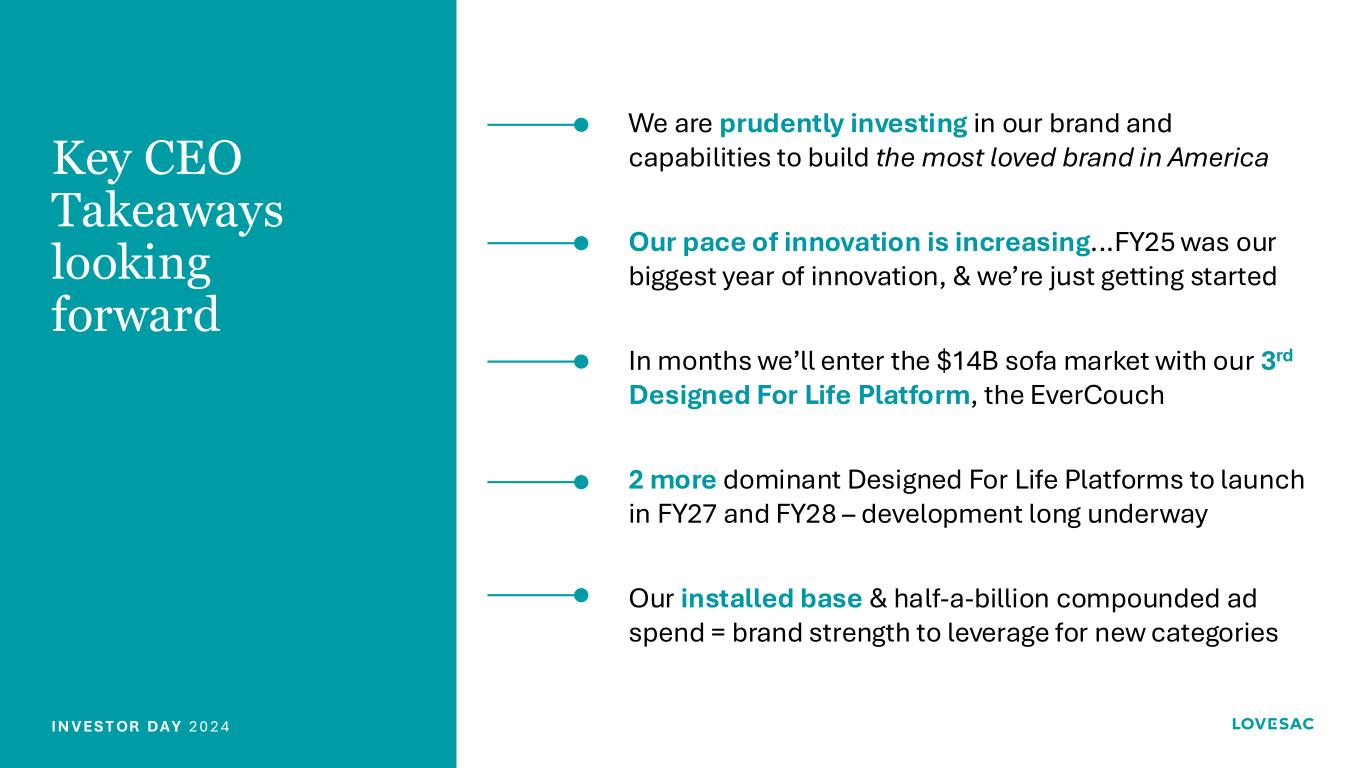

I N V ES T OR DA Y 2 0 2 4 We are prudently investing in our brand and capabilities to build the most loved brand in America 2 more dominant Designed For Life Platforms to launch in FY27 and FY28 – development long underway Our pace of innovation is increasing...FY25 was our biggest year of innovation, & we’re just getting started In months we’ll enter the $14B sofa market with our 3rd Designed For Life Platform, the EverCouch Our installed base & half-a-billion compounded ad spend = brand strength to leverage for new categories Key CEO Takeaways looking forward

I N V ES T OR DA Y 2 0 2 4 Our model is profitable immediately and builds over time as customers invest in our platforms Our Customer Acquisition Engines simplify highly complex products for efficient conversion We marry digital, physical and partner models to meet the customer where they are in their journey Key COO Takeaways Customer Acquisition Engines Our customer obsession converts customers’ brand love into our strongest marketing engine

I N V ES T OR DA Y 2 0 2 4 Our capital-light Supply Chain model unlocks speed and agility to catalyze profitable growth at scale We have assembled a world-class leadership team to lead and scale our next chapter of growth We have fortified our Insights and Innovation teams to support rapid platform expansion Our frontline engagement is a competitive advantage as they continue to turn customers into advocates Key COO Takeaways Growth Enablers

I N V ES T OR DA Y 2 0 2 4 Key CFO Takeaways We have massive secular growth potential ahead We are uniquely positioned to capitalize on macro upside Our profitable growth strategy is entirely self- funded We retain optionality for excess capital to enhance ROIC and growth

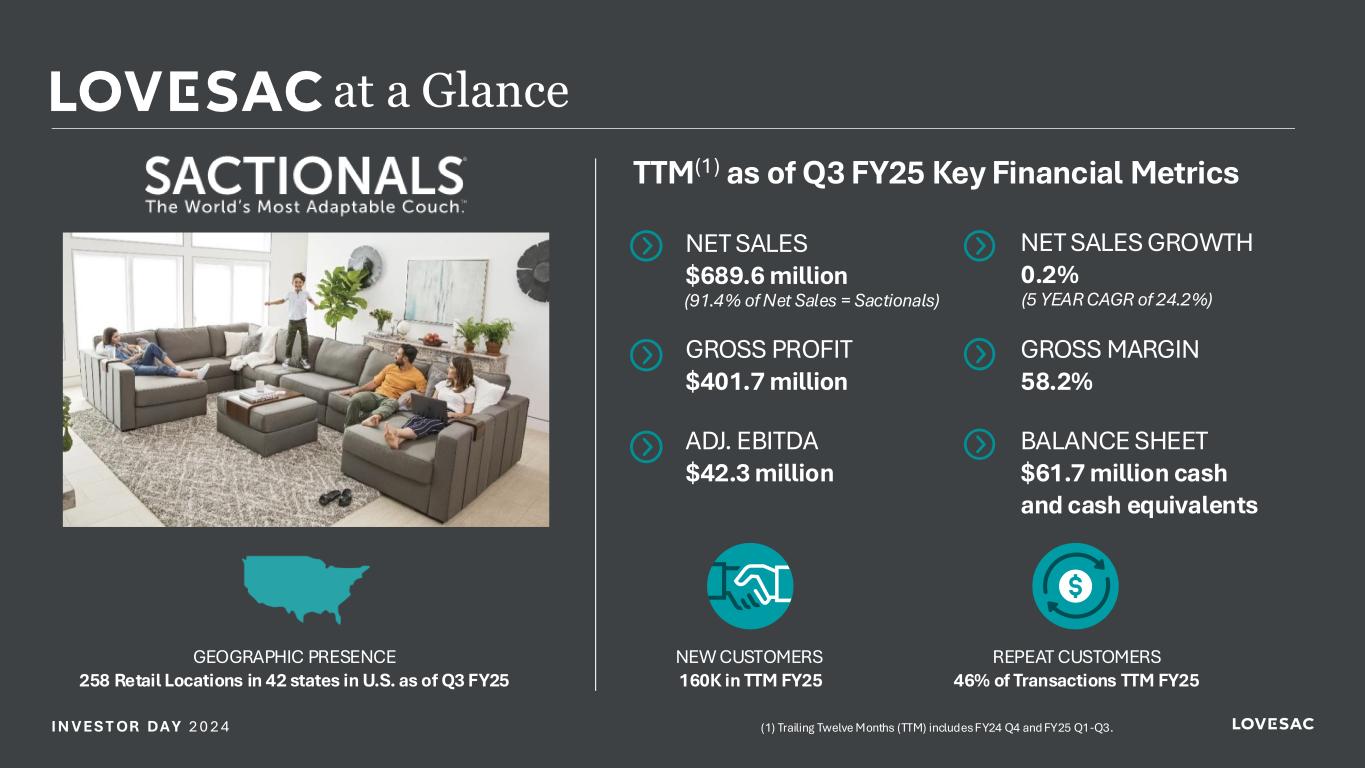

I N V ES T OR DA Y 2 0 2 4 at a Glance TTM(1) as of Q3 FY25 Key Financial Metrics NET SALES $689.6 million NET SALES GROWTH 0.2% GROSS MARGIN 58.2% GROSS PROFIT $401.7 million ADJ. EBITDA $42.3 million BALANCE SHEET $61.7 million cash and cash equivalents (91.4% of Net Sales = Sactionals) GEOGRAPHIC PRESENCE 258 Retail Locations in 42 states in U.S. as of Q3 FY25 REPEAT CUSTOMERS 46% of Transactions TTM FY25 NEW CUSTOMERS 160K in TTM FY25 (5 YEAR CAGR of 24.2%) (1) Trailing Twelve Months (TTM) includes FY24 Q4 and FY25 Q1-Q3.

I N V ES T OR DA Y 2 0 2 4 Shawn Nelson Founder & Chief Executive Officer

I N V ES T OR DA Y 2 0 2 4 Designed For Life since 1998

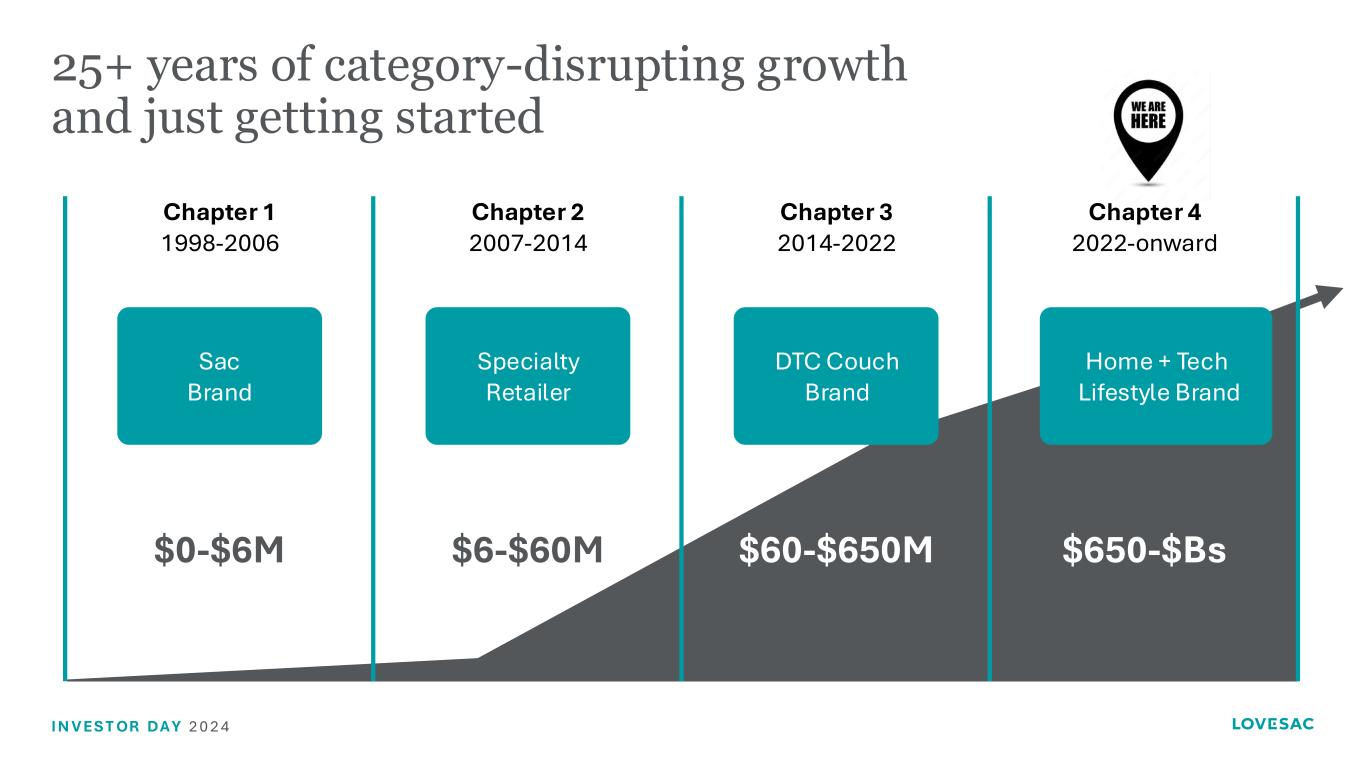

I N V ES T OR DA Y 2 0 2 4 25+ years of category-disrupting growth and just getting started Chapter 1 1998-2006 Chapter 2 2007-2014 Chapter 3 2014-2022 Chapter 4 2022-onward Sac Brand $0-$6M $6-$60M $60-$650M $650-$Bs Specialty Retailer DTC Couch Brand Home + Tech Lifestyle Brand

I N V ES T OR DA Y 2 0 2 4 1998

I N V ES T OR DA Y 2 0 2 4 2002

I N V ES T OR DA Y 2 0 2 4 2006

I N V ES T OR DA Y 2 0 2 4 2010

I N V ES T OR DA Y 2 0 2 4 2016

I N V ES T OR DA Y 2 0 2 4 2018

I N V ES T OR DA Y 2 0 2 4 Growth on Growth FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 FY25 TTM* 39% 23% 26% 23% 3% 33% 63% 41% 37% 55% 31% 7.5% 0.2% +31% CAGR since FY18 Net Sales and Y/Y Growth * Trailing Twelve Months (TTM) includes FY24 Q4 and FY25 Q1-Q3.

I N V ES T OR DA Y 2 0 2 4

I N V ES T OR DA Y 2 0 2 4

I N V ES T OR DA Y 2 0 2 4

I N V ES T OR DA Y 2 0 2 4 Delivery in Days

I N V ES T OR DA Y 2 0 2 4 Washable

I N V ES T OR DA Y 2 0 2 4 Maintainable

I N V ES T OR DA Y 2 0 2 4 “Designed For Life” Driven By Sustainable Inputs 82 3 1 Plastic Plastic Bottles Bottles 966 Plastic Bottles 82 Plastic Bottles 31 Plastic Bottles From April 2018 to today, Lovesac repurposed more than 300 million plastic water bottles to make Sactionals

I N V ES T OR DA Y 2 0 2 4 Movable

I N V ES T OR DA Y 2 0 2 4 Accessorizable

I N V ES T OR DA Y 2 0 2 4 Upgradable

I N V ES T OR DA Y 2 0 2 4 StealthTech

I N V ES T OR DA Y 2 0 2 4 ChargeSide

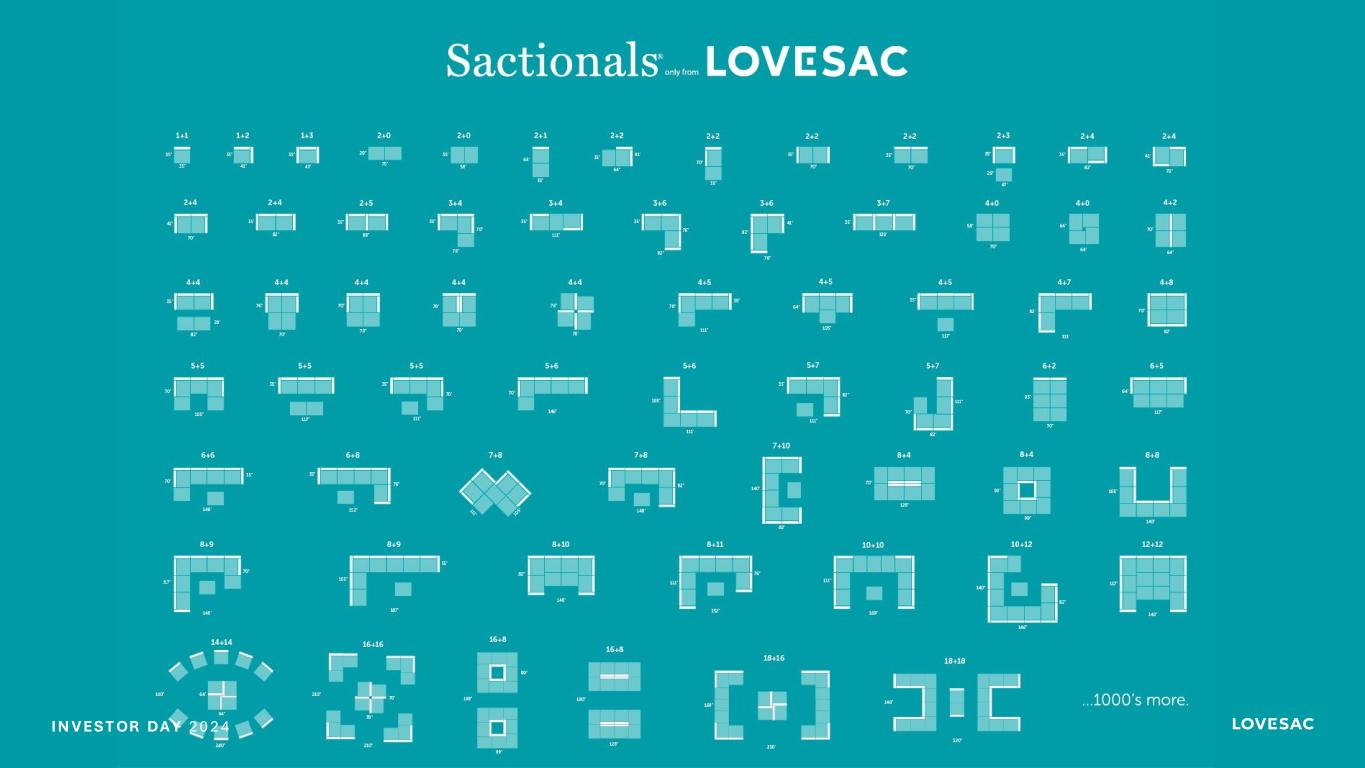

I N V ES T OR DA Y 2 0 2 4 ®

I N V ES T OR DA Y 2 0 2 4 Comfortable

I N V ES T OR DA Y 2 0 2 4 Lovable

I N V ES T OR DA Y 2 0 2 4 Where are we today?

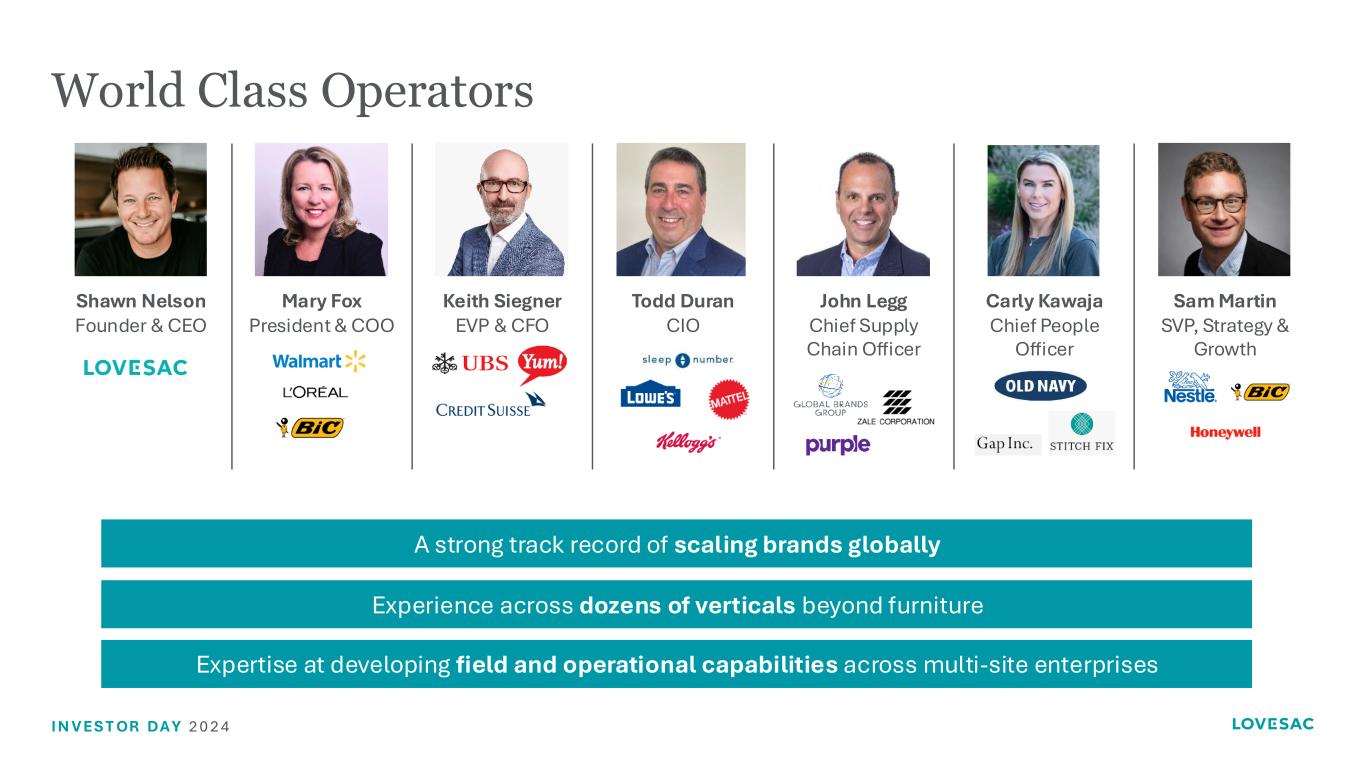

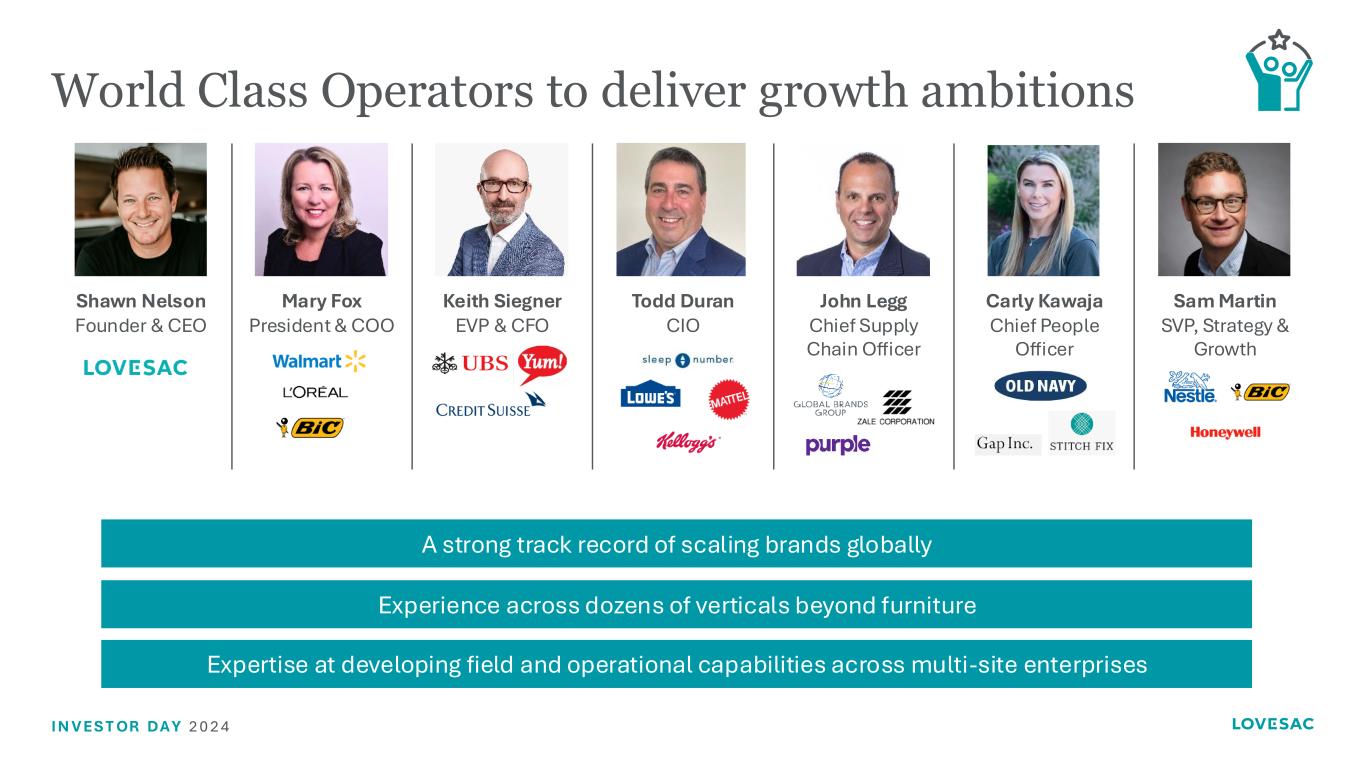

I N V ES T OR DA Y 2 0 2 4 World Class Operators Shawn Nelson Founder & CEO Keith Siegner EVP & CFO Mary Fox President & COO Todd Duran CIO John Legg Chief Supply Chain Officer Carly Kawaja Chief People Officer Sam Martin SVP, Strategy & Growth A strong track record of scaling brands globally Experience across dozens of verticals beyond furniture Expertise at developing field and operational capabilities across multi-site enterprises

I N V ES T OR DA Y 2 0 2 4 25 years of growth…and we are just getting started Chapter 1 1998-2006: Sac Startup $0M to $6M Chapter 2 2006-2014: Specialty Retailer $6M to $60M Chapter 3 2014-2022: DTC Couch Brand $60M to $650M Chapter 4 2022 onward: Lifestyle Brand (Home + Tech ) $650M to $1.5B+ ~20% CAGR ~30% CAGR ~40% CAGR ~15% CAGR New Categories + StealthTech + Services DFL Products + Customer Acquisition Engines = Huge market-share gains across multiple Home + Tech categories Direct-to-Consumer model powers profitable growth Digital-first approach leveraging national & niche marketing to drive conversion. All "stores” become showrooms designed to explain our complex "Living Products" to consumers. Huge market-share gains. Introducing Sactionals + Small-box Retail Expertise Furniture Merchandising Model Lovesac Foundation & Complete reorg in 8 years Founder led team, strong marketing buzz around Sacs

I N V ES T OR DA Y 2 0 2 4 Lovesac Can Be Tough to Define… …More than a Furniture Company …More than a Specialty Retailer …More than a Merchant-led Assortment …More than a DTC Company

I N V ES T OR DA Y 2 0 2 4 Defined… … A Data-Driven Innovator Our customer obsession and deep insights drive innovation in both product and marketing … Inventor of Product Platforms Our expanding IP-moat of customized home + tech solutions is shaped by our "Designed For Life" approach … An Architect of Customer Acquisition Engines Superior brand experiences that yield lifetime loyalty … A More Efficient Inventory Model Modular core SKUs underpin capital efficiency; no obsolescence, no shrink, and no waste … A Top Brand

I N V ES T OR DA Y 2 0 2 4 Stated Mission: To become the most loved brand in America

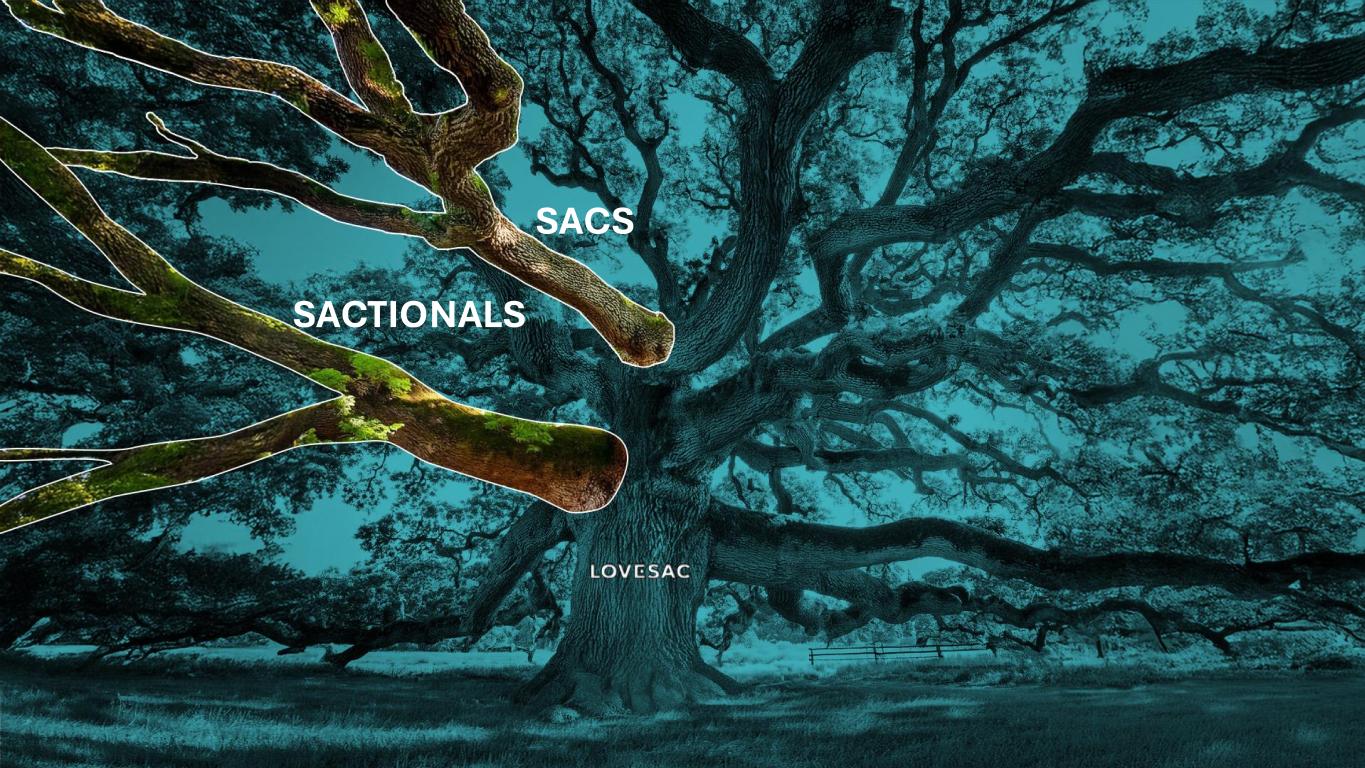

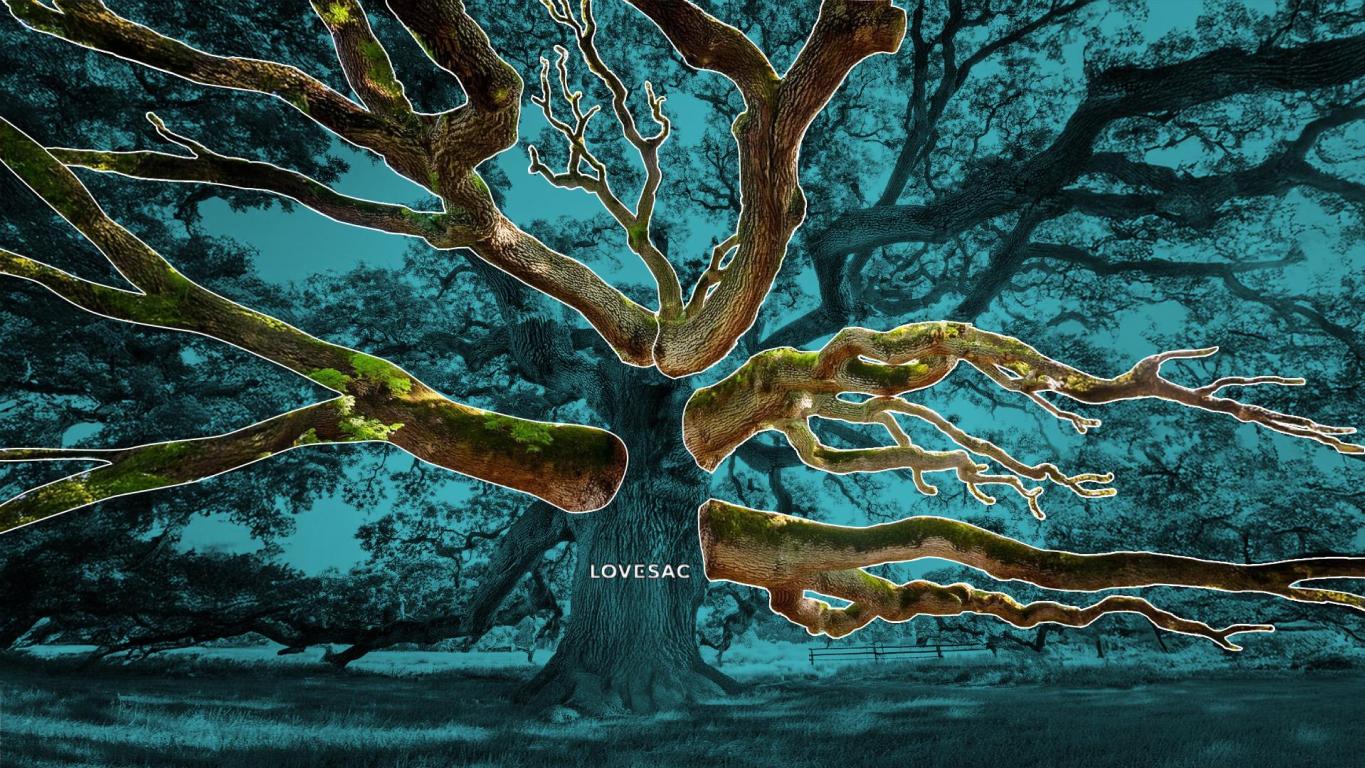

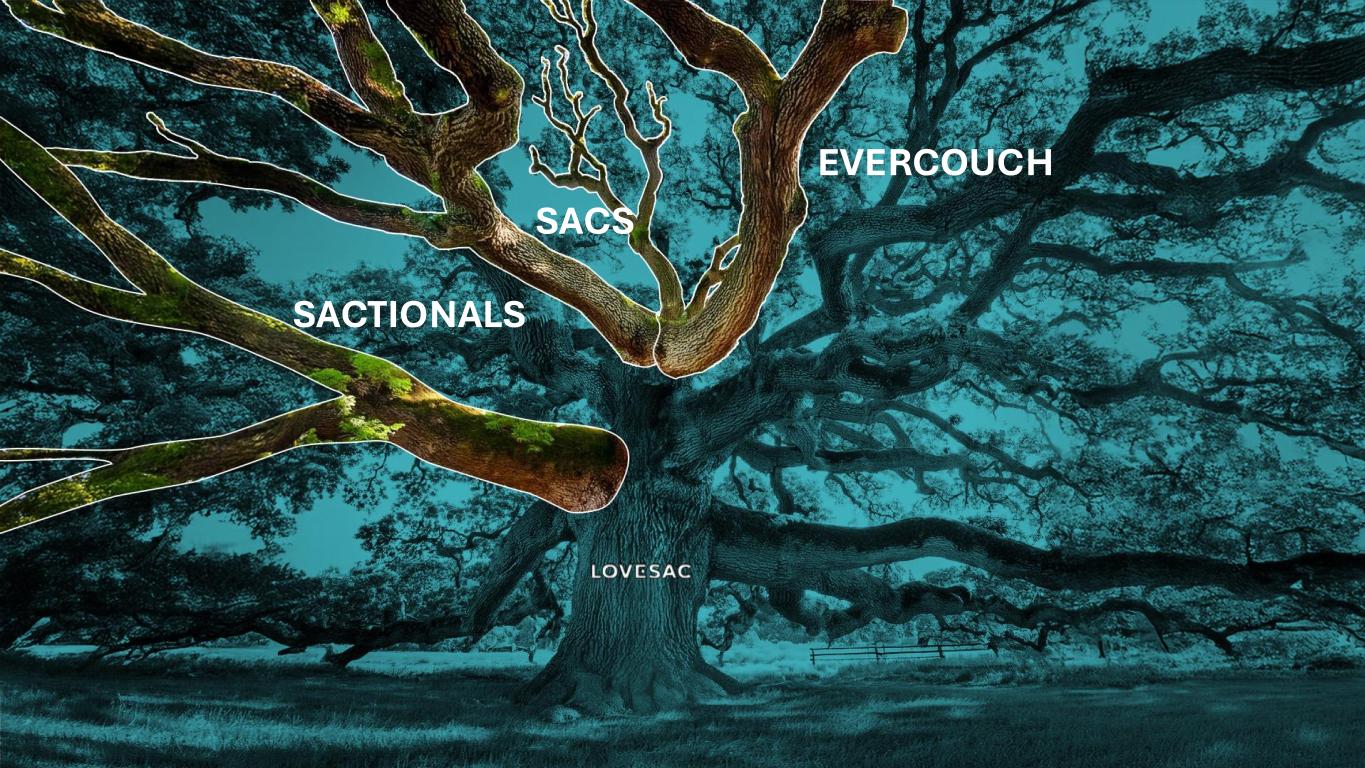

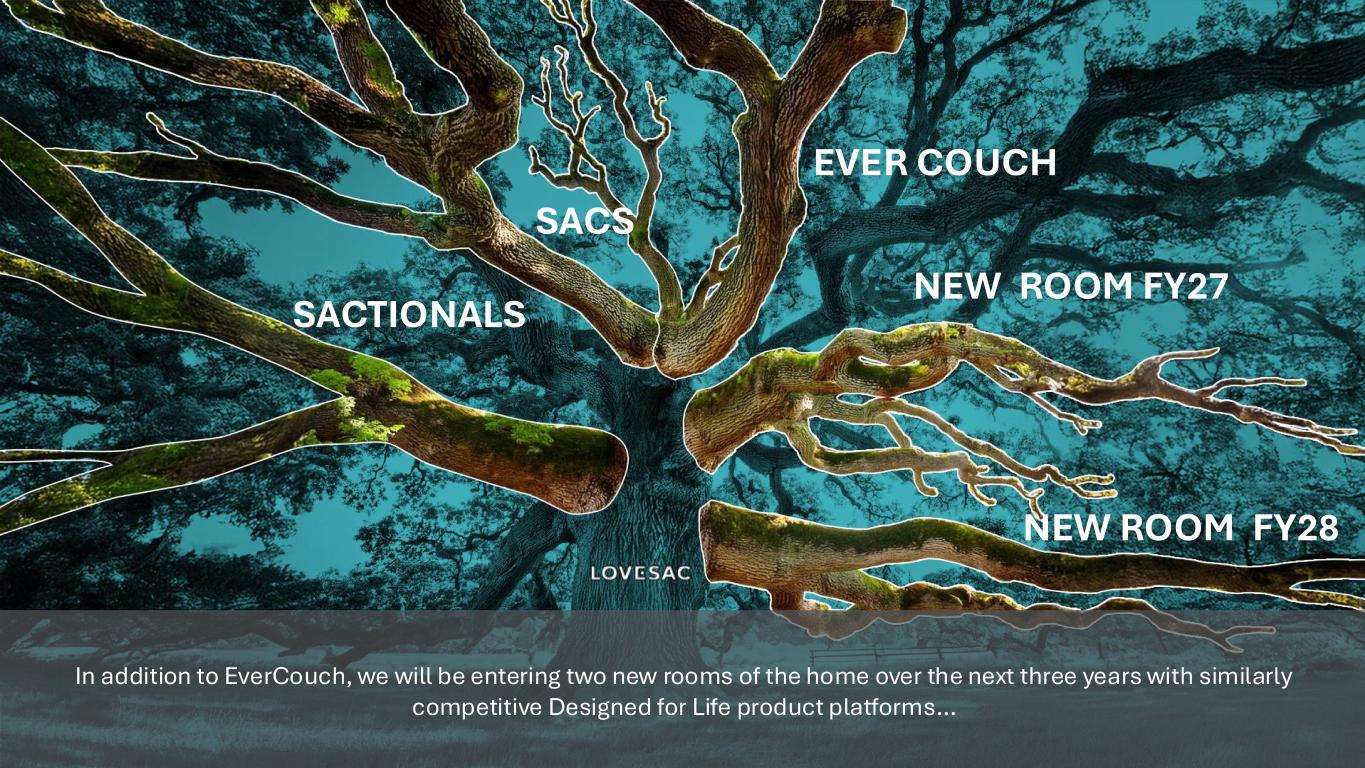

I N V ES T OR DA Y 2 0 2 4 We think of our brand through the metaphor of an Oak Tree, revered across cultures as a symbol of strength and endurance, of growth and renewal. They live for centuries and leave a lasting legacy, and we intend to build a brand and a business that does the same.

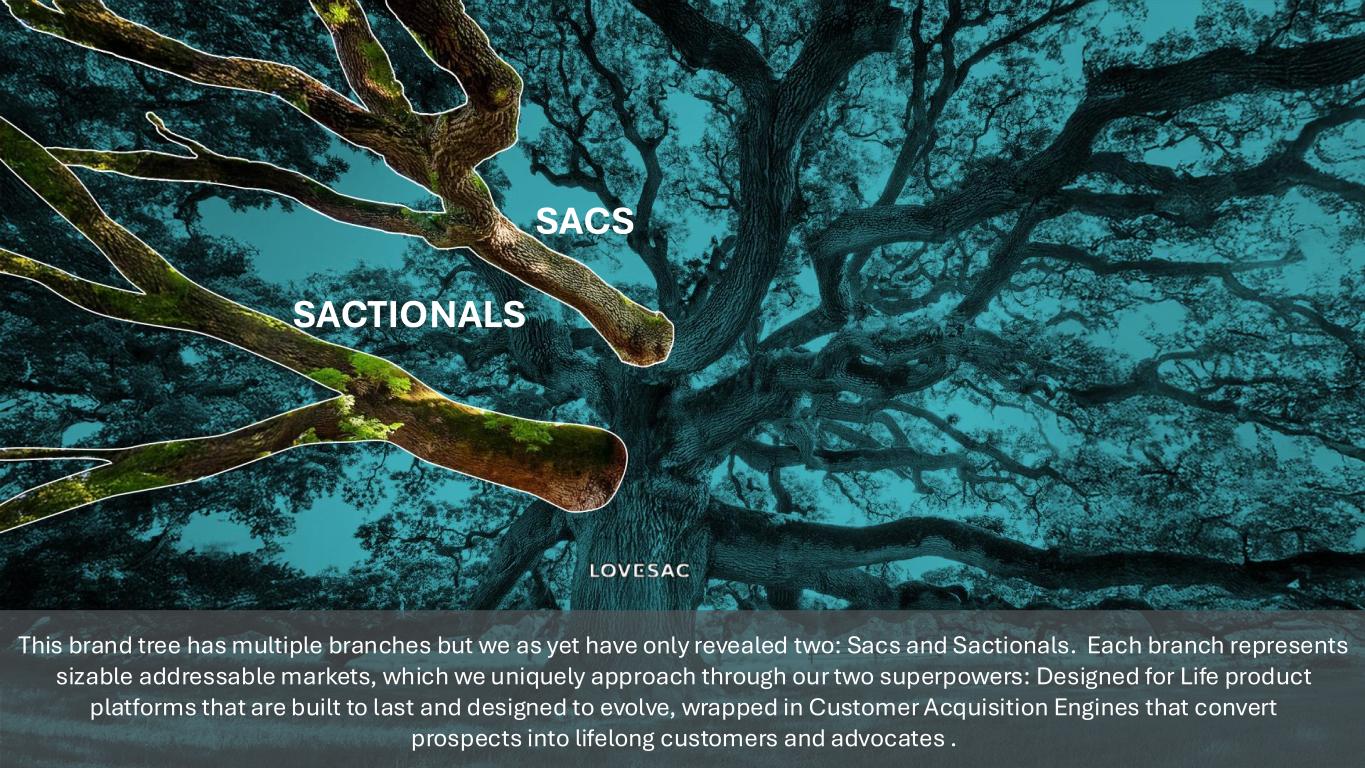

I N V ES T OR DA Y 2 0 2 4 SACTIONALS SACS This brand tree has multiple branches but we as yet have only revealed two: Sacs and Sactionals. Each branch represents sizable addressable markets, which we uniquely approach through our two superpowers: Designed for Life product platforms that are built to last and designed to evolve, wrapped in Customer Acquisition Engines that convert prospects into lifelong customers and advocates .

I N V ES T OR DA Y 2 0 2 4 Investor Day 2024 CUSTOMER ACQUISITION ENGINE Brand & Performance Marketing Showroom Experience Partner Demonstrations Digital Configuration Customer Relationships Drink Holders Custom Covers Deep Side Roll Arm Designer Collabs StealthTech Angled Side Tray & Coaster Charge Side AnyTable Recliner Storage Seat SACTIONALS: Designed for Life Platform

I N V ES T OR DA Y 2 0 2 4 Our 2 Superpowers A High-Growth Capital-Light Profitable Business Model (and brand) Designed For Life TM PRODUCTS CUSTOMER ACQUISITION ENGINES

I N V ES T OR DA Y 2 0 2 4 If you don’t love it, you won’t keep it. Viscerally pleasing design is a hallmark of the DFL approach. Fads, trends, or limited editions are incorporated in transient and changeable elements only, shaping a core product line that is reliable, endearing, and timeless. Built to Last Designed to Evolve A DFL product aims to last for the lifetime of the consumer. Reliability and quality are a top priority, from the design-concept phase to the delivery of goods. LOVEABLE DURABLE MAINTAINABLE Life changes, and the products that support our lives should change along with us. A DFL product is designed with interchangeable, adaptable, or modular components that enable the user to change the way they can utilize it and designers to add functionality later. ADAPTABLE The DFL vision means being transparent and accountable from the outset, while continuing to take pro-active steps that lead to true, meaningful, and measurable results in protecting our planet. SUSTAINABLE Good products are designed with the end in mind. The DFL design process purposefully makes plans for all components to be repurposed, recycled, or even biodegraded so the nutrients can be reclaimed by the earth. RECLAIMABLE Superpower #1: Designed for Life Product Platforms DFL products are thoughtfully engineered from the outset with standardized parts and replaceable components that make restoring, repairing, or even upgrading, easy and desirable.

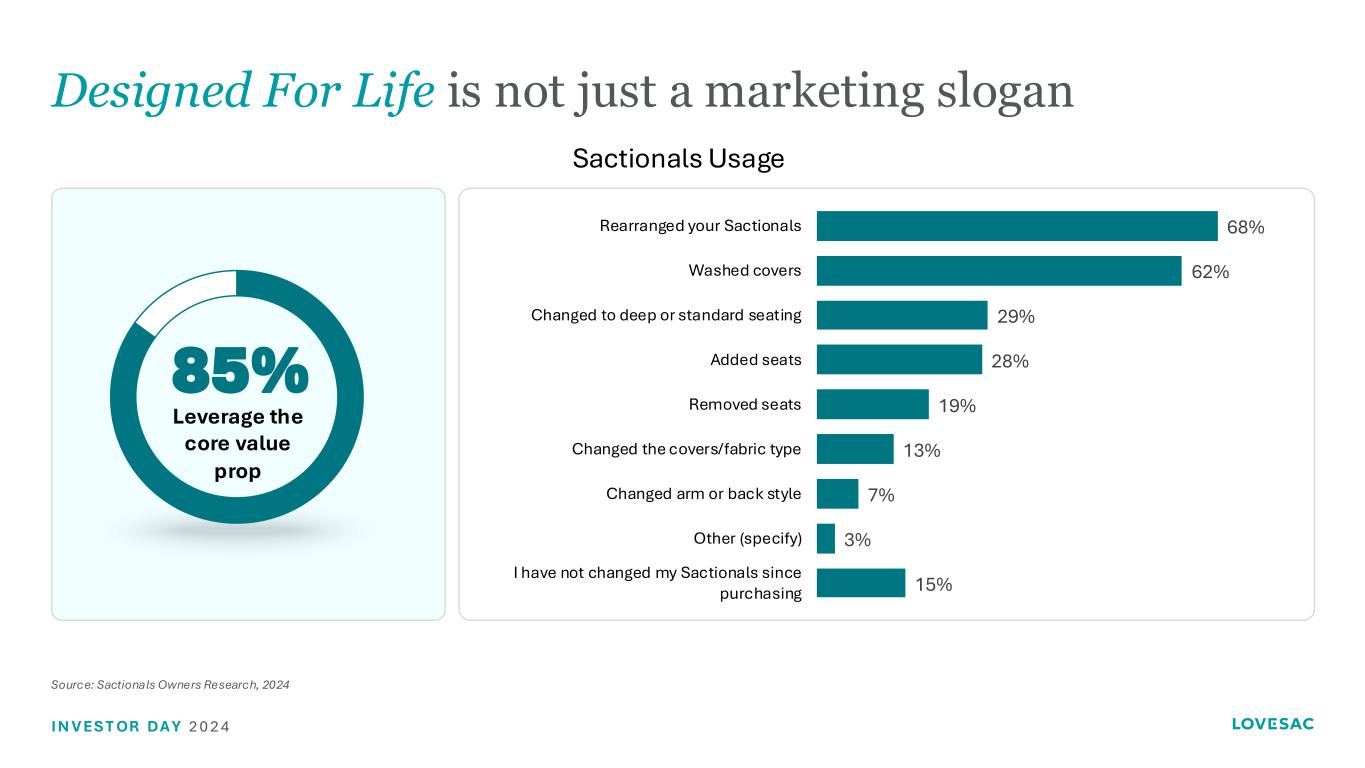

I N V ES T OR DA Y 2 0 2 4 Designed For Life is not just a marketing slogan Source: Sactionals Owners Research, 2024 Sactionals Usage 68% 62% 29% 28% 19% 13% 7% 3% 15% Rearranged your Sactionals Washed covers Changed to deep or standard seating Added seats Removed seats Changed the covers/fabric type Changed arm or back style Other (specify) I have not changed my Sactionals since purchasing 85% Leverage the core value prop

I N V ES T OR DA Y 2 0 2 4 Designed For Life Value Prop makes Sactionals the best-selling couch in America (as far as we can tell)

I N V ES T OR DA Y 2 0 2 4 Stated Purpose: To Inspire Humankind to Buy Better to Buy Less

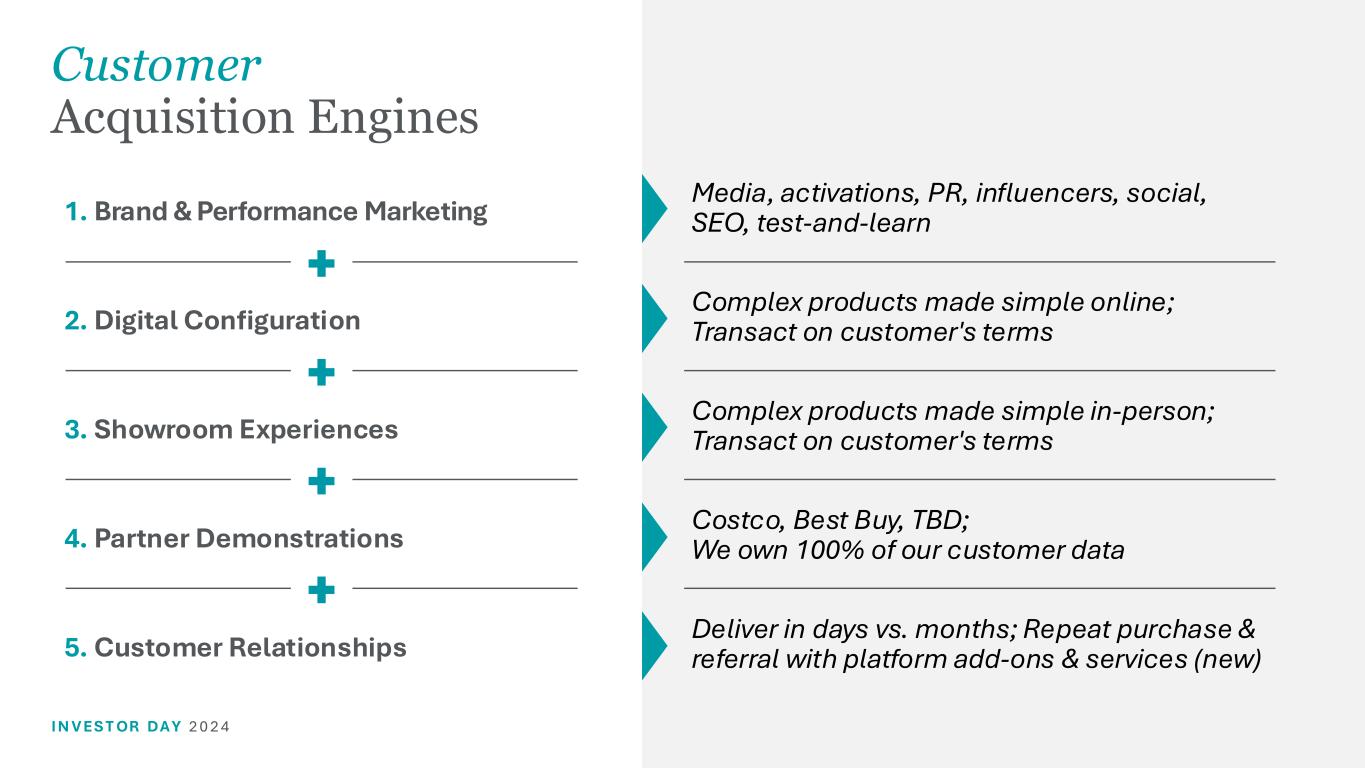

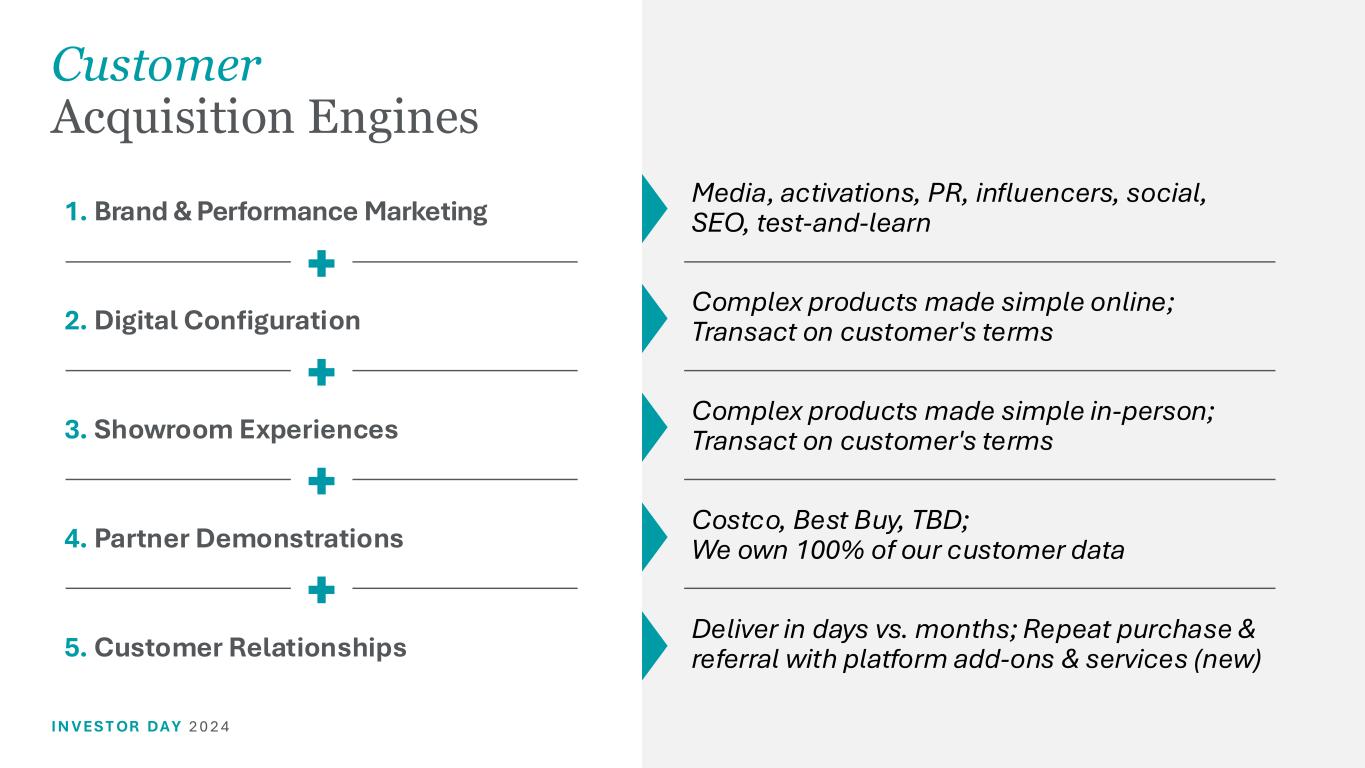

I N V ES T OR DA Y 2 0 2 4 Media, activations, PR, influencers, social, SEO, test-and-learn1. Brand & Performance Marketing Complex products made simple online; Transact on customer's terms2. Digital Configuration Complex products made simple in-person; Transact on customer's terms3. Showroom Experiences Costco, Best Buy, TBD; We own 100% of our customer data4. Partner Demonstrations Deliver in days vs. months; Repeat purchase & referral with platform add-ons & services (new)5. Customer Relationships Customer Acquisition Engines

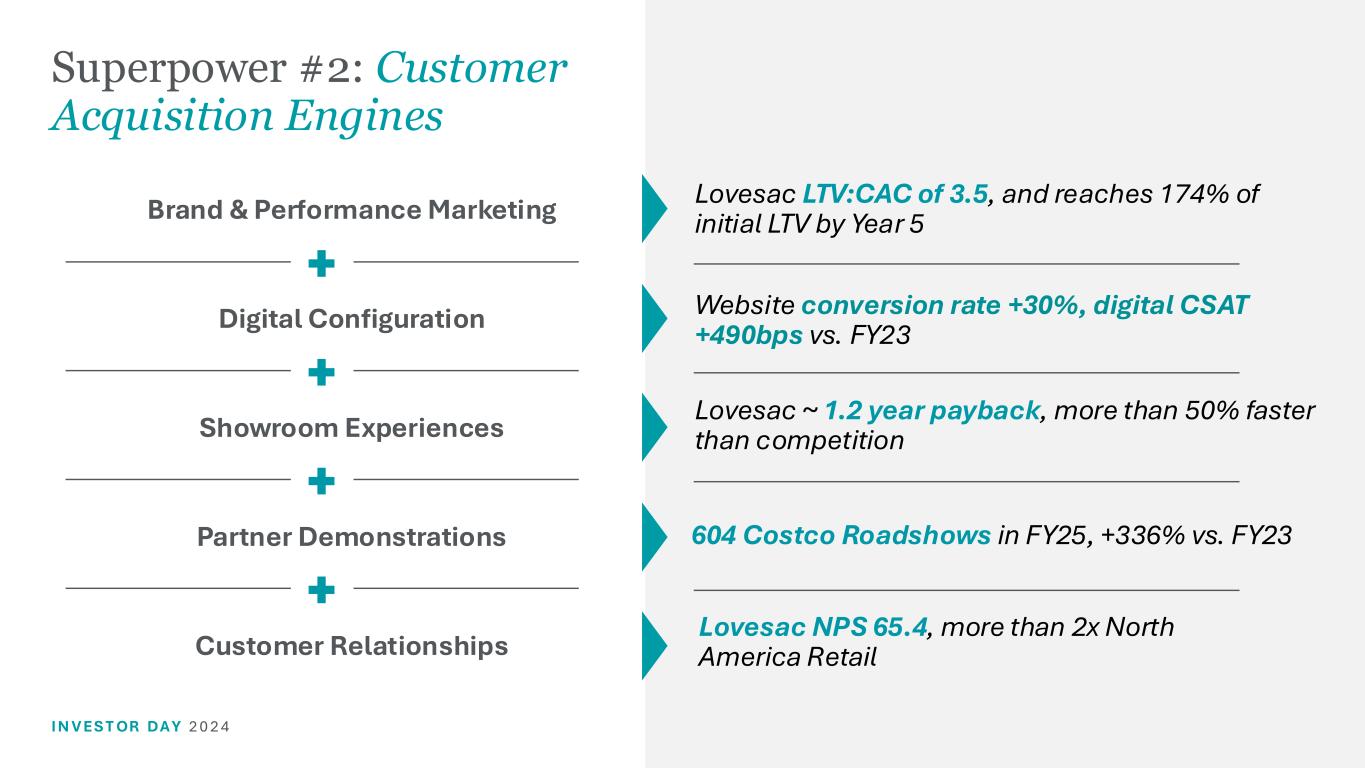

I N V ES T OR DA Y 2 0 2 4 Brand & Performance Marketing Digital Configuration Showroom Experiences Partner Demonstrations Customer Relationships Superpower #2: Customer Acquisition Engines Lovesac LTV:CAC of 3.5, and reaches 174% of initial LTV by Year 5 Website conversion rate +30%, digital CSAT +490bps vs. FY23 Lovesac ~ 1.2 year payback, more than 50% faster than competition 604 Costco Roadshows in FY25, +336% vs. FY23 Lovesac NPS 65.4, more than 2x North America Retail

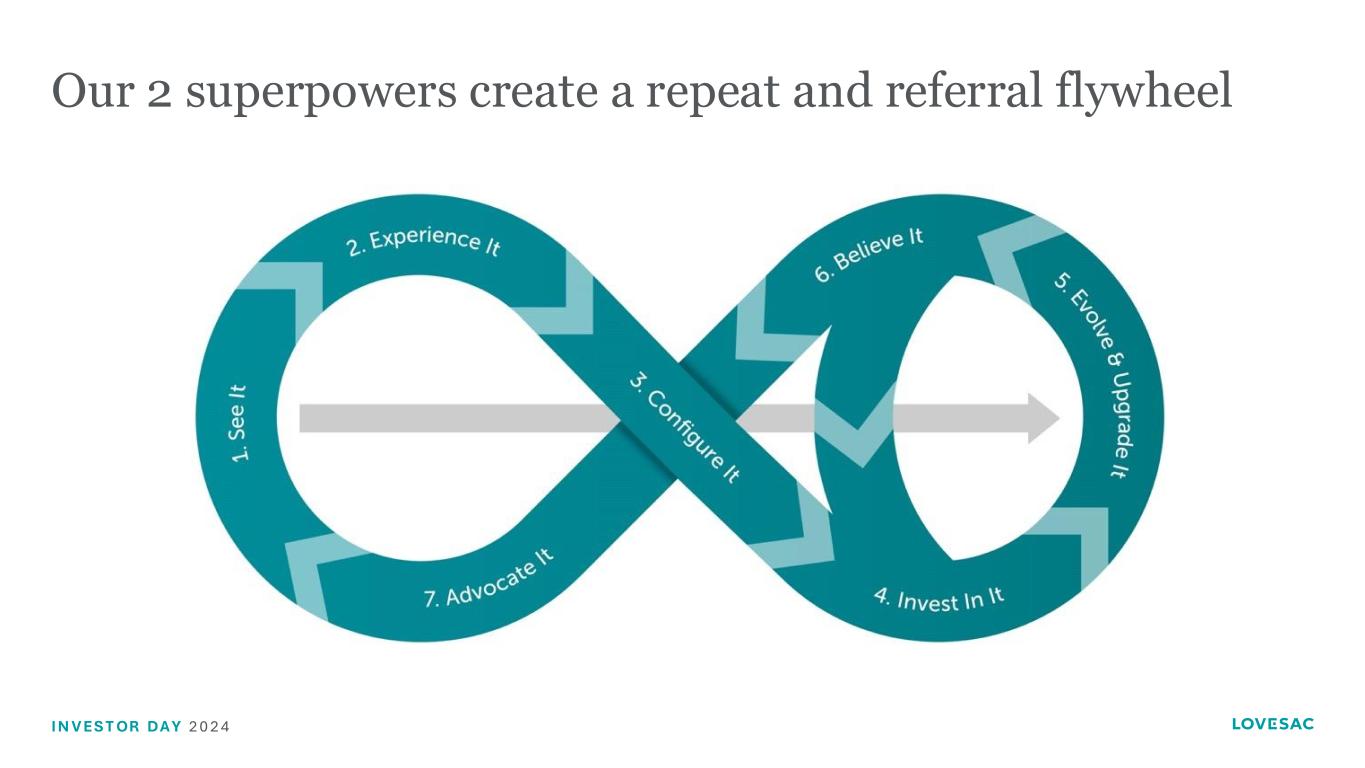

I N V ES T OR DA Y 2 0 2 4 Our 2 superpowers create a repeat and referral flywheel

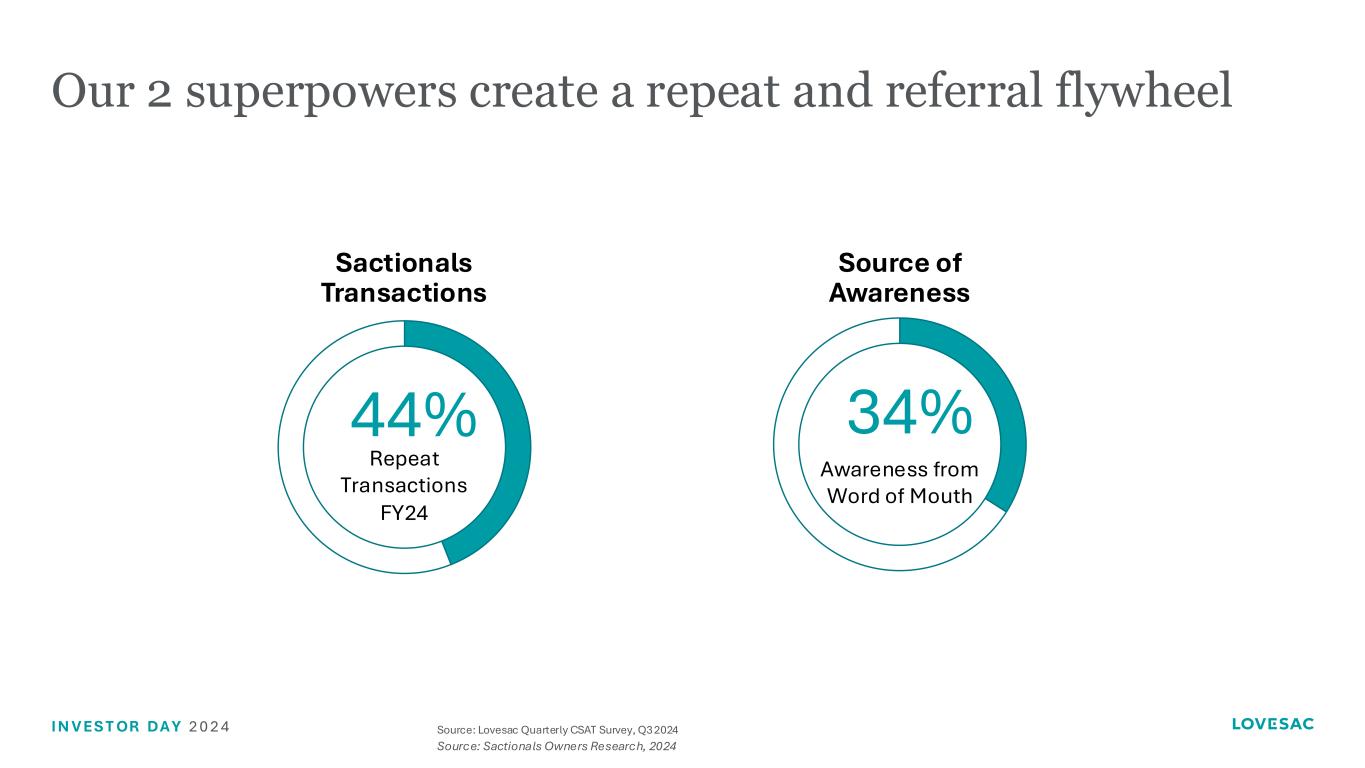

I N V ES T OR DA Y 2 0 2 4 Our 2 superpowers create a repeat and referral flywheel 44% Repeat Transactions FY24 Sactionals Transactions 34% Awareness from Word of Mouth Source of Awareness Source: Lovesac Quarterly CSAT Survey, Q3 2024 Source: Sactionals Owners Research, 2024

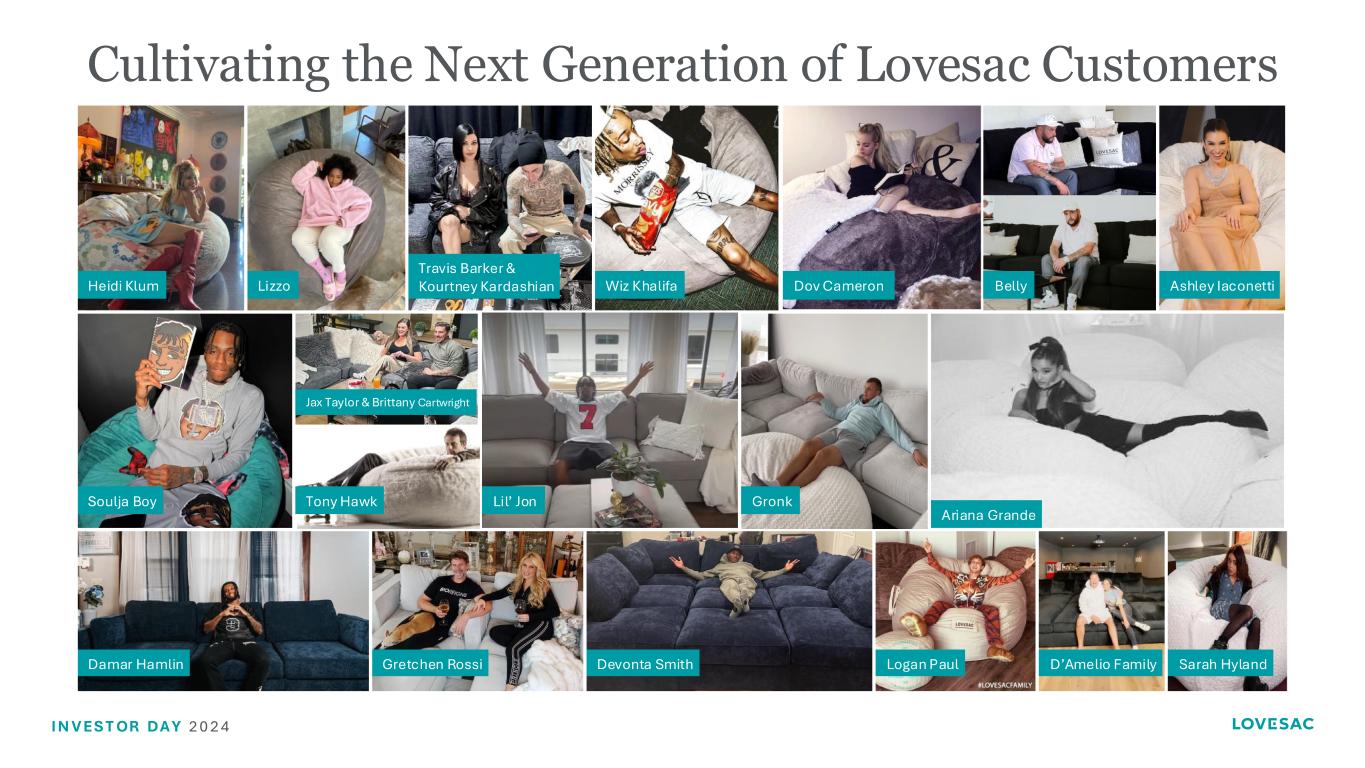

I N V ES T OR DA Y 2 0 2 4 Heidi Klum Travis Barker & Kourtney Kardashian Wiz KhalifaLizzo Belly Ashley IaconettiDov Cameron Soulja Boy Jax Taylor & Brittany Cartwright Ariana Grande Lil’ Jon GronkTony Hawk Gretchen RossiDamar Hamlin Devonta Smith D’Amelio FamilyLogan Paul Sarah Hyland Cultivating the Next Generation of Lovesac Customers

I N V ES T OR DA Y 2 0 2 4 Key CEO Takeaways through today Lovesac has a track record of profitable growth regardless of macro or category conditions 2 superpowers driving huge market share gains: Designed For Life Products + Customer Acquisition Engines Massive TAM and household penetration opportunity ahead despite our 7 year 31% CAGR of late Digital platform, showrooms & partners provide a long runway of growth as we expand into new DFL platforms

I N V ES T OR DA Y 2 0 2 4 Our Strategic Outlook

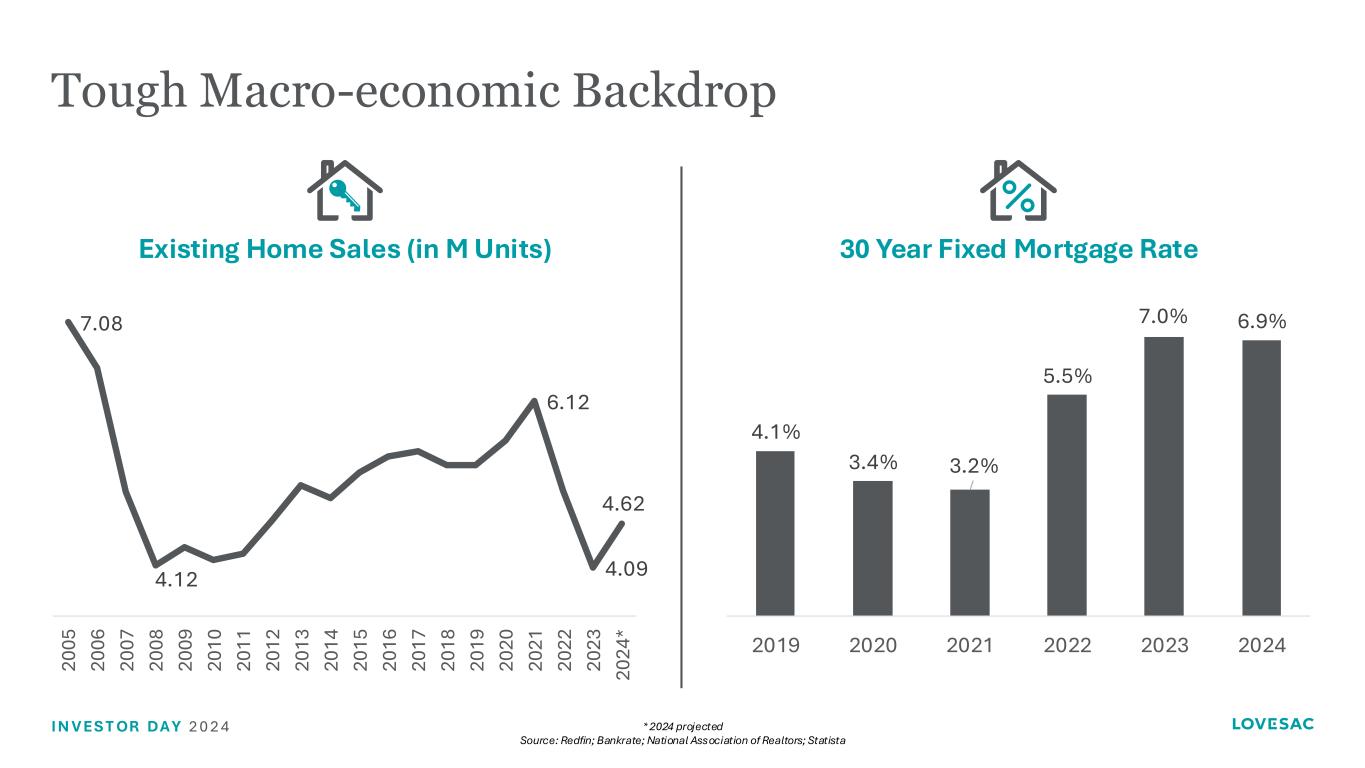

I N V ES T OR DA Y 2 0 2 4 Tough Macro-economic Backdrop * 2024 projected Source: Redfin; Bankrate; National Association of Realtors; Statista 4.1% 3.4% 3.2% 5.5% 7.0% 6.9% 2019 2020 2021 2022 2023 2024 Existing Home Sales (in M Units) 30 Year Fixed Mortgage Rate 7.08 4.12 6.12 4.09 4.62 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 *

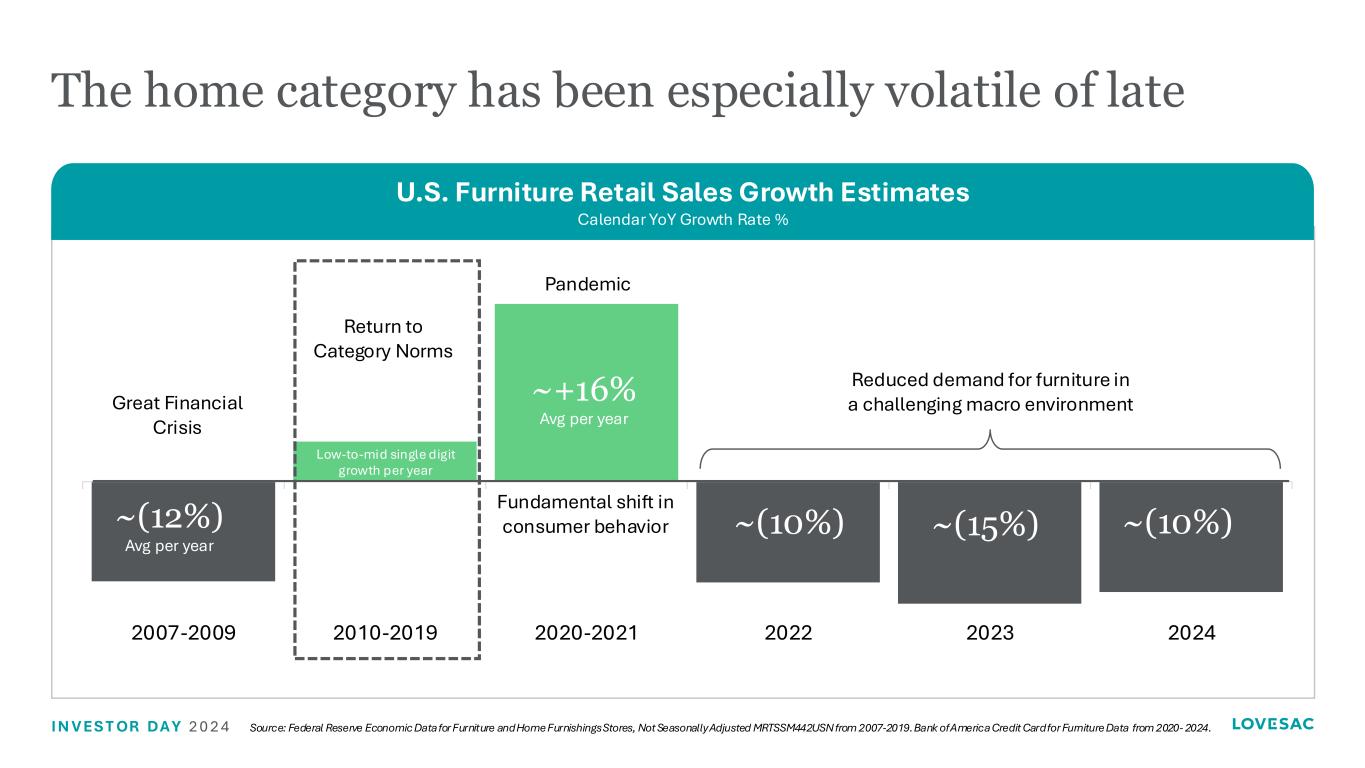

I N V ES T OR DA Y 2 0 2 4 Source: Federal Reserve Economic Data for Furniture and Home Furnishings Stores, Not Seasonally Adjusted MRTSSM442USN from 2007-2019. Bank of America Credit Card for Furniture Data from 2020- 2024. 2007-2009 2010-2019 2020-2021 2022 2023 2024 Great Financial Crisis ~(12%) Avg per year Pandemic ~+16% Avg per year Fundamental shift in consumer behavior Reduced demand for furniture in a challenging macro environment ~(10%) ~(15%) ~(10%) Low-to-mid single digit growth per year Return to Category Norms The home category has been especially volatile of late U.S. Furniture Retail Sales Growth Estimates Calendar YoY Growth Rate %

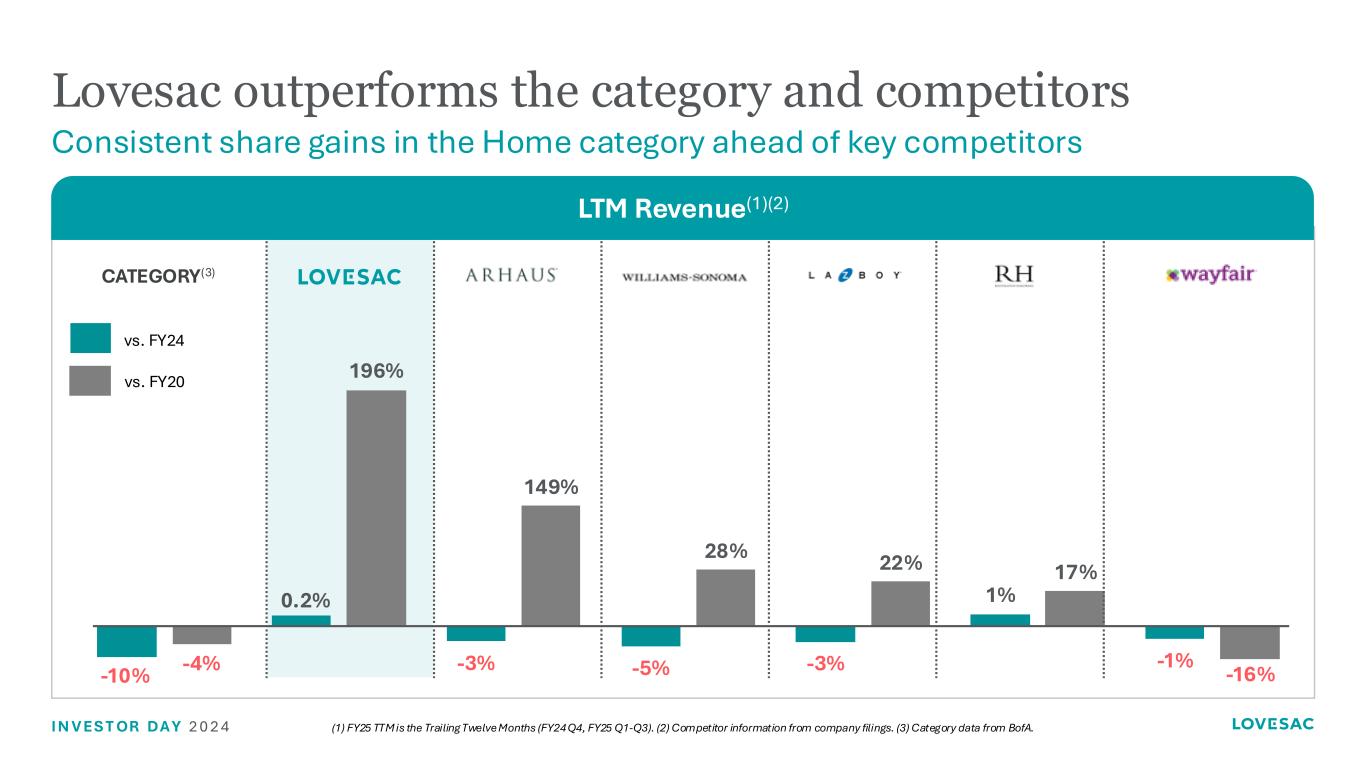

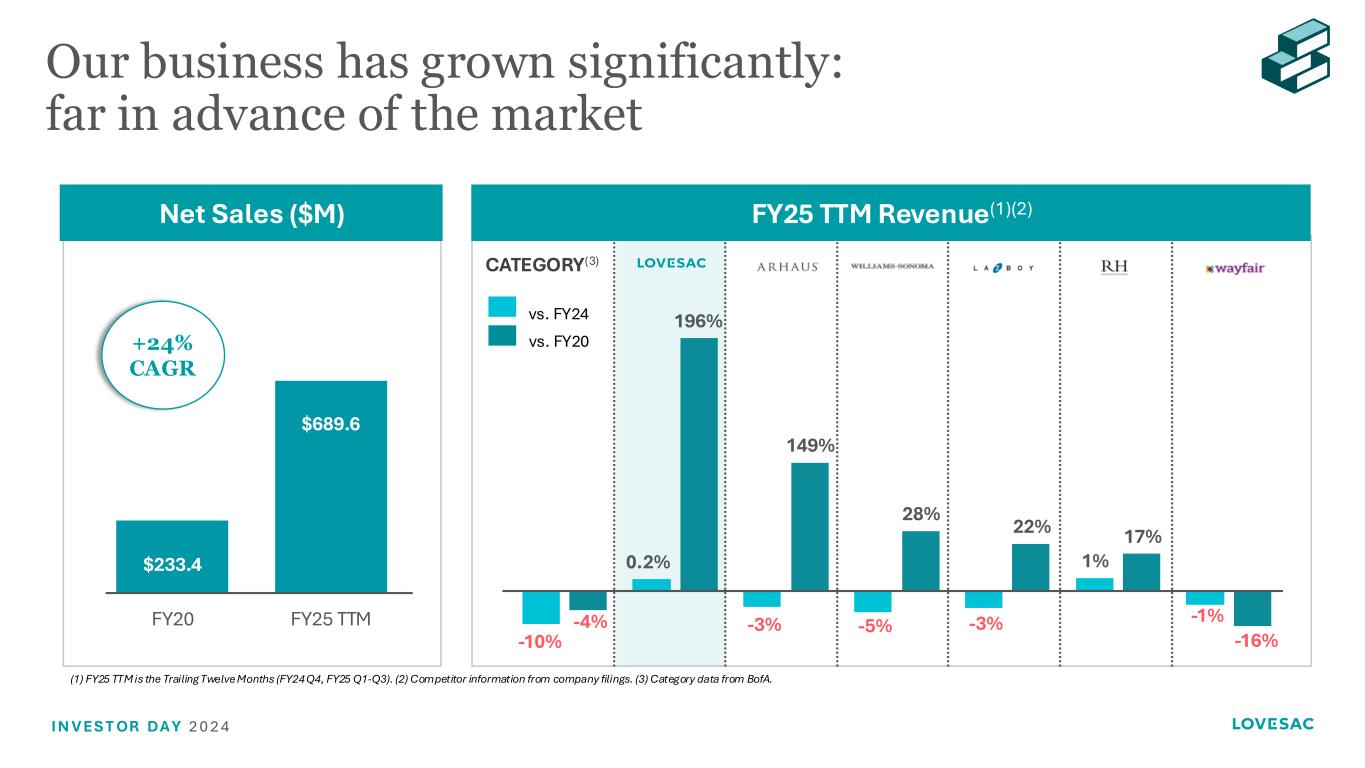

I N V ES T OR DA Y 2 0 2 4 -10% 0.2% -3% -5% -3% 1% -1%-4% 196% 149% 28% 22% 17% -16% Lovesac outperforms the category and competitors Consistent share gains in the Home category ahead of key competitors CATEGORY(3) vs. FY20 vs. FY24 (1) FY25 TTM is the Trailing Twelve Months (FY24 Q4, FY25 Q1-Q3). (2) Competitor information from company filings. (3) Category data from BofA. LTM Revenue(1)(2)

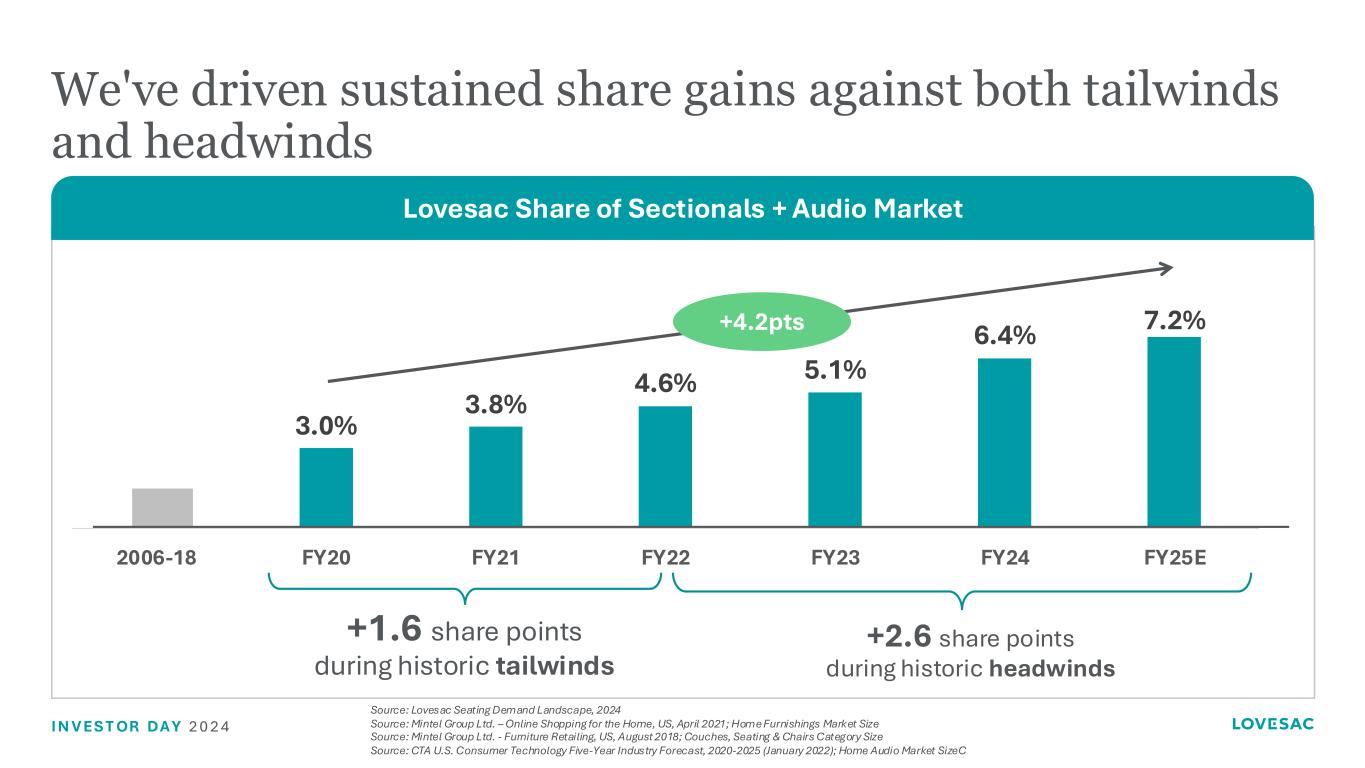

I N V ES T OR DA Y 2 0 2 4 We've driven sustained share gains against both tailwinds and headwinds 3.0% 3.8% 4.6% 5.1% 6.4% 7.2% 2006-18 FY20 FY21 FY22 FY23 FY24 FY25E +4.2pts +1.6 share points during historic tailwinds +2.6 share points during historic headwinds Lovesac Share of Sectionals + Audio Market Source: Lovesac Seating Demand Landscape, 2024 Source: Mintel Group Ltd. – Online Shopping for the Home, US, April 2021; Home Furnishings Market Size Source: Mintel Group Ltd. - Furniture Retailing, US, August 2018; Couches, Seating & Chairs Category Size Source: CTA U.S. Consumer Technology Five-Year Industry Forecast, 2020-2025 (January 2022); Home Audio Market SizeC

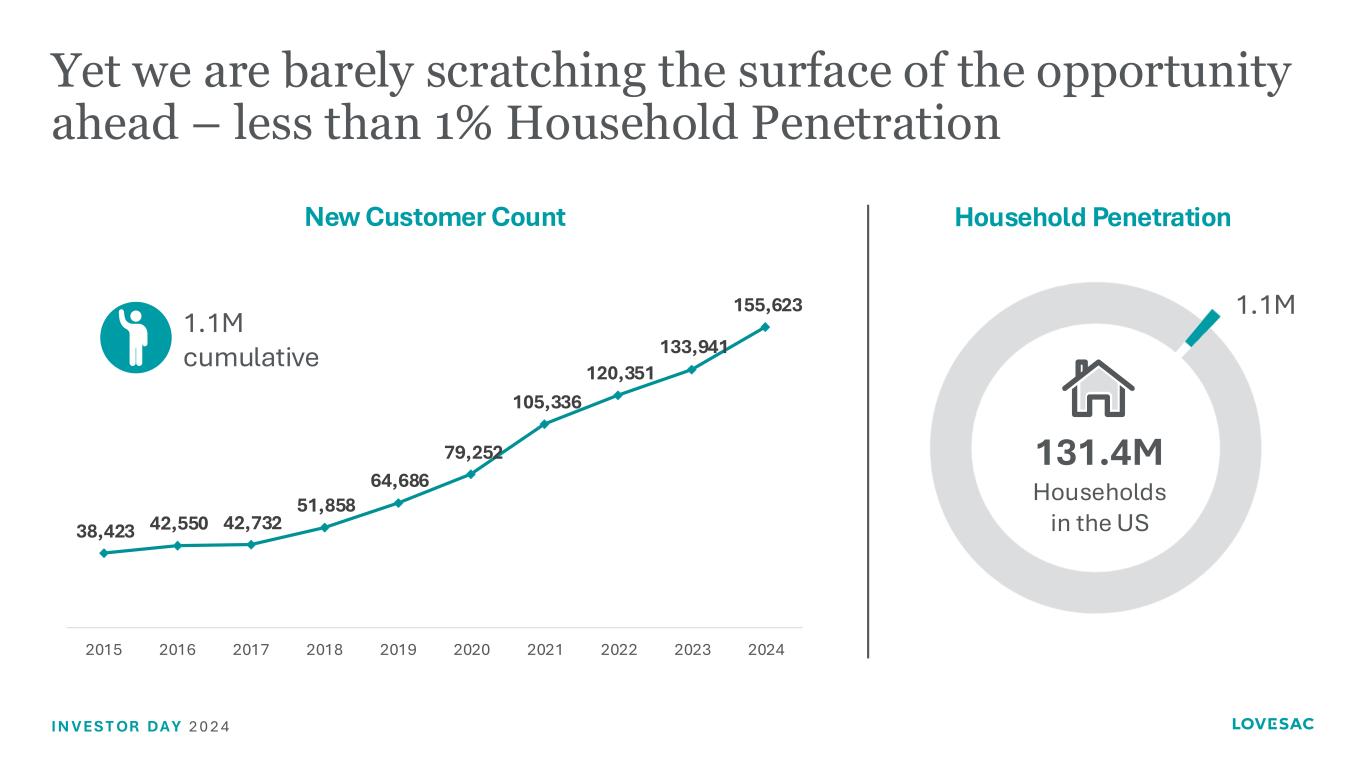

I N V ES T OR DA Y 2 0 2 4 Yet we are barely scratching the surface of the opportunity ahead – less than 1% Household Penetration 38,423 42,550 42,732 51,858 64,686 79,252 105,336 120,351 133,941 155,623 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 New Customer Count 1.1M cumulative Household Penetration 131.4M Households in the US 1.1M

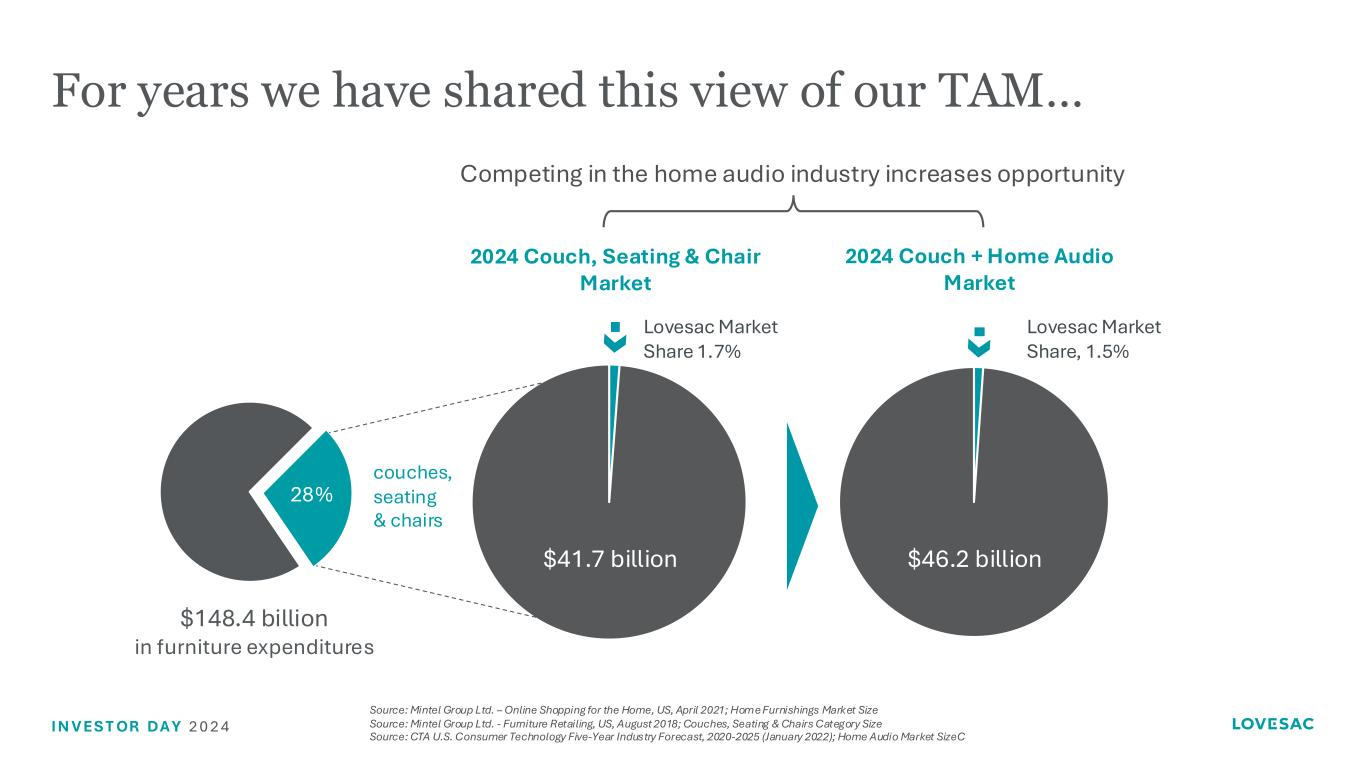

I N V ES T OR DA Y 2 0 2 4 For years we have shared this view of our TAM… $148.4 billion in furniture expenditures $38.6 billion $41.7 billion Lovesac Market Share, 1.5% Competing in the home audio industry increases opportunity $46.2 billion 2024 Couch + Home Audio Market 2024 Couch, Seating & Chair Market 28% Lovesac Market Share 1.7% couches, seating & chairs Source: Mintel Group Ltd. – Online Shopping for the Home, US, April 2021; Home Furnishings Market Size Source: Mintel Group Ltd. - Furniture Retailing, US, August 2018; Couches, Seating & Chairs Category Size Source: CTA U.S. Consumer Technology Five-Year Industry Forecast, 2020-2025 (January 2022); Home Audio Market SizeC

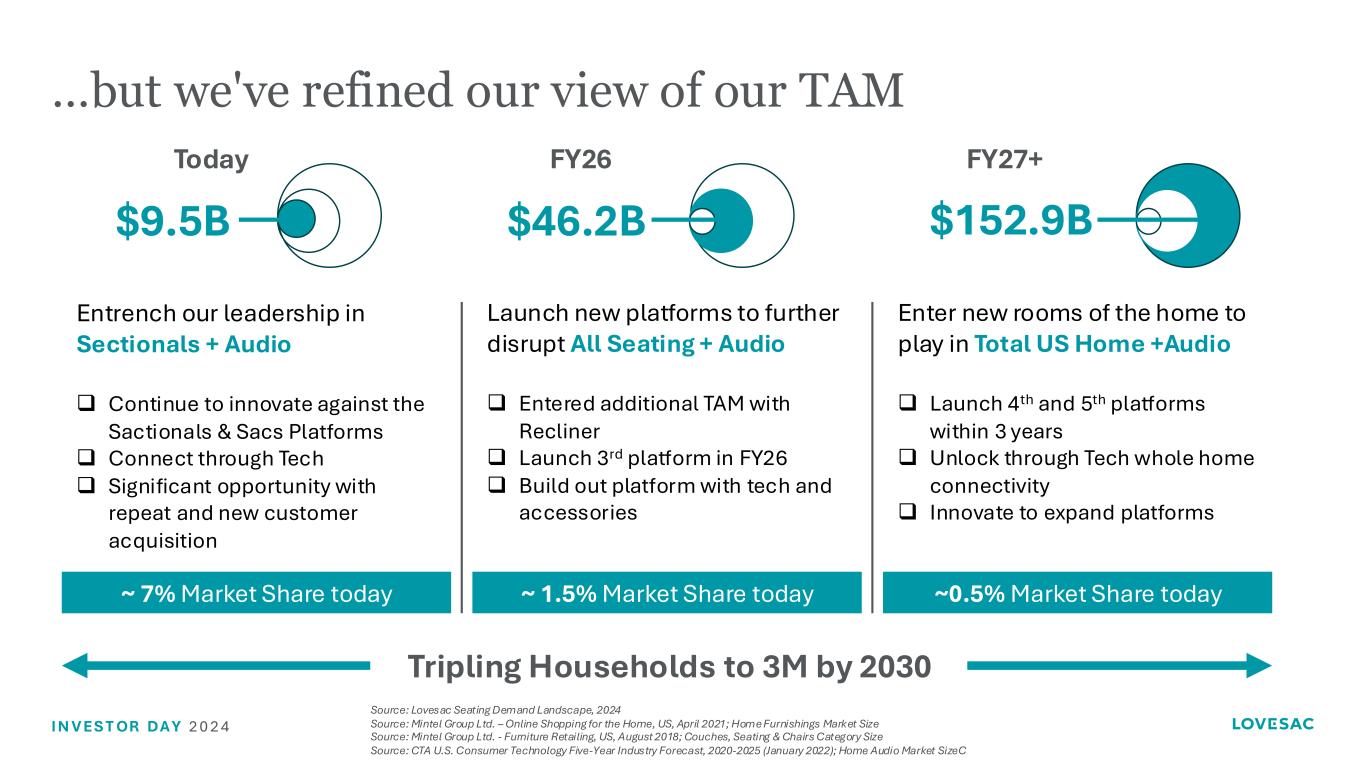

I N V ES T OR DA Y 2 0 2 4 …but we've refined our view of our TAM $9.5B $46.2B $152.9B Entrench our leadership in Sectionals + Audio ❑ Continue to innovate against the Sactionals & Sacs Platforms ❑ Connect through Tech ❑ Significant opportunity with repeat and new customer acquisition Launch new platforms to further disrupt All Seating + Audio ❑ Entered additional TAM with Recliner ❑ Launch 3rd platform in FY26 ❑ Build out platform with tech and accessories Enter new rooms of the home to play in Total US Home +Audio ❑ Launch 4th and 5th platforms within 3 years ❑ Unlock through Tech whole home connectivity ❑ Innovate to expand platforms ~ 7% Market Share today ~ 1.5% Market Share today ~0.5% Market Share today Tripling Households to 3M by 2030 Today FY26 FY27+ Source: Lovesac Seating Demand Landscape, 2024 Source: Mintel Group Ltd. – Online Shopping for the Home, US, April 2021; Home Furnishings Market Size Source: Mintel Group Ltd. - Furniture Retailing, US, August 2018; Couches, Seating & Chairs Category Size Source: CTA U.S. Consumer Technology Five-Year Industry Forecast, 2020-2025 (January 2022); Home Audio Market SizeC

I N V ES T OR DA Y 2 0 2 4 Our Territory

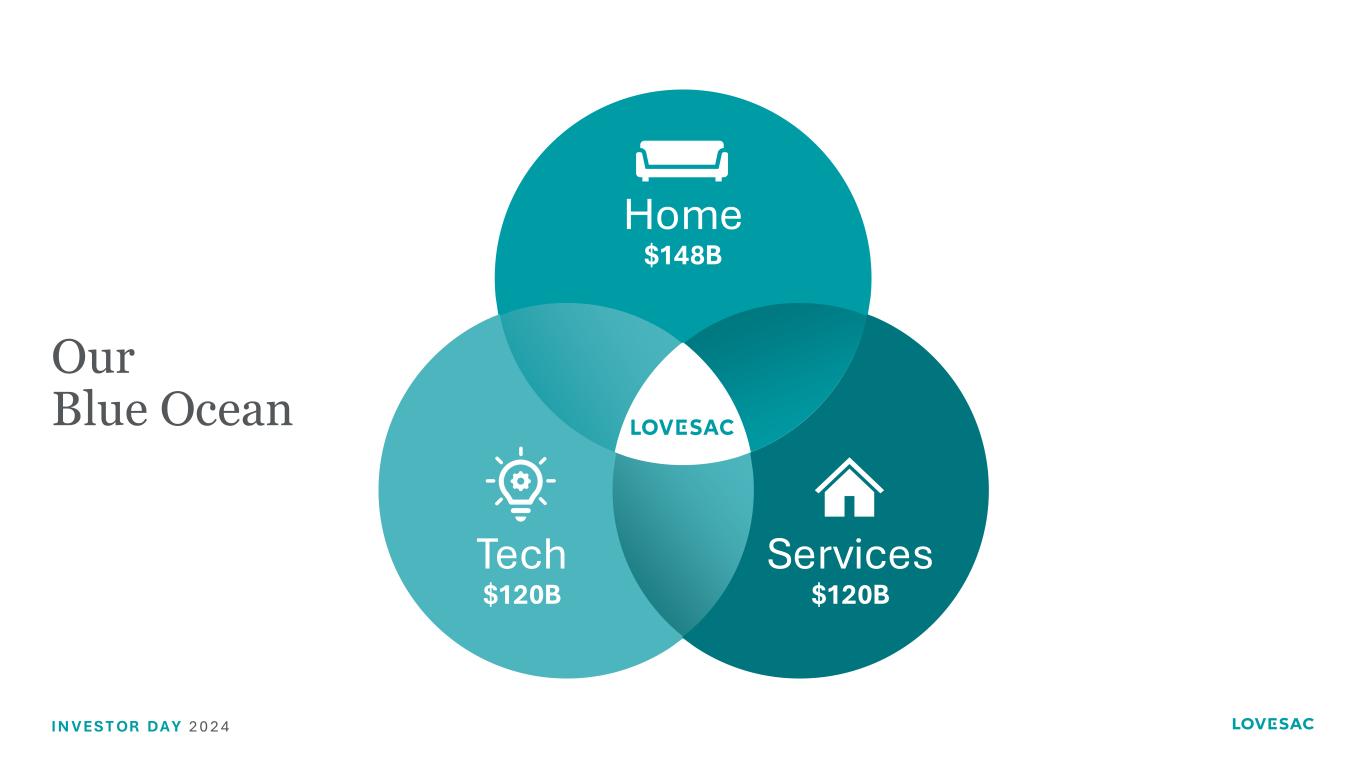

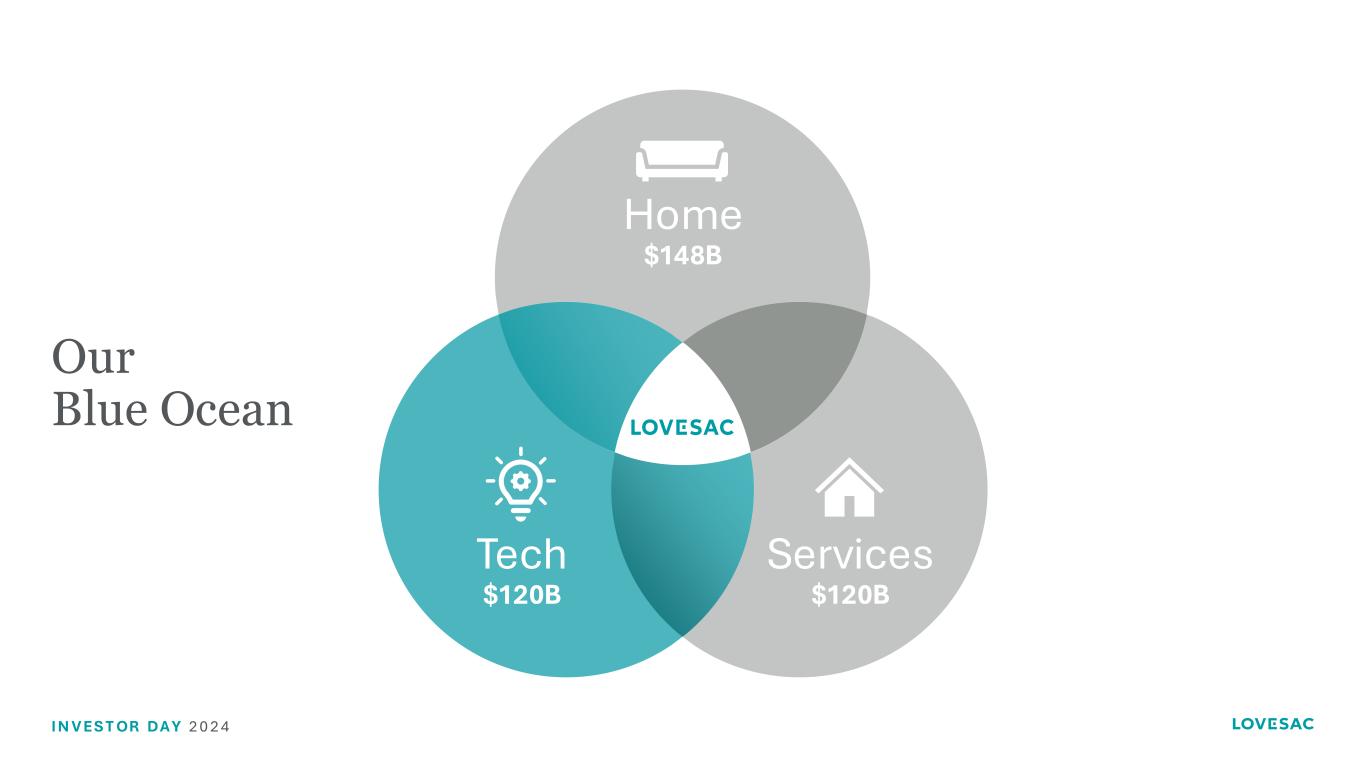

I N V ES T OR DA Y 2 0 2 4 Our Blue Ocean Home $148B Services $120B Tech $120B

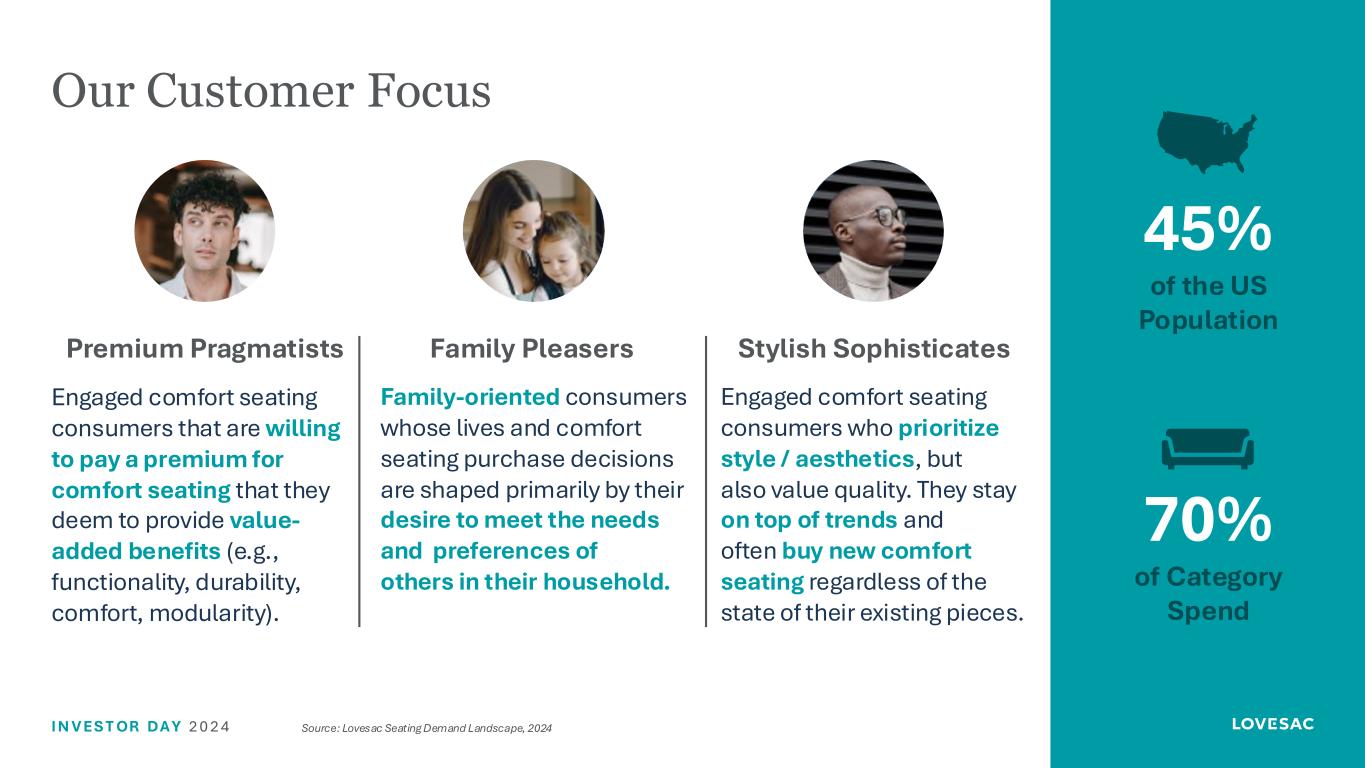

I N V ES T OR DA Y 2 0 2 4 Our Customer Focus Premium Pragmatists Stylish Sophisticates Engaged comfort seating consumers that are willing to pay a premium for comfort seating that they deem to provide value- added benefits (e.g., functionality, durability, comfort, modularity). Engaged comfort seating consumers who prioritize style / aesthetics, but also value quality. They stay on top of trends and often buy new comfort seating regardless of the state of their existing pieces. Family Pleasers Family-oriented consumers whose lives and comfort seating purchase decisions are shaped primarily by their desire to meet the needs and preferences of others in their household. 45% of the US Population 70% of Category Spend Source: Lovesac Seating Demand Landscape, 2024

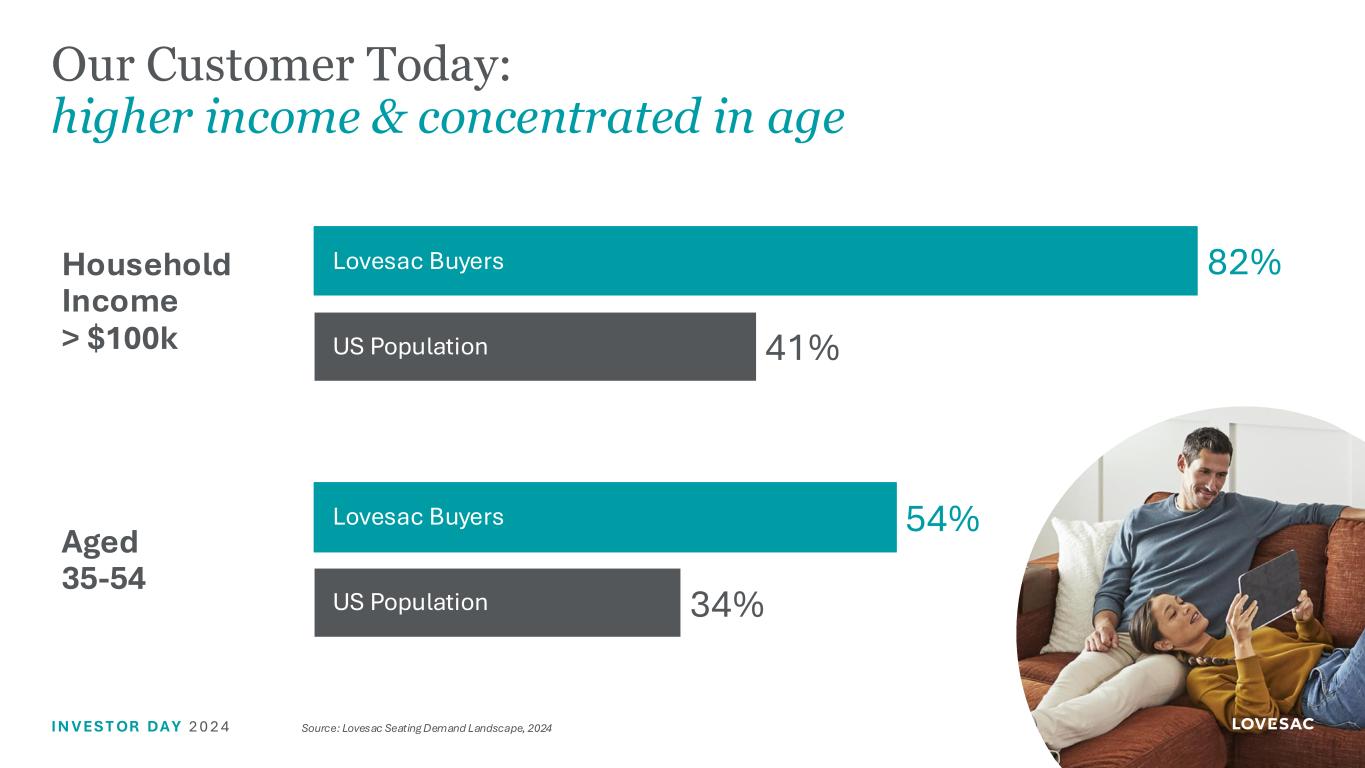

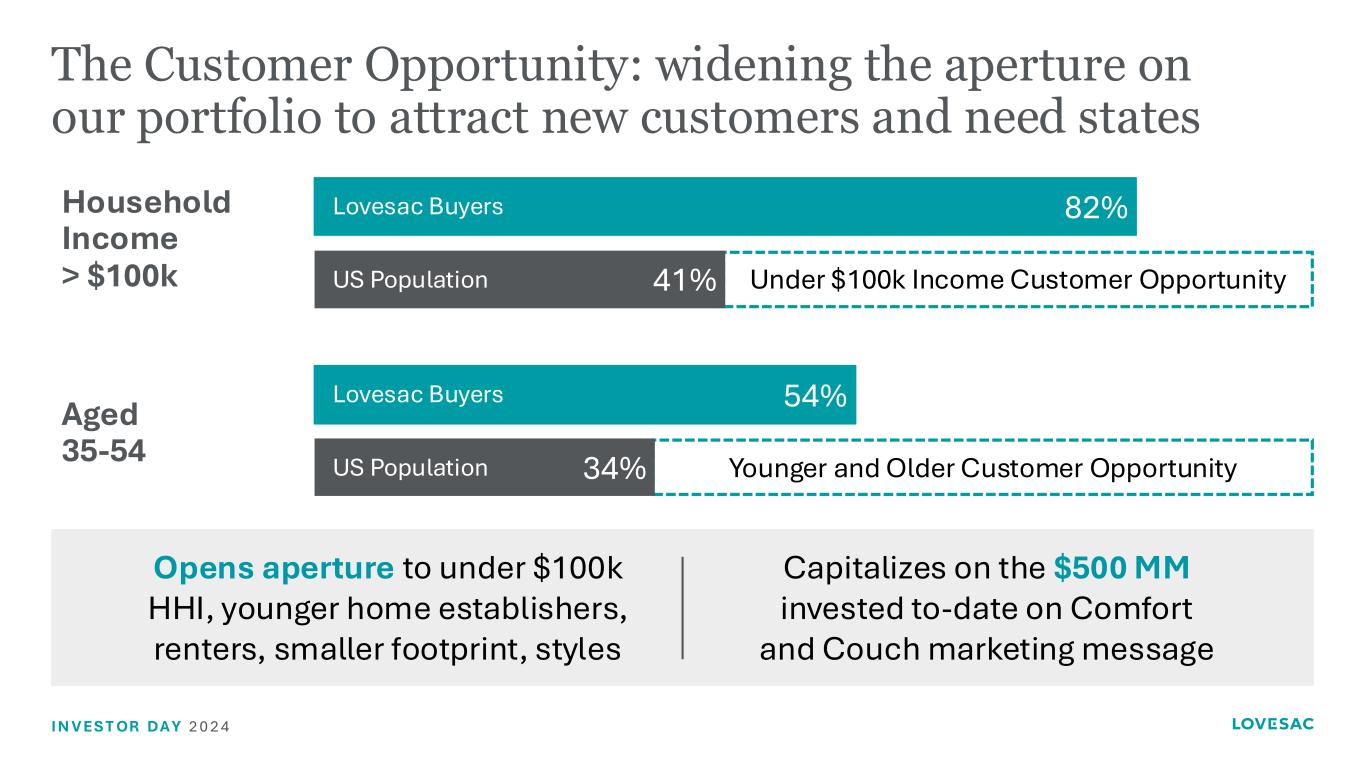

I N V ES T OR DA Y 2 0 2 4 Our Customer Today: higher income & concentrated in age 34% 41% 54% 82%Household Income > $100k US Population Lovesac Buyers Aged 35-54 US Population Lovesac Buyers Source: Lovesac Seating Demand Landscape, 2024

I N V ES T OR DA Y 2 0 2 4 We will leverage Designed for Life products and Customer Acquisition Engines to penetrate 3M homes and aim to build the most loved brand in America

I N V ES T OR DA Y 2 0 2 4 Expansion: New Designed for Life Platforms

I N V ES T OR DA Y 2 0 2 4 We will continue to build the Sacs and Sactionals platforms through differentiated top-quality innovation at an accelerated pace, and additionally we will bring 3 new branches to market over the next three years, leveraging the infrastructure we’ve built to drive profitable growth at scale.

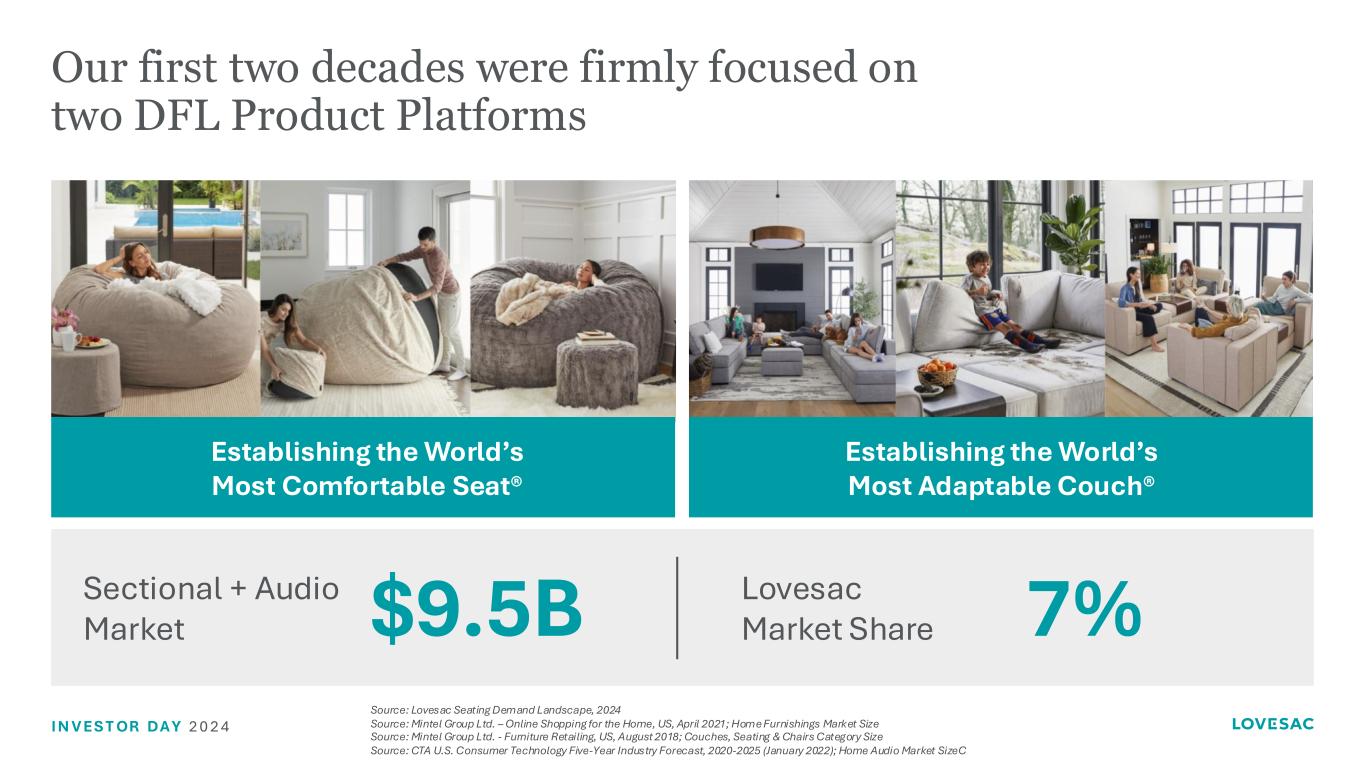

I N V ES T OR DA Y 2 0 2 4 Our first two decades were firmly focused on two DFL Product Platforms Establishing the World’s Most Comfortable Seat® Establishing the World’s Most Adaptable Couch® Sectional + Audio Market Lovesac Market Share$9.5B 7% Source: Lovesac Seating Demand Landscape, 2024 Source: Mintel Group Ltd. – Online Shopping for the Home, US, April 2021; Home Furnishings Market Size Source: Mintel Group Ltd. - Furniture Retailing, US, August 2018; Couches, Seating & Chairs Category Size Source: CTA U.S. Consumer Technology Five-Year Industry Forecast, 2020-2025 (January 2022); Home Audio Market SizeC

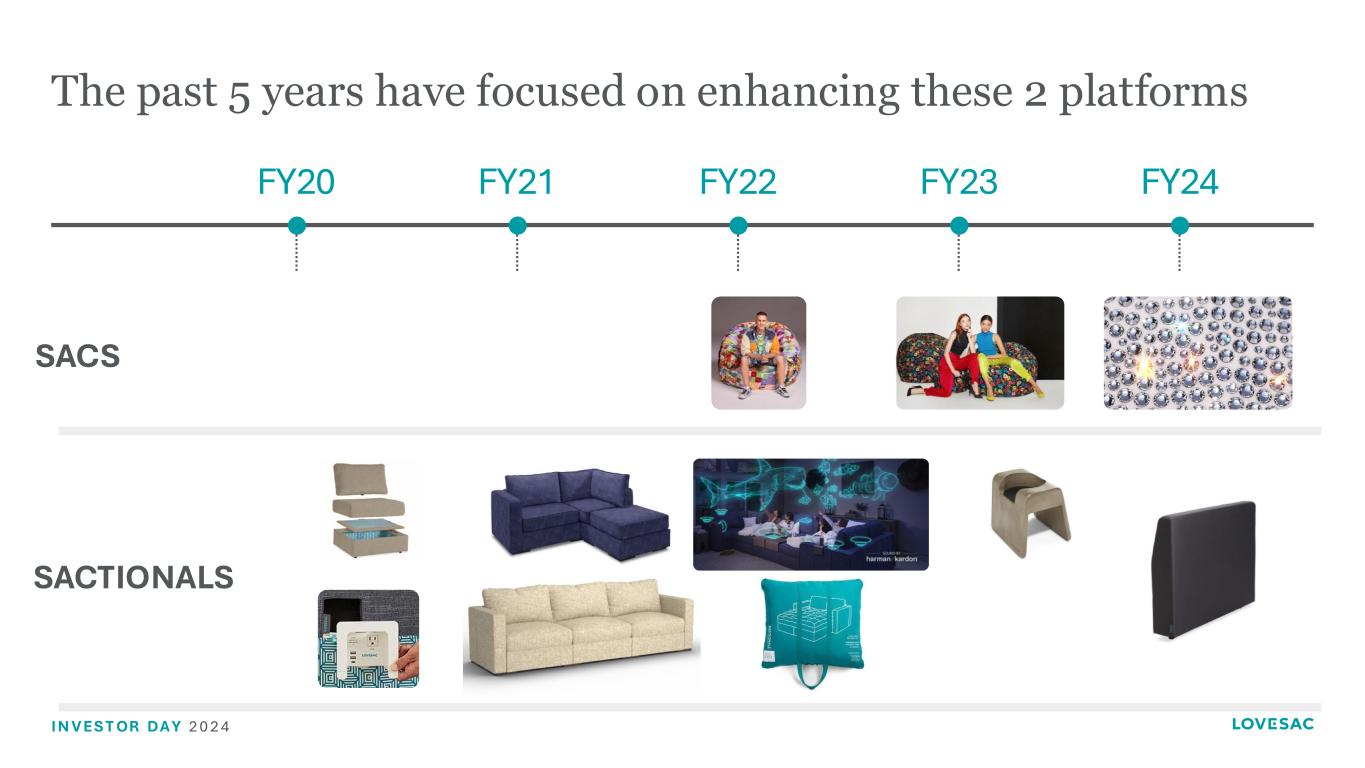

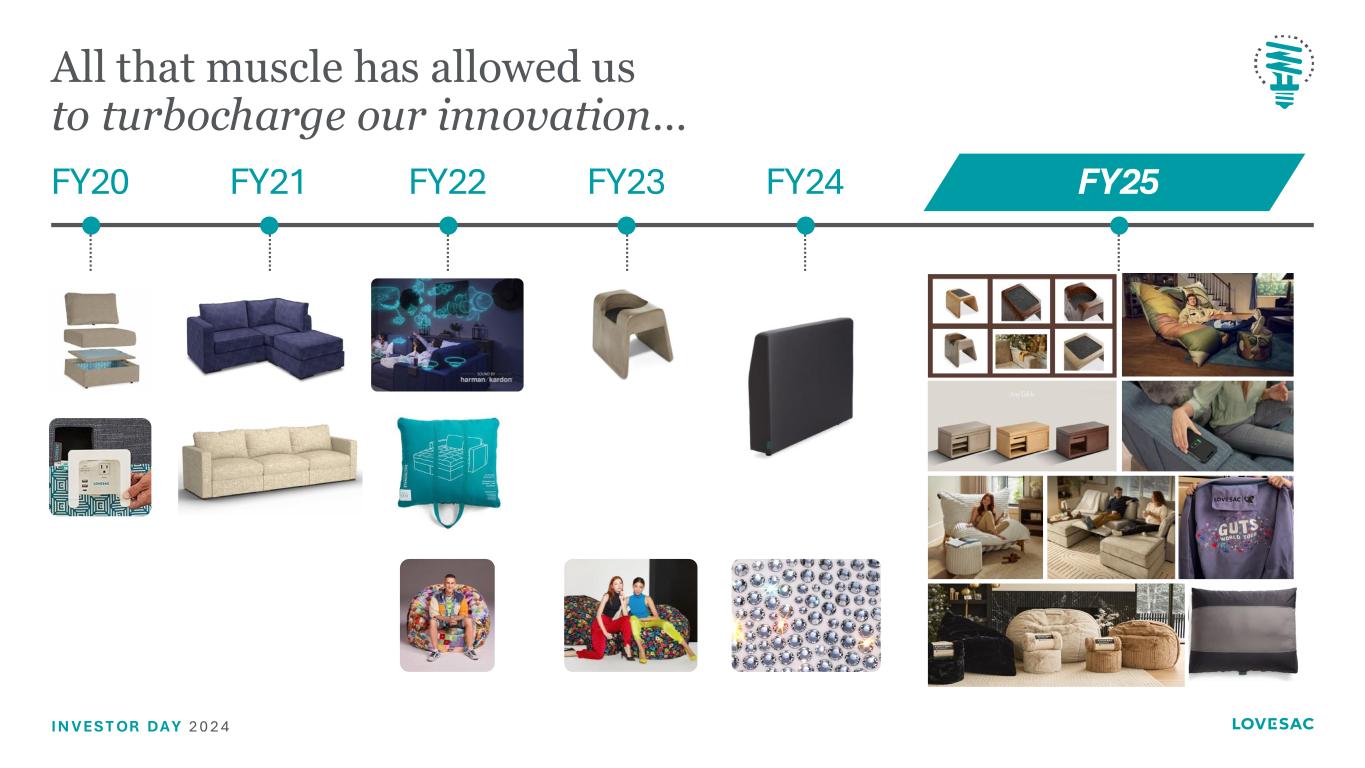

I N V ES T OR DA Y 2 0 2 4 The past 5 years have focused on enhancing these 2 platforms FY20 FY21 FY22 FY23 FY24 SACTIONALS SACS

I N V ES T OR DA Y 2 0 2 4 FY 2025 Has Been Our Most Prolific Year for Product Launches Ever

I N V ES T OR DA Y 2 0 2 4 Our Pace of Innovation is Increasing Custom Fabric Revitalization Surface Product Optimization AnyTableInsert Protectors Just a few of the introductions this year

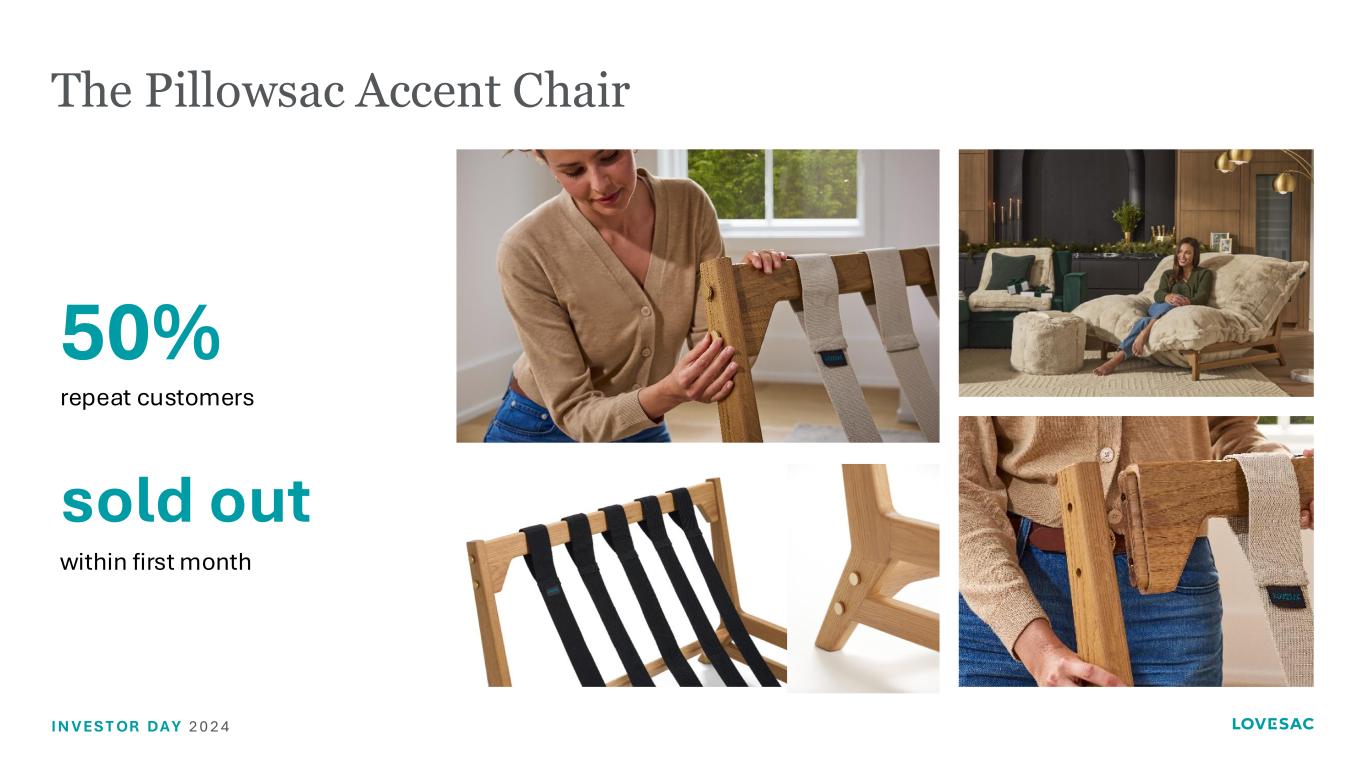

I N V ES T OR DA Y 2 0 2 4 The Pillowsac Accent Chair 50% repeat customers sold out within first month

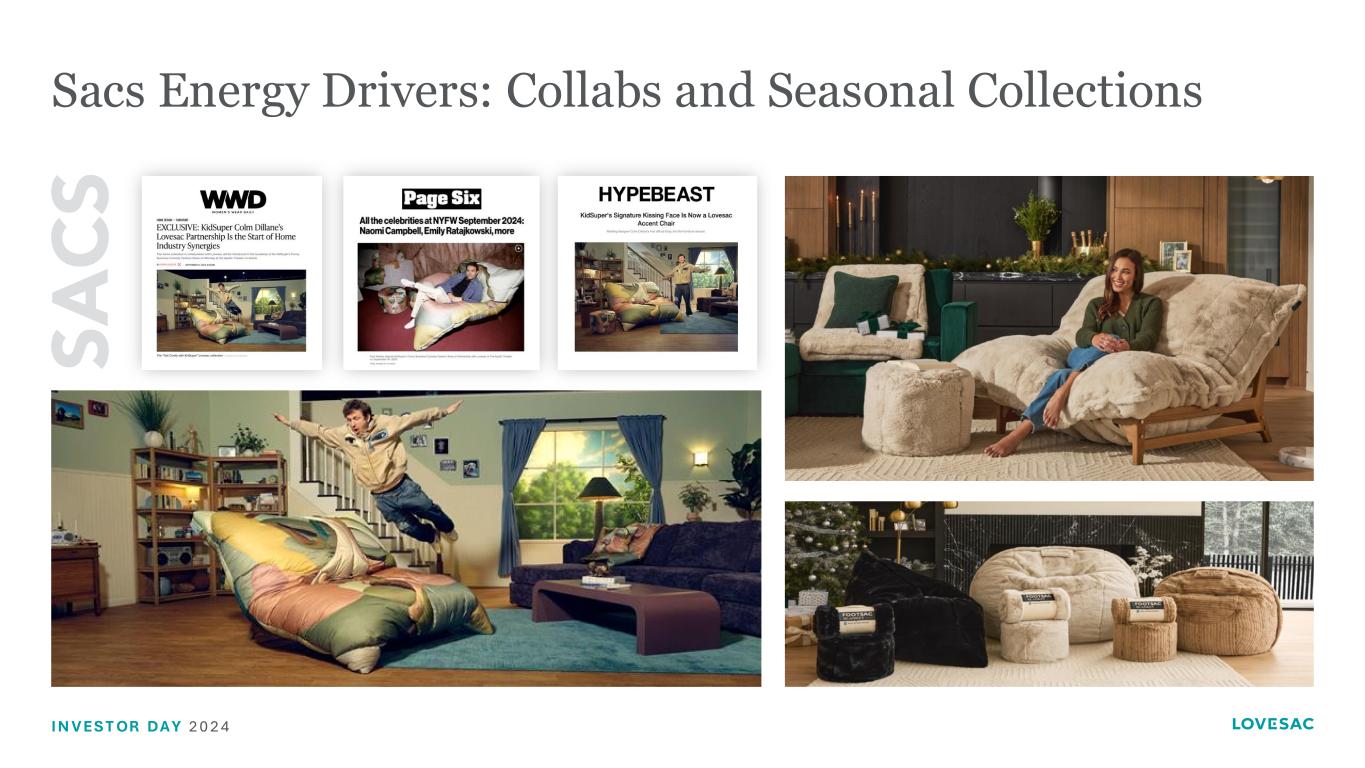

I N V ES T OR DA Y 2 0 2 4 Sacs Energy Drivers: Collabs and Seasonal Collections

I N V ES T OR DA Y 2 0 2 4 Our Blue Ocean Home $148B Services $120B Tech $120B

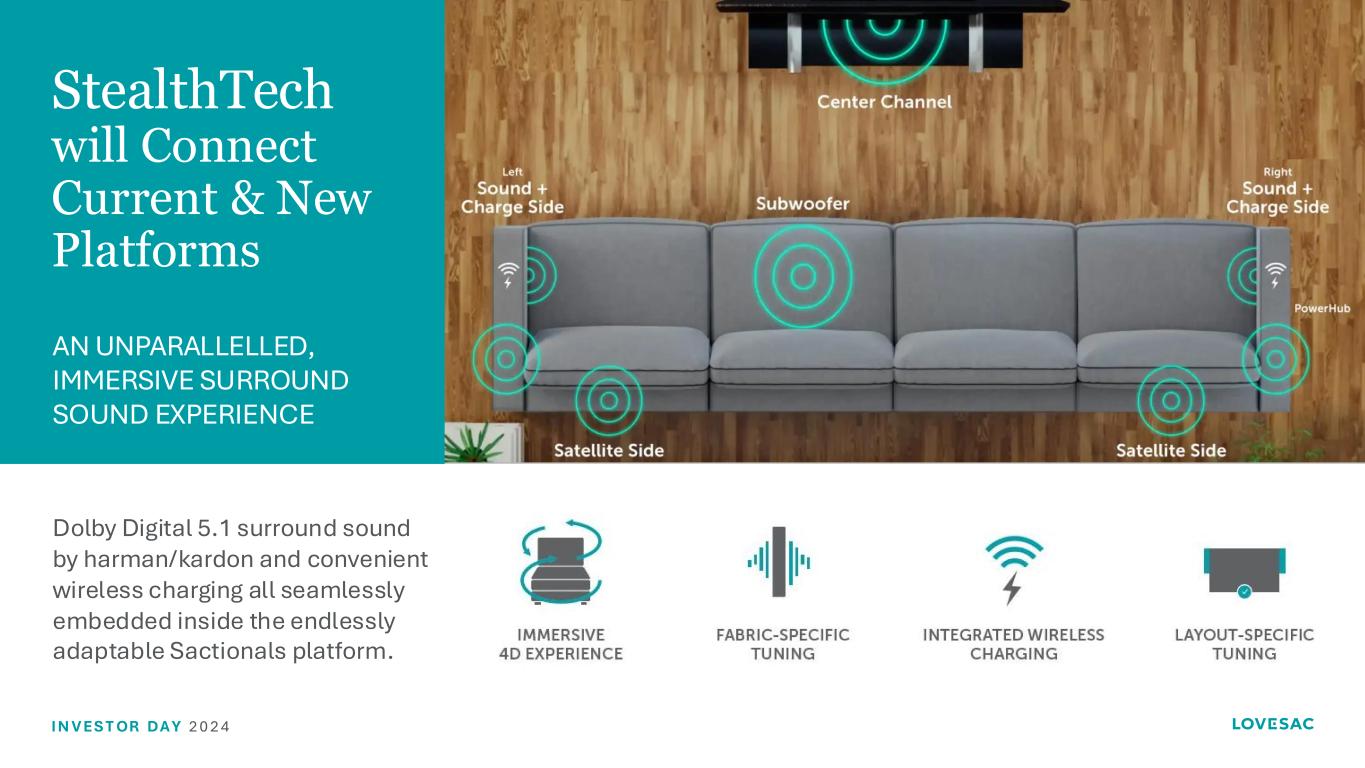

I N V ES T OR DA Y 2 0 2 4 StealthTech will Connect Current & New Platforms Dolby Digital 5.1 surround sound by harman/kardon and convenient wireless charging all seamlessly embedded inside the endlessly adaptable Sactionals platform. AN UNPARALLELLED, IMMERSIVE SURROUND SOUND EXPERIENCE

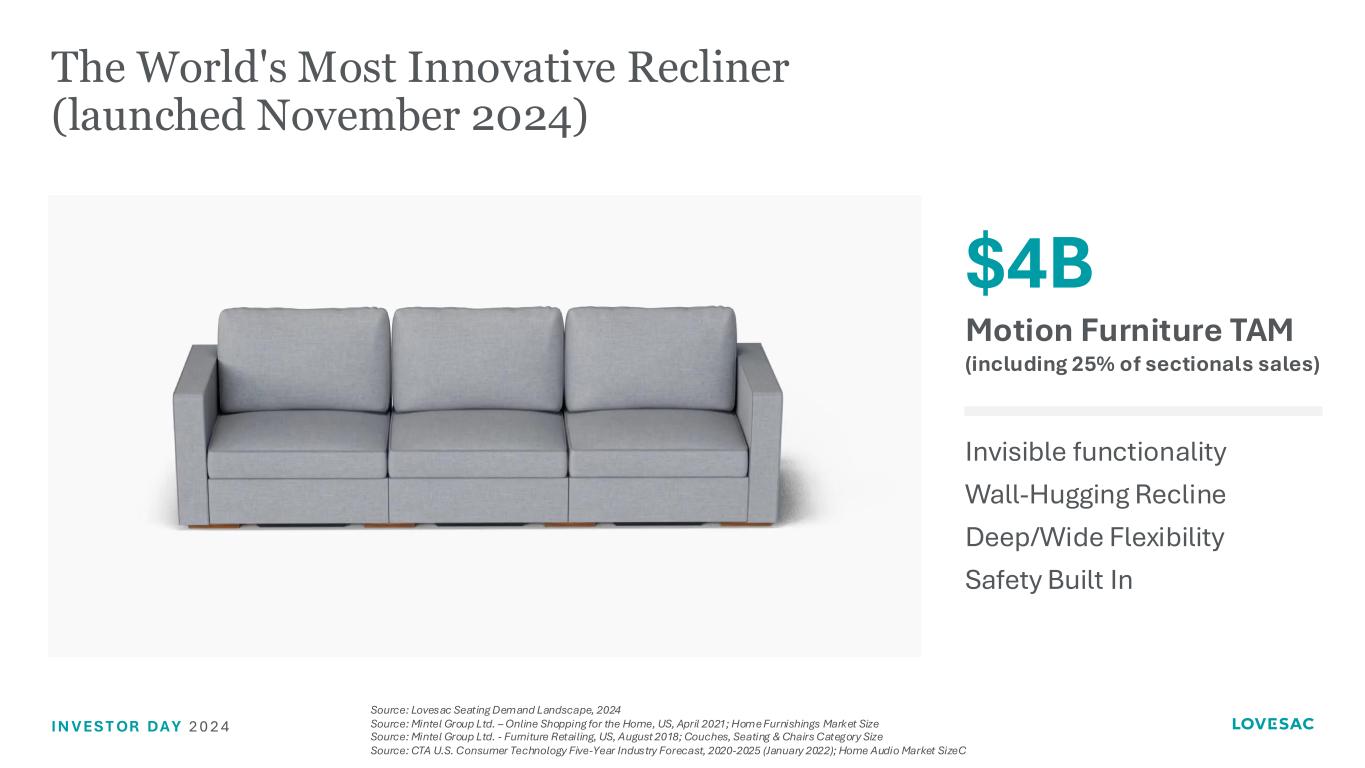

I N V ES T OR DA Y 2 0 2 4 The World's Most Innovative Recliner (launched November 2024) $4B Motion Furniture TAM (including 25% of sectionals sales) Invisible functionality Wall-Hugging Recline Deep/Wide Flexibility Safety Built In Source: Lovesac Seating Demand Landscape, 2024 Source: Mintel Group Ltd. – Online Shopping for the Home, US, April 2021; Home Furnishings Market Size Source: Mintel Group Ltd. - Furniture Retailing, US, August 2018; Couches, Seating & Chairs Category Size Source: CTA U.S. Consumer Technology Five-Year Industry Forecast, 2020-2025 (January 2022); Home Audio Market SizeC

I N V ES T OR DA Y 2 0 2 4 2 Years of Engineering & Design

I N V ES T OR DA Y 2 0 2 4 First of its Kind Reverse- Compatible, Reconfigurable Recliner

I N V ES T OR DA Y 2 0 2 4 First of its Kind Reverse- Compatible, Reconfigurable Recliner

I N V ES T OR DA Y 2 0 2 4

I N V ES T OR DA Y 2 0 2 4

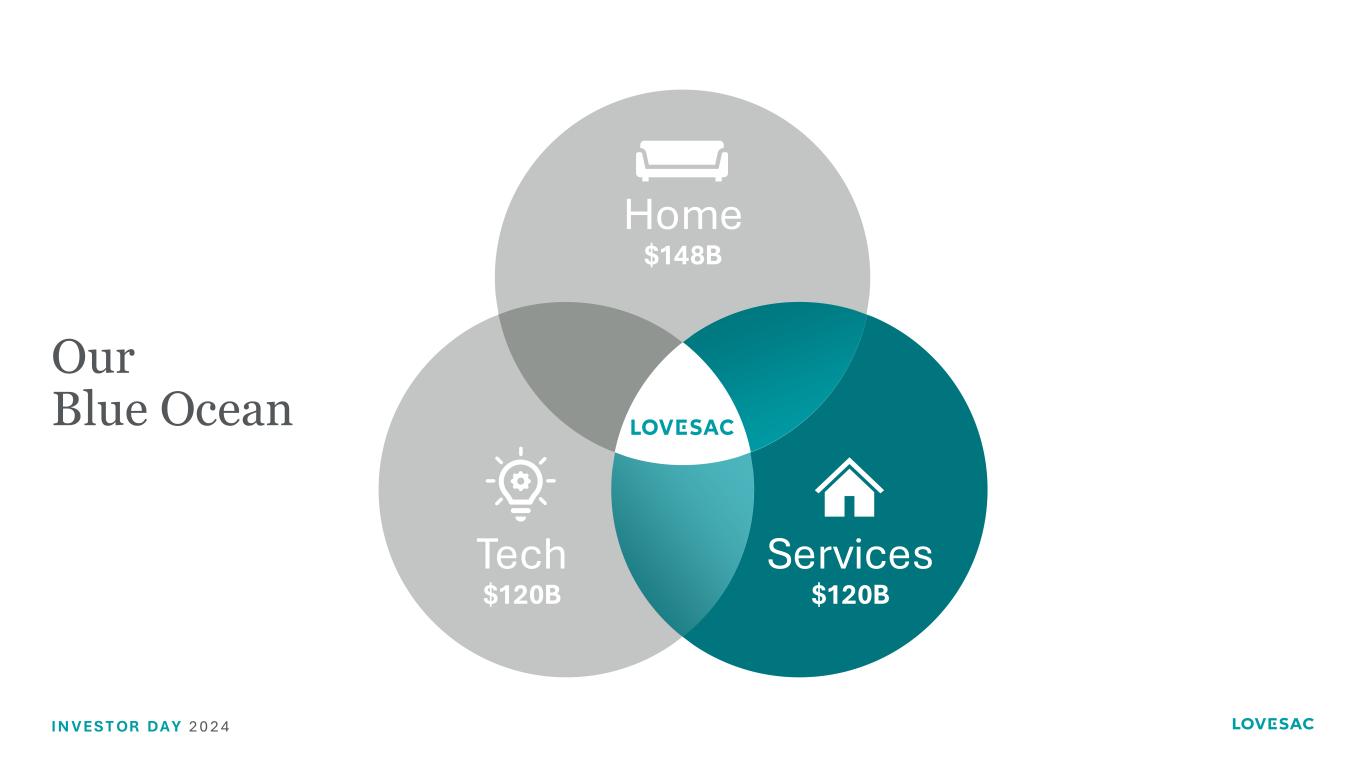

I N V ES T OR DA Y 2 0 2 4 Our Blue Ocean Home $148B Services $120B Tech $120B

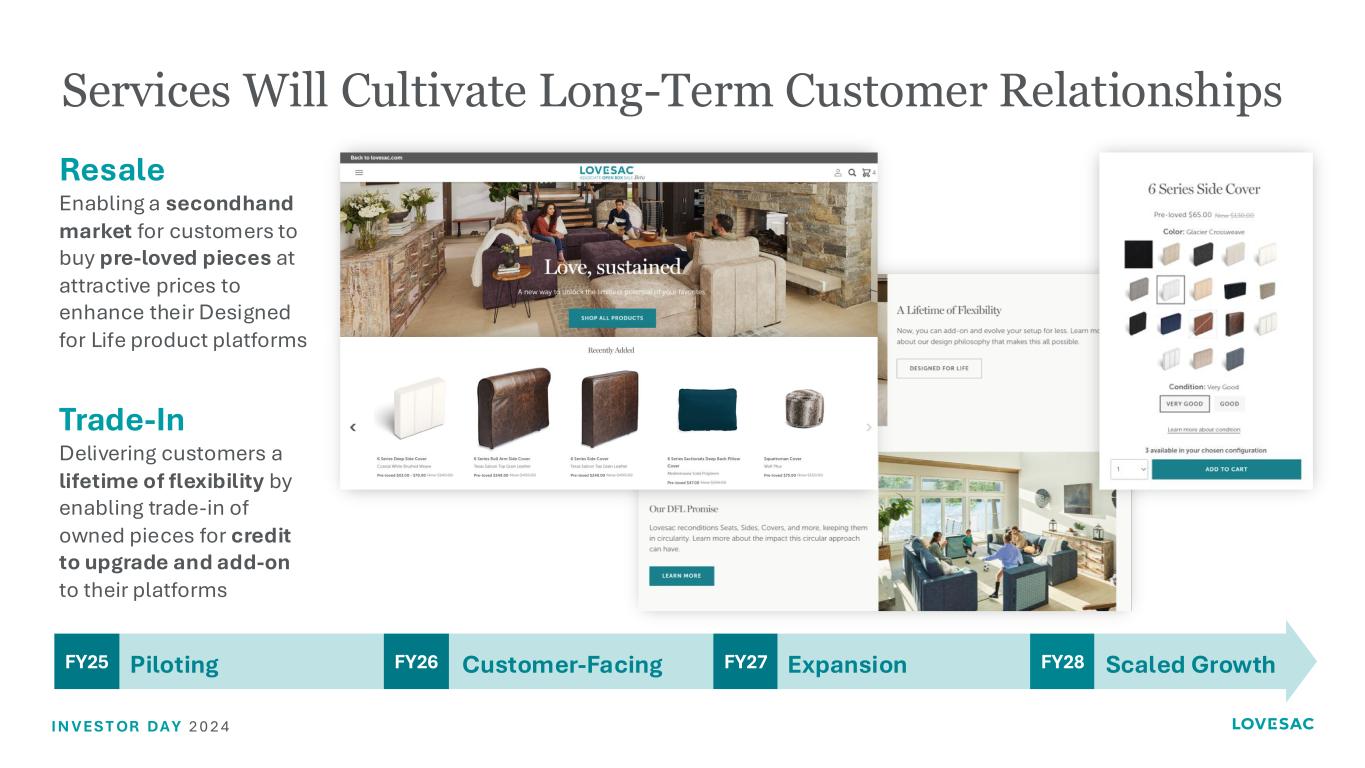

I N V ES T OR DA Y 2 0 2 4 Services Will Cultivate Long-Term Customer Relationships FY25 FY26 FY28FY27Piloting Customer-Facing Expansion Scaled Growth Trade-In Delivering customers a lifetime of flexibility by enabling trade-in of owned pieces for credit to upgrade and add-on to their platforms Resale Enabling a secondhand market for customers to buy pre-loved pieces at attractive prices to enhance their Designed for Life product platforms

I N V ES T OR DA Y 2 0 2 4 FY 2025 Our Biggest Year of Innovation Yet

I N V ES T OR DA Y 2 0 2 4 SACTIONALS SACS

I N V ES T OR DA Y 2 0 2 4

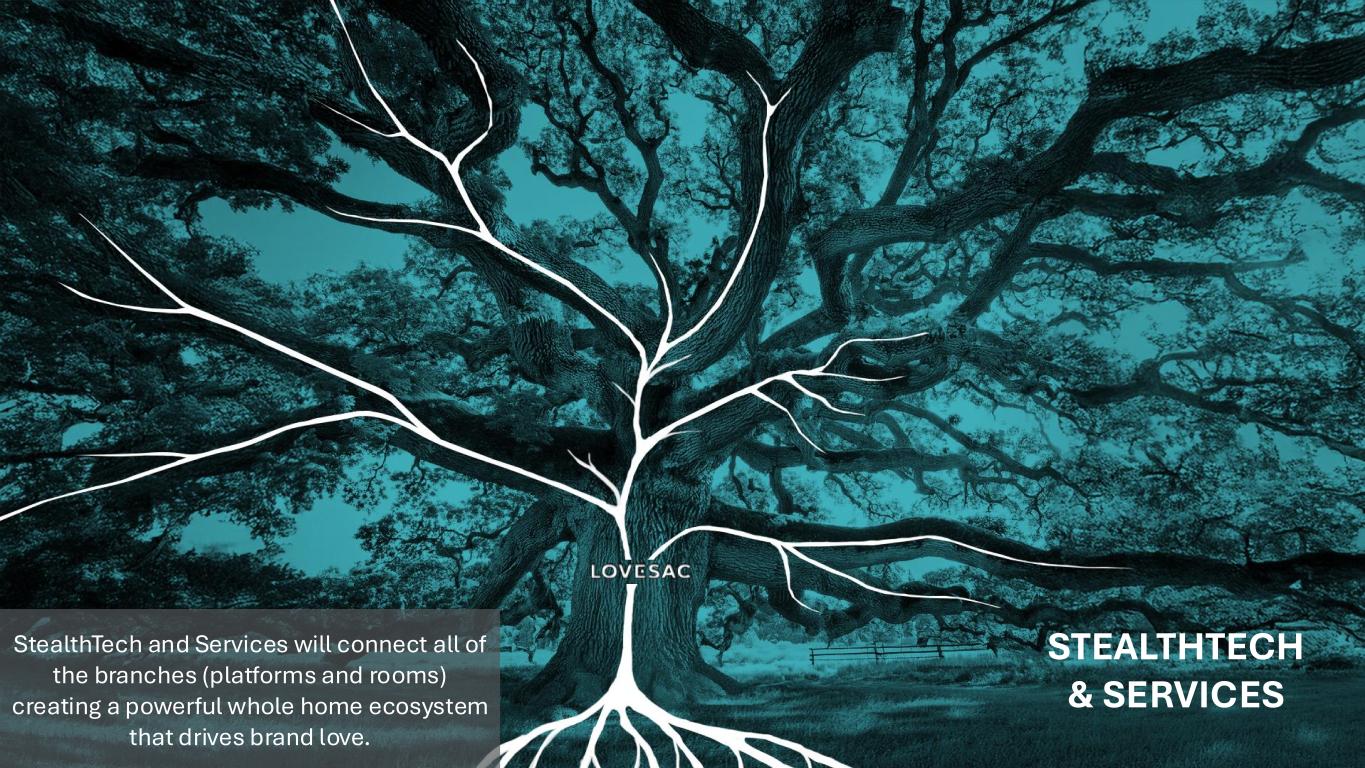

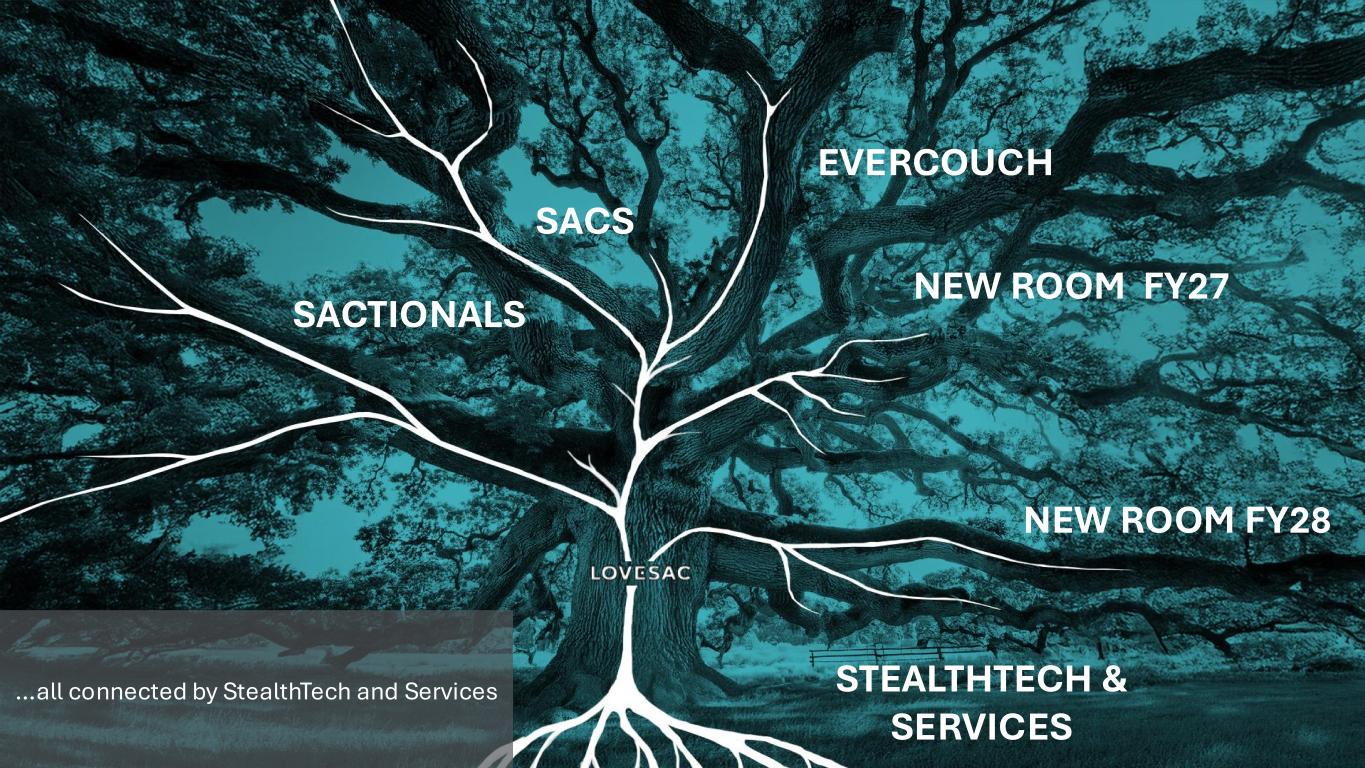

I N V ES T OR DA Y 2 0 2 4 STEALTHTECH & SERVICES StealthTech and Services will connect all of the branches (platforms and rooms) creating a powerful whole home ecosystem that drives brand love.

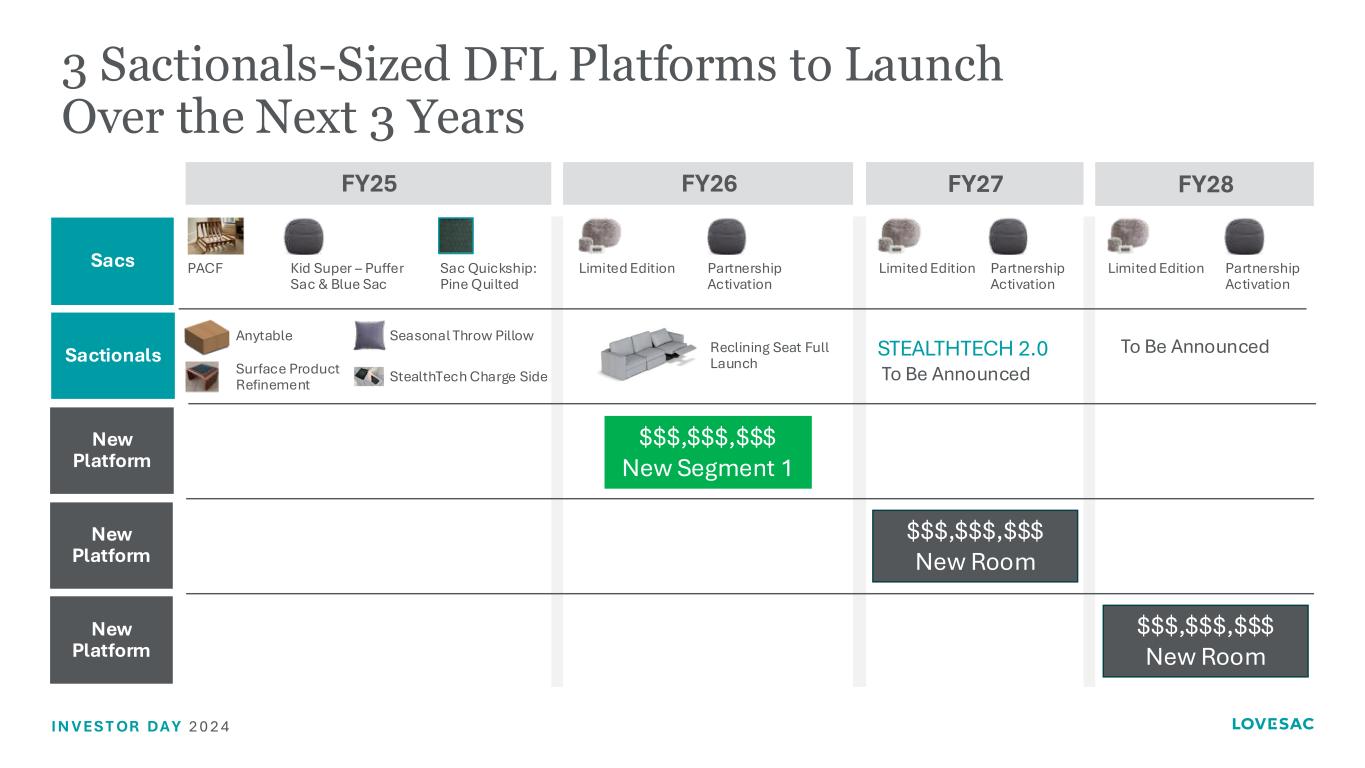

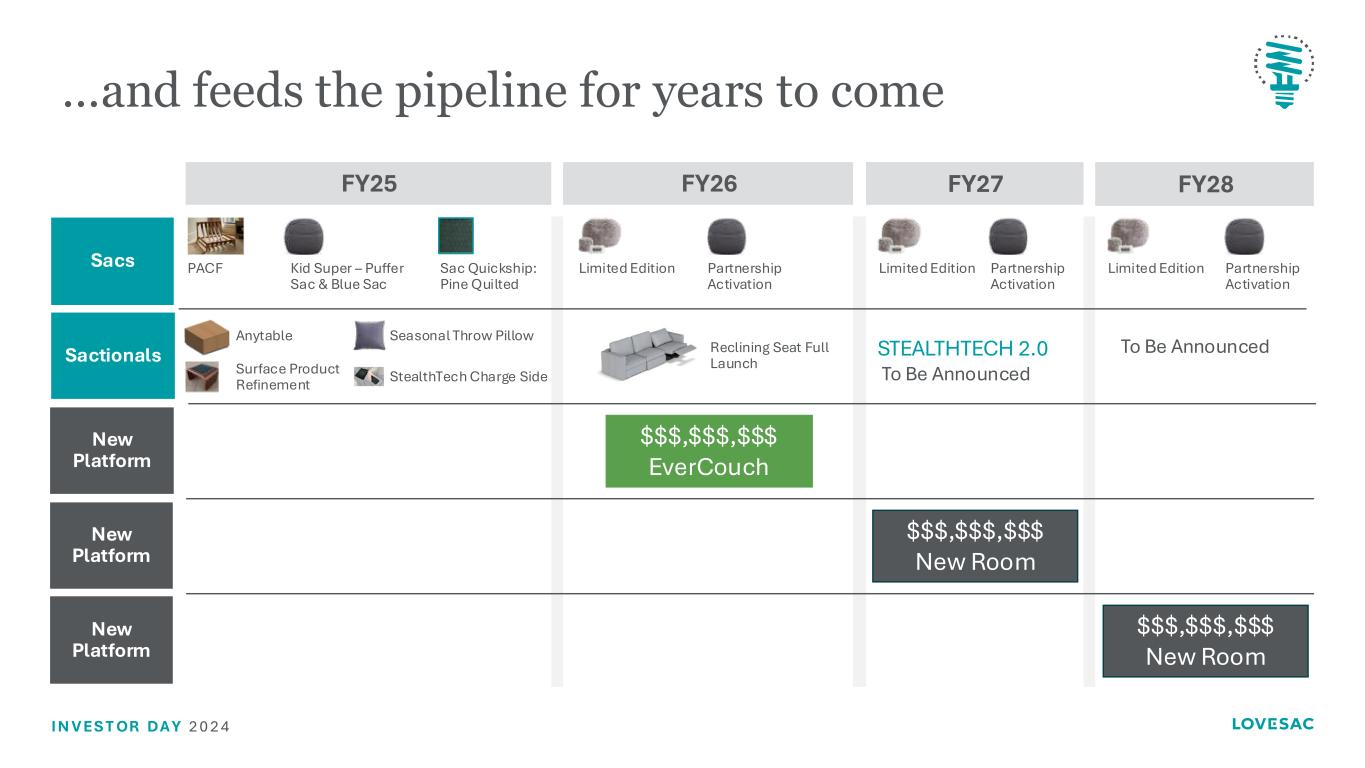

I N V ES T OR DA Y 2 0 2 4 3 Sactionals-Sized DFL Platforms to Launch Over the Next 3 Years FY25 FY26 FY27 FY28 $$$,$$$,$$$ New Segment 1 $$$,$$$,$$$ New Room STEALTHTECH 2.0 To Be Announced Reclining Seat Full Launch Seasonal Throw Pillow StealthTech Charge Side Anytable Surface Product Refinement New Platform New Platform New Platform Sactionals Sacs PACF Sac Quickship: Pine Quilted Kid Super – Puffer Sac & Blue Sac Limited Edition Partnership Activation Limited Edition Limited Edition Partnership Activation Partnership Activation To Be Announced $$$,$$$,$$$ New Room

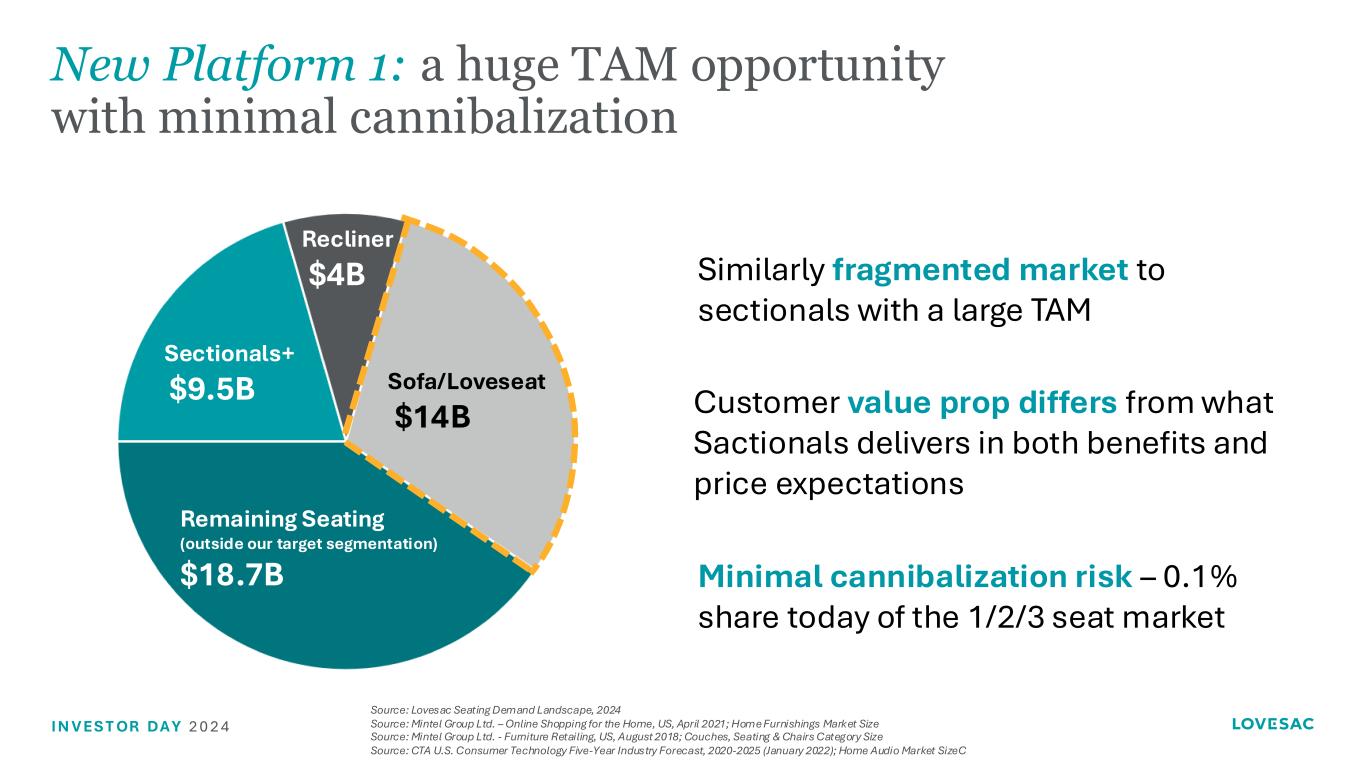

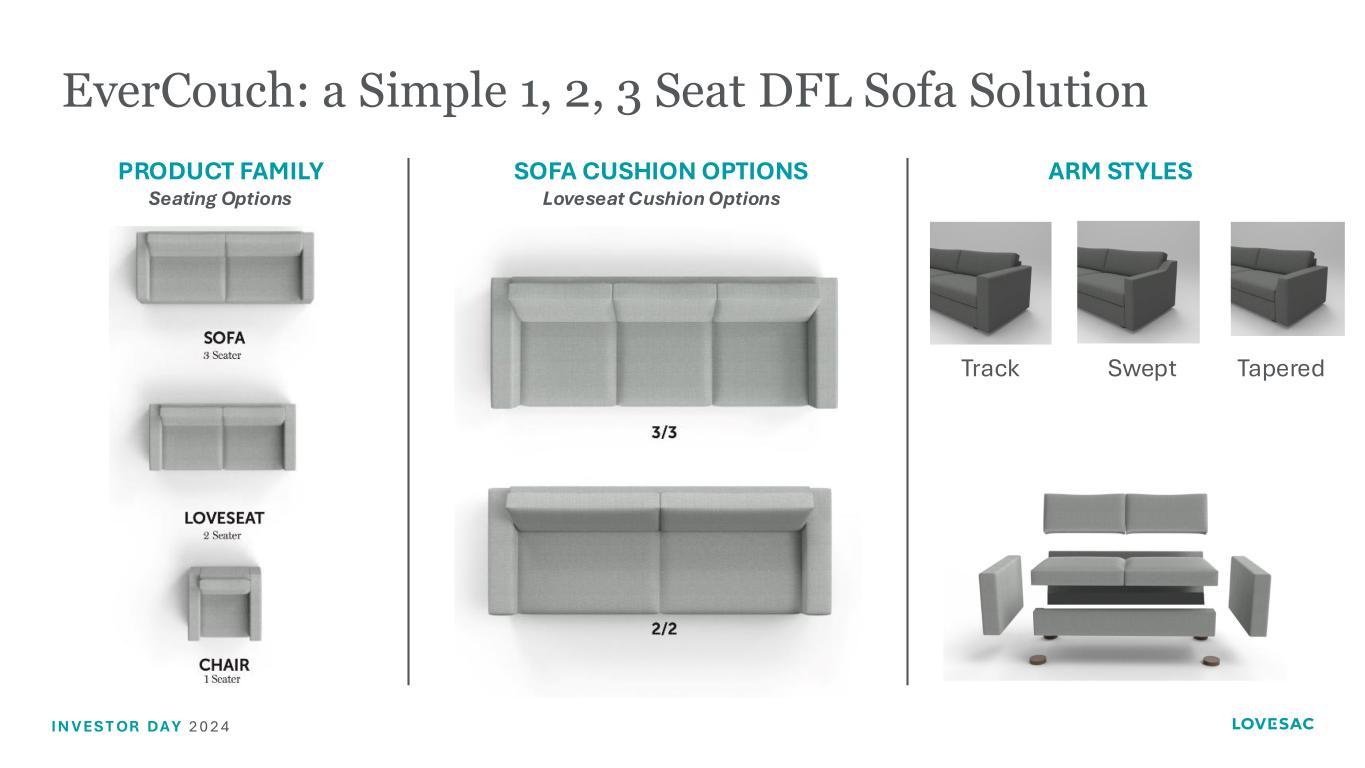

I N V ES T OR DA Y 2 0 2 4 Similarly fragmented market to sectionals with a large TAM Customer value prop differs from what Sactionals delivers in both benefits and price expectations Minimal cannibalization risk – 0.1% share today of the 1/2/3 seat market New Platform 1: a huge TAM opportunity with minimal cannibalization Recliner $4B Sectionals+ $9.5B Sofa/Loveseat $14B Remaining Seating (outside our target segmentation) $18.7B Source: Lovesac Seating Demand Landscape, 2024 Source: Mintel Group Ltd. – Online Shopping for the Home, US, April 2021; Home Furnishings Market Size Source: Mintel Group Ltd. - Furniture Retailing, US, August 2018; Couches, Seating & Chairs Category Size Source: CTA U.S. Consumer Technology Five-Year Industry Forecast, 2020-2025 (January 2022); Home Audio Market SizeC

I N V ES T OR DA Y 2 0 2 4 Younger and Older Customer Opportunity Under $100k Income Customer Opportunity 34% 41% 54% 82% The Customer Opportunity: widening the aperture on our portfolio to attract new customers and need states Opens aperture to under $100k HHI, younger home establishers, renters, smaller footprint, styles Capitalizes on the $500 MM invested to-date on Comfort and Couch marketing message Household Income > $100k US Population Lovesac Buyers Aged 35-54 US Population Lovesac Buyers

I N V ES T OR DA Y 2 0 2 4 SACTIONALS SACS EVERCOUCH

I N V ES T OR DA Y 2 0 2 4 EverCouch by Lovesac, NEW mid-year FY26

I N V ES T OR DA Y 2 0 2 4 EverCouch: a Simple 1, 2, 3 Seat DFL Sofa Solution SOFA CUSHION OPTIONS Loveseat Cushion Options ARM STYLESPRODUCT FAMILY Seating Options Track Swept Tapered

I N V ES T OR DA Y 2 0 2 4

I N V ES T OR DA Y 2 0 2 4

I N V ES T OR DA Y 2 0 2 4

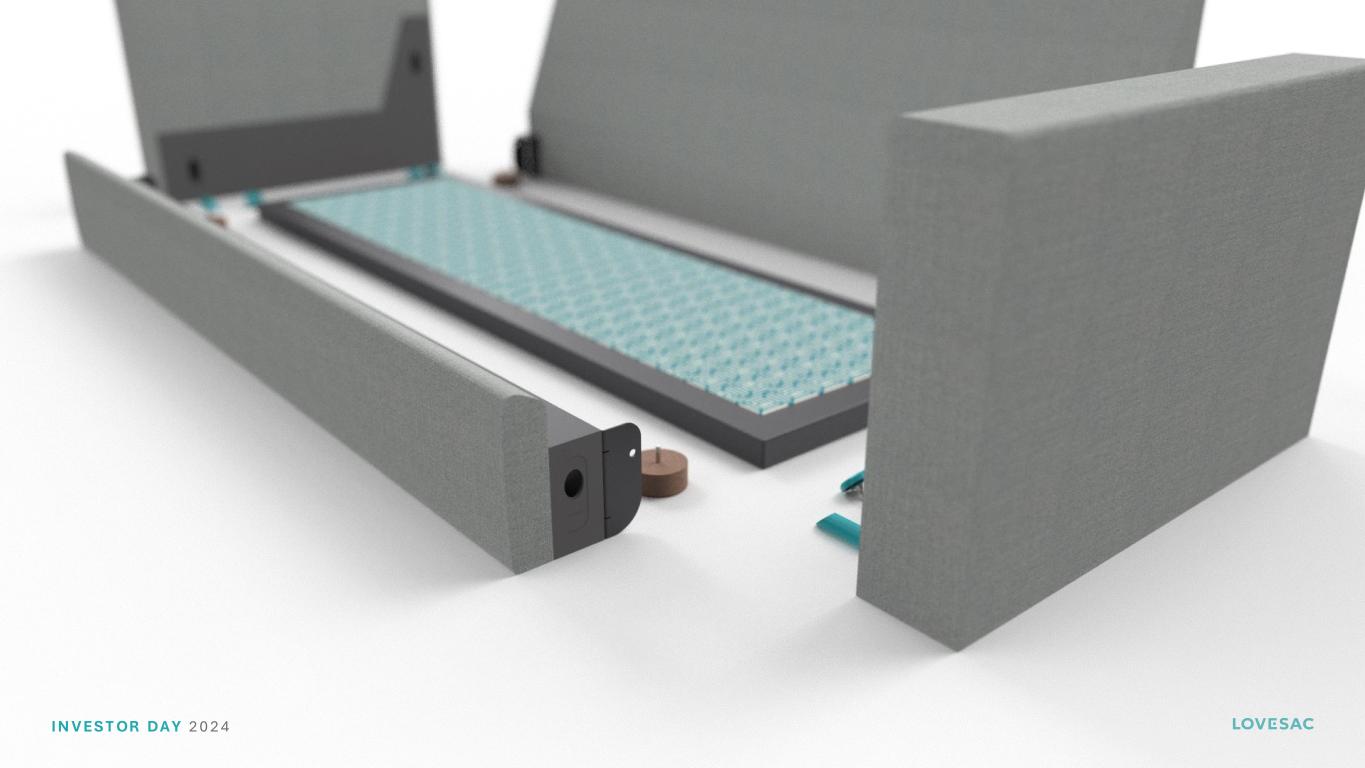

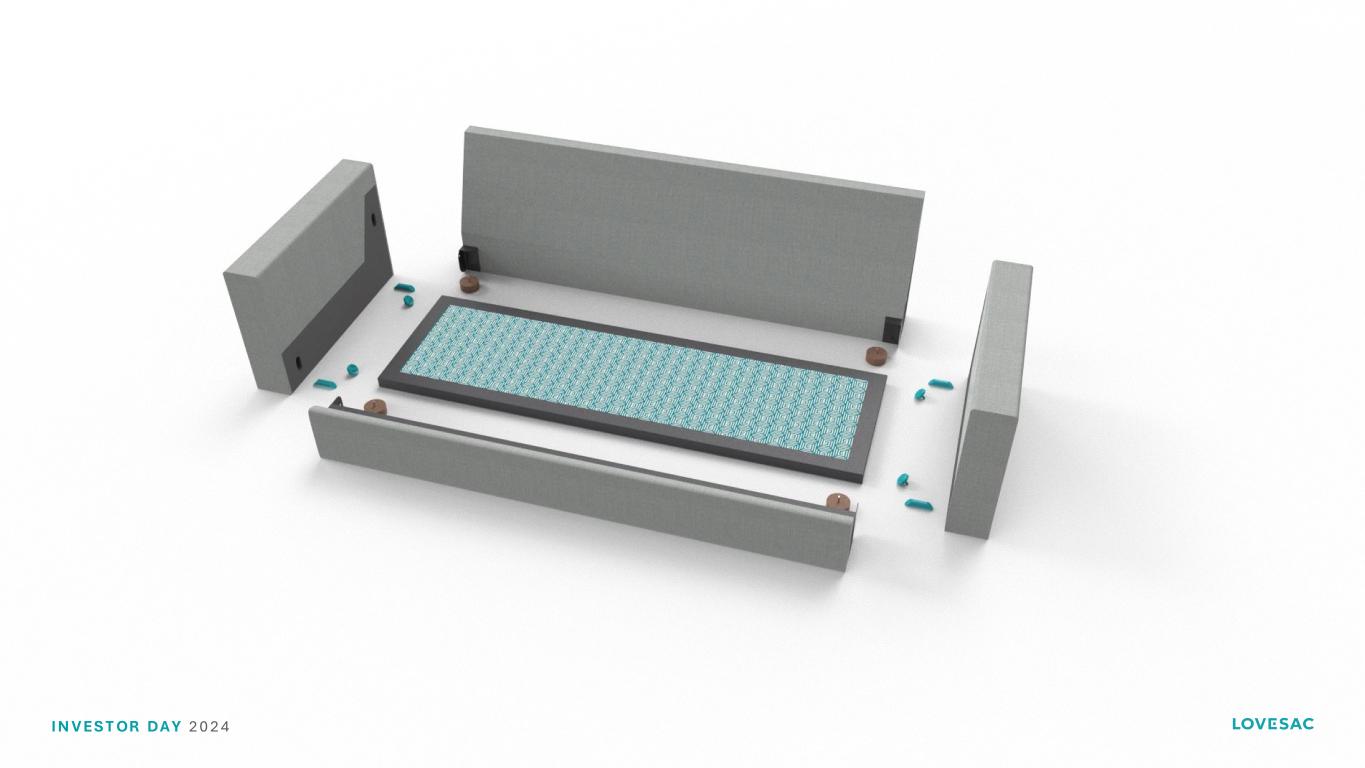

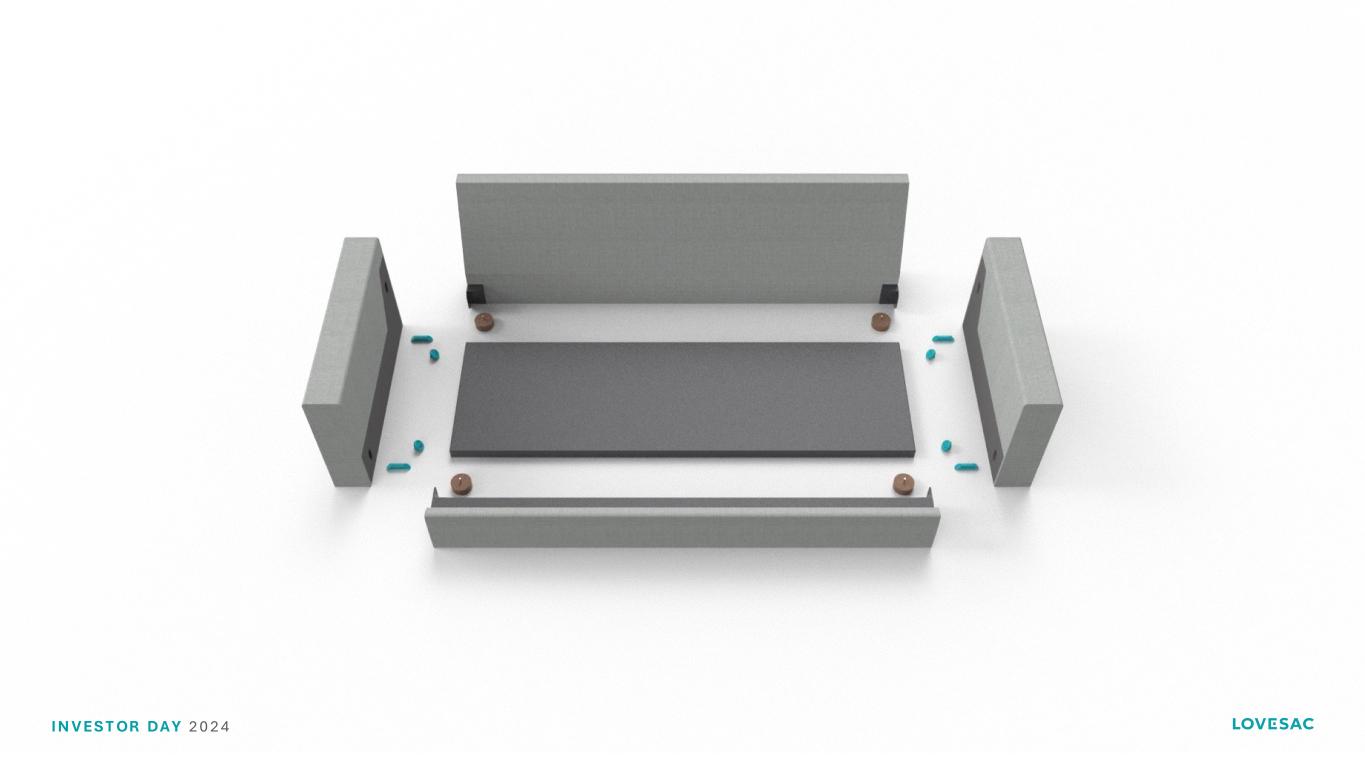

I N V ES T OR DA Y 2 0 2 4 EverCouch Reveal MULTIPLE ARM STYLES REPREVE INSERT LINER INTERIOR FRAME CUSHION & BACK PILLOW BRAND PRINT INSIDE BEAM CONNECTION METHOD CIRCULUAR FEET Cover OptionsComponents

I N V ES T OR DA Y 2 0 2 4 Significantly differentiated from the competition… BENEFIT EVERCOUCH COMPETITION FABRICS Upholstered-look Removable Covers ✓ Machine Washable ✓ Variety of Quick Ship/Stock Options ✓ ✓ CUSTOMIZATIONS Multiple Fill Options ✓ ✓ Multiple Arm Style Options ✓ ✓ FUNCTIONALITY Hidden Storage In Every Seat ✓ Changeable Style Via Arms and Covers ✓ DESIGNED FOR LIFE Lifetime Warranty ✓ ✓ Replaceable Pieces ✓ Upgradeable ✓

I N V ES T OR DA Y 2 0 2 4 …and from Sactionals to minimize interaction BENEFIT SACTIONALS EVERCOUCH DESIGNED TO EVOLVE Rearrangeable ✓ Expandable ✓ Changeable Style ✓ ✓ Moveable ✓ Less modular BUILT TO LAST Maintainable ✓ Less modular Replaceable Components ✓ Less modular Upgradeable Components ✓ Platform-specific over time Durable ✓ ✓

I N V ES T OR DA Y 2 0 2 4 Investor Day 2024 EVERCOUCH CUSTOMER ACQUISITION ENGINE Brand & Performance Marketing Digital Configuration Showroom Experiences Partner Demonstrations Customer Relationships Built to Last Designed to Evolve Platform Extensions… Like everything Lovesac does, EverCouch will have its own Designed for Life product roadmap and will be wrapped in a tailored Customer Acquisition Engine to drive awareness, conversion and repeat.

I N V ES T OR DA Y 2 0 2 4 Digital Configuration Showroom Experiences Partner Demonstrations Customer Relationships Customer Acquisition Engines Tailored to Each Platform NEW PRODUCT PLATFORMS FY27 NEW PRODUCT PLATFORMS FY28 SACTIONALS SACS EVERCOUCH Brand & Performance Marketing NEW ROOM NEW ROOM

I N V ES T OR DA Y 2 0 2 4 SACTIONALS SACS EVER COUCH NEW ROOM FY27 NEW ROOM FY28 In addition to EverCouch, we will be entering two new rooms of the home over the next three years with similarly competitive Designed for Life product platforms…

I N V ES T OR DA Y 2 0 2 4 STEALTHTECH & SERVICES SACTIONALS SACS EVERCOUCH NEW ROOM FY27 NEW ROOM FY28 …all connected by StealthTech and Services

I N V ES T OR DA Y 2 0 2 4 We are prudently investing in our brand and capabilities to build the most loved brand in America 2 more dominant Designed For Life Platforms to launch in FY27 and FY28 – development long underway Our pace of innovation is increasing...FY25 was our biggest year of innovation, & we’re just getting started In months we’ll enter the $14B sofa market with our 3rd Designed For Life Platform, the EverCouch Our installed base & half-a-billion compounded ad spend = brand strength to leverage for new categories Key CEO Takeaways looking forward

I N V ES T OR DA Y 2 0 2 4

I N V ES T OR DA Y 2 0 2 4 Mary Fox President and COO Sam Martin SVP, Strategy & Growth

I N V ES T OR DA Y 2 0 2 4 Customer Acquisition Engines

I N V ES T OR DA Y 2 0 2 4 Our 2 Superpowers A High-Growth Capital-Light Profitable Business Model (and brand) Designed For Life TM PRODUCTS CUSTOMER ACQUISITION ENGINES

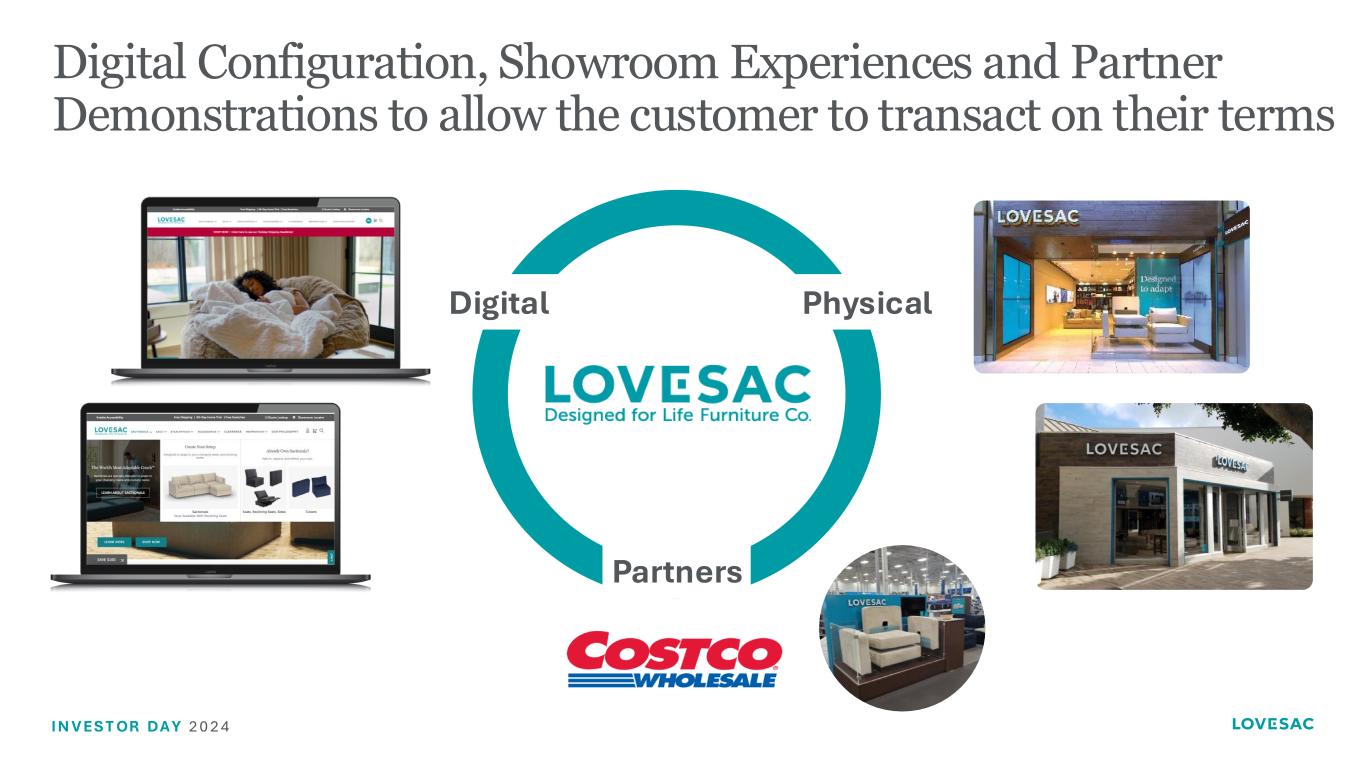

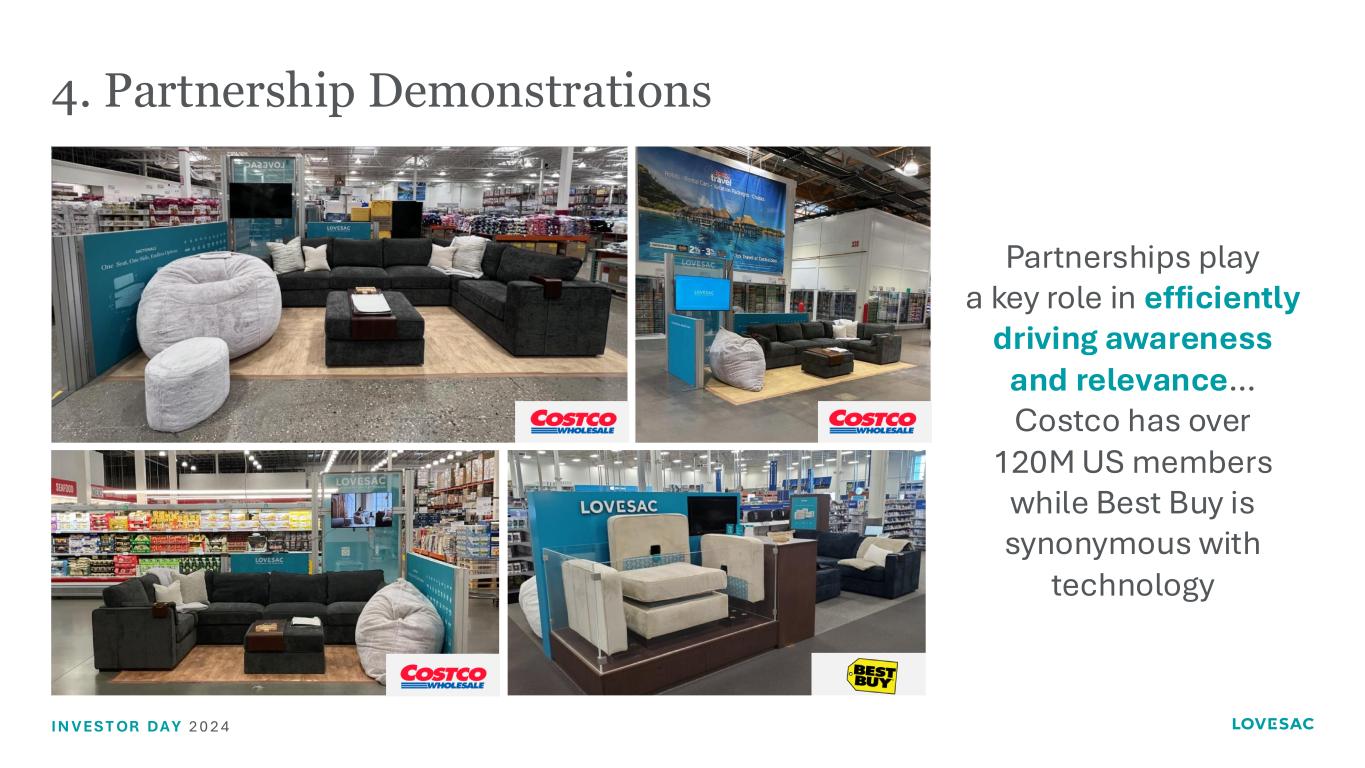

I N V ES T OR DA Y 2 0 2 4 Media, activations, PR, influencers, social, SEO, test-and-learn1. Brand & Performance Marketing Complex products made simple online; Transact on customer's terms2. Digital Configuration Complex products made simple in-person; Transact on customer's terms3. Showroom Experiences Costco, Best Buy, TBD; We own 100% of our customer data4. Partner Demonstrations Deliver in days vs. months; Repeat purchase & referral with platform add-ons & services (new)5. Customer Relationships Customer Acquisition Engines

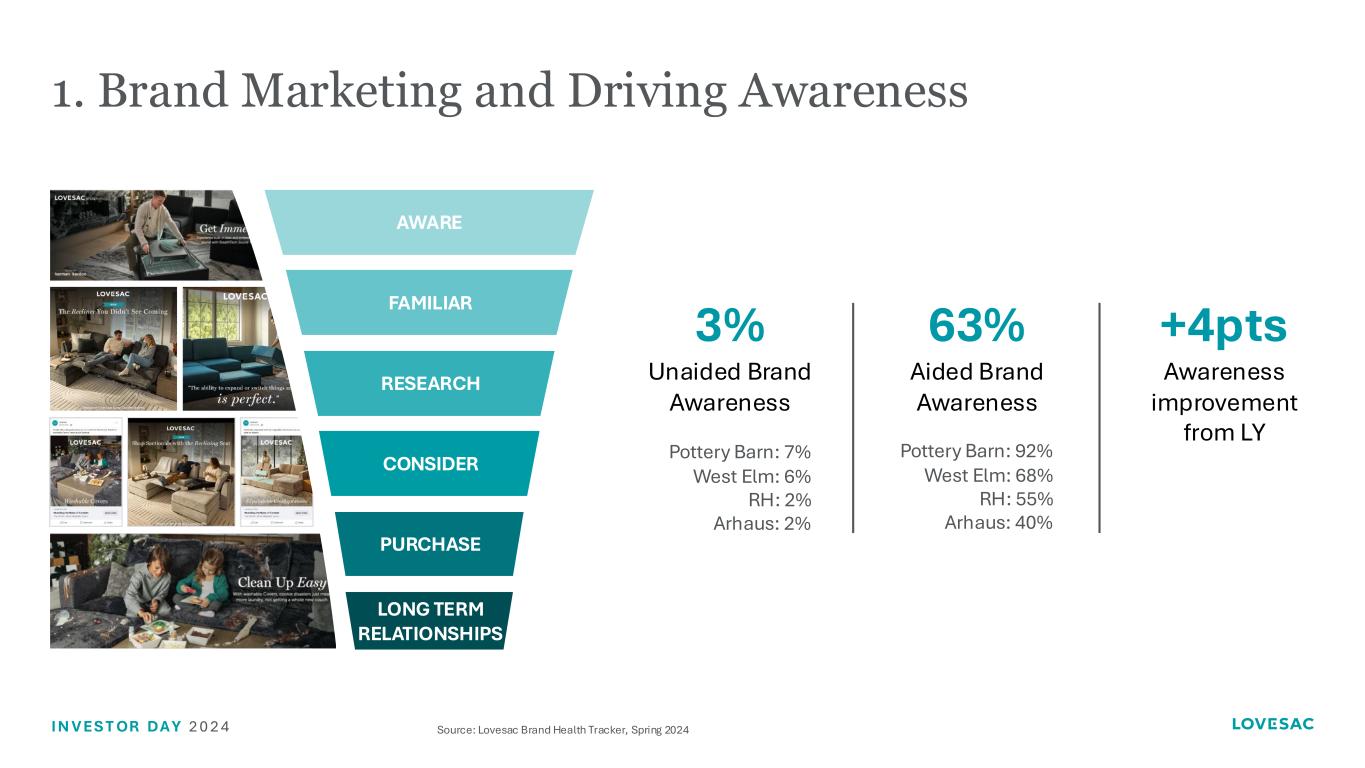

I N V ES T OR DA Y 2 0 2 4 1. Brand Marketing and Driving Awareness RESEARCH FAMILIAR CONSIDER AWARE PURCHASE LONG TERM RELATIONSHIPS 63% Aided Brand Awareness +4pts Awareness improvement from LY Pottery Barn: 92% West Elm: 68% RH: 55% Arhaus: 40% 3% Unaided Brand Awareness Pottery Barn: 7% West Elm: 6% RH: 2% Arhaus: 2% Source: Lovesac Brand Health Tracker, Spring 2024

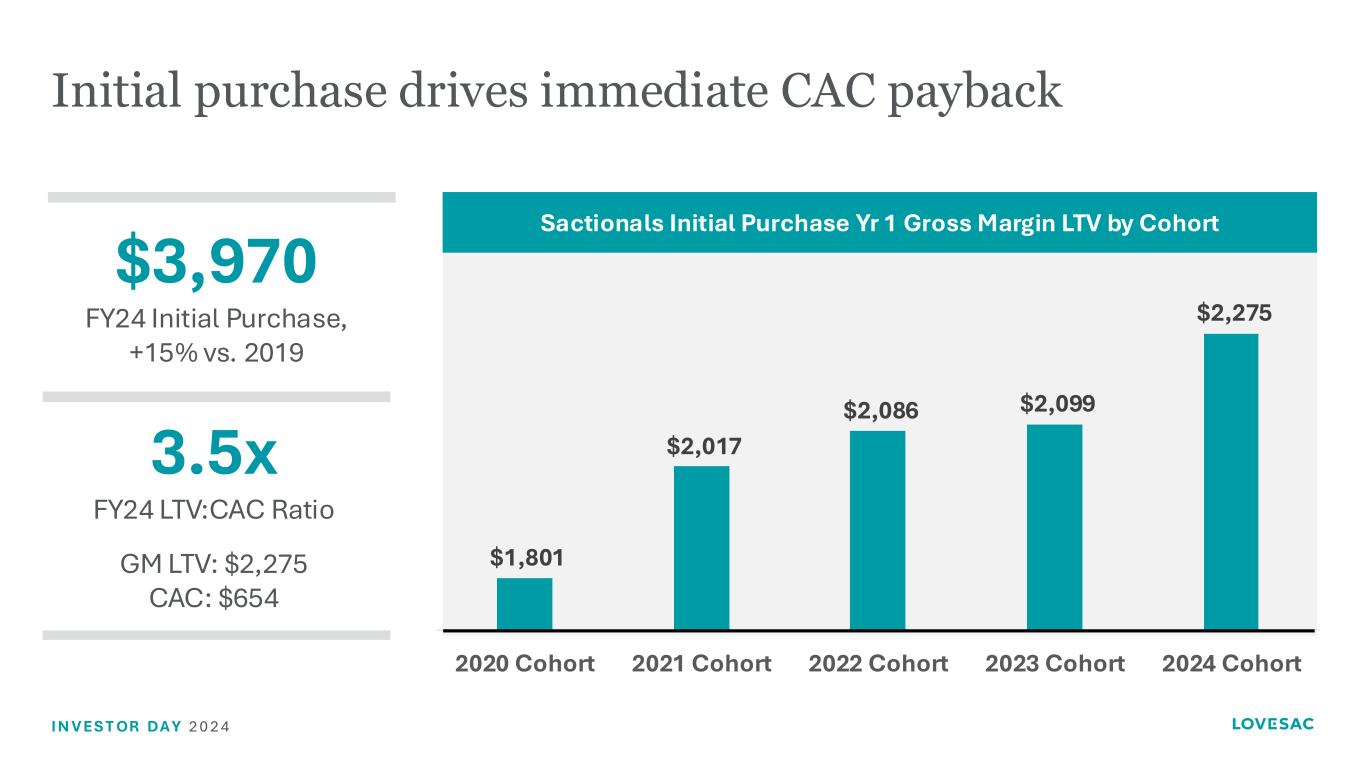

I N V ES T OR DA Y 2 0 2 4 Initial purchase drives immediate CAC payback Sactionals Initial Purchase Yr 1 Gross Margin LTV by Cohort GM LTV: $2,275 CAC: $654 3.5x FY24 LTV:CAC Ratio $1,801 $2,017 $2,086 $2,099 $2,275 2020 Cohort 2021 Cohort 2022 Cohort 2023 Cohort 2024 Cohort $3,970 FY24 Initial Purchase, +15% vs. 2019

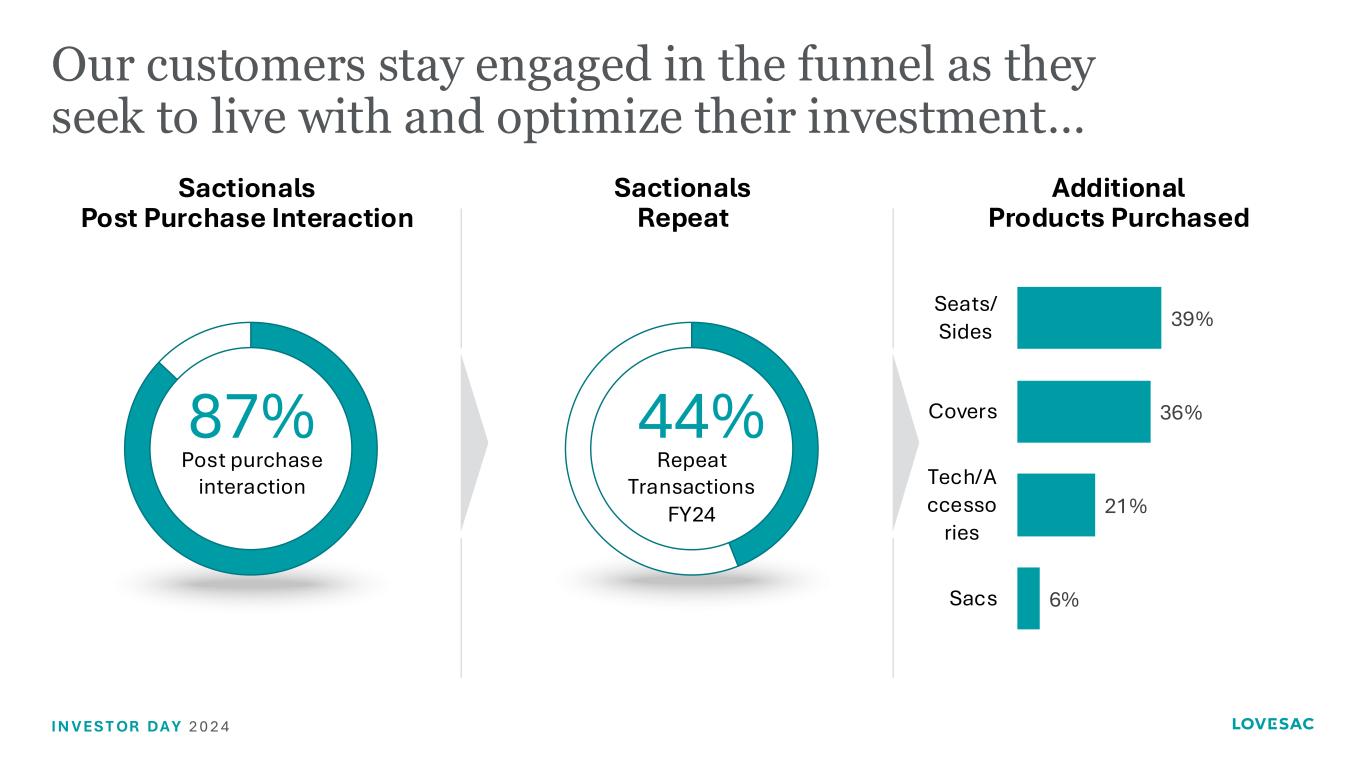

I N V ES T OR DA Y 2 0 2 4 Sactionals Post Purchase Interaction 87% Post purchase interaction 44% Repeat Transactions FY24 39% 36% 21% 6% Seats/ Sides Covers Tech/A ccesso ries Sacs Sactionals Repeat Additional Products Purchased Our customers stay engaged in the funnel as they seek to live with and optimize their investment…

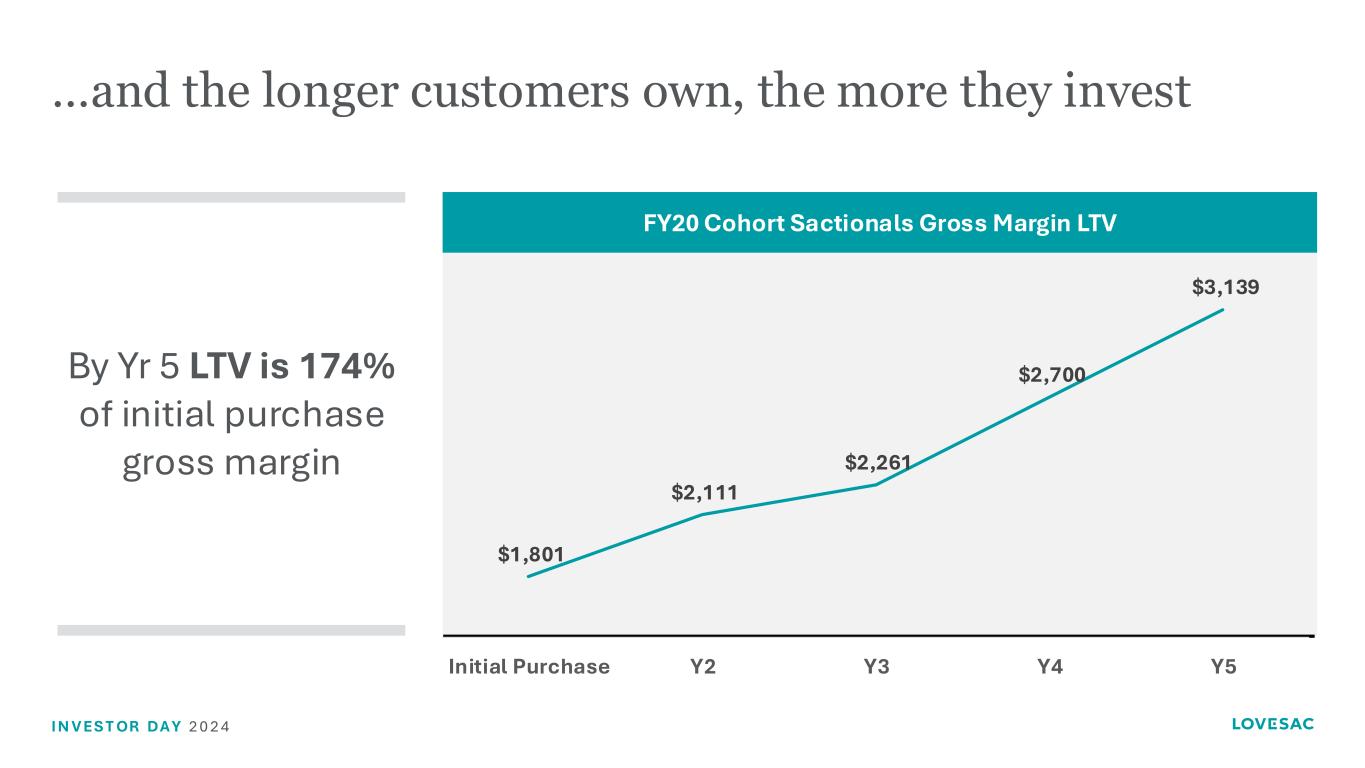

I N V ES T OR DA Y 2 0 2 4 …and the longer customers own, the more they invest By Yr 5 LTV is 174% of initial purchase gross margin $1,801 $2,111 $2,261 $2,700 $3,139 Initial Purchase Y2 Y3 Y4 Y5 FY20 Cohort Sactionals Gross Margin LTV

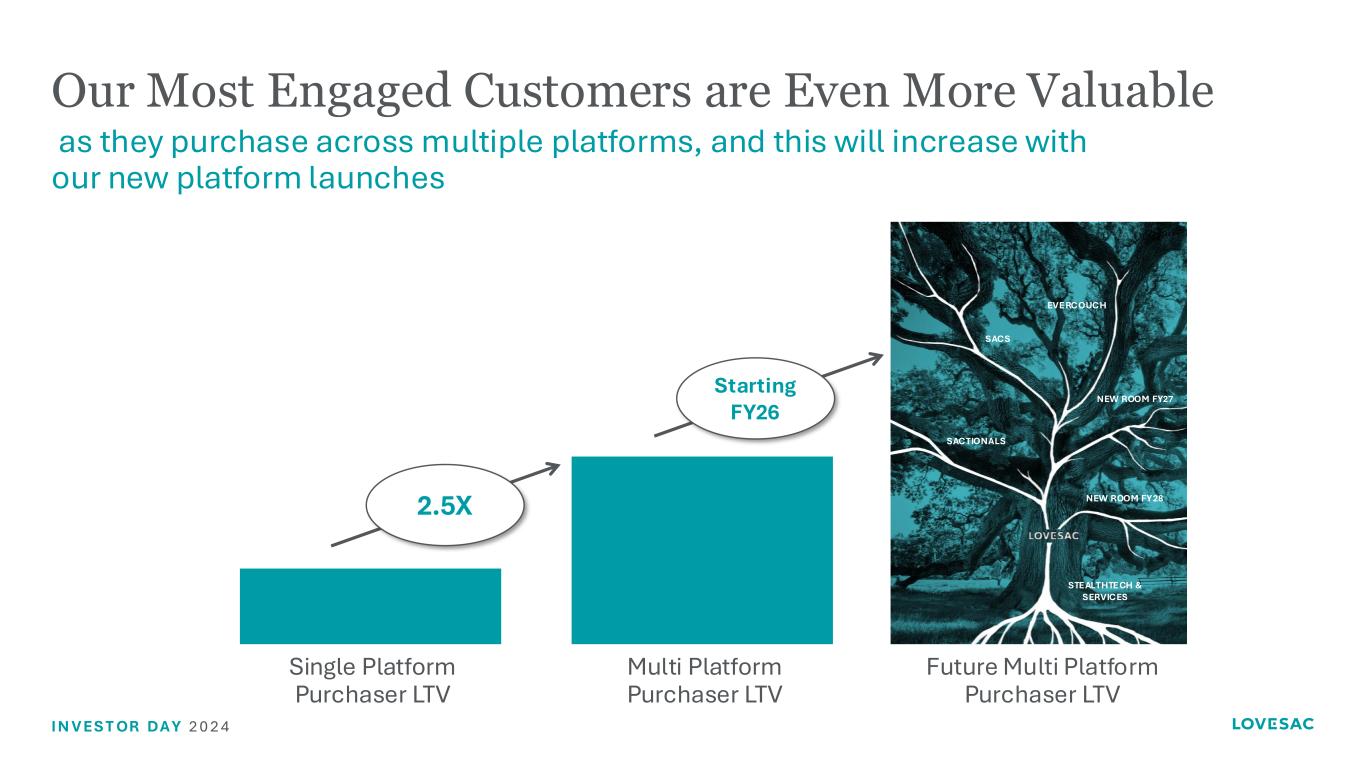

I N V ES T OR DA Y 2 0 2 4 2.5X Starting FY26 Our Most Engaged Customers are Even More Valuable Single Platform Purchaser LTV Multi Platform Purchaser LTV Future Multi Platform Purchaser LTV STEALTHTECH & SERVICES SACTIONALS SACS EVERCOUCH NEW ROOM FY27 NEW ROOM FY28 as they purchase across multiple platforms, and this will increase with our new platform launches

I N V ES T OR DA Y 2 0 2 4 Partners Digital Physical Digital Configuration, Showroom Experiences and Partner Demonstrations to allow the customer to transact on their terms

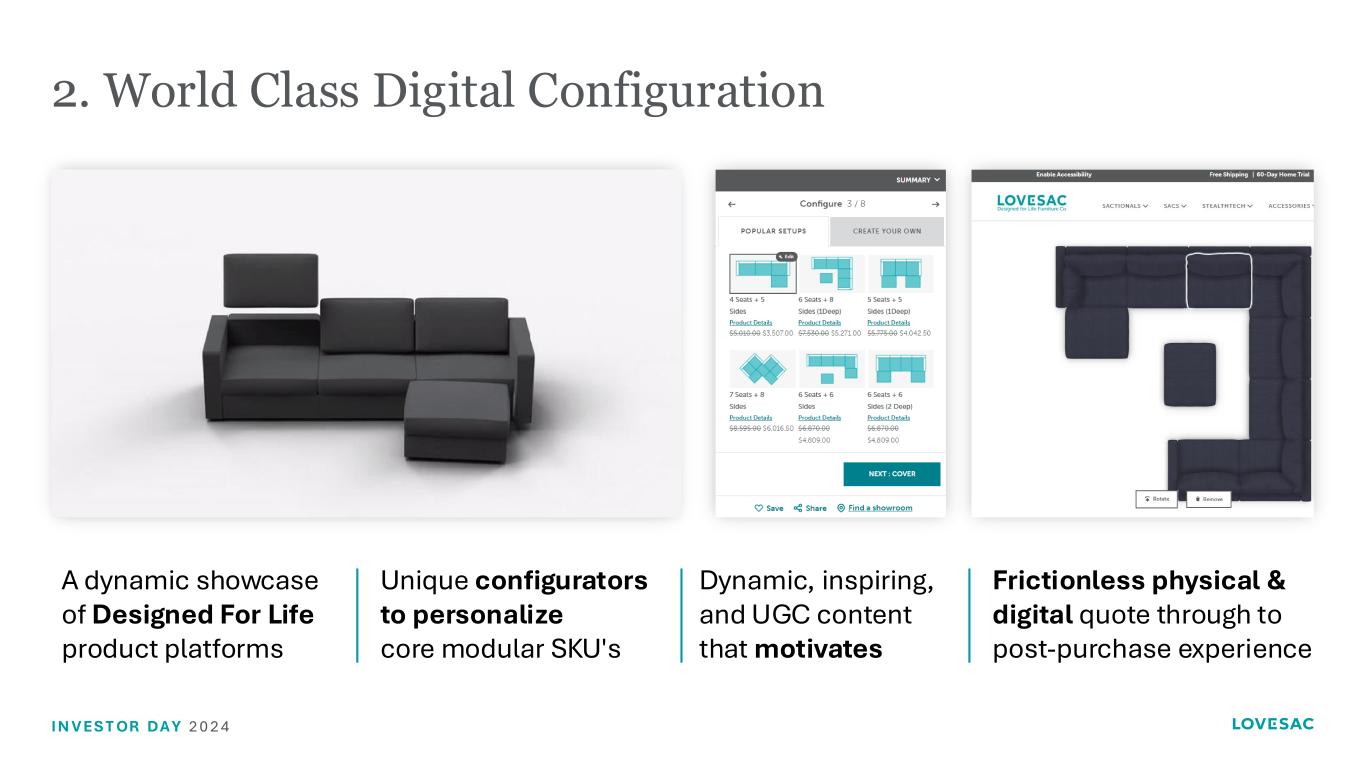

I N V ES T OR DA Y 2 0 2 4 2. World Class Digital Configuration Dynamic, inspiring, and UGC content that motivates A dynamic showcase of Designed For Life product platforms Unique configurators to personalize core modular SKU's Frictionless physical & digital quote through to post-purchase experience

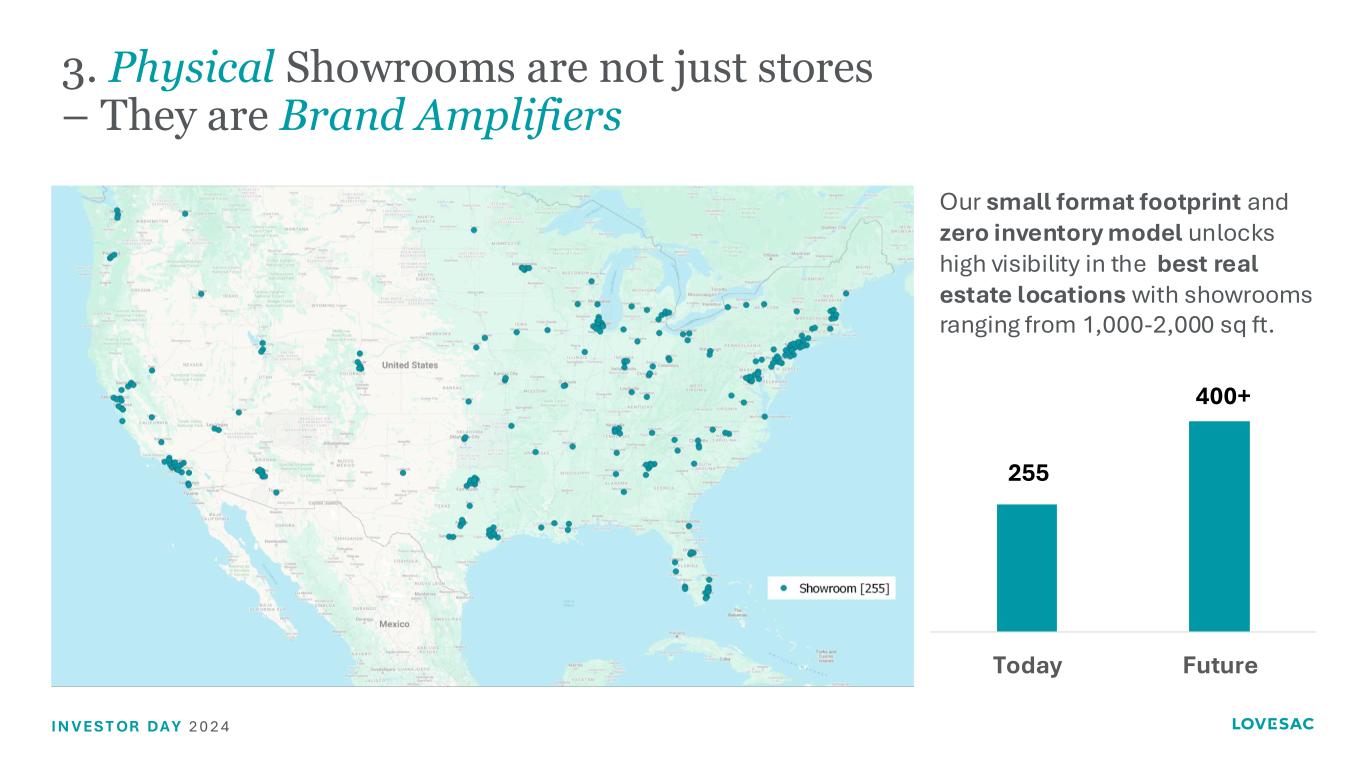

I N V ES T OR DA Y 2 0 2 4 3. Physical Showrooms are not just stores – They are Brand Amplifiers Our small format footprint and zero inventory model unlocks high visibility in the best real estate locations with showrooms ranging from 1,000-2,000 sq ft. Today Future 400+ 255

I N V ES T OR DA Y 2 0 2 4

I N V ES T OR DA Y 2 0 2 4

I N V ES T OR DA Y 2 0 2 4

I N V ES T OR DA Y 2 0 2 4 Physical: Our Showrooms are great investments on their merits Key focus is delivering simple demos of our complex Designed for Life platforms 1.2 yrs 4-Wall Payback 255 Showrooms in FY25 28% Web lift in new-market post- opening $1.8M Avg 4-Wall Net Sales(1) (1) Showrooms open more than 12 months. Average net sales trailing twelve months Q3 FY25.

I N V ES T OR DA Y 2 0 2 4 4. Partnership Demonstrations Partnerships play a key role in efficiently driving awareness and relevance… Costco has over 120M US members while Best Buy is synonymous with technology

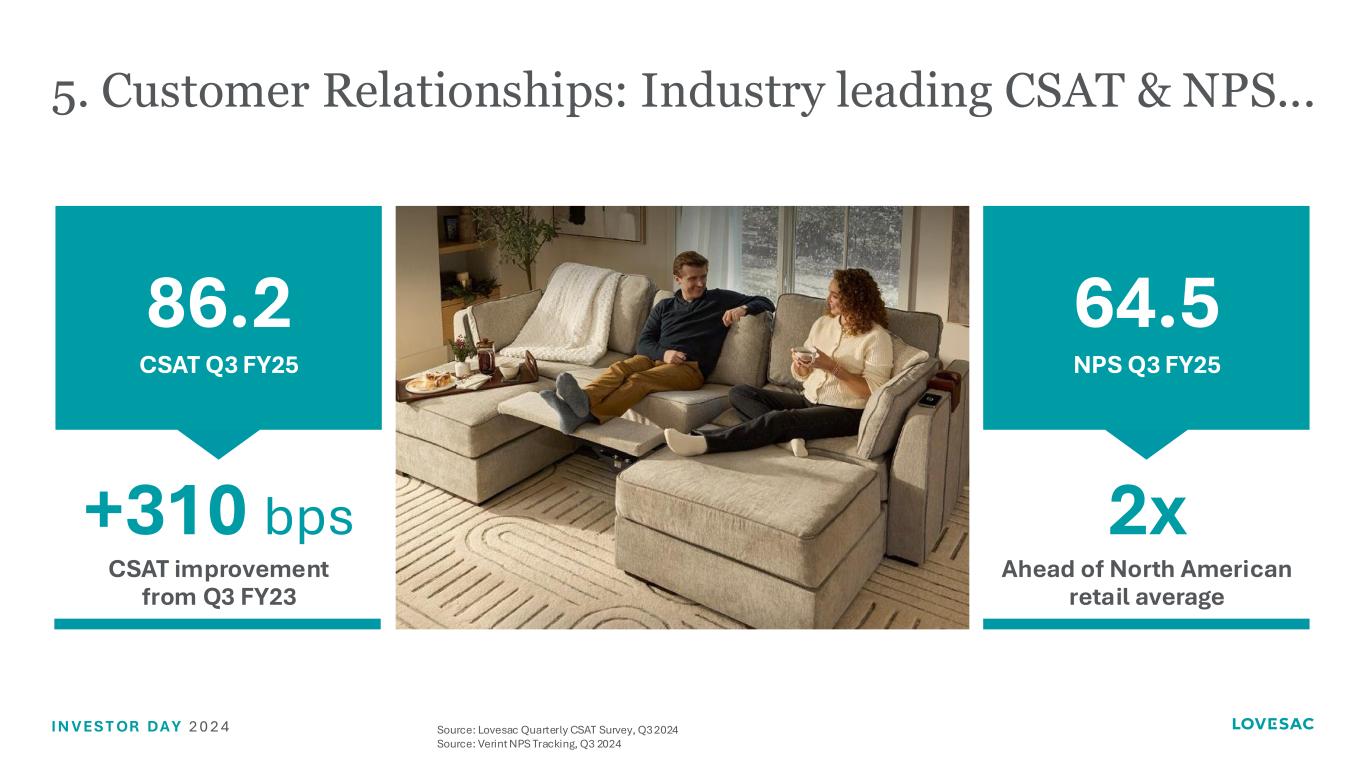

I N V ES T OR DA Y 2 0 2 4 5. Customer Relationships: Industry leading CSAT & NPS... 64.5 NPS Q3 FY25 86.2 CSAT Q3 FY25 2x Ahead of North American retail average +310 bps CSAT improvement from Q3 FY23 Source: Lovesac Quarterly CSAT Survey, Q3 2024 Source: Verint NPS Tracking, Q3 2024

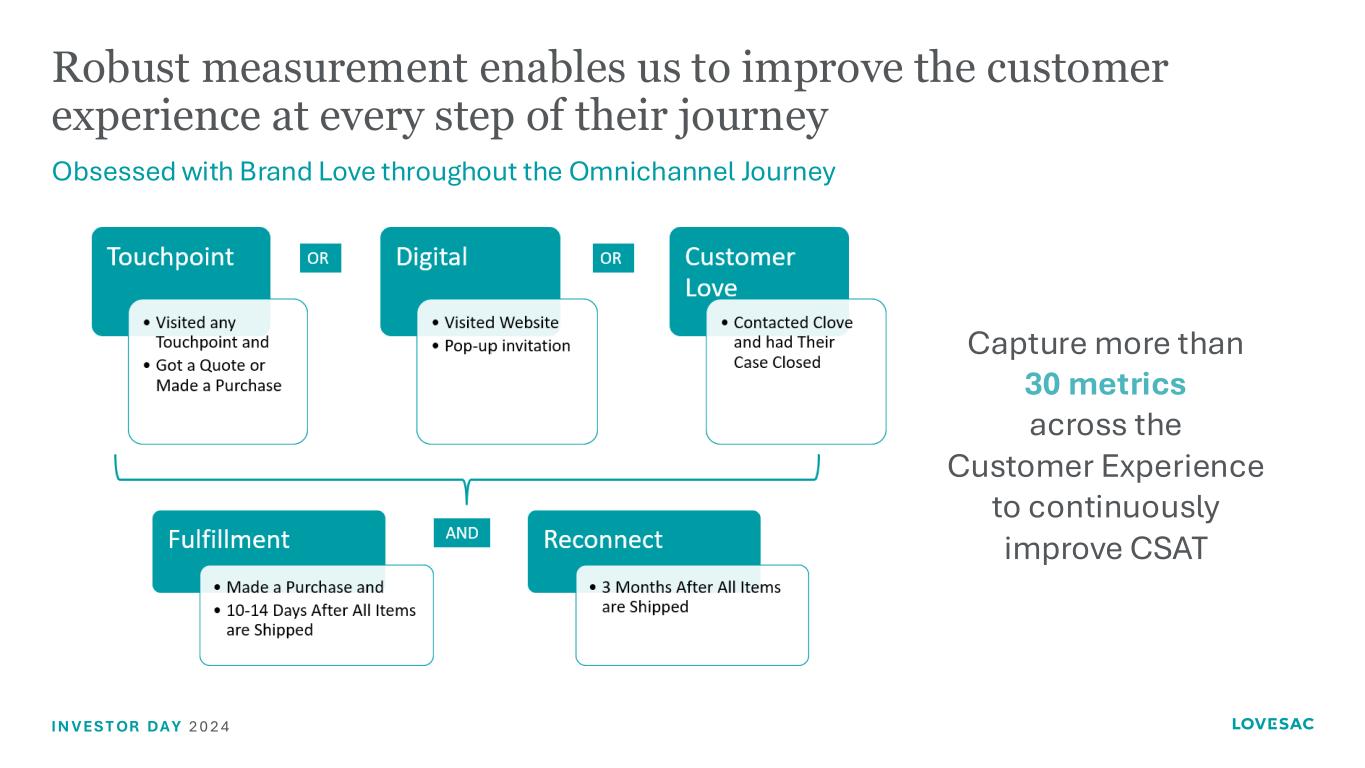

I N V ES T OR DA Y 2 0 2 4 Robust measurement enables us to improve the customer experience at every step of their journey Obsessed with Brand Love throughout the Omnichannel Journey Capture more than 30 metrics across the Customer Experience to continuously improve CSAT

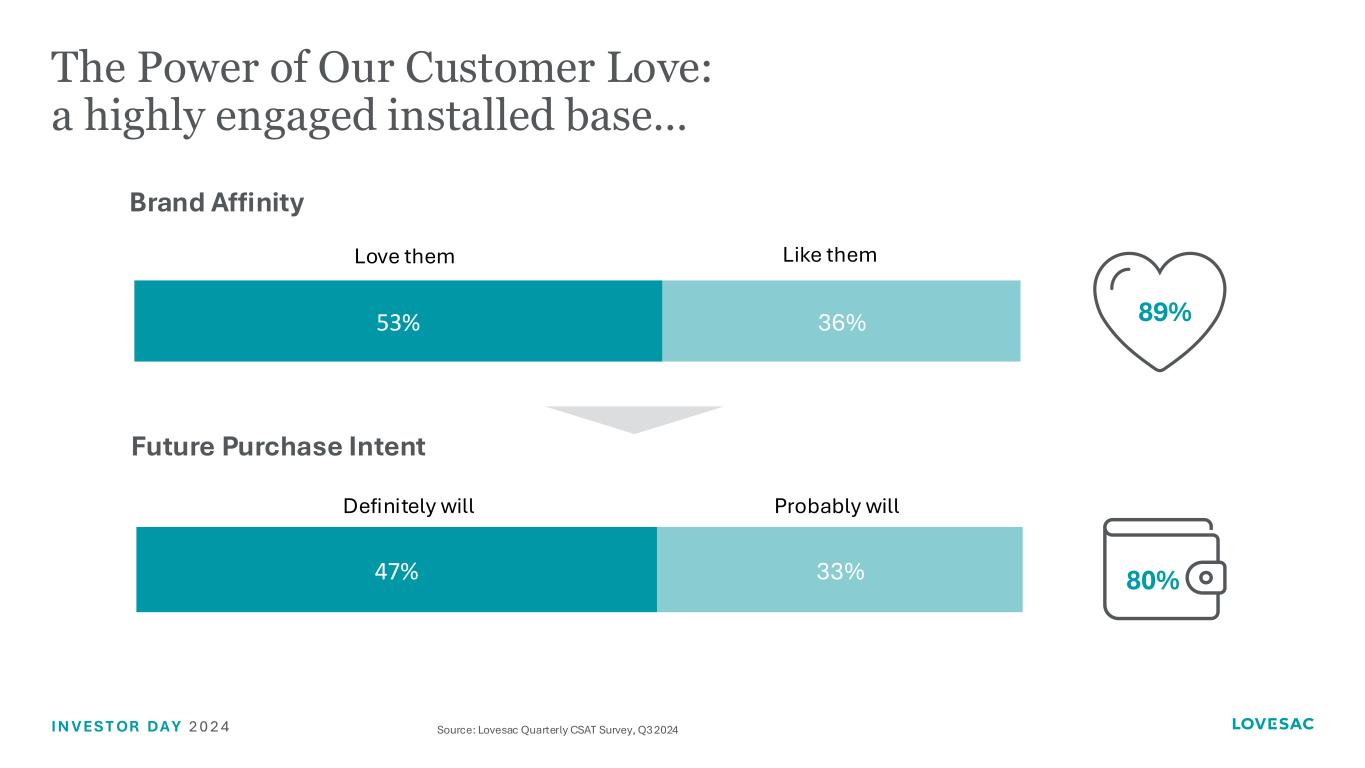

I N V ES T OR DA Y 2 0 2 4 The Power of Our Customer Love: a highly engaged installed base… 47% 33% Future Purchase Intent Definitely will Probably will 80% 53% 36% Brand Affinity Love them Like them 89% Source: Lovesac Quarterly CSAT Survey, Q3 2024

I N V ES T OR DA Y 2 0 2 4 …that become our most effective marketers 58% 42% 1% Share my opinion unsolicited Share opinion if prompted I would keep my opinion to myself New Customer Source of Awareness 31% 35% 34% Word of Mouth Media Brand Advocacy All Other Source: Lovesac Quarterly CSAT Survey, Q3 2024

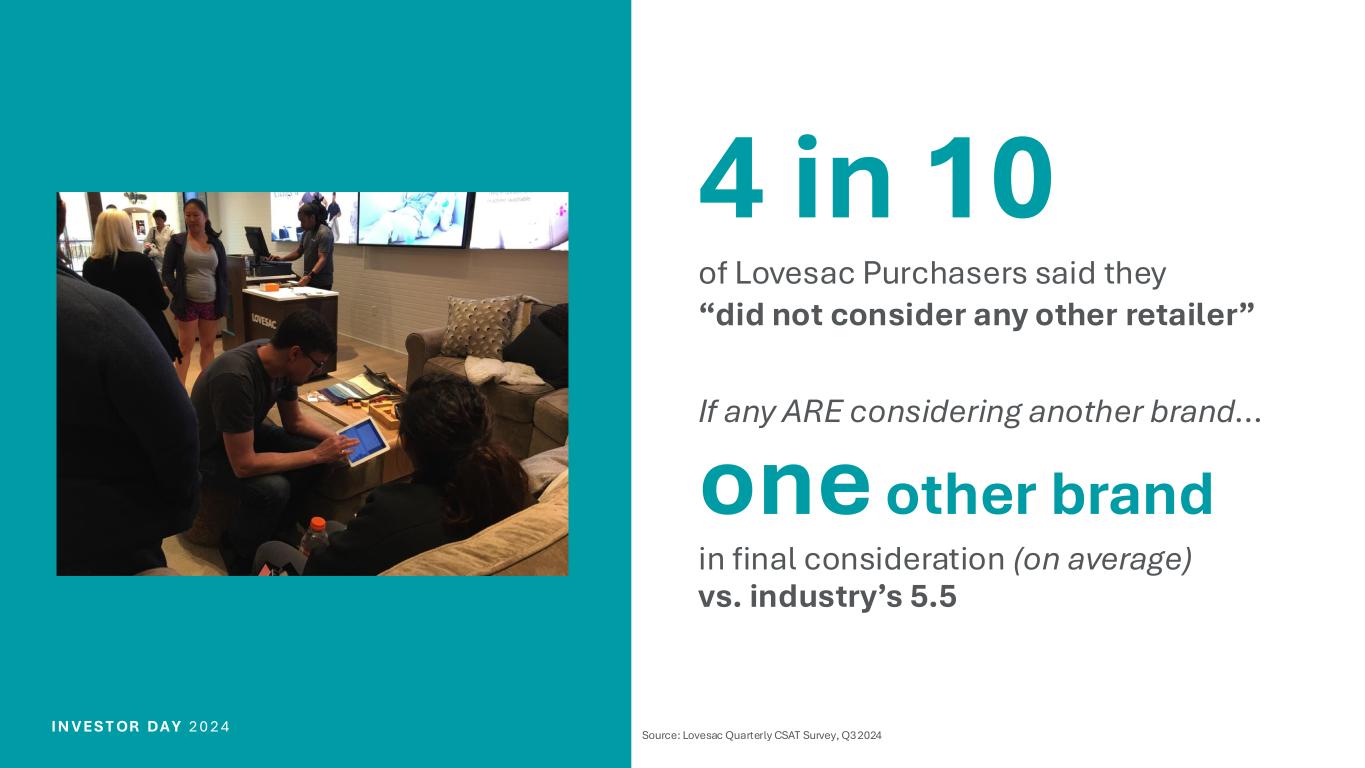

I N V ES T OR DA Y 2 0 2 4 4 in 10 of Lovesac Purchasers said they “did not consider any other retailer” If any ARE considering another brand… one other brand in final consideration (on average) vs. industry’s 5.5 Source: Lovesac Quarterly CSAT Survey, Q3 2024

I N V ES T OR DA Y 2 0 2 4 “I have had my Sactional for a little over 3 years now and just upgraded it with the StealthTech. It's truly amazing, the sound quality is better than expected and has made watching movies next level! I couldn't be happier with my Lovesac products and I'm looking forward to enjoying them for years to come!” -- AK “Bought our Lovesac about 5 years ago. We just did basic canvas fabric in Navy. This is actually installed on our houseboat. Between wet kids and two wet dogs it somehow looks new. It is a pain to put together but not impossible by any means. It’s great that it can be configured in so many layouts. We recently moved it to a bigger houseboat, and I was able to reconfigure to meet our new space. Super comfy too!” – LMT “I started my Lovesac Sactional 4 years ago. Since then, I have changed the color once, configuration more times than I can count and added multiple new pieces. I manage all changes by myself (I would definitely need help with traditional sofa). I love that I can wash my sofa regularly since all the covers are removable! Lovesac Sactionals are perfect as a sofa, chair, pit or whatever arrangement you need now and whatever you might need in the future.” – Kelly B You will not be disappointed. Our oldest is 10 years old and it lives like 1 year old furniture - still amazing after all these years.” – Dave M Our customers in action

I N V ES T OR DA Y 2 0 2 4 Our model is profitable immediately and builds over time as customers invest in our platforms Our Customer Acquisition Engines simplify highly complex products for efficient conversion We marry digital, physical and partner models to meet the customer where they are in their journey Key COO Takeaways Customer Acquisition Engines Our customer obsession converts customers’ brand love into our strongest marketing engine

I N V ES T OR DA Y 2 0 2 4 Our Growth Enablers

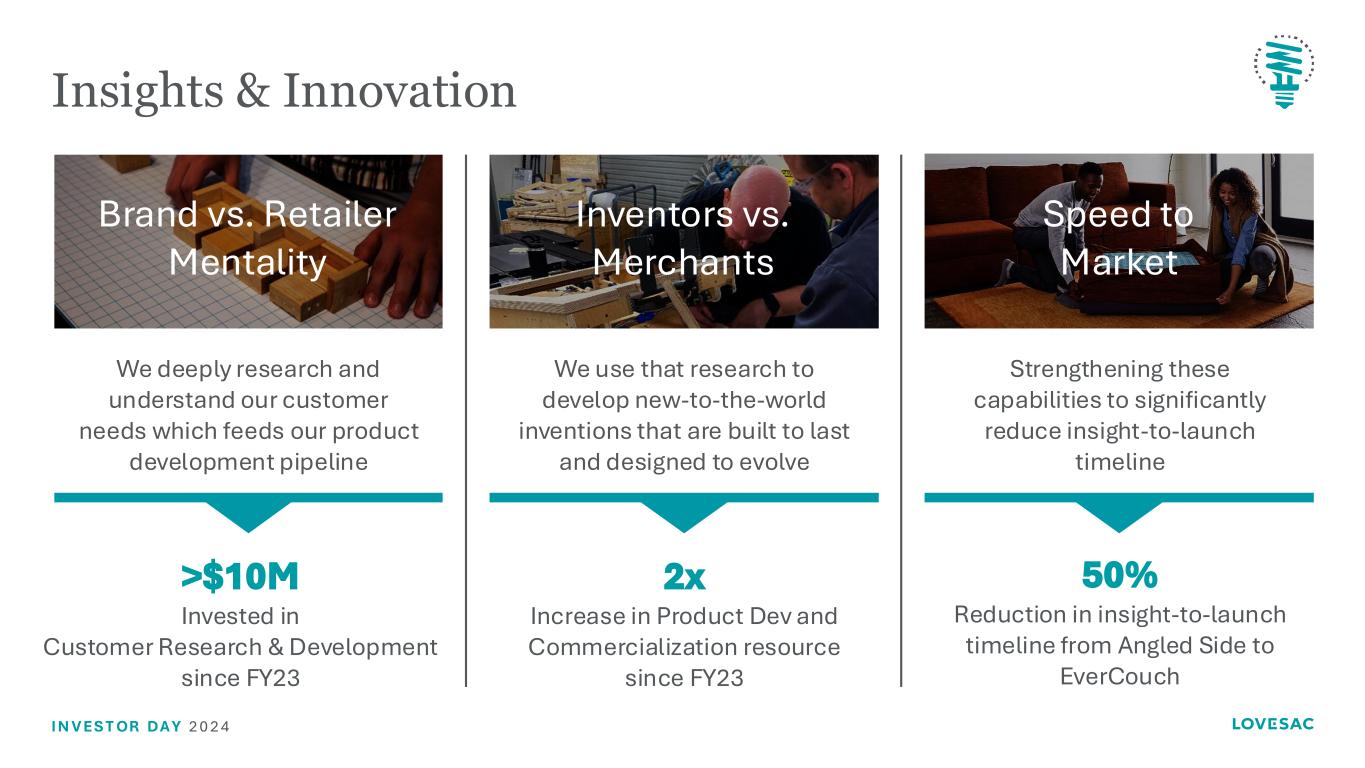

I N V ES T OR DA Y 2 0 2 4 Insights & Innovation We deeply research and understand our customer needs which feeds our product development pipeline We use that research to develop new-to-the-world inventions that are built to last and designed to evolve Strengthening these capabilities to significantly reduce insight-to-launch timeline >$10M Invested in Customer Research & Development since FY23 2x Increase in Product Dev and Commercialization resource since FY23 50% Reduction in insight-to-launch timeline from Angled Side to EverCouch Brand vs. Retailer Mentality Inventors vs. Merchants Speed to Market

I N V ES T OR DA Y 2 0 2 4 All that muscle has allowed us to turbocharge our innovation… FY20 FY21 FY22 FY23 FY24 FY25

I N V ES T OR DA Y 2 0 2 4 …and feeds the pipeline for years to come FY25 FY26 FY27 FY28 $$$,$$$,$$$ EverCouch $$$,$$$,$$$ New Room STEALTHTECH 2.0 To Be Announced Reclining Seat Full Launch Seasonal Throw Pillow StealthTech Charge Side Anytable Surface Product Refinement New Platform New Platform New Platform Sactionals Sacs PACF Sac Quickship: Pine Quilted Kid Super – Puffer Sac & Blue Sac Limited Edition Partnership Activation Limited Edition Limited Edition Partnership Activation Partnership Activation To Be Announced $$$,$$$,$$$ New Room

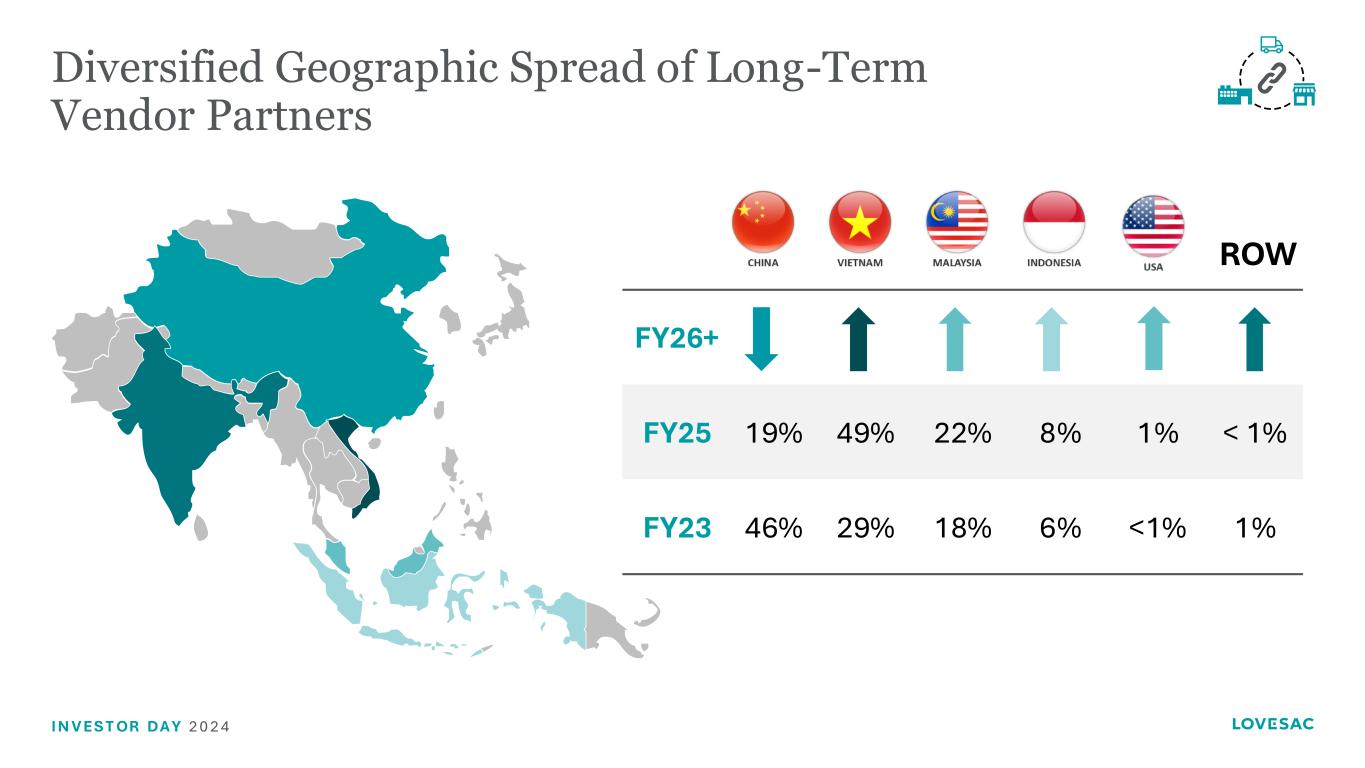

I N V ES T OR DA Y 2 0 2 4 We have built an Advantaged Supply Chain SKU-light and optimized model enables deep in-stock position and scale economies 3PL network partnership enables delivery within days using standard carriers Speed-to-market allows for unparalleled reaction to market trends Diversified geographic vendor base with redundancy and unmatched quality

I N V ES T OR DA Y 2 0 2 4 Diversified Geographic Spread of Long-Term Vendor Partners FY26+ FY25 19% 49% 22% 8% 1% < 1% FY23 46% 29% 18% 6% <1% 1% ROW

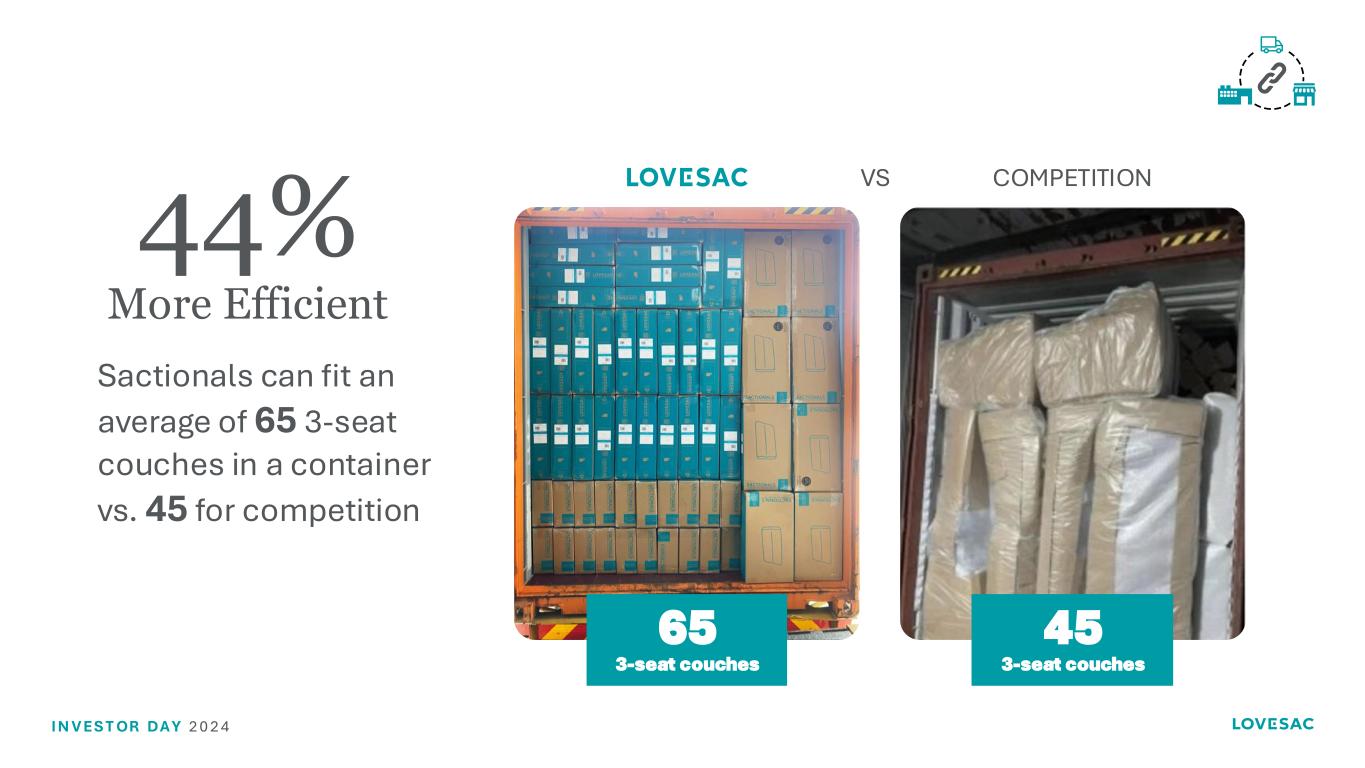

I N V ES T OR DA Y 2 0 2 4 44% More Efficient Sactionals can fit an average of 65 3-seat couches in a container vs. 45 for competition COMPETITION 65 3-seat couches VS 45 3-seat couches

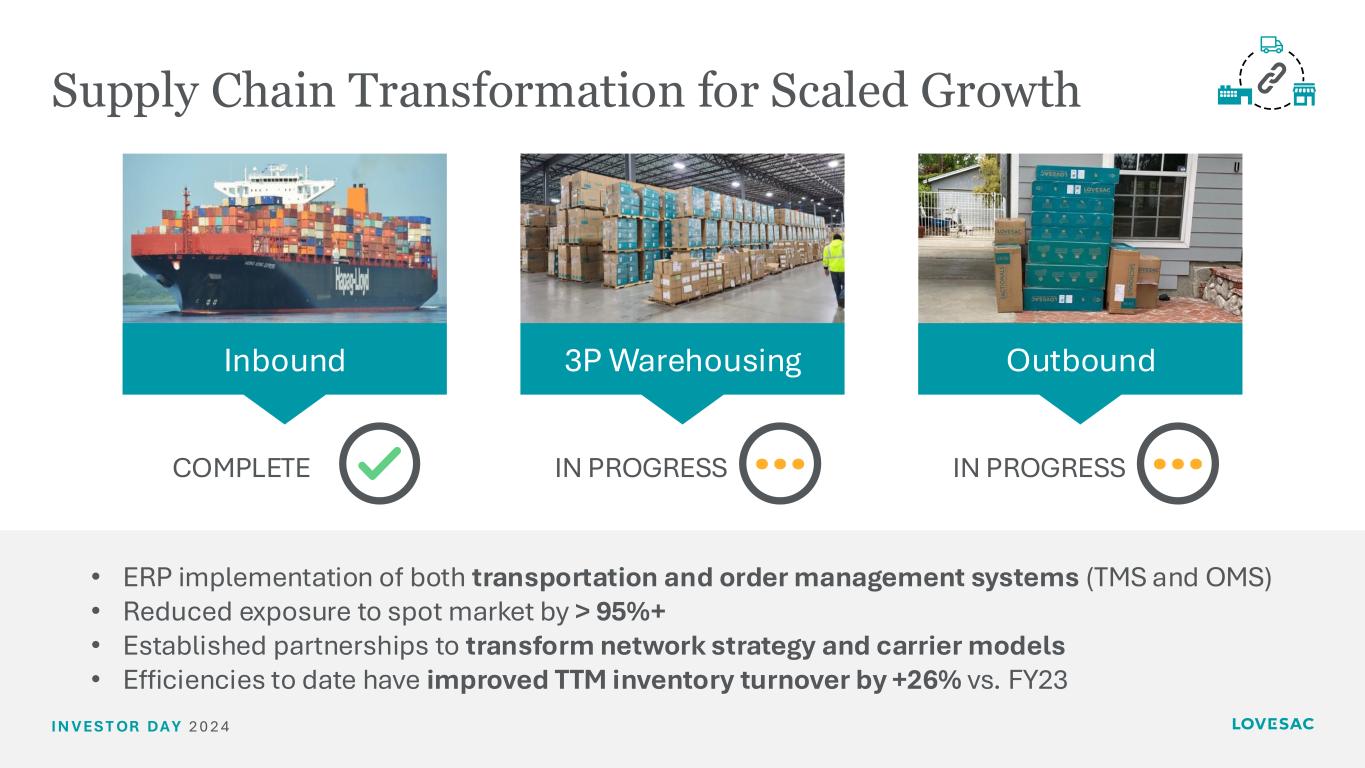

I N V ES T OR DA Y 2 0 2 4 Supply Chain Transformation for Scaled Growth • ERP implementation of both transportation and order management systems (TMS and OMS) • Reduced exposure to spot market by > 95%+ • Established partnerships to transform network strategy and carrier models • Efficiencies to date have improved TTM inventory turnover by +26% vs. FY23 Inbound 3P Warehousing Outbound IN PROGRESSIN PROGRESSCOMPLETE

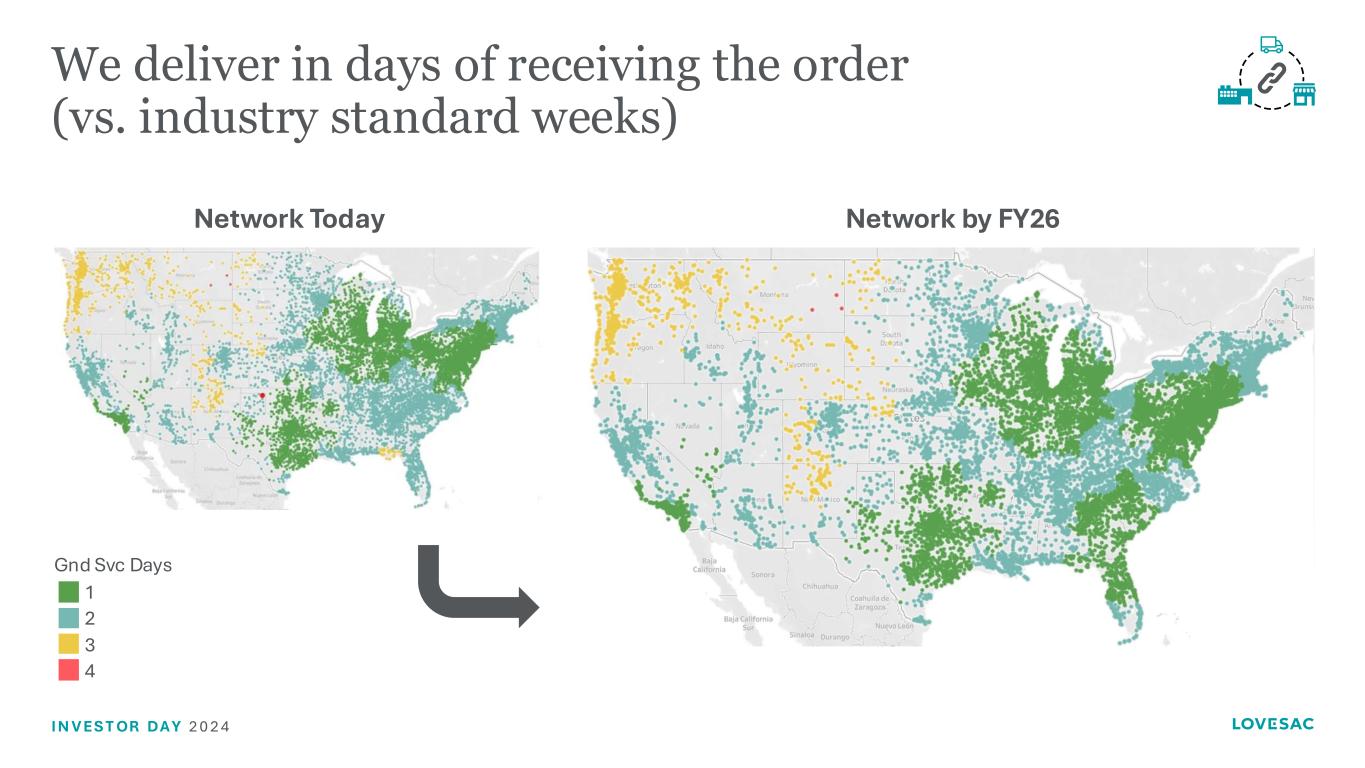

I N V ES T OR DA Y 2 0 2 4 We deliver in days of receiving the order (vs. industry standard weeks) Network Today Network by FY26 1 2 3 4 Gnd Svc Days

I N V ES T OR DA Y 2 0 2 4 Winner Culture OUR #1 CORE VALUE TOP AMBITION: We are united in purpose and passionate about our vision as we drive to achieve results that exceed expectations.

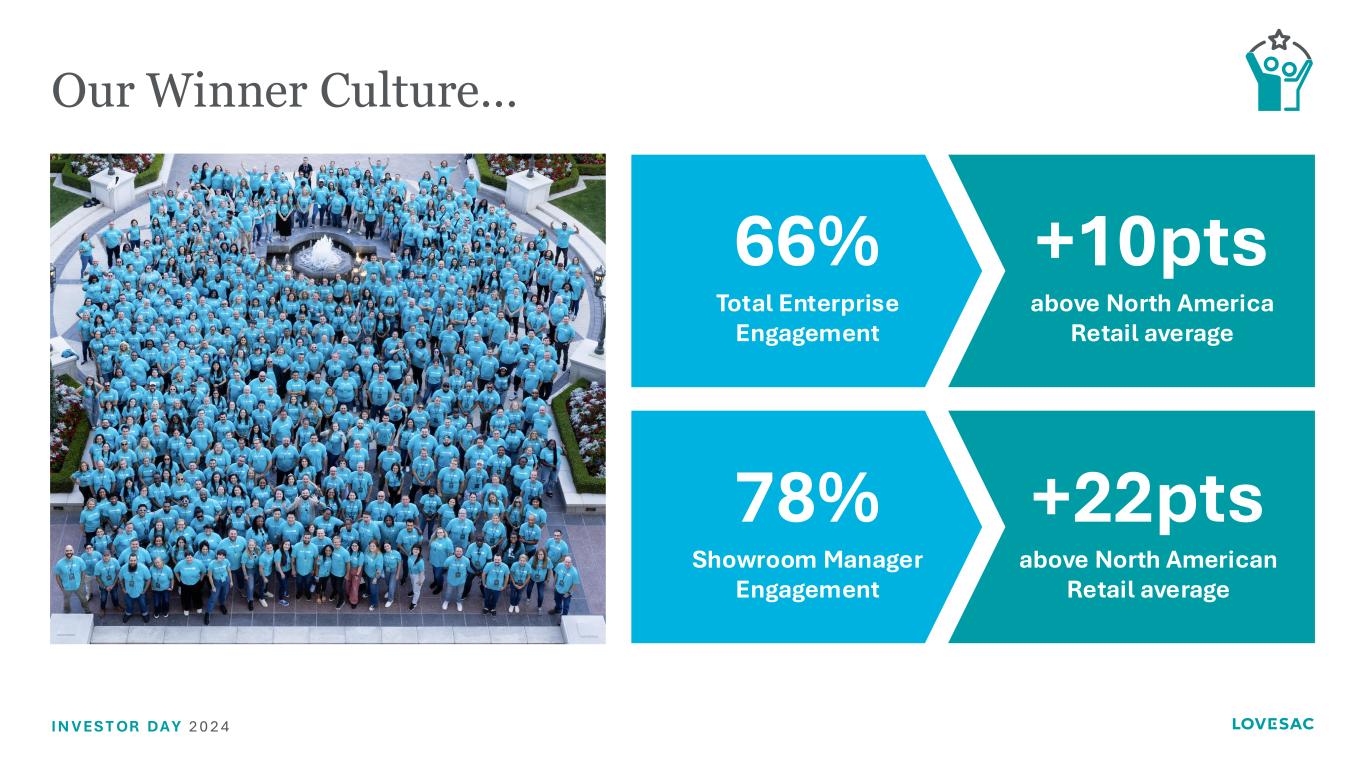

I N V ES T OR DA Y 2 0 2 4 +22pts above North American Retail average Our Winner Culture… 78% Showroom Manager Engagement +10pts above North America Retail average 66% Total Enterprise Engagement

I N V ES T OR DA Y 2 0 2 4 Our Stated Mission: To build the most loved brand in America and triple our household penetration to 3M homes by 2030 …United by Our Stated Purpose: to inspire humankind to buy better to buy less Our Shared KPI’s: Every associate from CEO to the front line is bonused on: 1) financial performance and 2) customer satisfaction

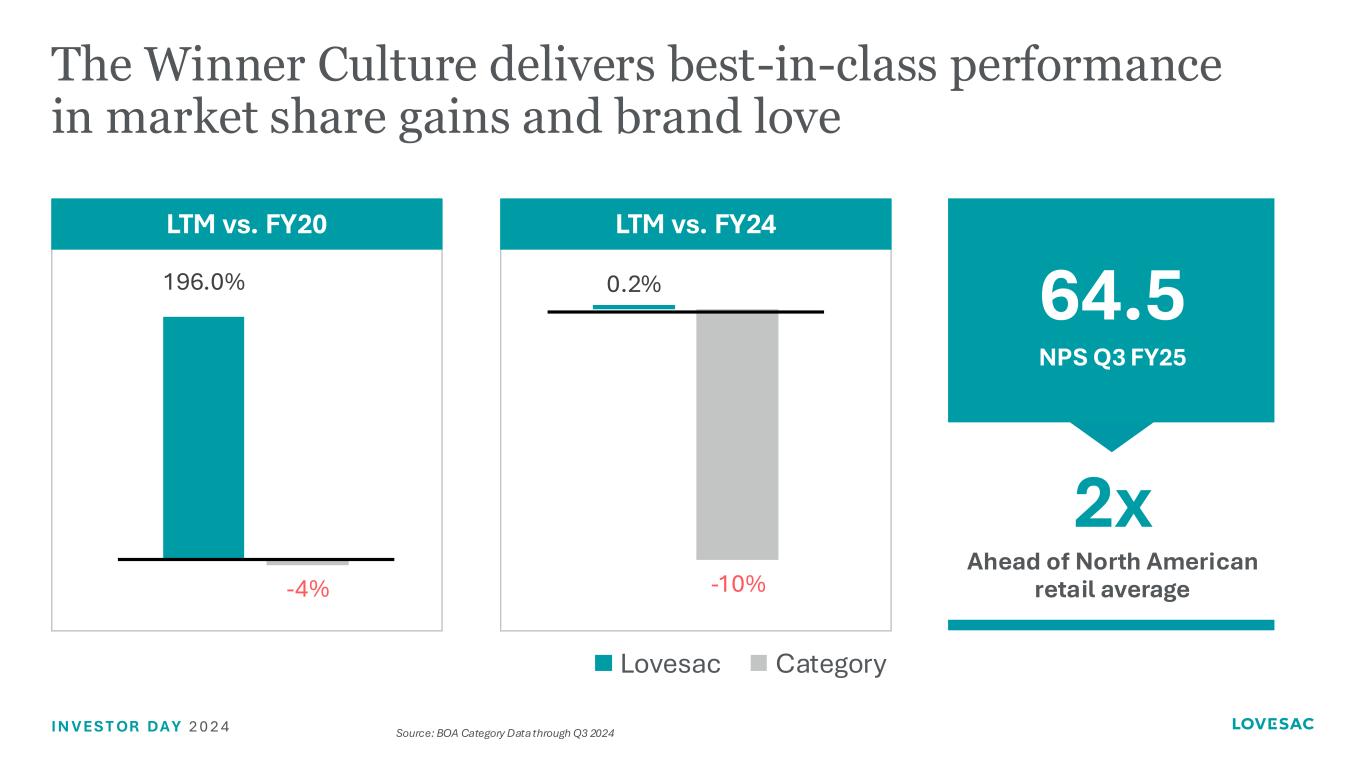

I N V ES T OR DA Y 2 0 2 4 The Winner Culture delivers best-in-class performance in market share gains and brand love 64.5 NPS Q3 FY25 2x Ahead of North American retail average 0.2% -10% 196.0% -4% LTM vs. FY20 LTM vs. FY24 Lovesac Category Source: BOA Category Data through Q3 2024

I N V ES T OR DA Y 2 0 2 4 World Class Operators to deliver growth ambitions Shawn Nelson Founder & CEO Keith Siegner EVP & CFO Mary Fox President & COO Todd Duran CIO John Legg Chief Supply Chain Officer Carly Kawaja Chief People Officer Sam Martin SVP, Strategy & Growth A strong track record of scaling brands globally Experience across dozens of verticals beyond furniture Expertise at developing field and operational capabilities across multi-site enterprises

I N V ES T OR DA Y 2 0 2 4 Our capital-light Supply Chain model unlocks speed and agility to catalyze profitable growth at scale We have assembled a world-class leadership team to lead and scale our next chapter of growth We have fortified our Insights and Innovation teams to support rapid platform expansion Our frontline engagement is a competitive advantage as they continue to turn customers into advocates Key COO Takeaways Growth Enablers

I N V ES T OR DA Y 2 0 2 4 Keith Siegner Chief Financial Officer

I N V ES T OR DA Y 2 0 2 4 Our Financial Outlook

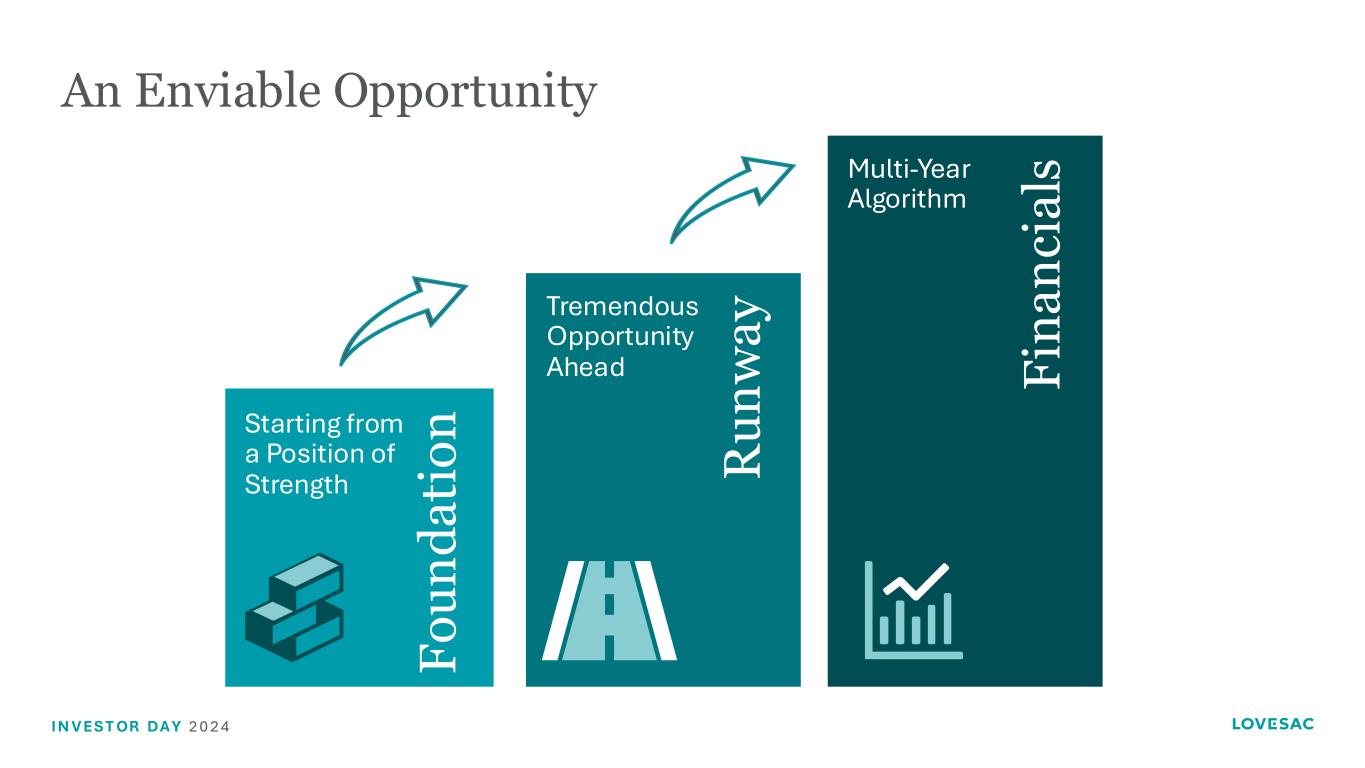

I N V ES T OR DA Y 2 0 2 4 F o u n d a ti o n An Enviable Opportunity R u n w a y F in a n ci a ls Starting from a Position of Strength Tremendous Opportunity Ahead Multi-Year Algorithm

I N V ES T OR DA Y 2 0 2 4 Our business has grown significantly: far in advance of the market CATEGORY(3) -10% 0.2% -3% -5% -3% 1% -1%-4% 196% 149% 28% 22% 17% -16% FY25 TTM Revenue(1)(2) vs. FY20 vs. FY24 Net Sales ($M) $233.4 $689.6 FY20 FY25 TTM +24% CAGR (1) FY25 TTM is the Trailing Twelve Months (FY24 Q4, FY25 Q1-Q3). (2) Competitor information from company filings. (3) Category data from BofA.

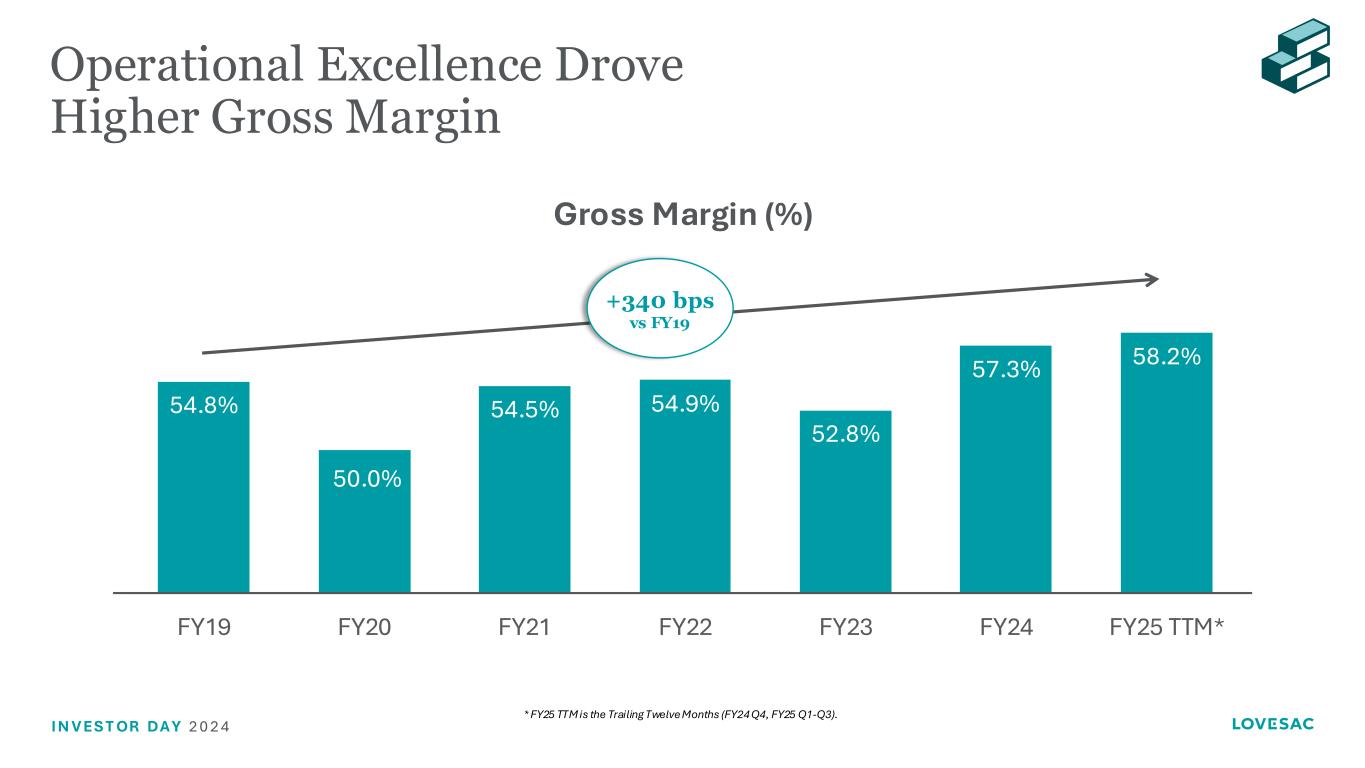

I N V ES T OR DA Y 2 0 2 4 Operational Excellence Drove Higher Gross Margin 54.8% 50.0% 54.5% 54.9% 52.8% 57.3% 58.2% FY19 FY20 FY21 FY22 FY23 FY24 FY25 TTM* * FY25 TTM is the Trailing Twelve Months (FY24 Q4, FY25 Q1-Q3). Gross Margin (%) +340 bps vs FY19

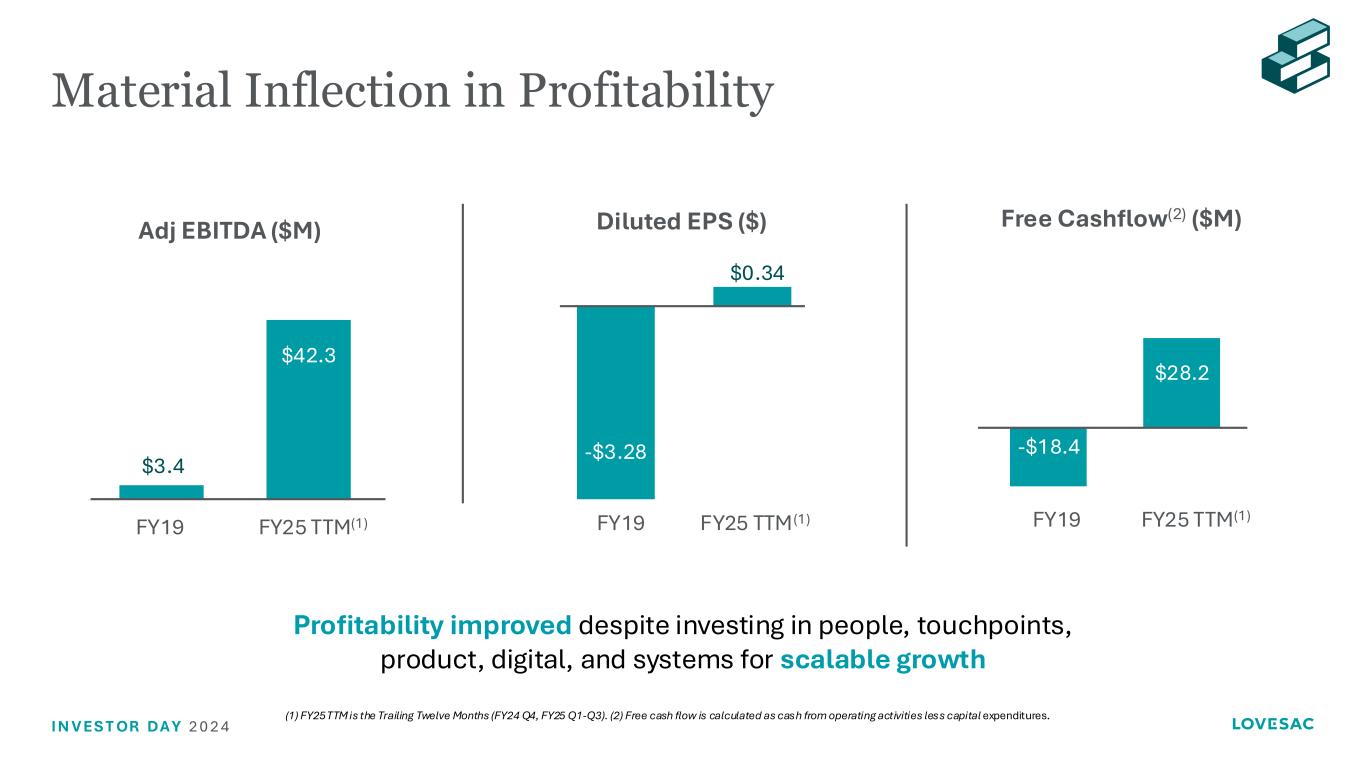

I N V ES T OR DA Y 2 0 2 4 $3.4 $42.3 FY19 FY25 TTM(1) Material Inflection in Profitability Diluted EPS ($) -$3.28 $0.34 Profitability improved despite investing in people, touchpoints, product, digital, and systems for scalable growth FY19 FY25 TTM(1)9 Adj EBITDA ($M) -$18.4 $28.2 Free Cashflow(2) ($M) (1) FY25 TTM is the Trailing Twelve Months (FY24 Q4, FY25 Q1-Q3). (2) Free cash flow is calculated as cash from operating activities less capital expenditures. FY25 TM(1)9 FY19 FY25 TTM(1)9

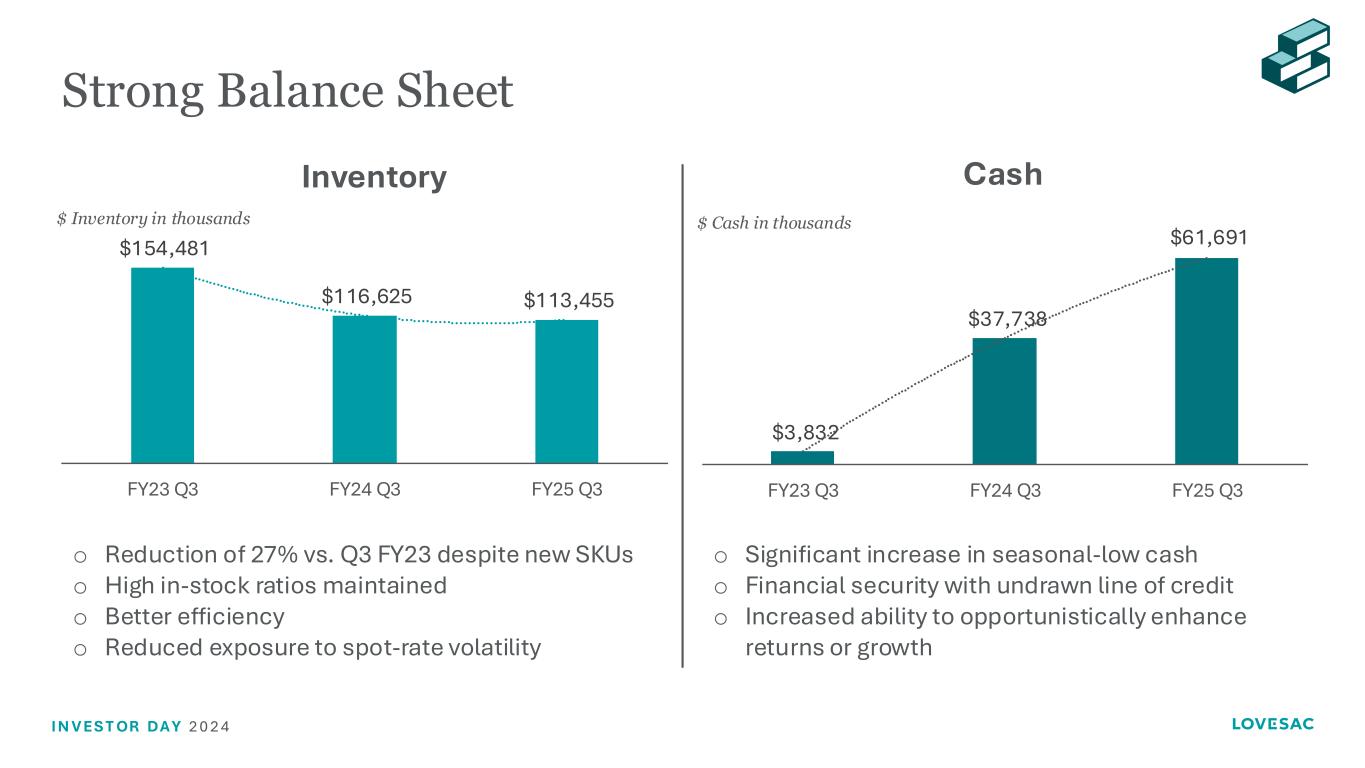

I N V ES T OR DA Y 2 0 2 4 Strong Balance Sheet $154,481 $116,625 $113,455 FY23 Q3 FY24 Q3 FY25 Q3 $ Inventory in thousands o Reduction of 27% vs. Q3 FY23 despite new SKUs o High in-stock ratios maintained o Better efficiency o Reduced exposure to spot-rate volatility Inventory $3,832 $37,738 $61,691 FY23 Q3 FY24 Q3 FY25 Q3 $ Cash in thousands o Significant increase in seasonal-low cash o Financial security with undrawn line of credit o Increased ability to opportunistically enhance returns or growth Cash

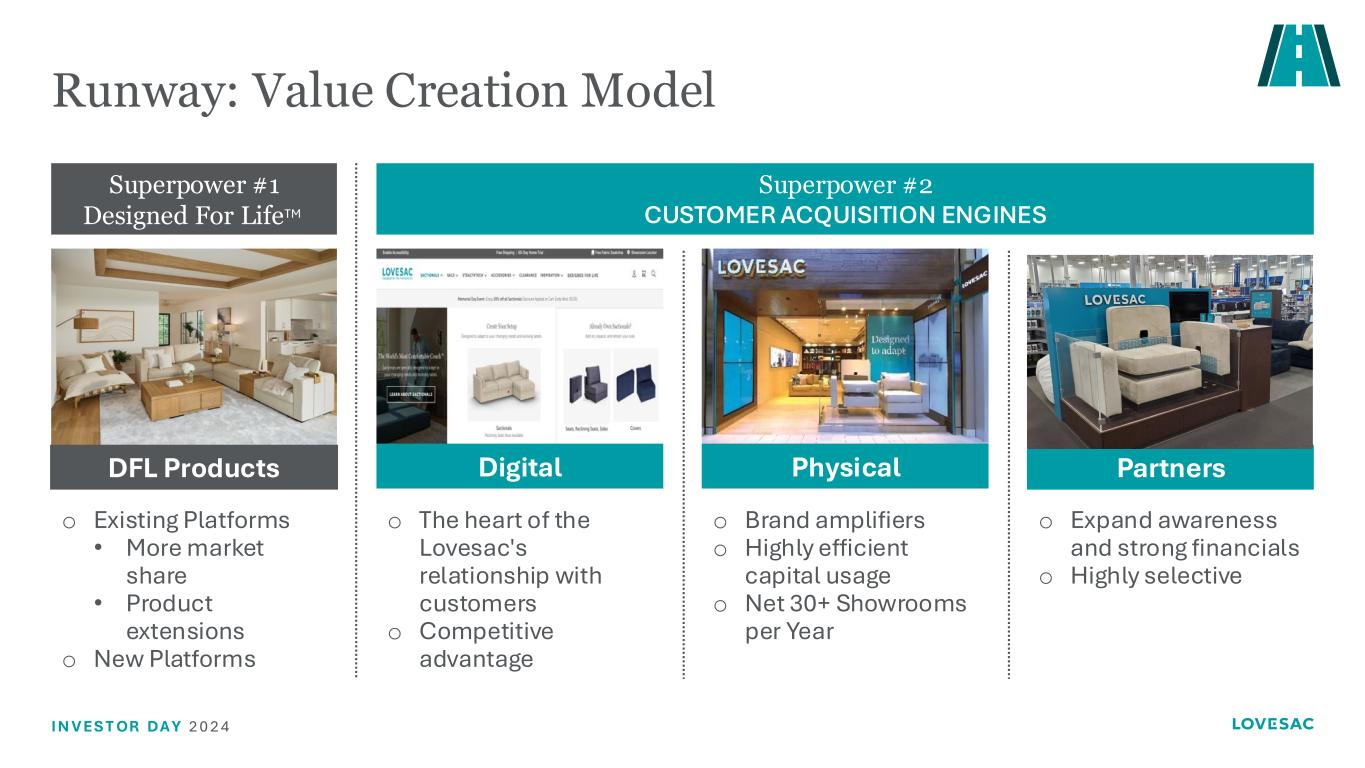

I N V ES T OR DA Y 2 0 2 4 Runway: Value Creation Model Physical o Brand amplifiers o Highly efficient capital usage o Net 30+ Showrooms per Year DFL Products o Existing Platforms • More market share • Product extensions o New Platforms Superpower #1 Designed For Life TM Digital o The heart of the Lovesac's relationship with customers o Competitive advantage Superpower #2 CUSTOMER ACQUISITION ENGINES Partners o Expand awareness and strong financials o Highly selective

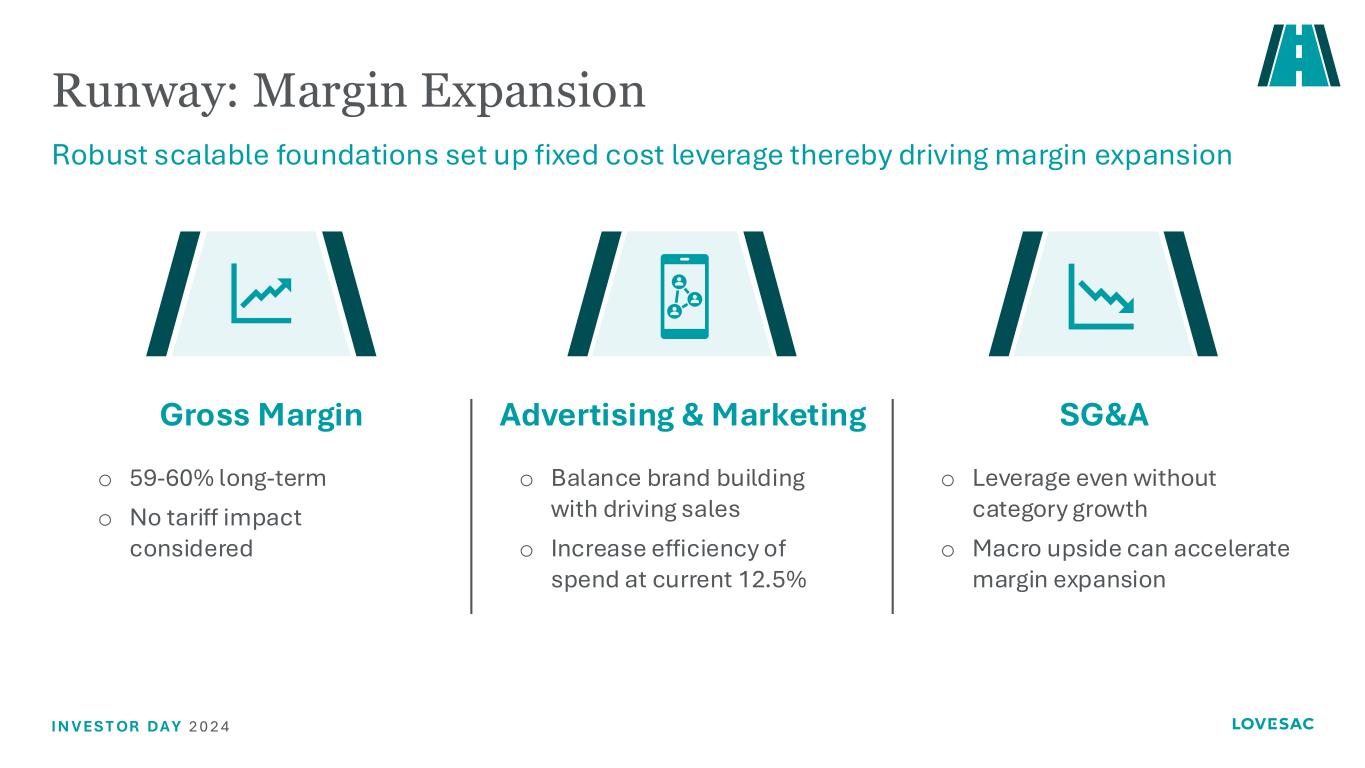

I N V ES T OR DA Y 2 0 2 4 Runway: Margin Expansion Robust scalable foundations set up fixed cost leverage thereby driving margin expansion SG&A o Leverage even without category growth o Macro upside can accelerate margin expansion Gross Margin o 59-60% long-term o No tariff impact considered Advertising & Marketing o Balance brand building with driving sales o Increase efficiency of spend at current 12.5%

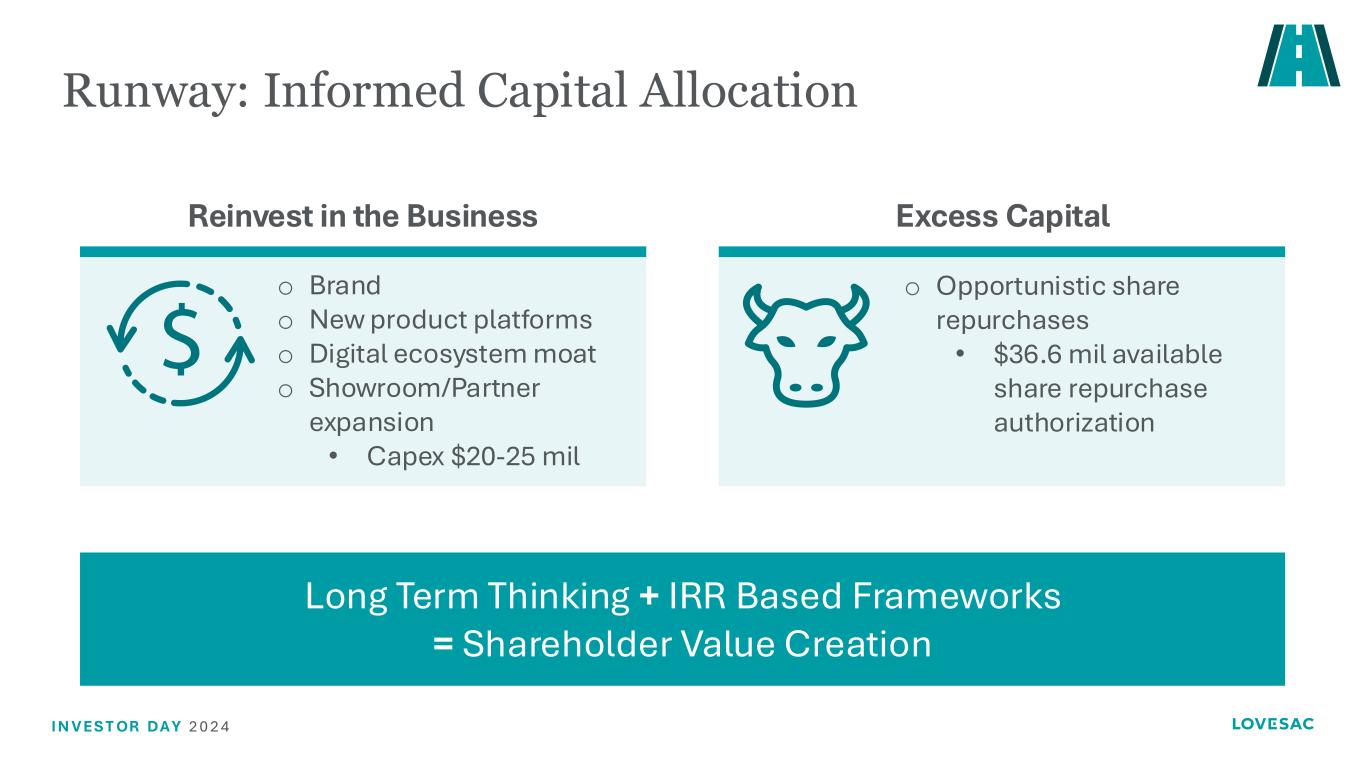

I N V ES T OR DA Y 2 0 2 4 Reinvest in the Business Excess Capital Runway: Informed Capital Allocation o Brand o New product platforms o Digital ecosystem moat o Showroom/Partner expansion • Capex $20-25 mil o Opportunistic share repurchases • $36.6 mil available share repurchase authorization Long Term Thinking + IRR Based Frameworks = Shareholder Value Creation

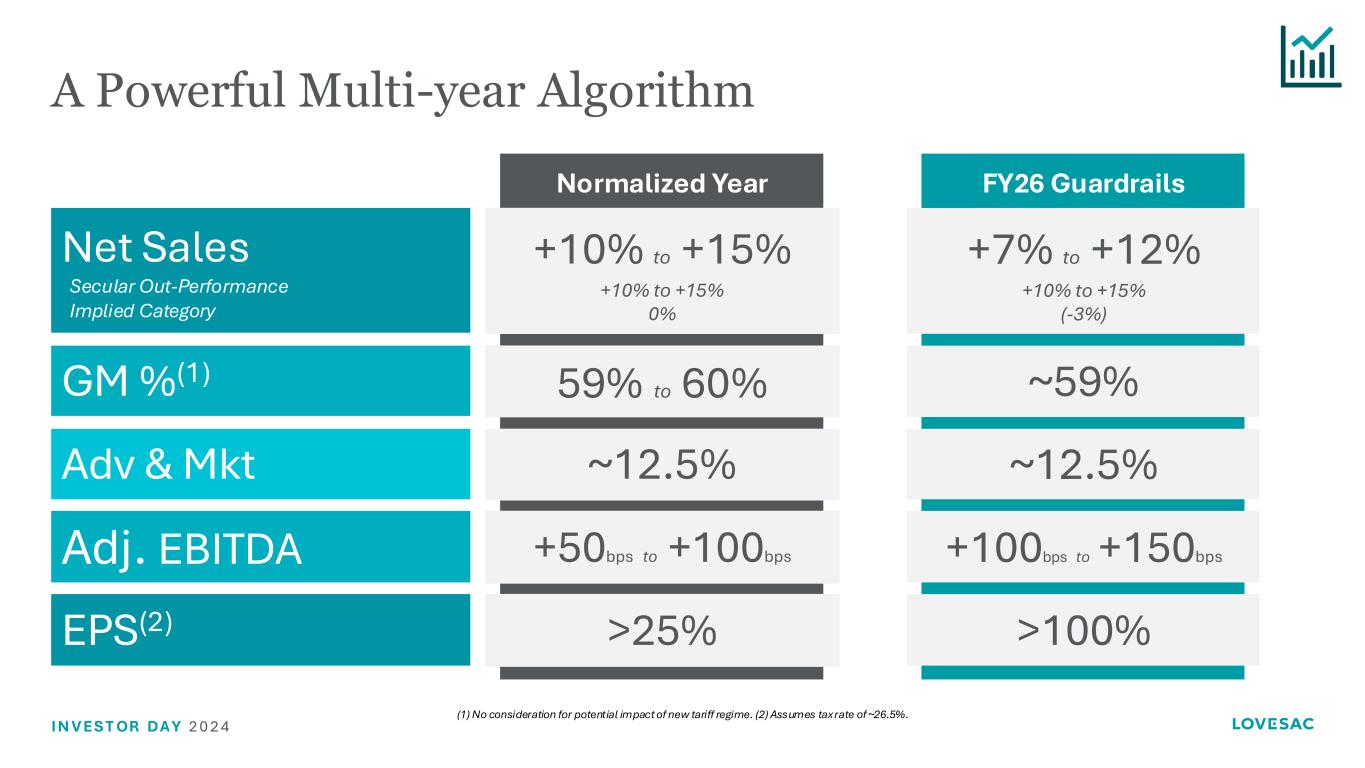

I N V ES T OR DA Y 2 0 2 4 A Powerful Multi-year Algorithm (1) No consideration for potential impact of new tariff regime. (2) Assumes tax rate of ~26.5%. Net Sales Secular Out-Performance Implied Category +10% to +15% +10% to +15% 0% GM %(1) Adv & Mkt Adj. EBITDA EPS(2) ~12.5% >25% 59% to 60% +50bps to +100bps Normalized Year FY26 Guardrails +7% to +12% +10% to +15% (-3%) ~59% ~12.5% +100bps to +150bps >100%

I N V ES T OR DA Y 2 0 2 4 Key CFO Takeaways We have massive secular growth potential ahead We are uniquely positioned to capitalize on macro upside Our profitable growth strategy is entirely self- funded We retain optionality for excess capital to enhance ROIC and growth

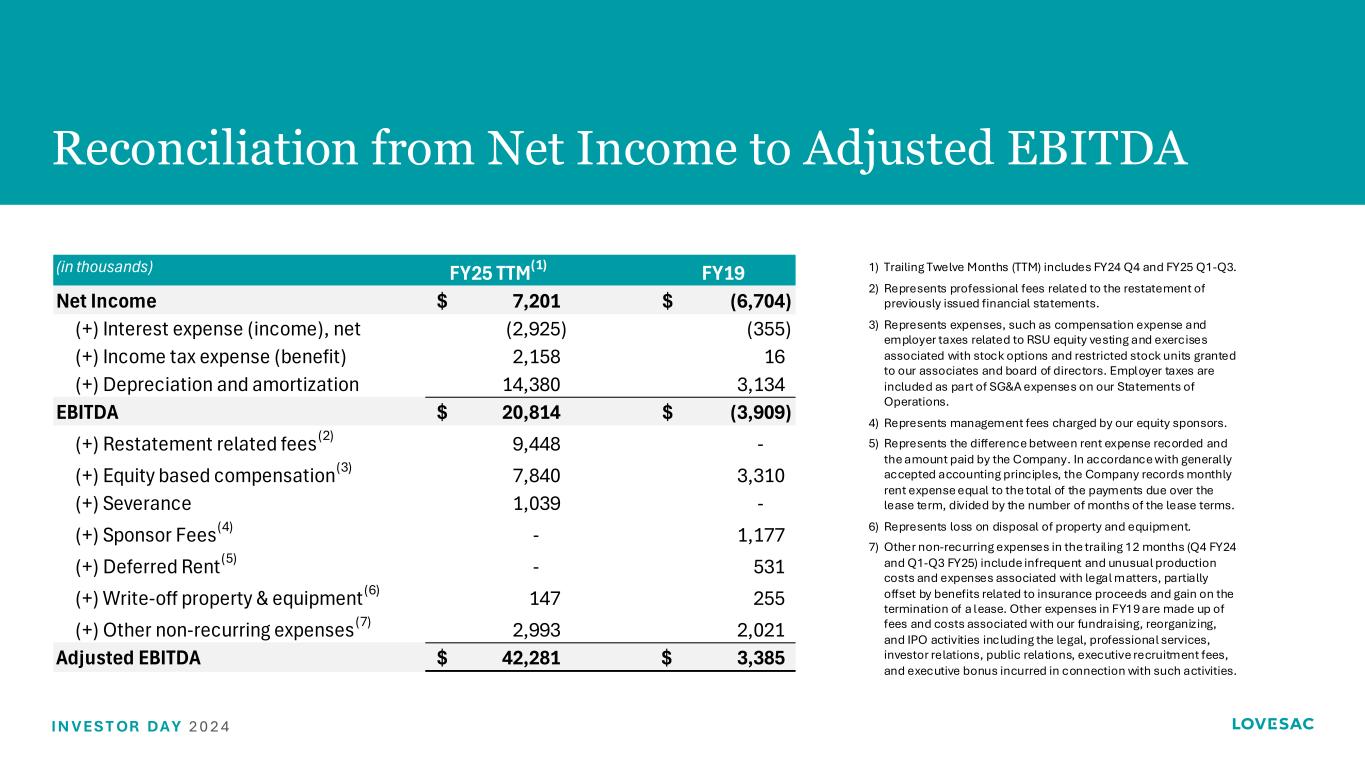

I N V ES T OR DA Y 2 0 2 4 1) Trailing Twelve Months (TTM) includes FY24 Q4 and FY25 Q1-Q3. 2) Represents professional fees related to the restatement of previously issued financial statements. 3) Represents expenses, such as compensation expense and employer taxes related to RSU equity vesting and exercises associated with stock options and restricted stock units granted to our associates and board of directors. Employer taxes are included as part of SG&A expenses on our Statements of Operations. 4) Represents management fees charged by our equity sponsors. 5) Represents the difference between rent expense recorded and the amount paid by the Company. In accordance with generally accepted accounting principles, the Company records monthly rent expense equal to the total of the payments due over the lease term, divided by the number of months of the lease terms. 6) Represents loss on disposal of property and equipment. 7) Other non-recurring expenses in the trailing 12 months (Q4 FY24 and Q1-Q3 FY25) include infrequent and unusual production costs and expenses associated with legal matters, partially offset by benefits related to insurance proceeds and gain on the termination of a lease. Other expenses in FY19 are made up of fees and costs associated with our fundraising, reorganizing, and IPO activities including the legal, professional services, investor relations, public relations, executive recruitment fees, and executive bonus incurred in connection with such activities. (in thousands) FY25 TTM(1) FY19 Net Income 7,201$ (6,704)$ (+) Interest expense (income), net (2,925) (355) (+) Income tax expense (benefit) 2,158 16 (+) Depreciation and amortization 14,380 3,134 EBITDA 20,814$ (3,909)$ (+) Restatement related fees(2) 9,448 - (+) Equity based compensation(3) 7,840 3,310 (+) Severance 1,039 - (+) Sponsor Fees(4) - 1,177 (+) Deferred Rent(5) - 531 (+) Write-off property & equipment(6) 147 255 (+) Other non-recurring expenses(7) 2,993 2,021 Adjusted EBITDA 42,281$ 3,385$ Reconciliation from Net Income to Adjusted EBITDA

I N V ES T OR DA Y 2 0 2 4